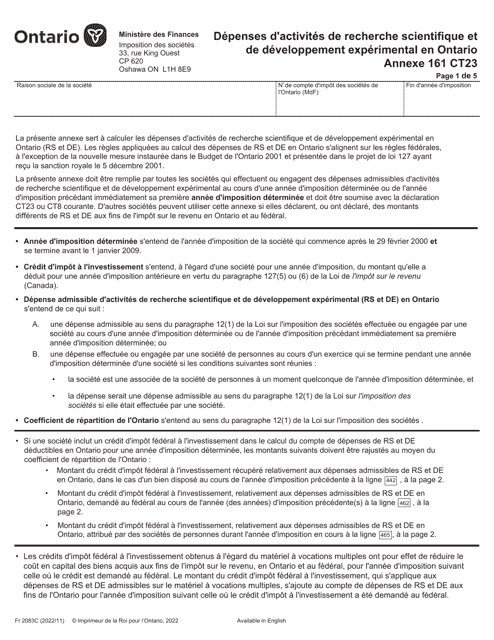

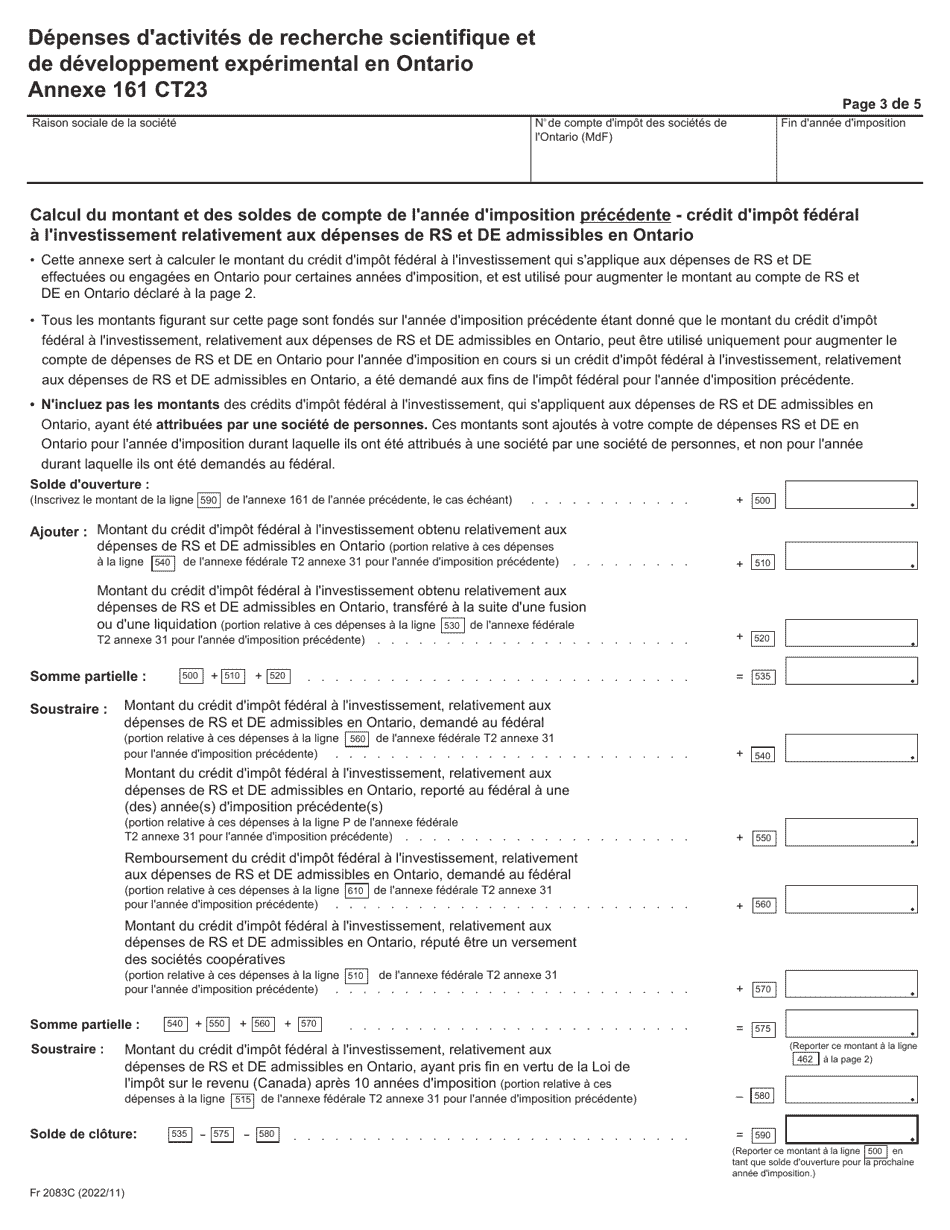

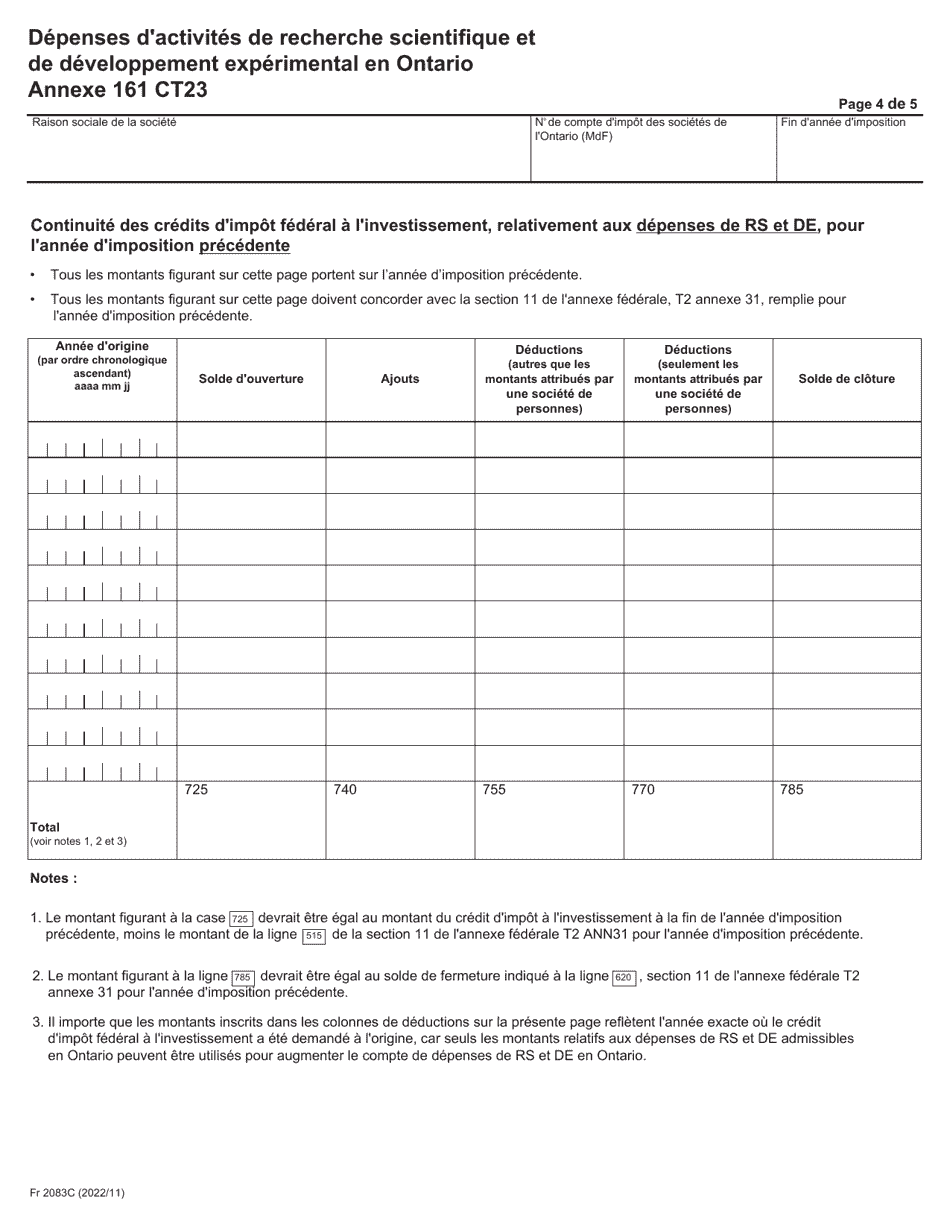

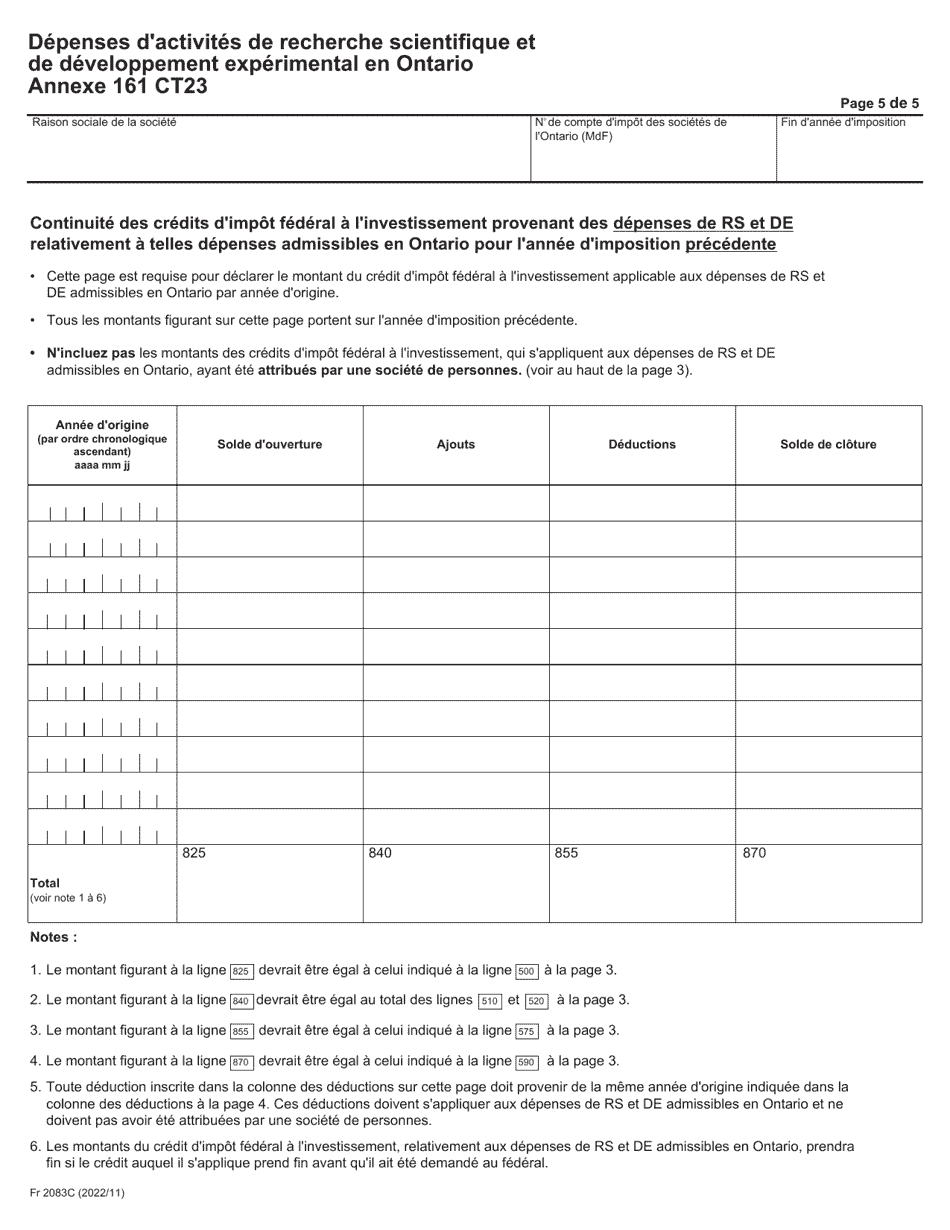

Forme 2083C Agenda 161 Depenses D'activites De Recherche Scientifique Et De Developpement Experimental En Ontario - Ontario, Canada (French)

FAQ

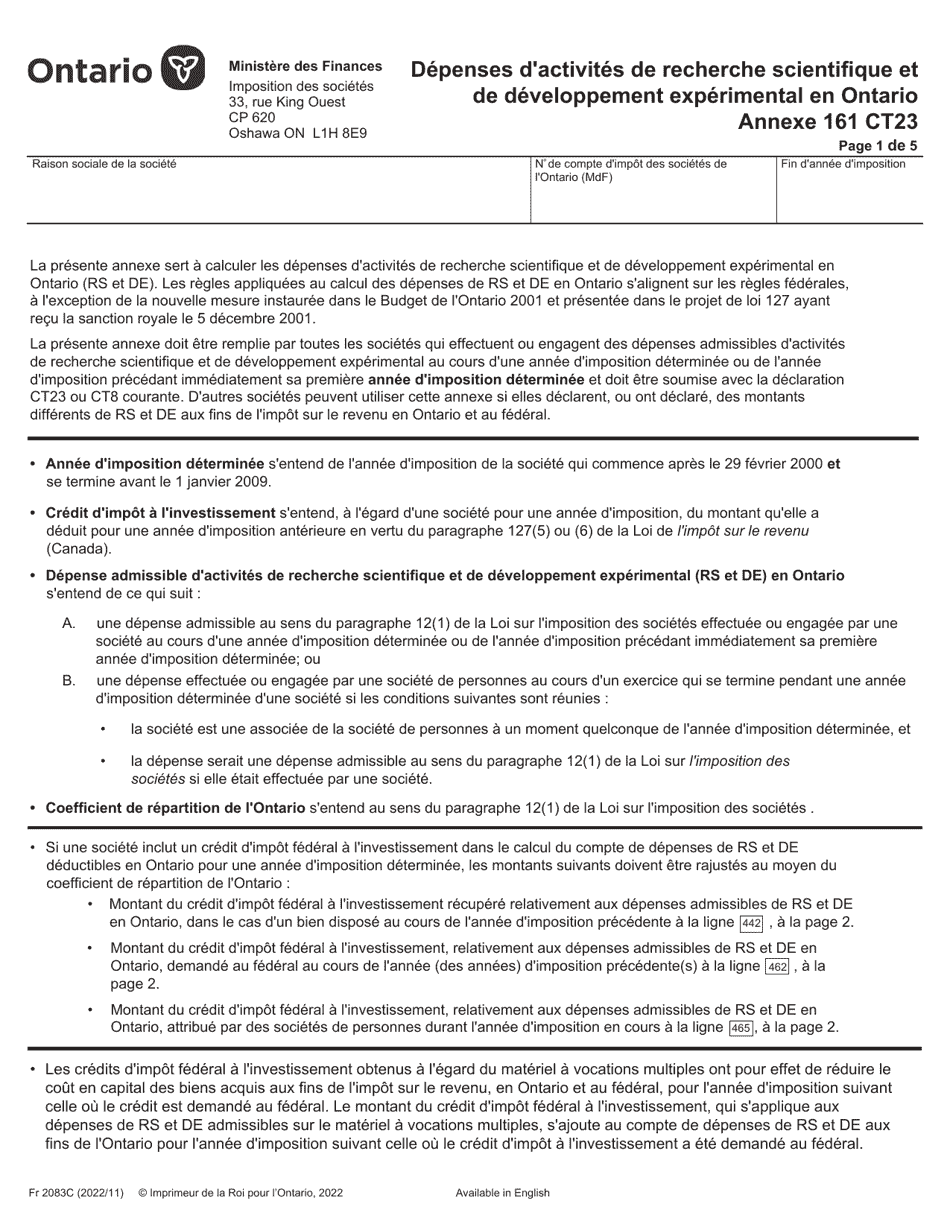

Q: What is the Form 2083C Agenda 161?

A: Form 2083C Agenda 161 is a form used to report expenses related to scientific research and experimental development activities in Ontario, Canada.

Q: What is considered as scientific research and experimental development activities?

A: Scientific research and experimental development activities refer to activities that contribute to scientific or technological advancement and involve the systematic investigation or experimentation.

Q: Who needs to fill out this form?

A: This form needs to be filled out by individuals or businesses that have incurred expenses related to scientific research and experimental development activities in Ontario.

Q: What is the purpose of this form?

A: The purpose of this form is to report and claim expenses incurred for scientific research and experimental development activities in order to qualify for tax credits and incentives.

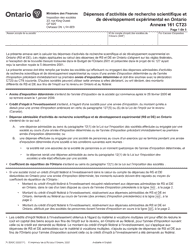

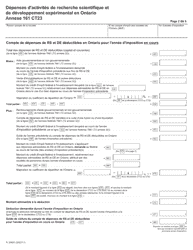

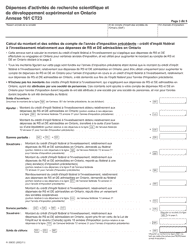

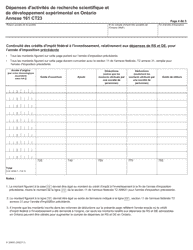

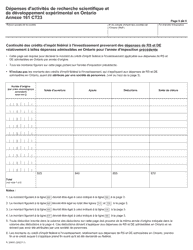

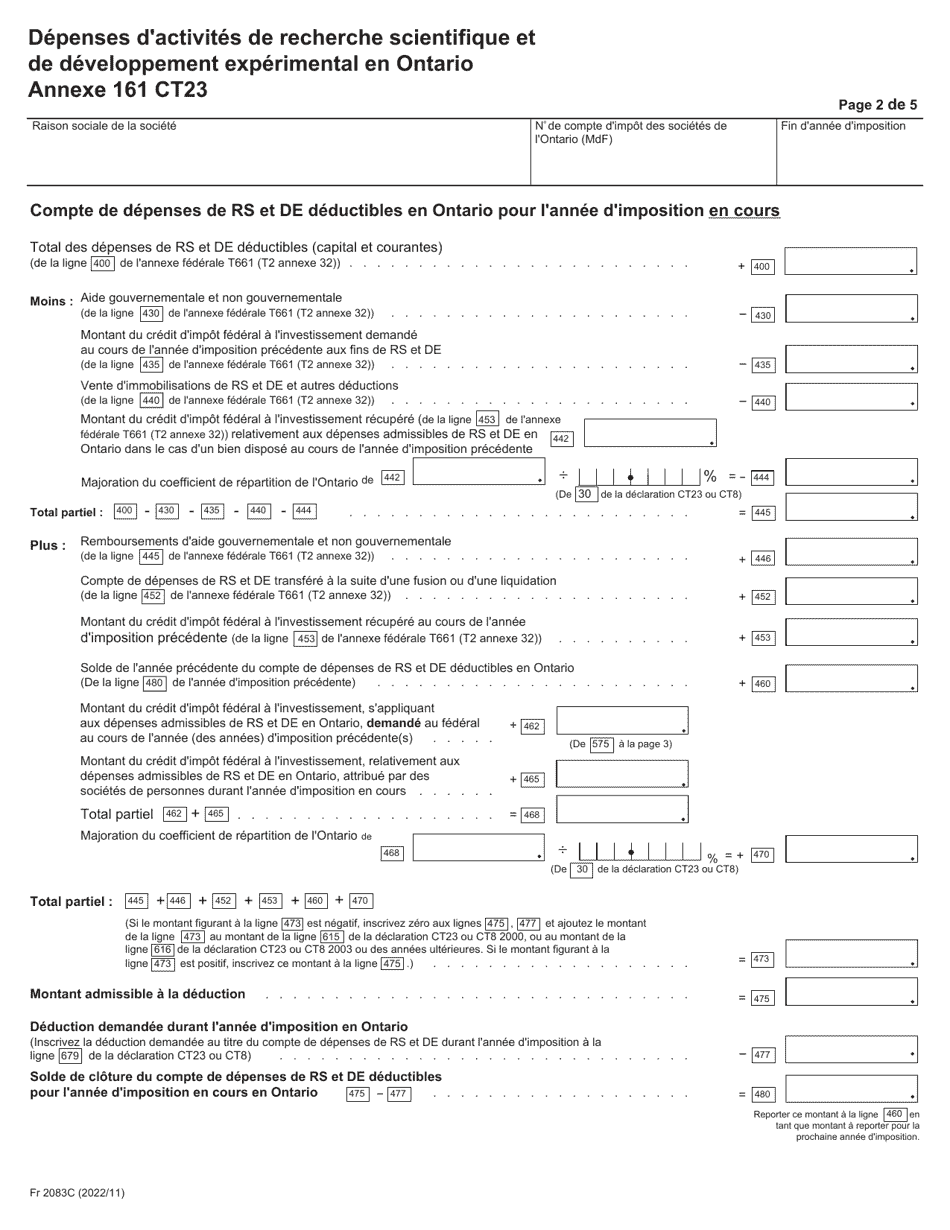

Q: What information is required on this form?

A: The form requires information about the taxpayer's identification, description of the activities, expenses incurred, and supporting documents.

Q: Are there any deadlines for submitting this form?

A: Yes, the form must be filed and submitted to the Ontario Ministry of Finance by a specific deadline, which is usually specified by the ministry.

Q: What are the benefits of filing this form?

A: By filing this form and reporting eligible expenses, individuals and businesses may qualify for tax credits and incentives for scientific research and experimental development activities.

Q: Can I claim expenses for research conducted outside of Ontario?

A: No, this form is specifically for claiming expenses related to scientific research and experimental development activities conducted in Ontario.

Q: Is there any assistance available for filling out this form?

A: Yes, you can seek assistance from tax professionals or the Ontario Ministry of Finance for any questions or guidance regarding this form.