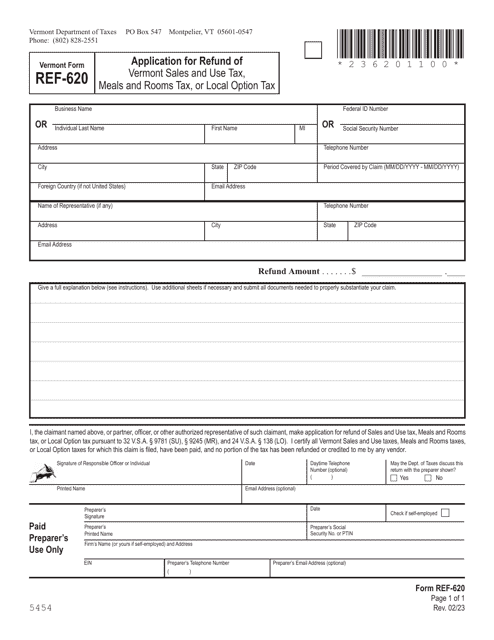

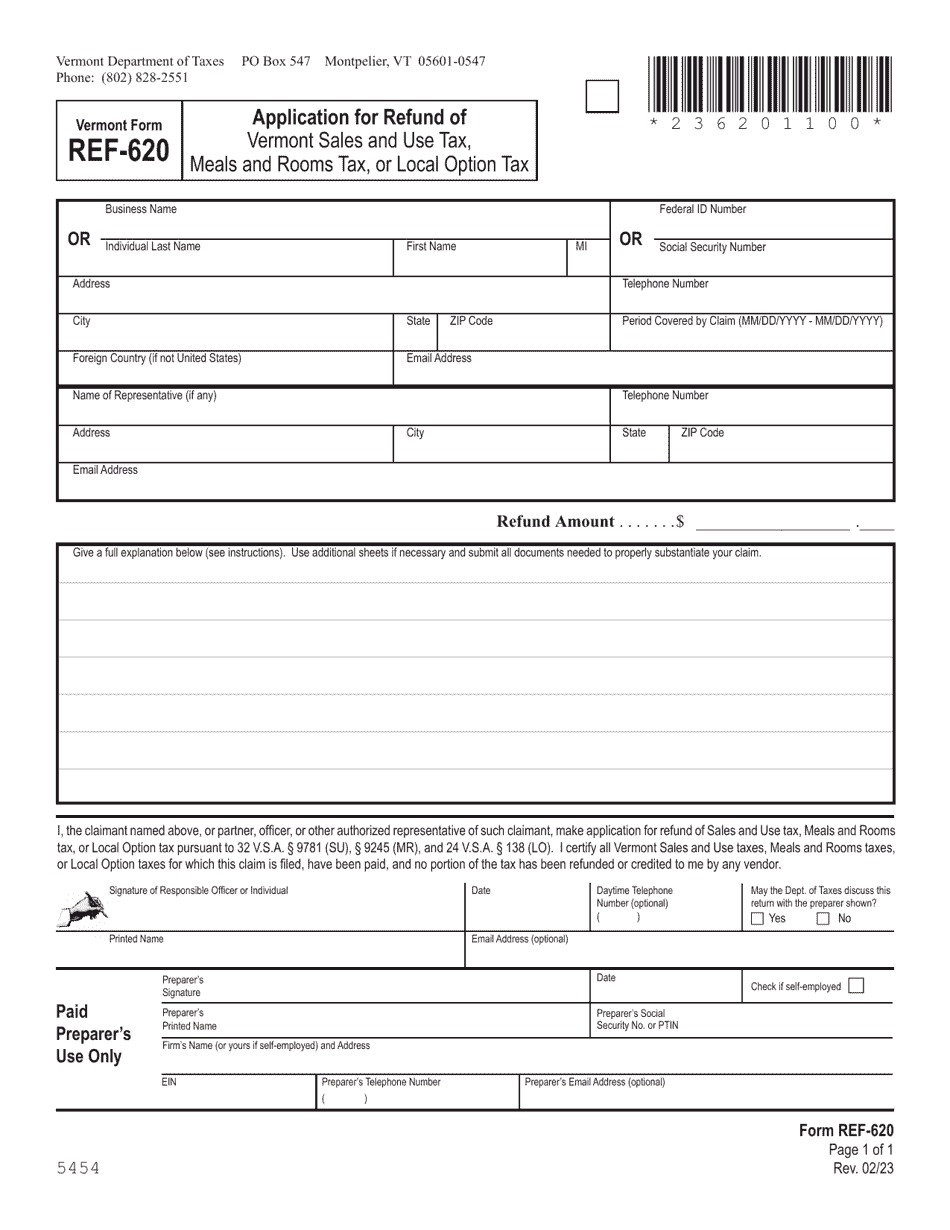

Form REF-620 Application for Refund of Vermont Sales and Use Tax, Meals and Rooms Tax, or Local Option Tax - Vermont

What Is Form REF-620?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is REF-620?

A: REF-620 is the application form used for requesting a refund of Vermont Sales and Use Tax, Meals and Rooms Tax, or Local Option Tax in Vermont.

Q: What taxes can be refunded using REF-620?

A: REF-620 can be used to request a refund of Vermont Sales and Use Tax, Meals and Rooms Tax, or Local Option Tax.

Q: How can I use REF-620?

A: You can use REF-620 by completing the form with all the required information and submitting it to the Vermont Department of Taxes.

Q: Are there any eligibility requirements for using REF-620?

A: Yes, there are specific eligibility requirements for using REF-620. You should review the instructions provided with the form to determine if you qualify for a refund.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REF-620 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.