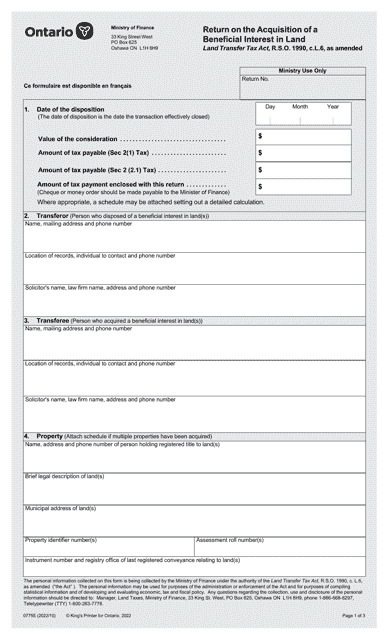

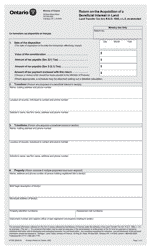

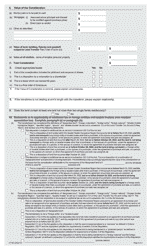

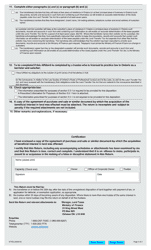

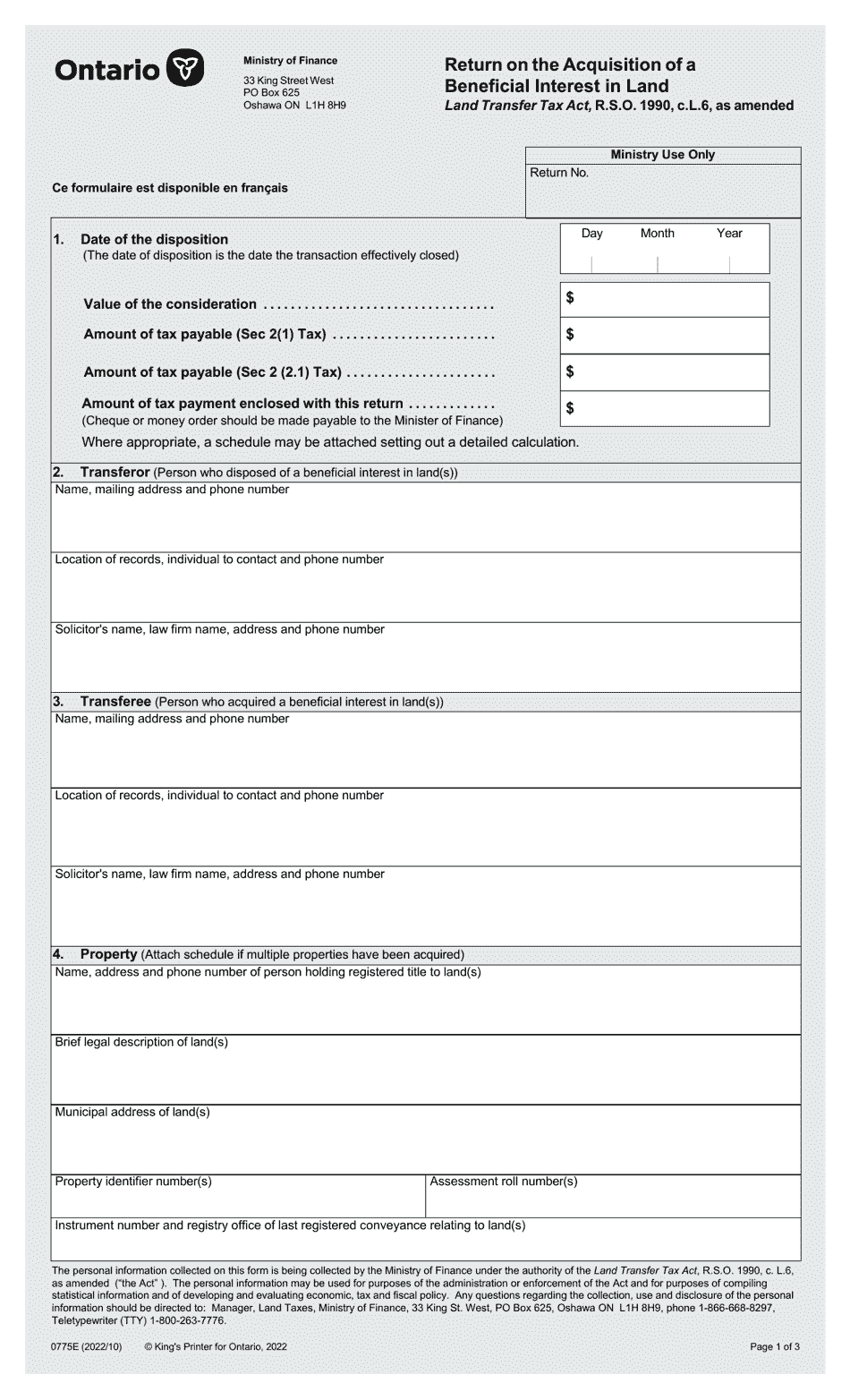

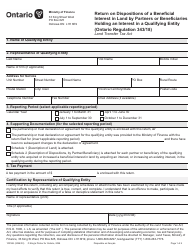

Form 0775E Return on the Acquisition of a Beneficial Interest in Land - Ontario, Canada

Form 0775E Return on the Acquisition of a Beneficial Interest in Land in Ontario, Canada is used to report the purchase or transfer of a beneficial interest in land to the government for tax purposes.

The buyer of the land files the Form 0775E Return on the Acquisition of a Beneficial Interest in Land in Ontario, Canada.

FAQ

Q: What is Form 0775E?

A: Form 0775E is the Return on the Acquisition of a Beneficial Interest in Land in Ontario, Canada.

Q: Who needs to file Form 0775E?

A: Any individual or corporation acquiring a beneficial interest in land in Ontario needs to file Form 0775E.

Q: When should Form 0775E be filed?

A: Form 0775E should be filed within 30 days of the date the acquisition of the beneficial interest in land occurs.

Q: Why is Form 0775E necessary?

A: Form 0775E is necessary for the Ontario government to track and assess land acquisitions and ensure compliance with tax regulations.

Q: Is there a fee associated with filing Form 0775E?

A: No, there is no fee associated with filing Form 0775E.