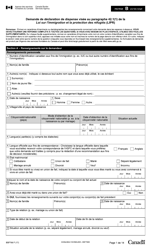

This version of the form is not currently in use and is provided for reference only. Download this version of

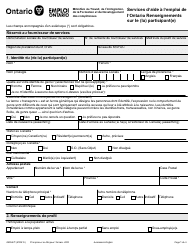

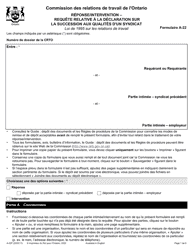

Forme 9955F

for the current year.

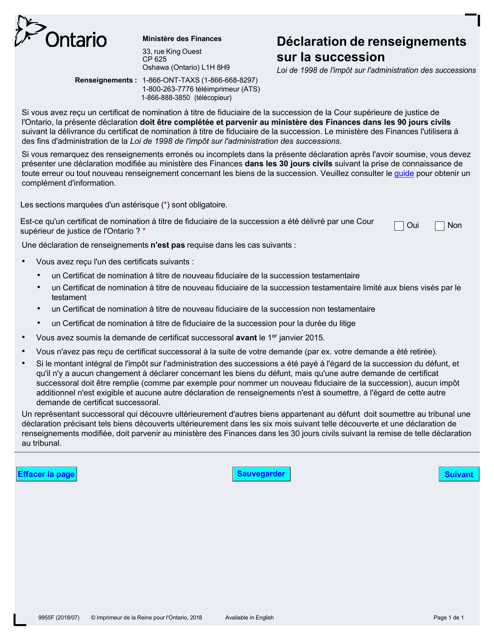

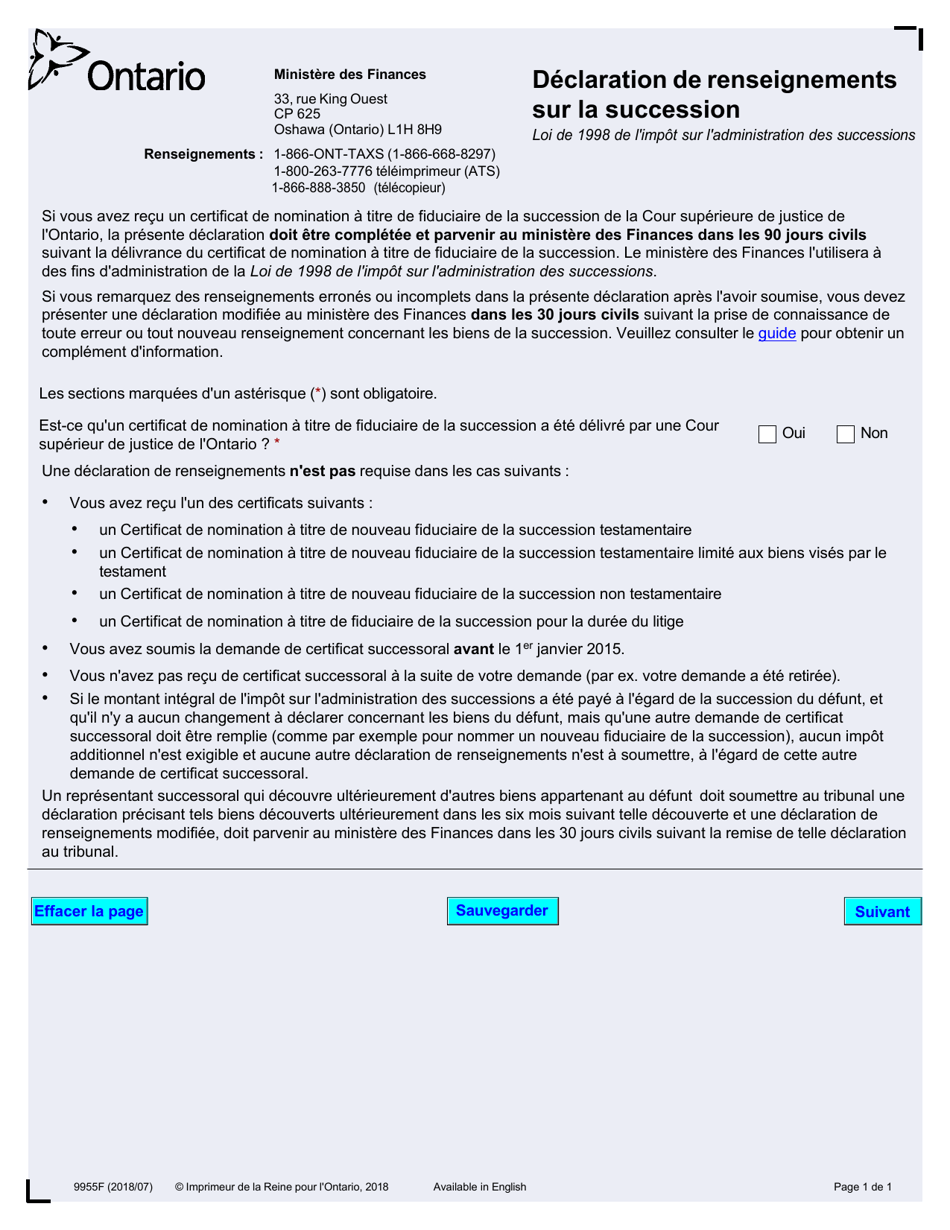

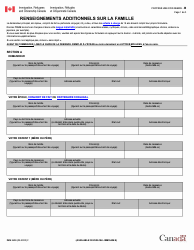

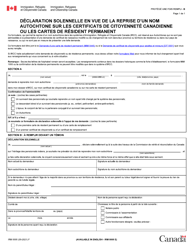

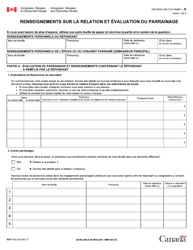

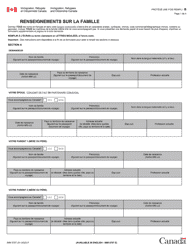

Forme 9955F Declaration De Renseignements Sur La Succession - up to December 31, 2019 - Ontario, Canada (French)

The Form 9955F Declaration De Renseignements Sur La Succession - up to December 31, 2019 in Ontario, Canada (French) is filed by the estate representative or executor of the deceased person.

FAQ

Q: What is Forme 9955F?

A: Forme 9955F is a Declaration of Information on the Estate form used for filing tax information in Ontario, Canada.

Q: What is the purpose of Forme 9955F?

A: The purpose of Forme 9955F is to provide information about the estate for tax purposes.

Q: Is Forme 9955F specific to Ontario?

A: Yes, Forme 9955F is specific to Ontario, Canada.

Q: What is the deadline for filing Forme 9955F?

A: The deadline for filing Forme 9955F is December 31, 2019.

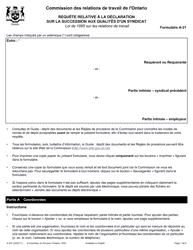

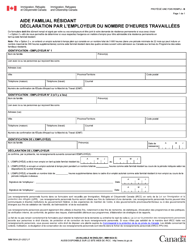

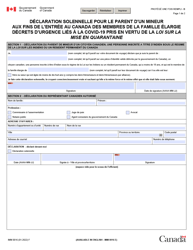

Q: What information is required on Forme 9955F?

A: Forme 9955F requires information about the estate, including the deceased person's personal information, details of assets and liabilities, and information about the estate's beneficiaries.

Q: Is Forme 9955F available in French only?

A: Yes, Forme 9955F is available in French only.

Q: Who needs to file Forme 9955F?

A: Forme 9955F needs to be filed by the executor or administrator of the estate.

Q: Is Forme 9955F used for personal or business taxes?

A: Forme 9955F is used for personal taxes related to the estate, not for business taxes.

Q: What happens if I don't file Forme 9955F?

A: Failure to file Forme 9955F may result in penalties or other consequences.

Q: Can I get assistance for filling out Forme 9955F?

A: Yes, you can seek assistance from a tax professional or contact the CRA for guidance on filling out Forme 9955F.