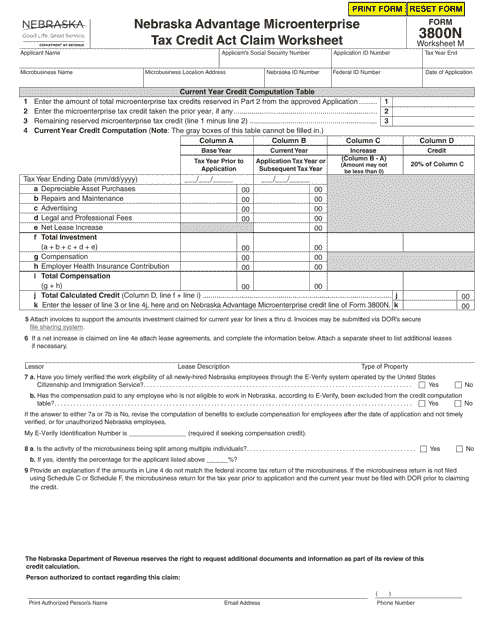

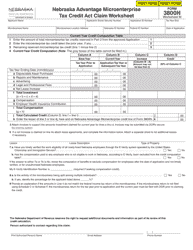

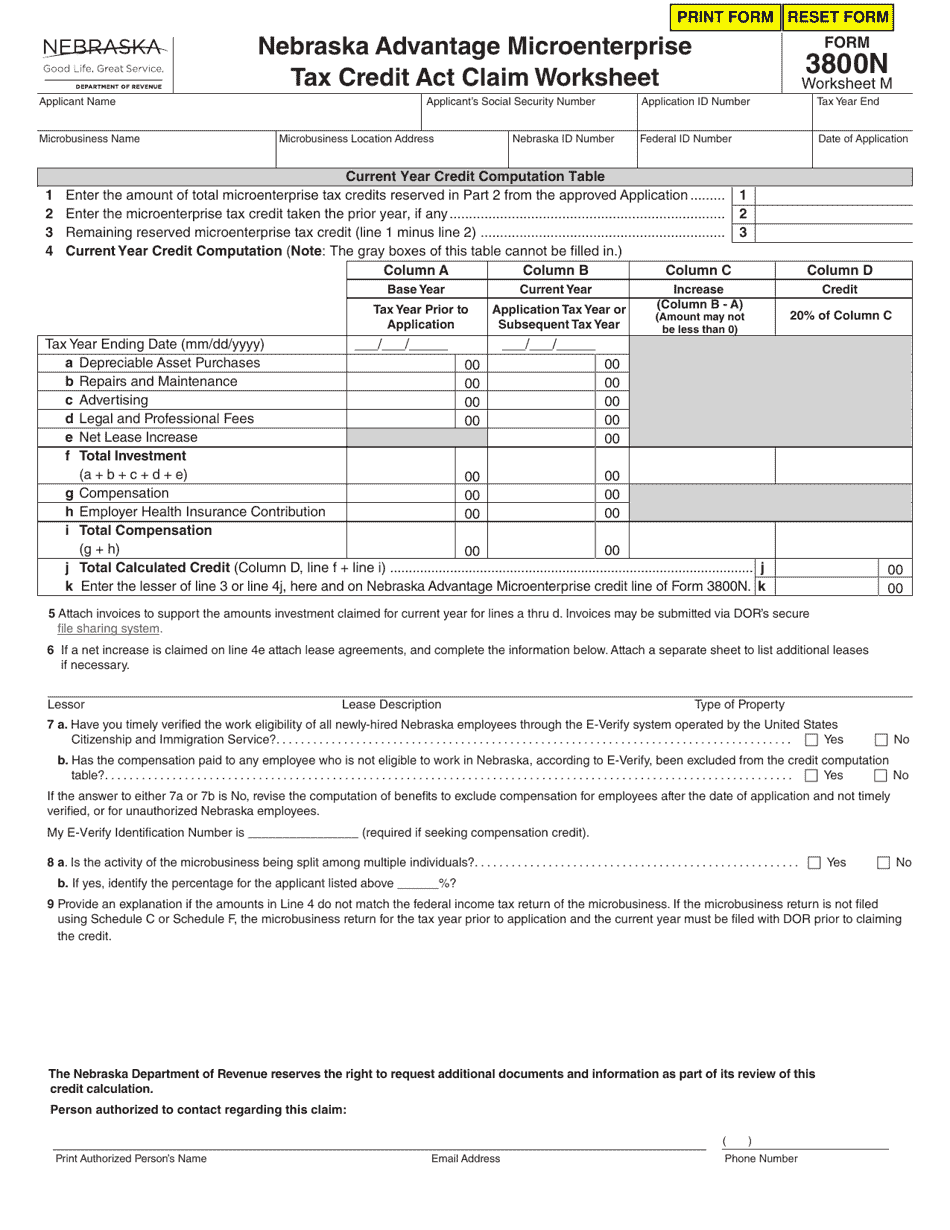

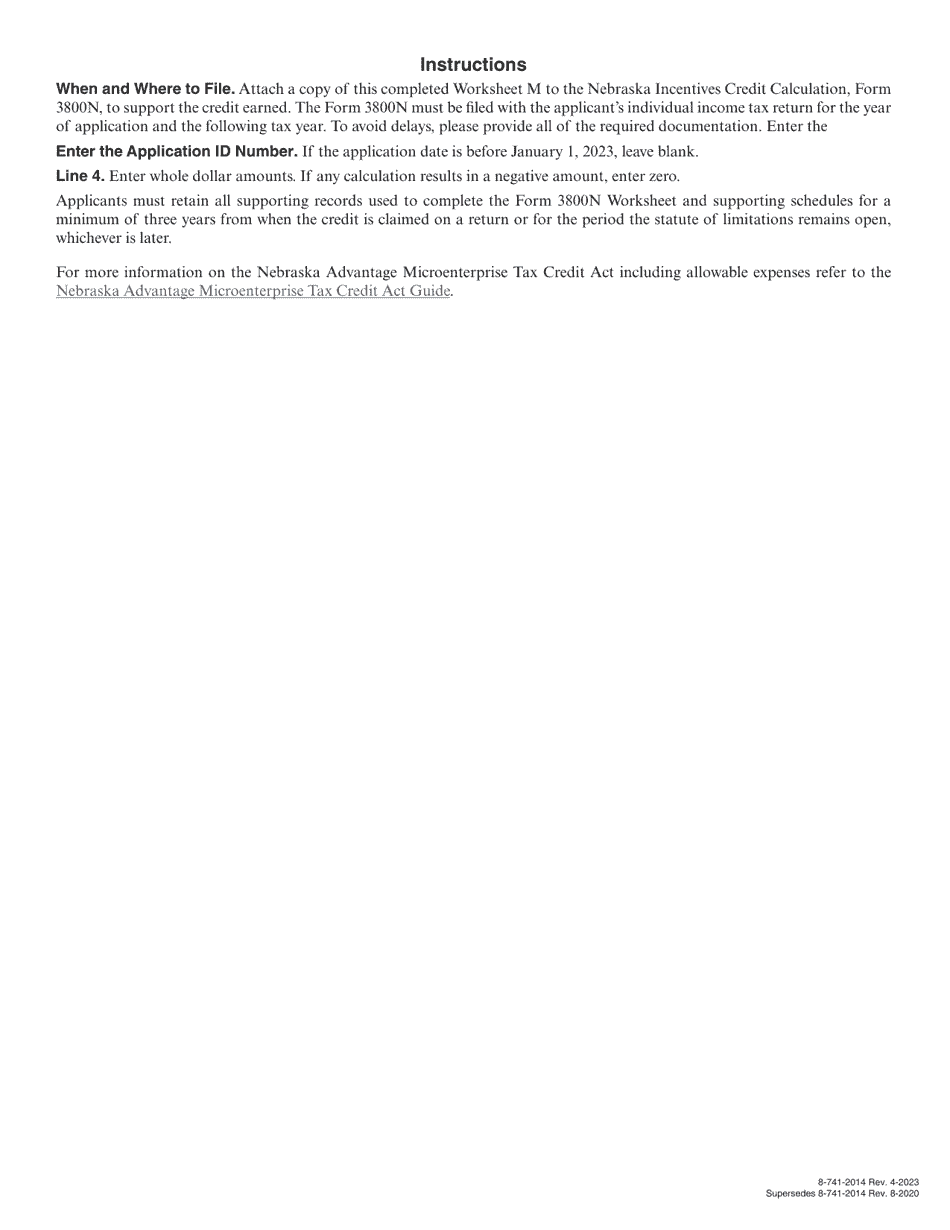

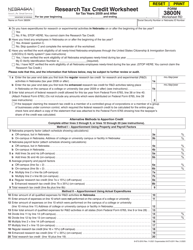

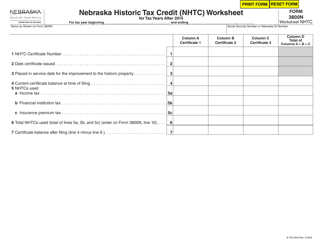

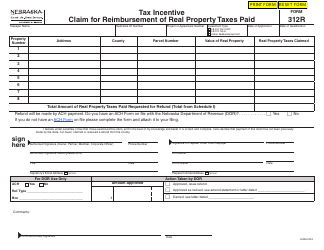

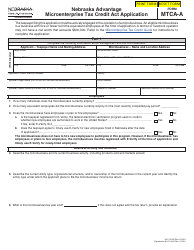

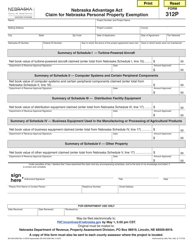

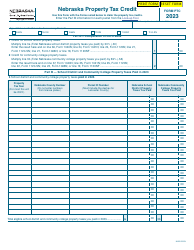

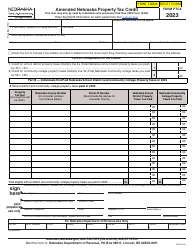

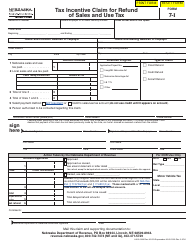

Form 3800N Worksheet M Nebraska Advantage Microenterprise Tax Credit Act Claim Worksheet - Nebraska

What Is Form 3800N Worksheet M?

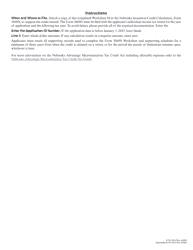

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 3800N, Nebraska Incentives Credit Computation for Tax Years After 2018. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 3800N Worksheet M?

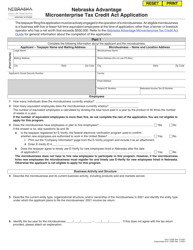

A: It is a worksheet related to the Nebraska Advantage Microenterprise Tax Credit Act.

Q: What does the Nebraska Advantage Microenterprise Tax Credit Act do?

A: It provides tax credits to eligible microenterprises in Nebraska.

Q: Who can claim the Nebraska Advantage Microenterprise Tax Credit?

A: Eligible microenterprises can claim the tax credit.

Q: What is the purpose of the Form 3800N Worksheet M?

A: The worksheet helps microenterprises calculate their tax credit under the Nebraska Advantage Microenterprise Tax Credit Act.

Q: How can a microenterprise qualify for the tax credit?

A: Microenterprises must meet certain eligibility criteria outlined in the Nebraska Advantage Microenterprise Tax Credit Act.

Form Details:

- Released on April 1, 2023;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3800N Worksheet M by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.