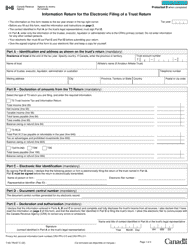

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 9955E

for the current year.

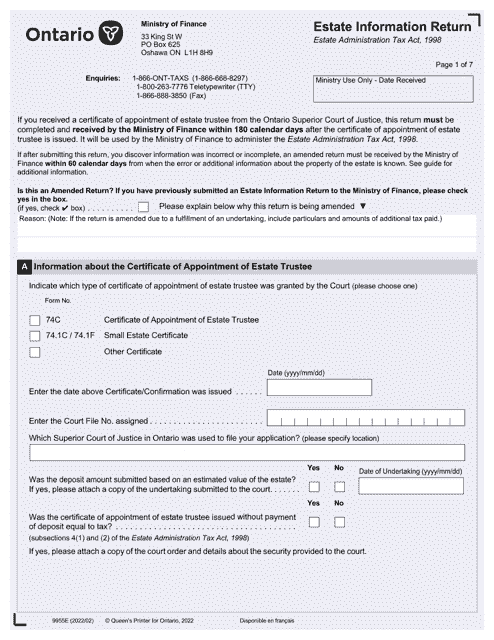

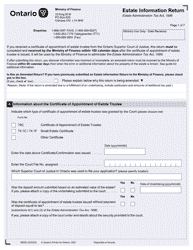

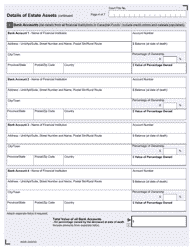

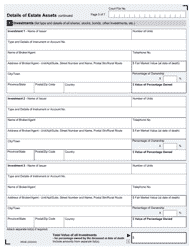

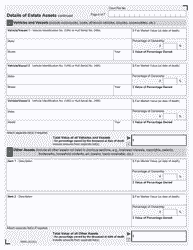

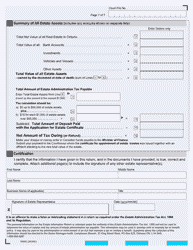

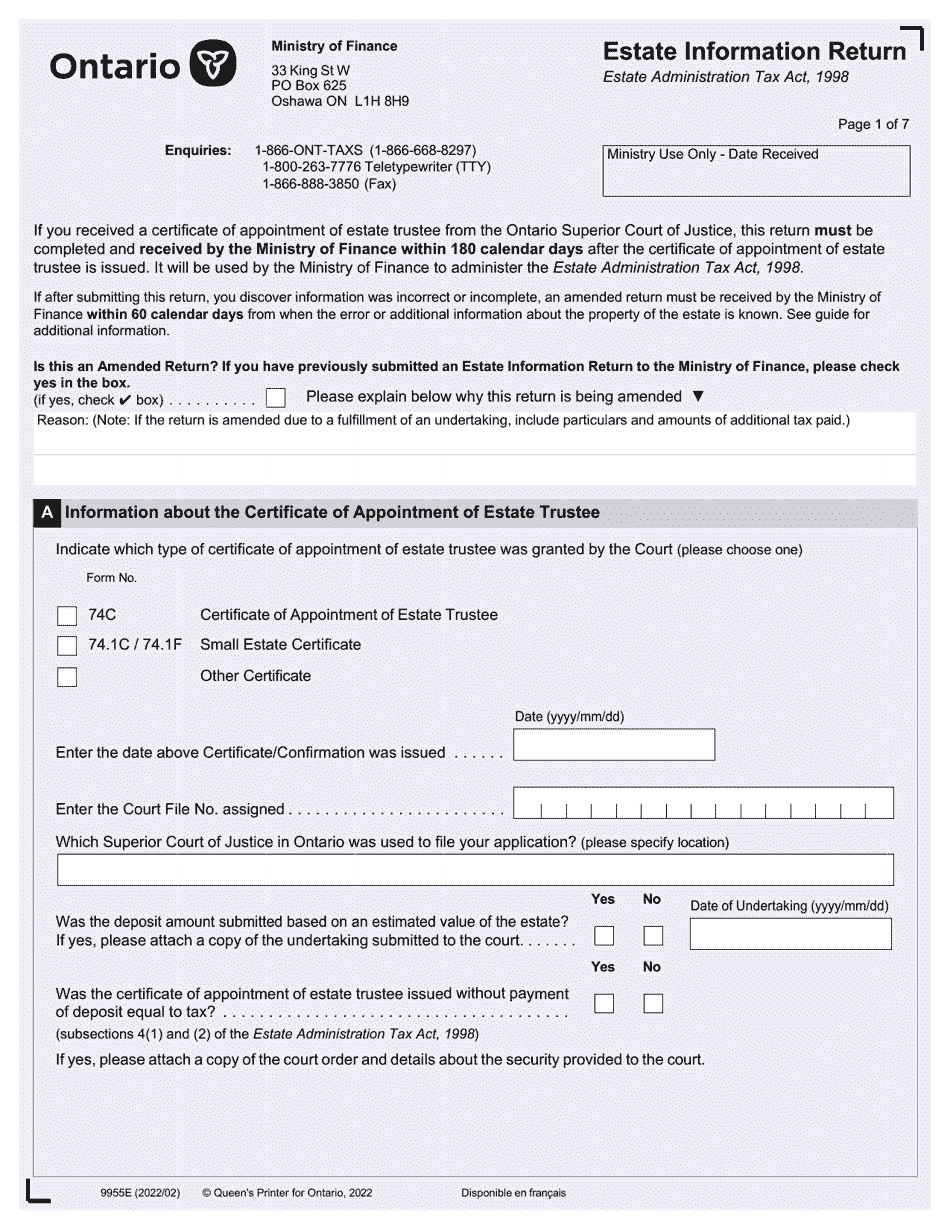

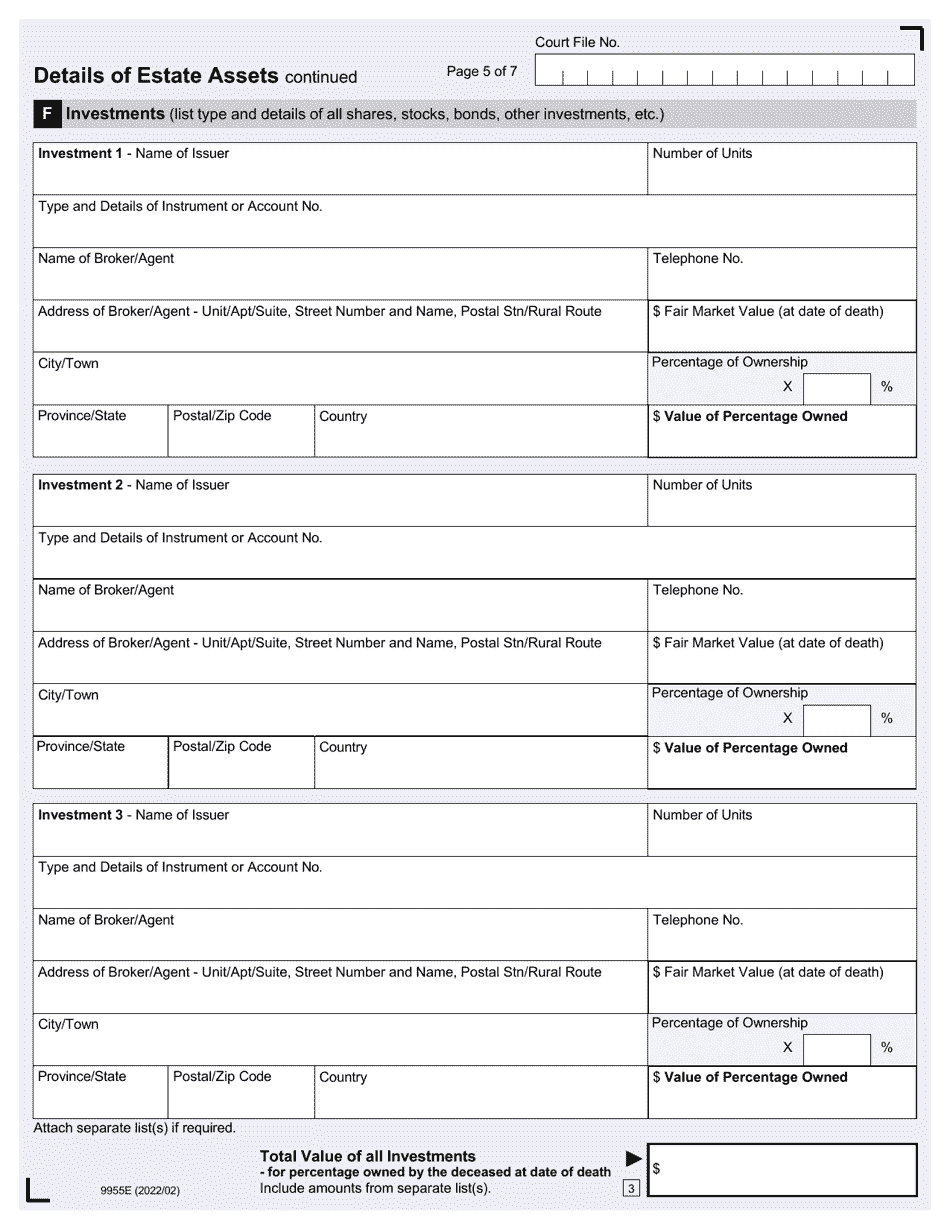

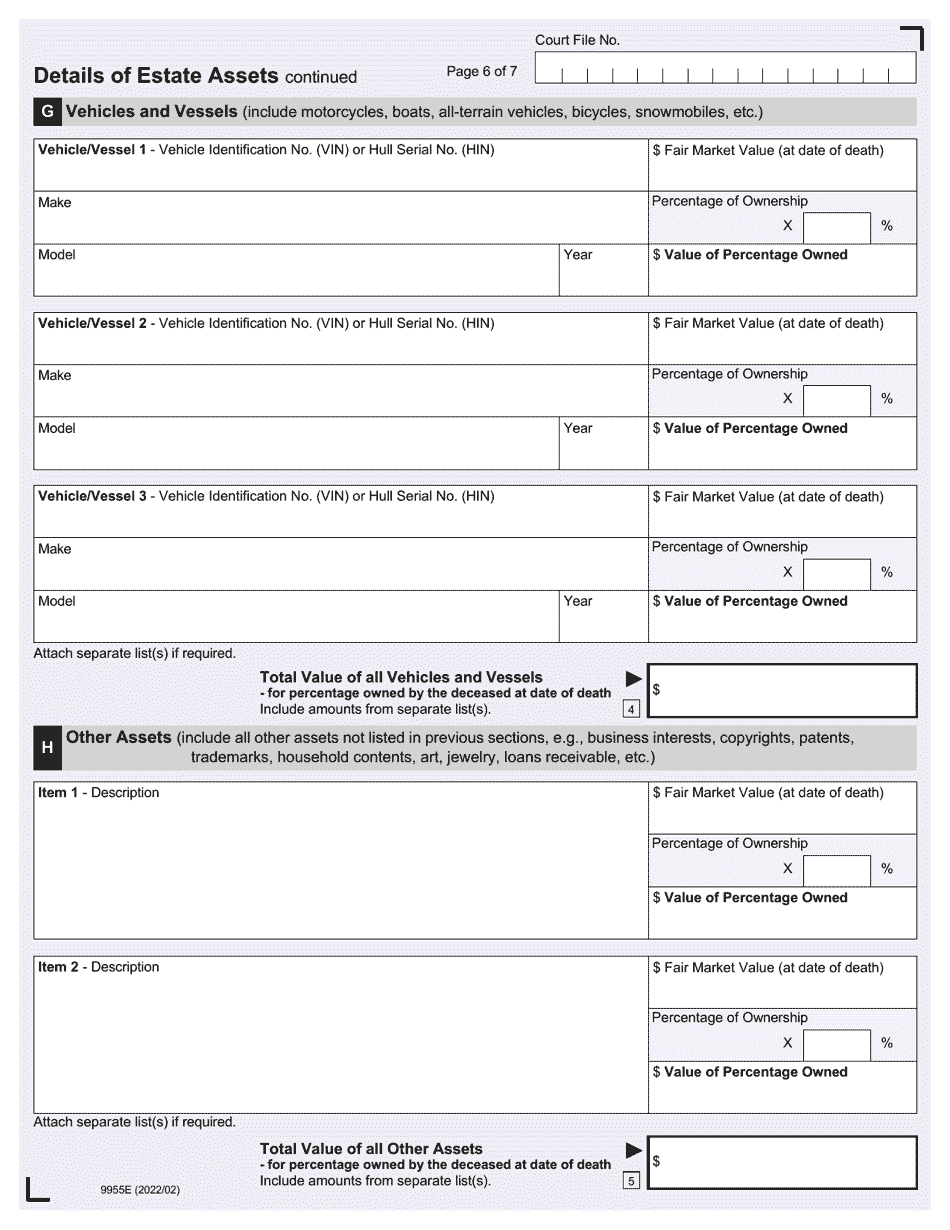

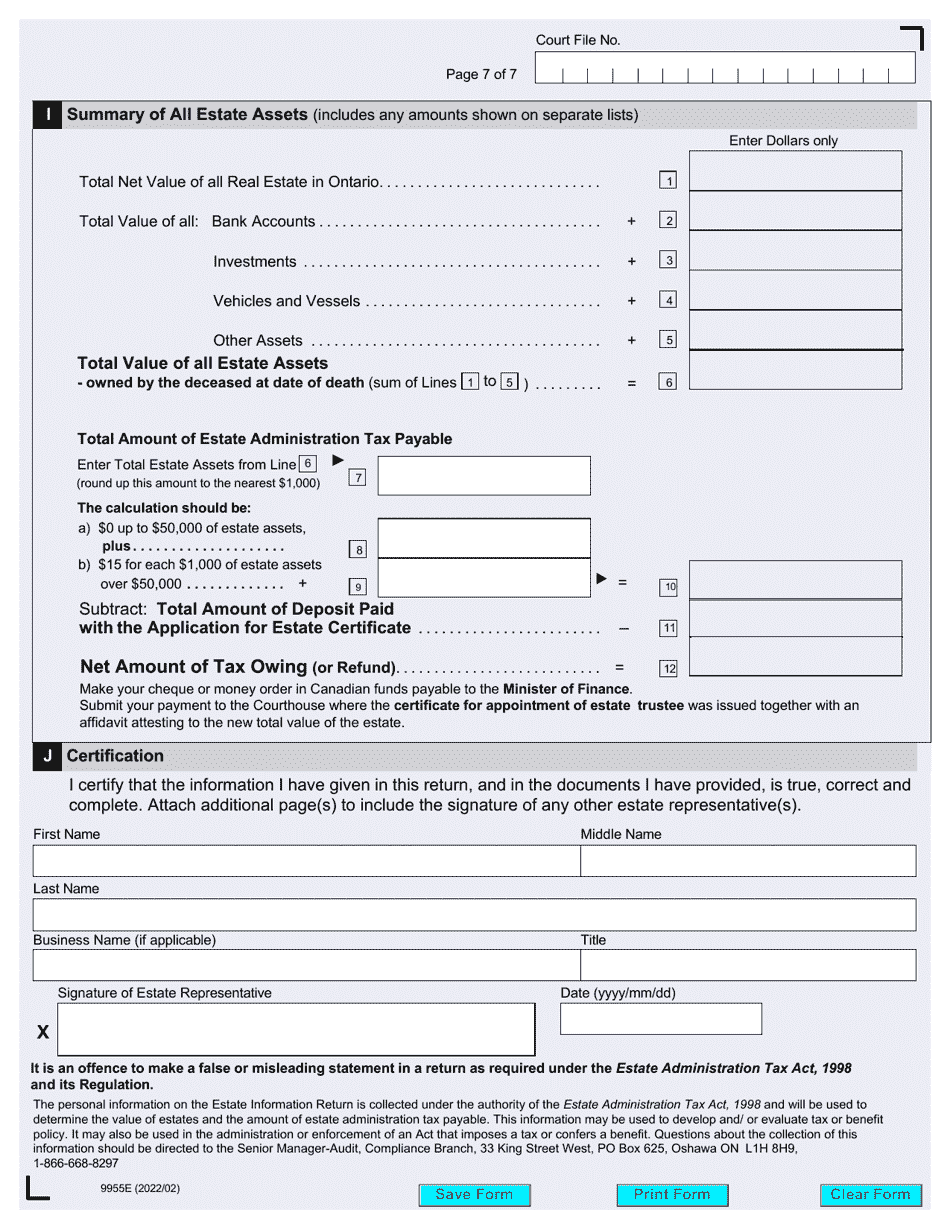

Form 9955E Estate Information Return - After January 1, 2020 - Ontario, Canada

The Form 9955E Estate Information Return is filed by the executor or administrator of the estate after January 1, 2020, in Ontario, Canada.

FAQ

Q: What is Form 9955E?

A: Form 9955E is the Estate Information Return form used in Ontario, Canada.

Q: When is Form 9955E required?

A: Form 9955E is required for the estate of a deceased person in Ontario, Canada.

Q: What is the deadline for filing Form 9955E?

A: The deadline for filing Form 9955E is within 180 days after the date of the deceased person's death.

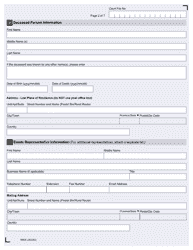

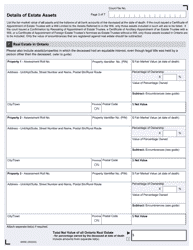

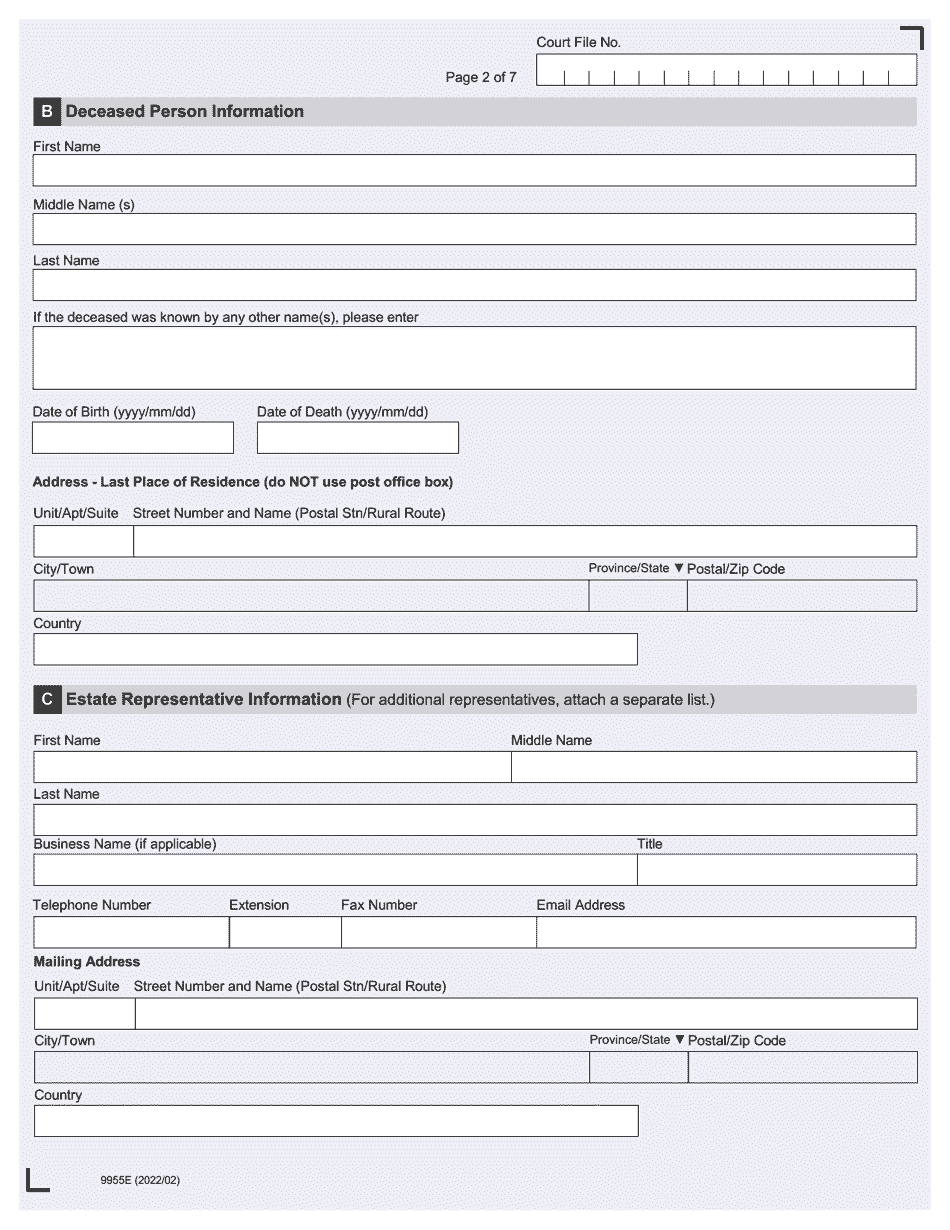

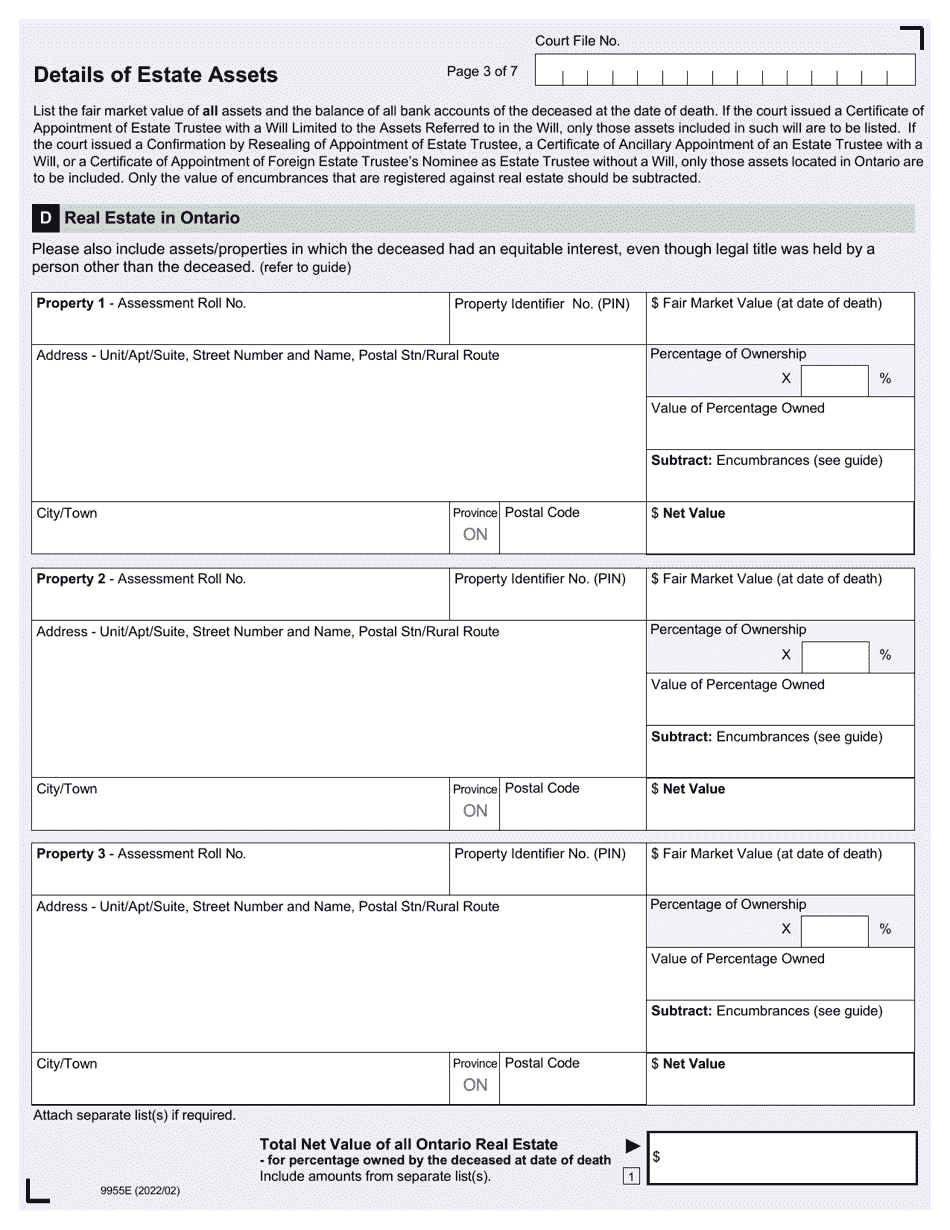

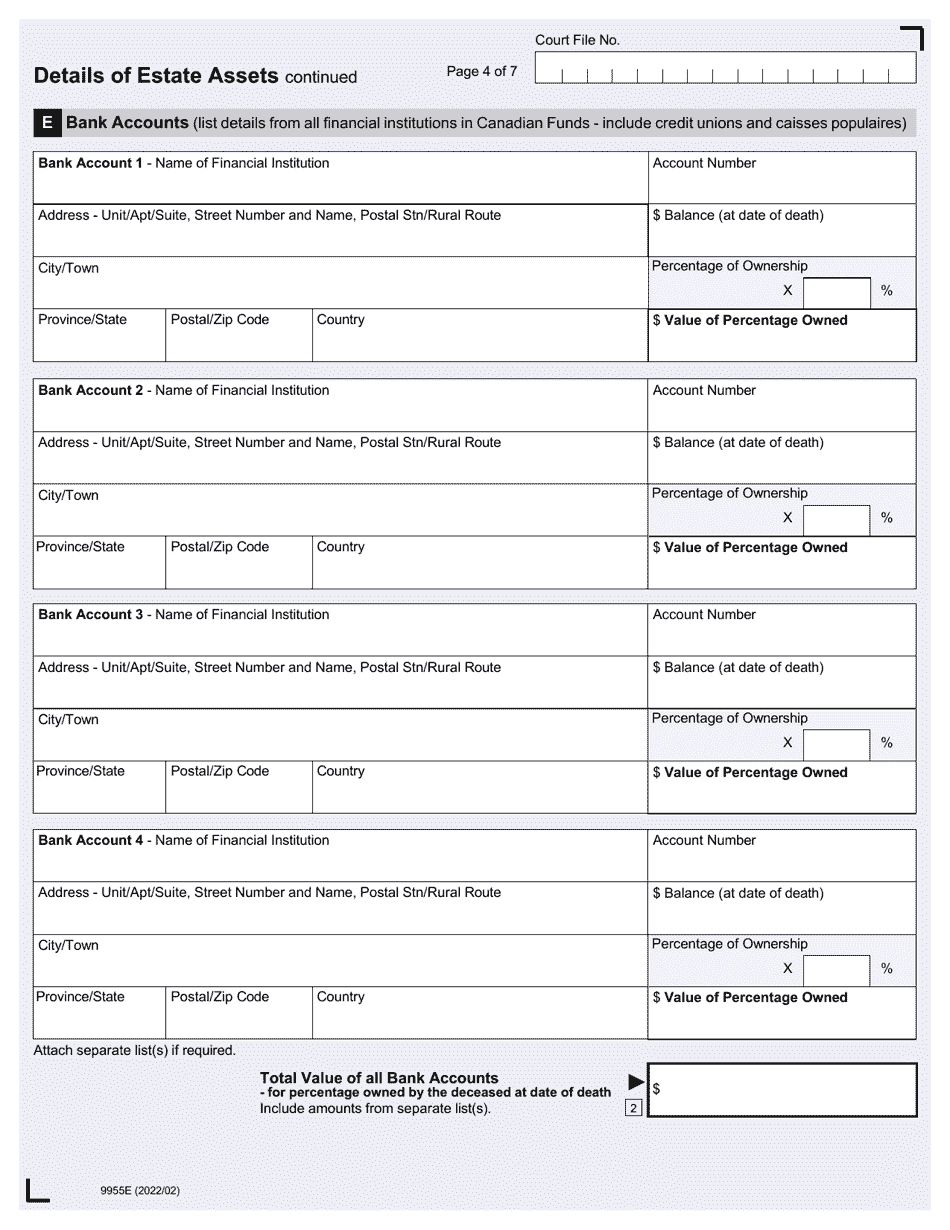

Q: What information is required on Form 9955E?

A: Form 9955E requires information about the deceased person, their assets, debts, and beneficiaries.

Q: Are there any penalties for late filing of Form 9955E?

A: Yes, there are penalties for late filing of Form 9955E, ranging from $1,000 to $10,000.