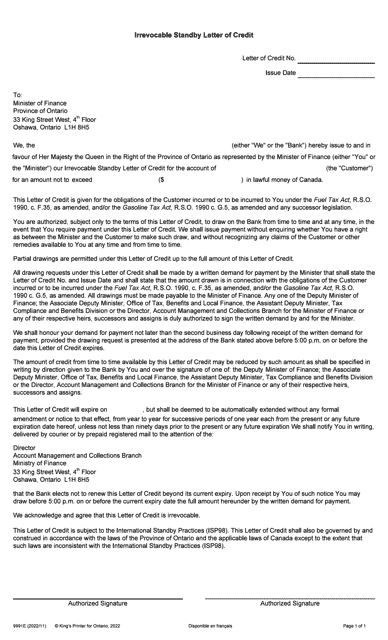

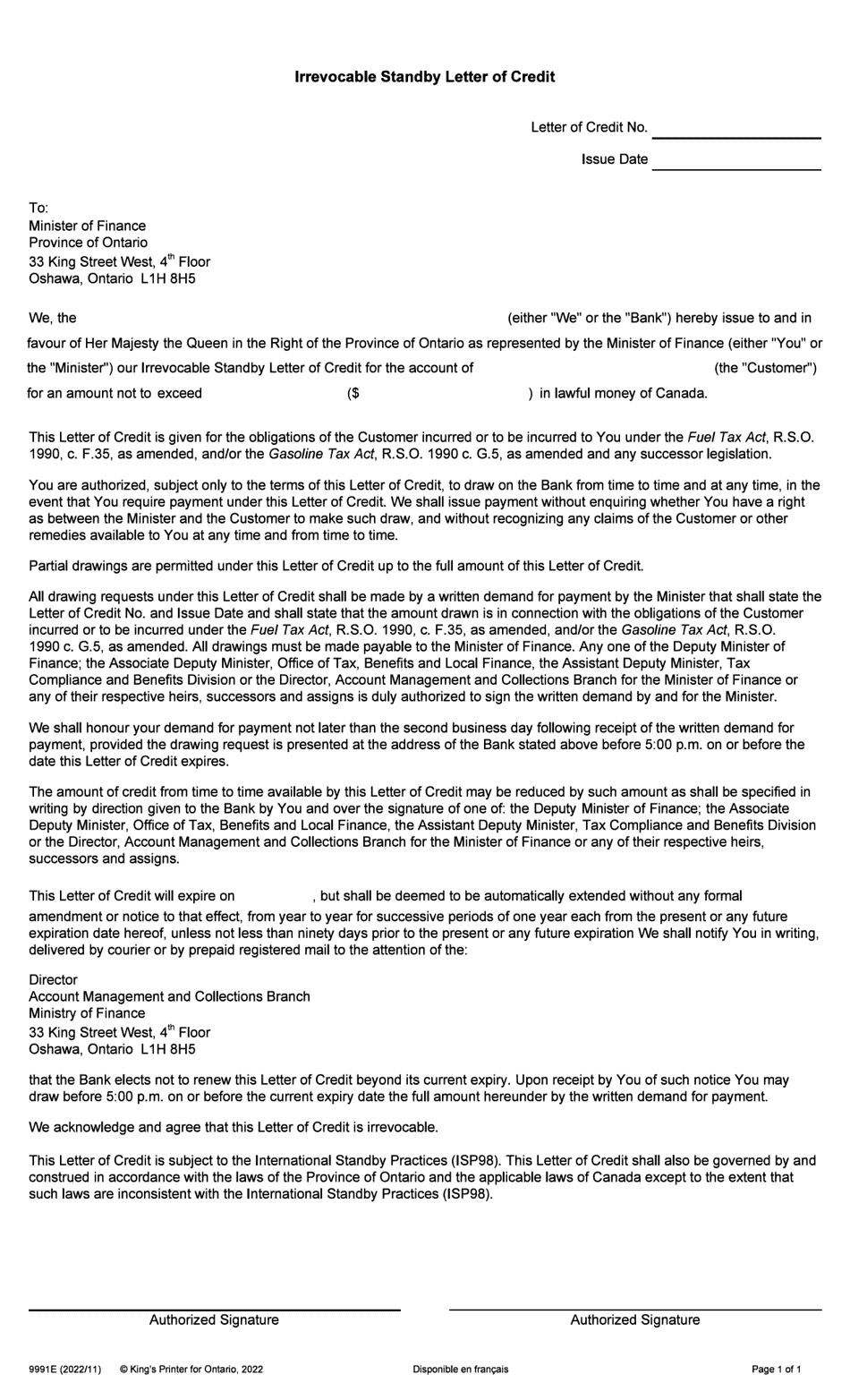

Form 9991E Irrevocable Standby Letter of Credit - Ontario, Canada

The Form 9991E Irrevocable Standby Letter of Credit in Ontario, Canada is typically filed by the party providing the letter of credit, such as a financial institution or a company.

FAQ

Q: What is Form 9991E?

A: Form 9991E is an Irrevocable Standby Letter of Credit.

Q: What is the purpose of Form 9991E?

A: Form 9991E is used as a guarantee in financial transactions.

Q: Who uses Form 9991E?

A: Form 9991E is used by individuals and businesses in Ontario, Canada.

Q: Is Form 9991E legally binding?

A: Yes, Form 9991E is a legally binding document once signed.

Q: What does 'irrevocable' mean in Form 9991E?

A: 'Irrevocable' means that the Standby Letter of Credit cannot be changed or cancelled without consent from all parties involved.

Q: Who can request Form 9991E?

A: Any party involved in a financial transaction can request the issuance of Form 9991E.

Q: What is the role of the issuer in Form 9991E?

A: The issuer of Form 9991E is the financial institution that provides the letter of credit as a guarantee to the beneficiary.

Q: What is the role of the beneficiary in Form 9991E?

A: The beneficiary is the party who will receive payment under the letter of credit upon fulfilling the terms and conditions outlined in Form 9991E.

Q: Can Form 9991E be transferred to another beneficiary?

A: No, Form 9991E cannot be transferred to another beneficiary without the consent of the issuer.

Q: Is Form 9991E specific to Ontario, Canada?

A: Yes, Form 9991E is specific to Ontario, Canada and may have different variations in other jurisdictions.