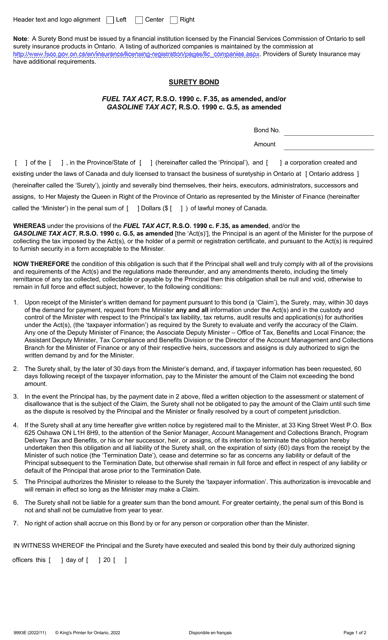

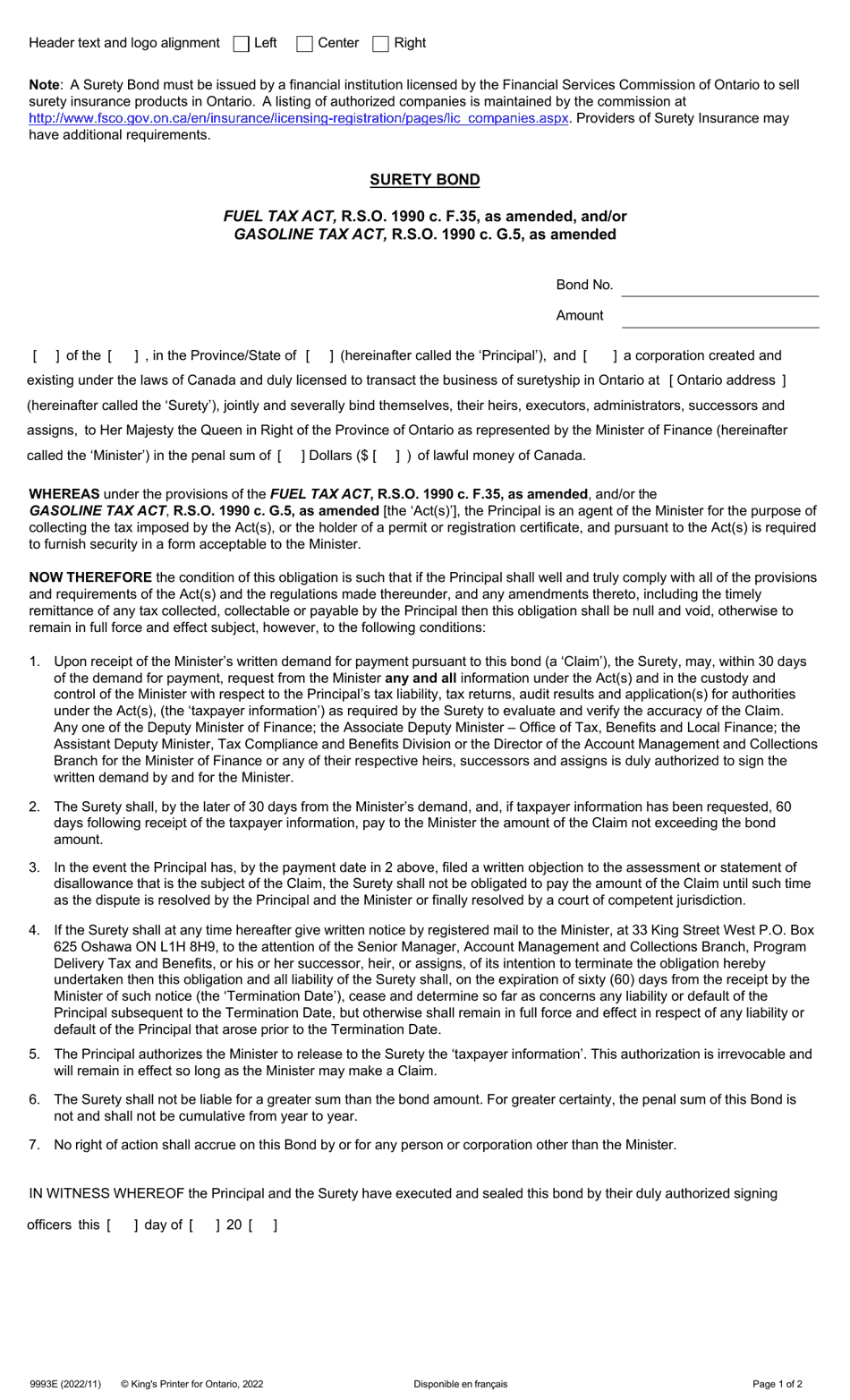

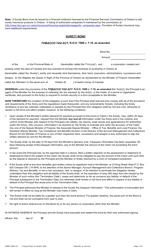

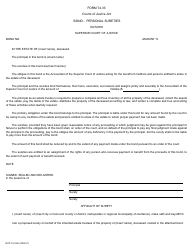

Form 9993E Surety Bond - Ontario, Canada

FAQ

Q: What is Form 9993E Surety Bond?

A: Form 9993E Surety Bond is a specific type of bond required in Ontario, Canada.

Q: What is the purpose of Form 9993E Surety Bond?

A: The purpose of Form 9993E Surety Bond is to provide financial assurance and protection to the obligee (the party requiring the bond) in case the bonded party fails to meet their contractual obligations.

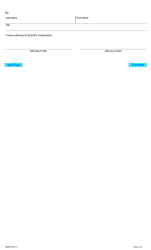

Q: Who needs to file Form 9993E Surety Bond?

A: Various individuals and businesses in Ontario may be required to file Form 9993E Surety Bond, such as contractors, construction companies, and other licensed professionals.

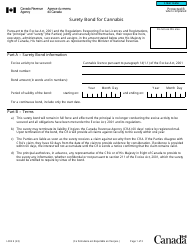

Q: How do I obtain Form 9993E Surety Bond?

A: To obtain Form 9993E Surety Bond, you would typically need to contact a licensed insurance company or a surety bond provider.

Q: What happens if I fail to obtain Form 9993E Surety Bond when required?

A: If you fail to obtain Form 9993E Surety Bond when required, you may be unable to obtain the necessary licenses or permits, and you may face legal penalties or other consequences.

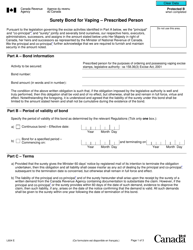

Q: How much does Form 9993E Surety Bond cost?

A: The cost of Form 9993E Surety Bond can vary depending on various factors, including the bond amount required, the type of business or profession, and the applicant's financial history.

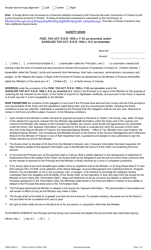

Q: How long does Form 9993E Surety Bond remain valid?

A: Form 9993E Surety Bond generally remains valid for the specific period stated in the bond, which is usually one year.

Q: Can Form 9993E Surety Bond be cancelled?

A: Form 9993E Surety Bond can be cancelled in certain circumstances, such as when the bond term expires, or if the bonded party no longer requires the bond.

Q: Can I get a refund for Form 9993E Surety Bond?

A: Refunds for Form 9993E Surety Bond are typically not available, as the premium paid for the bond is usually non-refundable.

Q: Are there any alternatives to Form 9993E Surety Bond?

A: Yes, in some cases, alternatives to Form 9993E Surety Bond may be accepted, such as cash deposits or letters of credit, depending on the requirements of the obligee.