This version of the form is not currently in use and is provided for reference only. Download this version of

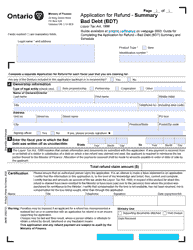

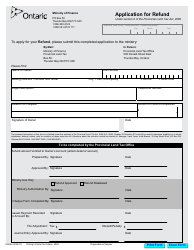

Form 0548E

for the current year.

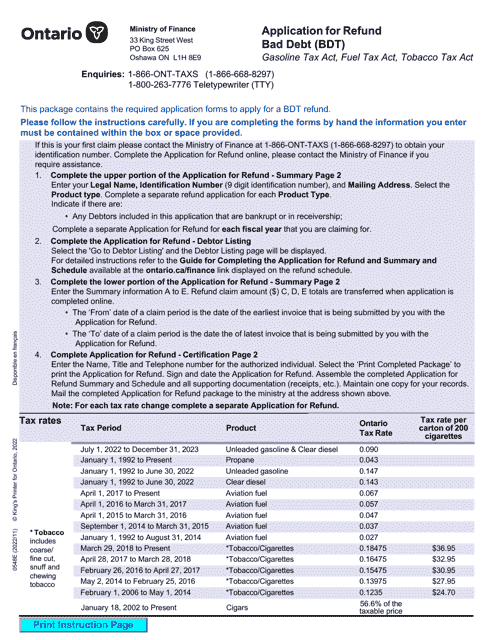

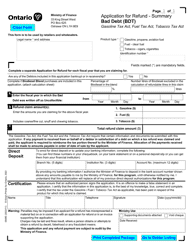

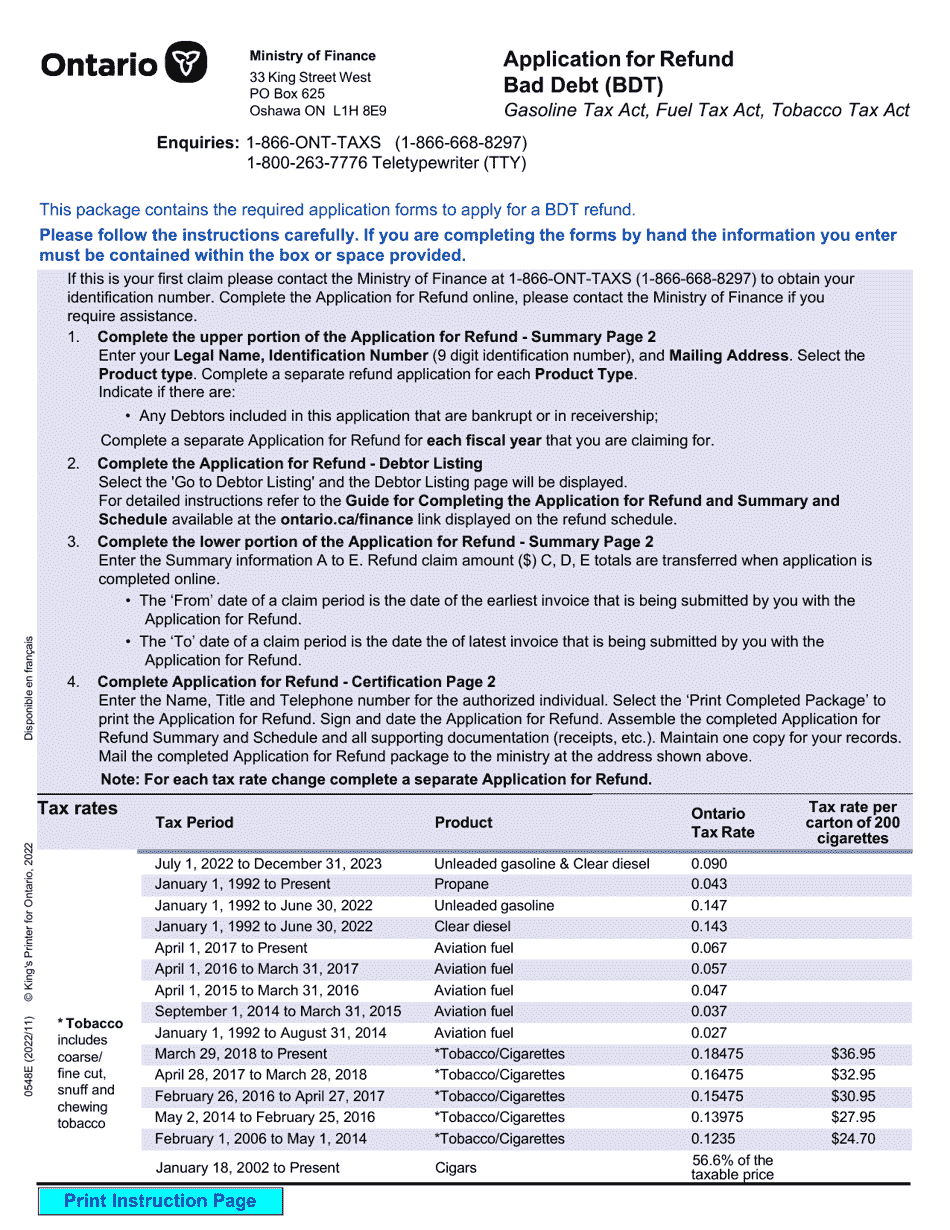

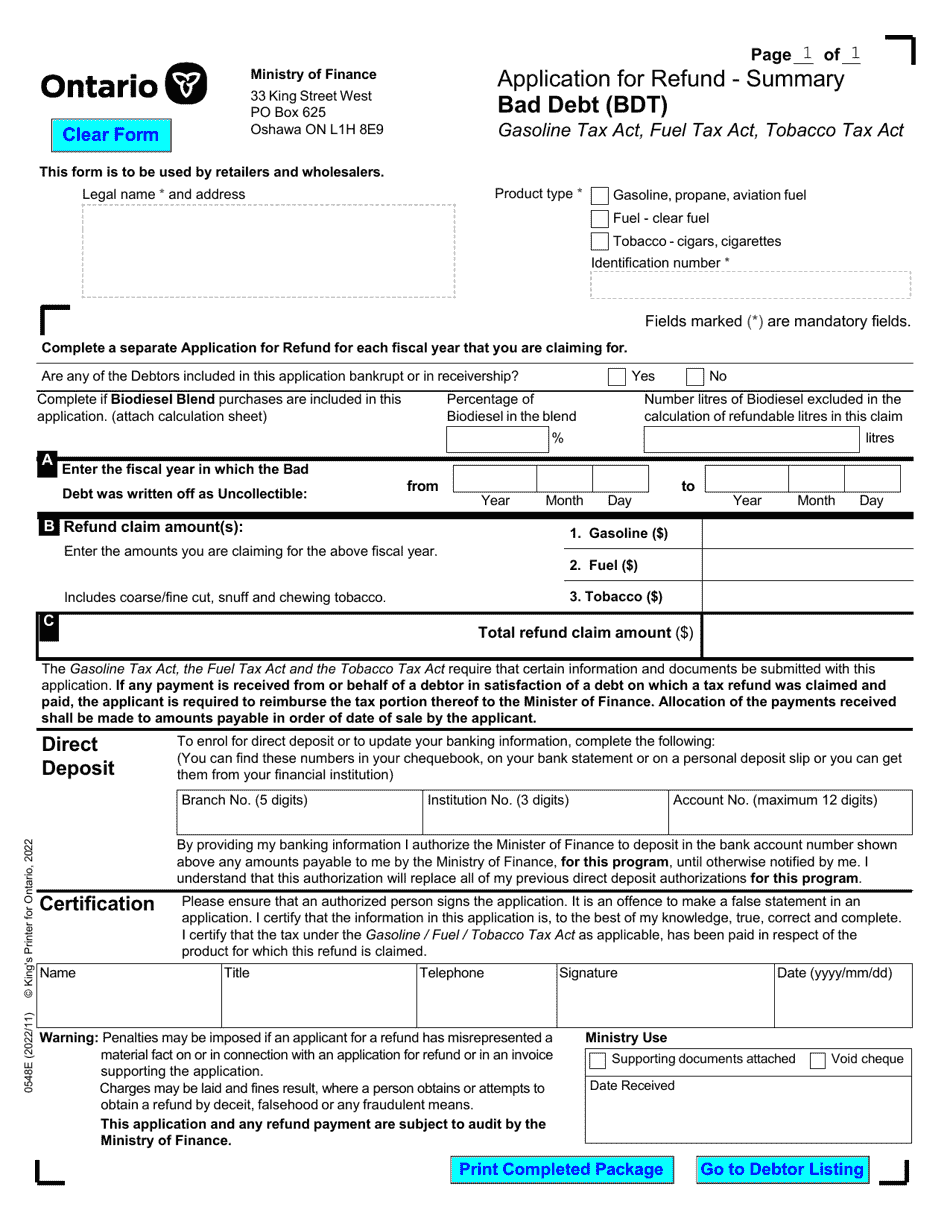

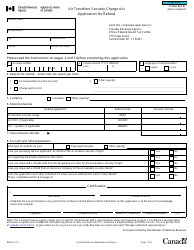

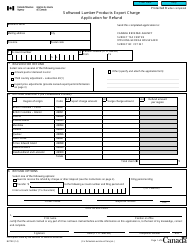

Form 0548E Application for Refund Bad Debt (Bdt) - Ontario, Canada

Form 0548E Application for Refund Bad Debt (Bdt) in Ontario, Canada is used to apply for a refund of sales tax paid on purchases that became bad debts. It is for businesses that have made taxable sales but were unable to collect the amount owed because the debt became uncollectible.

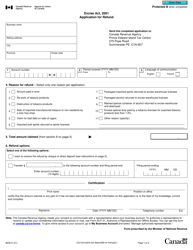

The Form 0548E Application for Refund Bad Debt (Bdt) in Ontario, Canada is typically filed by businesses or individuals who are seeking a refund for the bad debts they have incurred.

FAQ

Q: What is Form 0548E?

A: Form 0548E is the application for a refund of bad debt (Bdt) in Ontario, Canada.

Q: What is the purpose of Form 0548E?

A: The purpose of Form 0548E is to request a refund for bad debt in Ontario, Canada.

Q: Who can use Form 0548E?

A: Any individual or business in Ontario, Canada that has incurred bad debt can use Form 0548E.

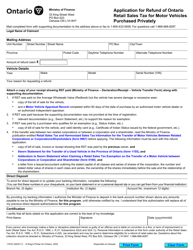

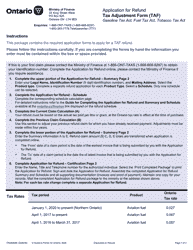

Q: What information is required in Form 0548E?

A: Form 0548E requires information such as the debtor's name, amount of bad debt, date of sale or service, and evidence of efforts made to collect the debt.

Q: Are there any deadlines for submitting Form 0548E?

A: Yes, Form 0548E must be submitted within four years from the date the debt became uncollectible.

Q: Is there a fee for submitting Form 0548E?

A: No, there is no fee for submitting Form 0548E.

Q: How long does it take to process a Form 0548E application?

A: The processing time for a Form 0548E application may vary, but it generally takes several weeks to receive a refund.

Q: Can I submit Form 0548E electronically?

A: No, Form 0548E must be submitted by mail or in person.

Q: What should I do if I need assistance with Form 0548E?

A: If you need assistance with Form 0548E, you can contact the Ministry of Finance or consult a tax professional.