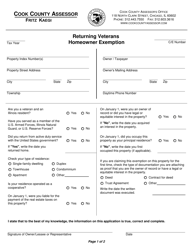

Returning Veterans Homeowner Exemption - Cook County, Illinois

Returning Veterans Homeowner Exemption is a legal document that was released by the Assessor's Office - Cook County, Illinois - a government authority operating within Illinois. The form may be used strictly within Cook County.

FAQ

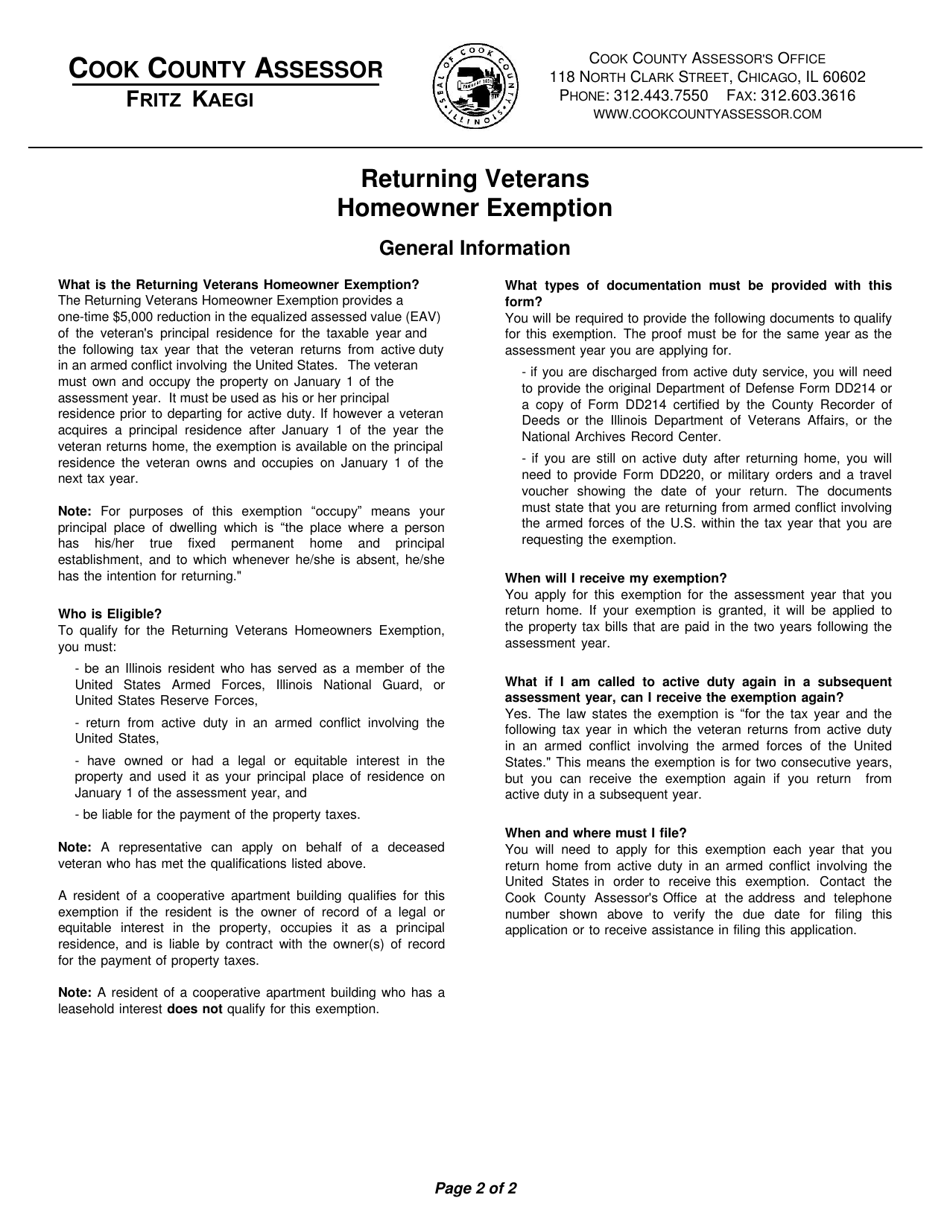

Q: What is the Returning Veterans Homeowner Exemption?

A: The Returning Veterans Homeowner Exemption is a property tax exemption in Cook County, Illinois.

Q: Who is eligible for the Returning Veterans Homeowner Exemption?

A: Eligible individuals are veterans who have recently returned from active duty in the U.S. Armed Forces.

Q: How do veterans apply for the exemption?

A: Veterans can apply for the Returning Veterans Homeowner Exemption by completing an application and submitting it to the Cook County Assessor's Office.

Q: What is the benefit of the exemption?

A: The exemption provides a reduction in the assessed value of the veteran's property, resulting in lower property taxes.

Q: Is there a deadline for applying for the exemption?

A: Yes, veterans must apply for the exemption within two years of returning from active duty.

Form Details:

- The latest edition currently provided by the Assessor's Office - Cook County, Illinois;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Assessor's Office - Cook County, Illinois.