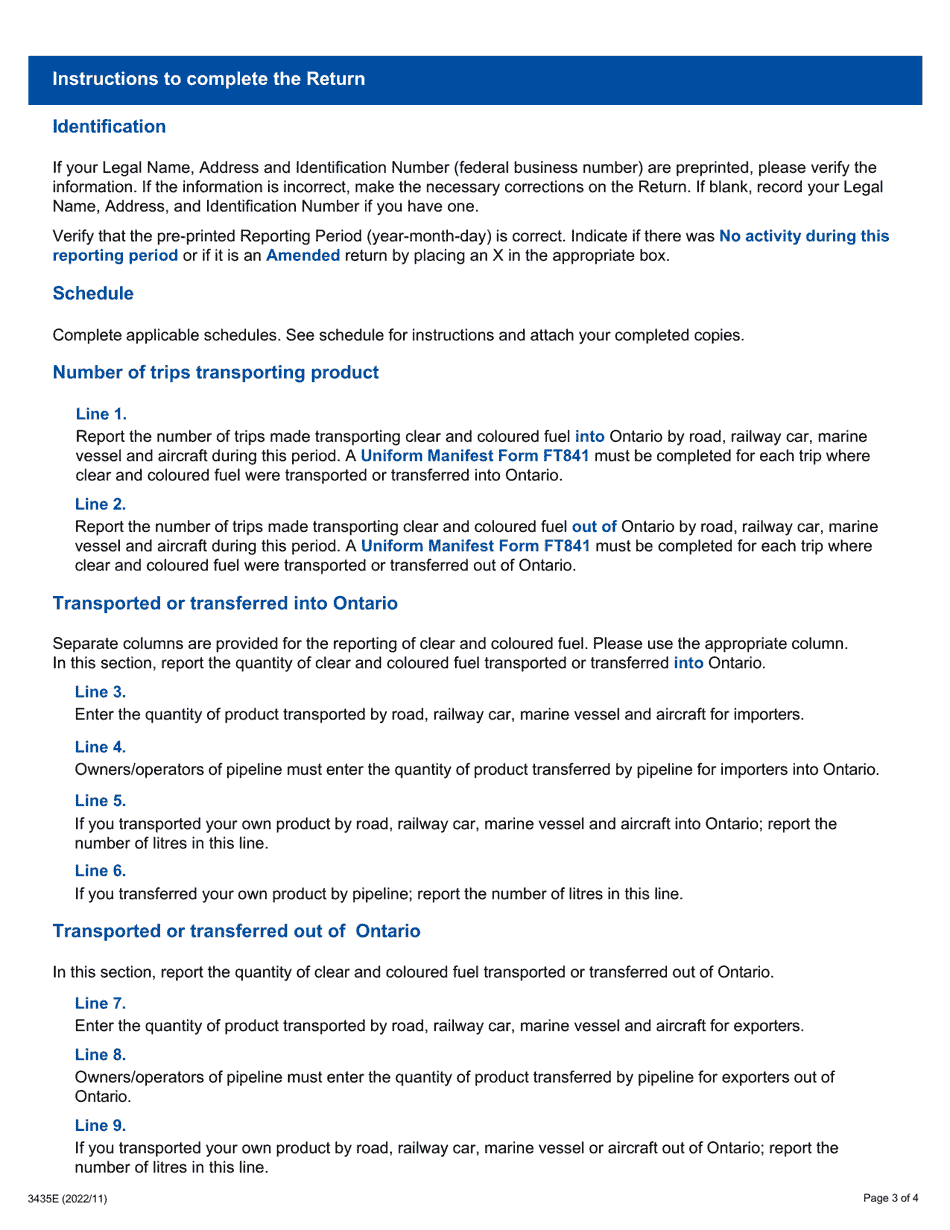

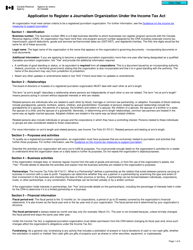

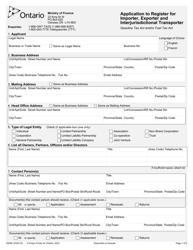

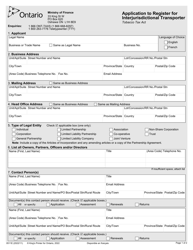

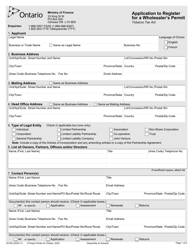

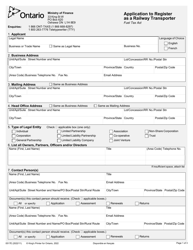

Instructions for Form 0504E Application to Register for Manufacturer, Wholesaler, Dyer, Importer, Exporter and Interjurisdictional Transporter - Gasoline Tax Act and / or Fuel Tax Act - Ontario, Canada

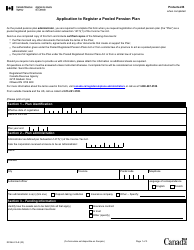

The Form 0504E Application is used to register for licenses under the Gasoline Tax Act and/or Fuel Tax Act in Ontario, Canada. It is required for manufacturers, wholesalers, dyers, importers, exporters, and interjurisdictional transporters of gasoline and fuel products. The instructions provide guidance on how to complete the application accurately.

FAQ

Q: What is Form 0504E?

A: Form 0504E is an application to register for various tax acts in Ontario, Canada.

Q: Who should use Form 0504E?

A: Manufacturers, wholesalers, dyers, importers, exporters, and interjurisdictional transporters of gasoline and fuel in Ontario, Canada should use Form 0504E.

Q: What can I register for using Form 0504E?

A: You can register for the Gasoline Tax Act and/or Fuel Tax Act in Ontario, Canada using Form 0504E.

Q: Are there any fees for submitting Form 0504E?

A: No, there are no fees for submitting Form 0504E.

Q: Do I have to register for both the Gasoline Tax Act and Fuel Tax Act?

A: No, you can choose to register for either the Gasoline Tax Act or the Fuel Tax Act, or both.

Q: What are the consequences of not registering?

A: Failure to register may result in penalties or legal actions.

Q: How long does it take to process the registration?

A: Processing times may vary, but it typically takes several weeks for the registration to be processed.

Q: Can I make changes to my registration after submitting Form 0504E?

A: Yes, you can make changes to your registration by submitting an amended application form.