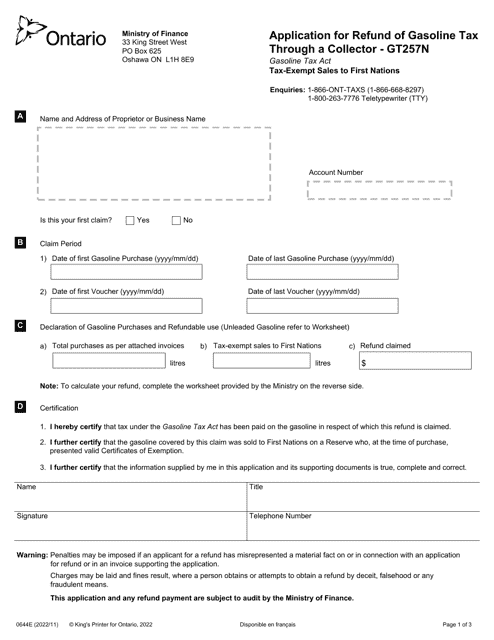

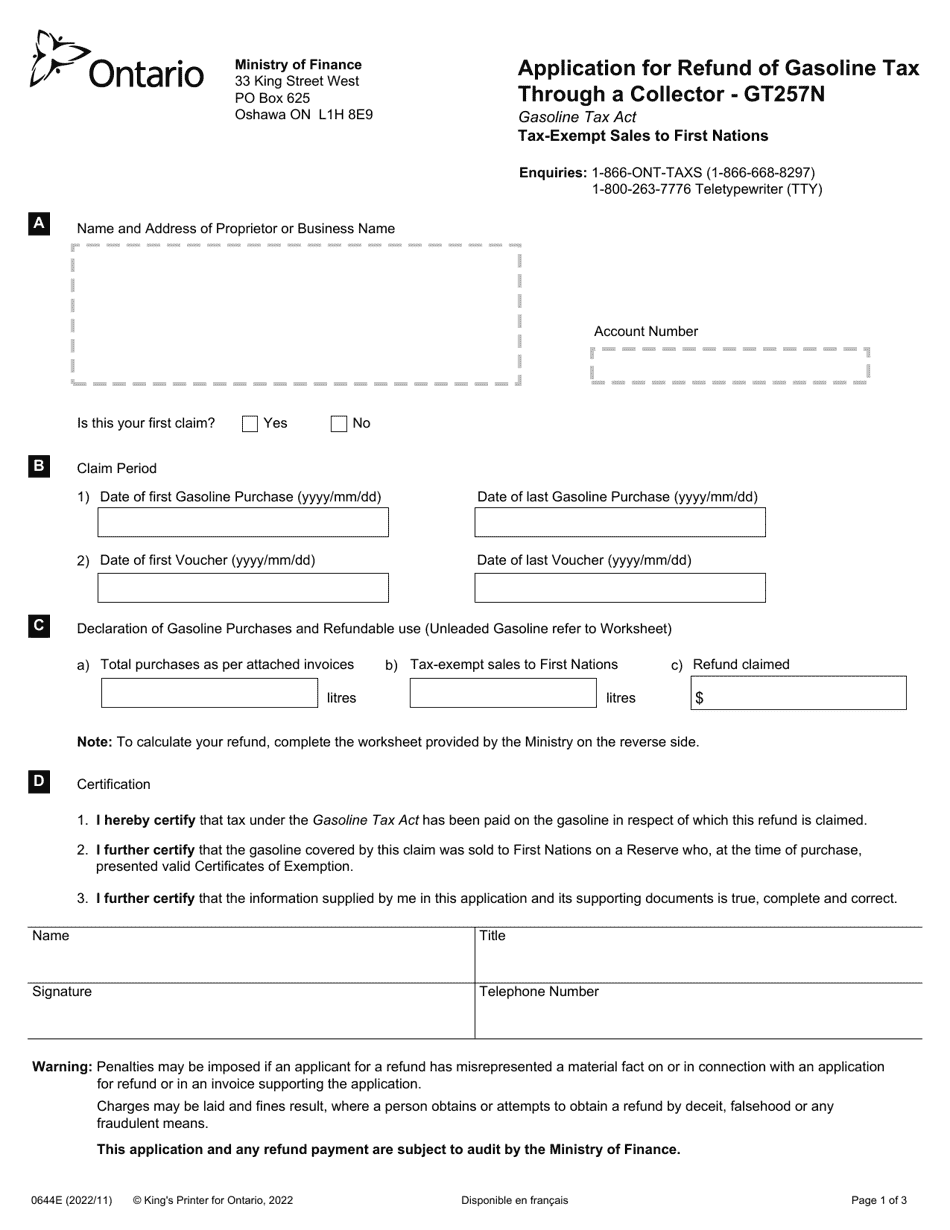

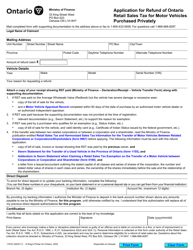

Form GT257N (0644E) Application for Refund of Gasoline Tax Through a Collector - Ontario, Canada

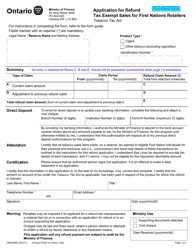

Form GT257N (0644E) Application for Refund of Gasoline Tax Through a Collector in Ontario, Canada is used to apply for a refund of gasoline tax paid by individuals or businesses to a designated collector in Ontario.

The Form GT257N (0644E) Application for Refund of Gasoline Tax Through a Collector in Ontario, Canada is filed by individuals or businesses who are eligible for a refund of gasoline tax.

FAQ

Q: What is form GT257N?

A: Form GT257N is an application for refund of gasoline tax through a collector in Ontario, Canada.

Q: Who can use form GT257N?

A: Any individual or company who has paid gasoline tax in Ontario and wants to apply for a refund can use form GT257N.

Q: What is the purpose of form GT257N?

A: The purpose of form GT257N is to request a refund of gasoline tax paid in Ontario.

Q: What information is required on form GT257N?

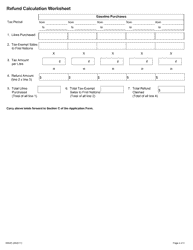

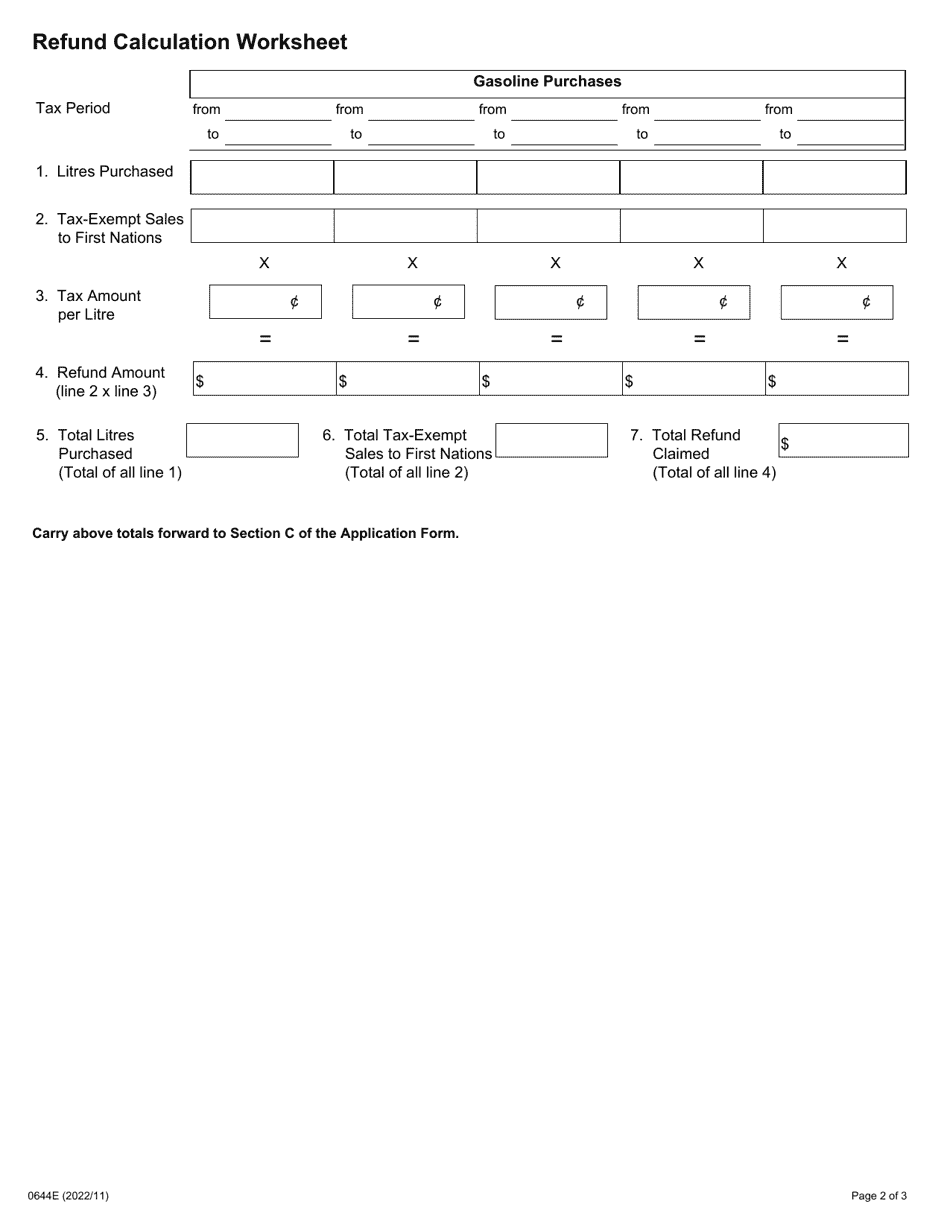

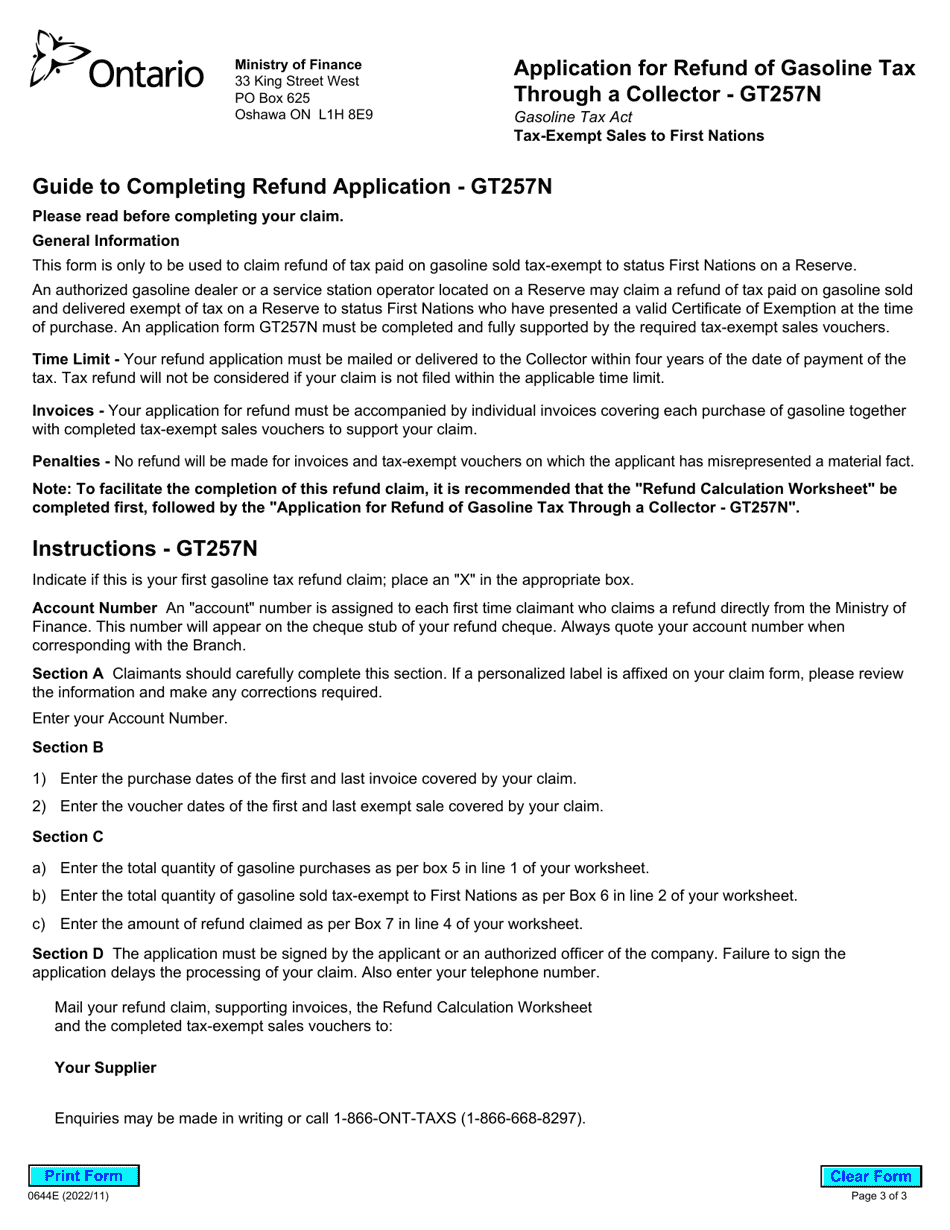

A: Form GT257N requires information such as the claimant's name, address, fuel details, collector's details, and supporting documents.

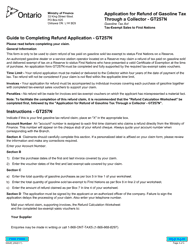

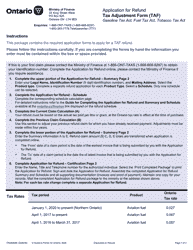

Q: Is there a deadline to submit form GT257N?

A: Yes, form GT257N must be submitted within four years of the date the tax was paid.

Q: Are there any fees to submit form GT257N?

A: No, there are no fees to submit form GT257N.

Q: How long does it take to process a refund application using form GT257N?

A: The processing time for refund applications can vary, but it generally takes around 4-6 weeks.

Q: What should I do if I have more questions about form GT257N?

A: If you have more questions about form GT257N, you can contact the Ontario Ministry of Finance or a local revenue office for assistance.