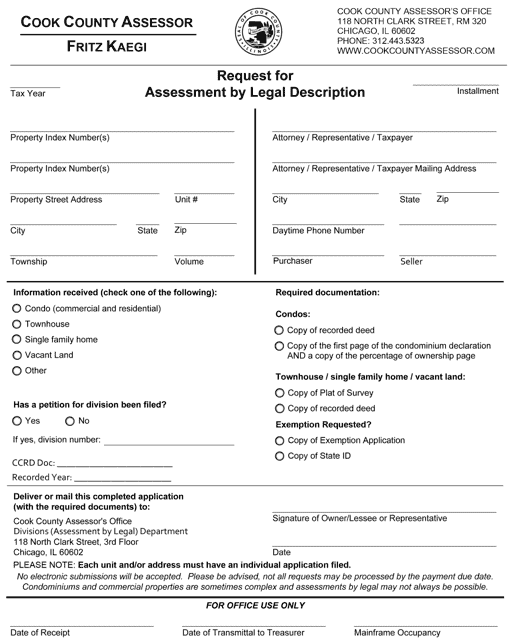

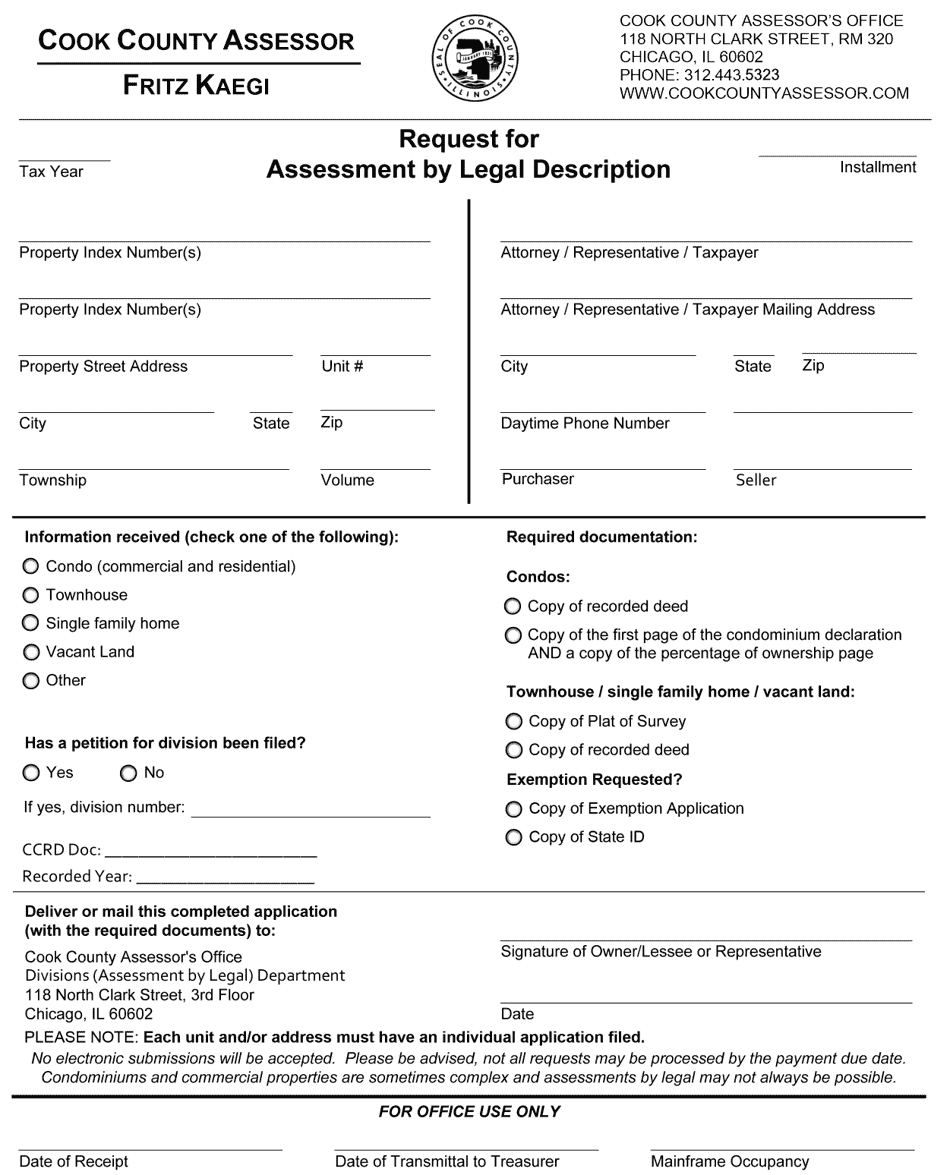

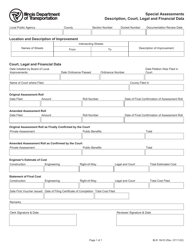

Request for Assessment by Legal Description - Cook County, Illinois

Request for Assessment by Legal Description is a legal document that was released by the Assessor's Office - Cook County, Illinois - a government authority operating within Illinois. The form may be used strictly within Cook County.

FAQ

Q: What is a Request for Assessment by Legal Description?

A: A Request for Assessment by Legal Description is a formal request made in Cook County, Illinois to review the assessed value of a property based on its legal description.

Q: Who can request an Assessment by Legal Description?

A: Any property owner or interested party can request an Assessment by Legal Description in Cook County.

Q: What is the purpose of a Request for Assessment by Legal Description?

A: The purpose of a Request for Assessment by Legal Description is to potentially lower the assessed value of a property, which can result in a lower property tax bill.

Q: How can I make a Request for Assessment by Legal Description in Cook County?

A: To make a Request for Assessment by Legal Description in Cook County, you can file the necessary paperwork with the Cook County Assessor's Office.

Q: Is there a deadline to submit a Request for Assessment by Legal Description?

A: Yes, there is a specific deadline to submit a Request for Assessment by Legal Description in Cook County. It is typically within 30 days of the date the assessment notice is mailed.

Q: What documents are required to make a Request for Assessment by Legal Description?

A: The required documents to make a Request for Assessment by Legal Description in Cook County may include a completed form, a copy of the current assessment notice, and supporting evidence or documentation.

Q: What happens after submitting a Request for Assessment by Legal Description?

A: After submitting a Request for Assessment by Legal Description, the Cook County Assessor's Office will review the request and may schedule a hearing to further evaluate the property's assessed value.

Q: Can I appeal the decision made on my Request for Assessment by Legal Description?

A: Yes, if you are not satisfied with the decision made on your Request for Assessment by Legal Description, you have the right to appeal the decision to the Cook County Board of Review or the Illinois Property Tax Appeal Board.

Q: Does a successful Request for Assessment by Legal Description guarantee a lower property tax bill?

A: A successful Request for Assessment by Legal Description can potentially result in a lower property tax bill, but it is not guaranteed. The final decision is determined by the assessment review process and the applicable tax laws.

Form Details:

- The latest edition currently provided by the Assessor's Office - Cook County, Illinois;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Assessor's Office - Cook County, Illinois.