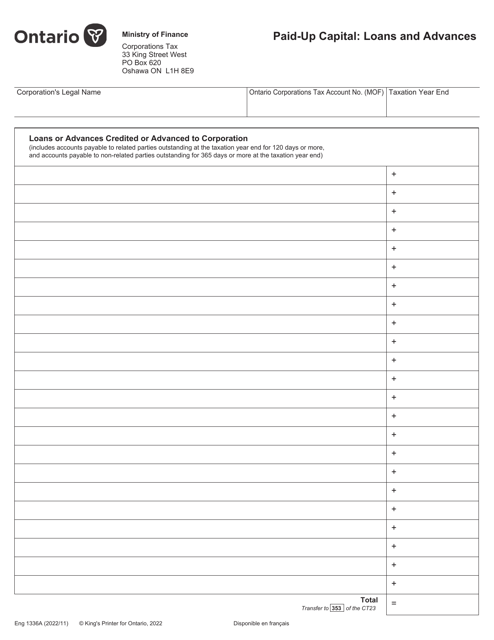

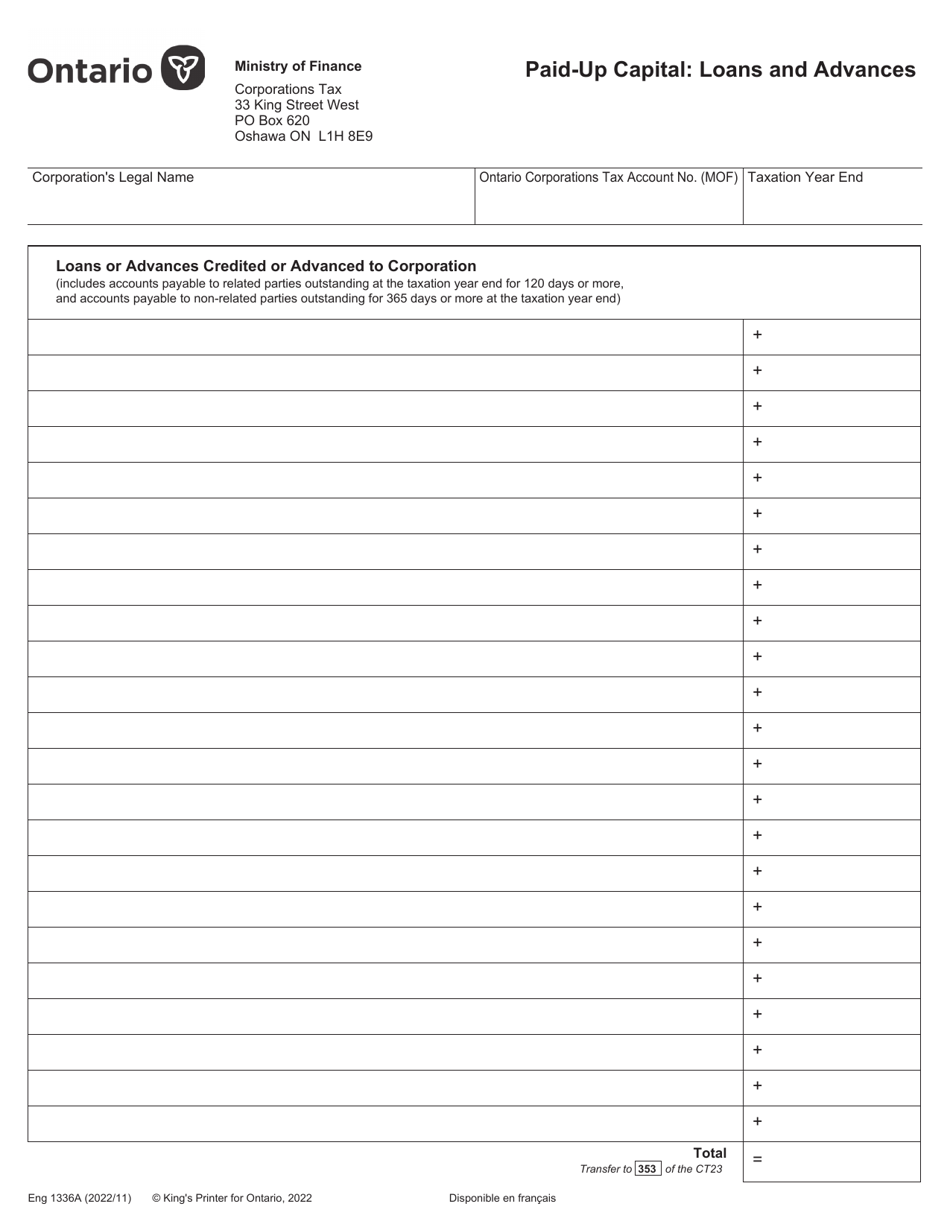

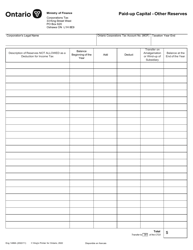

Form 1336A Paid-Up Capital: Loans and Advances - Ontario, Canada

Form 1336A Paid-Up Capital: Loans and Advances in Ontario, Canada is a document used to report the paid-up capital, loans, and advances of a company. It provides information on the amount of capital invested, outstanding loans, and any advances made by the company in Ontario, Canada.

FAQ

Q: What is Form 1336A?

A: Form 1336A is a document used to report paid-up capital, loans, and advances in Ontario, Canada.

Q: What is paid-up capital?

A: Paid-up capital refers to the amount of capital that has been contributed by shareholders in exchange for shares of a company's stock.

Q: What are loans and advances?

A: Loans and advances are funds provided by a company to another party, typically with the expectation of repayment with interest.

Q: Why is it important to report paid-up capital, loans, and advances?

A: Reporting paid-up capital, loans, and advances is important for regulatory compliance and to provide a clear picture of a company's financial position.

Q: Who is required to submit Form 1336A?

A: Companies operating in Ontario, Canada are required to submit Form 1336A if they have paid-up capital, loans, or advances to report.

Q: Are there any specific instructions for filling out Form 1336A?

A: Yes, there are specific instructions provided by the tax authorities on how to fill out Form 1336A accurately.

Q: When is the deadline for submitting Form 1336A?

A: The deadline for submitting Form 1336A may vary depending on the specific requirements of the Canada Revenue Agency (CRA). It is important to check the official guidelines or consult with a tax professional.