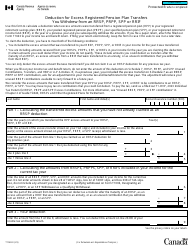

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 9950E

for the current year.

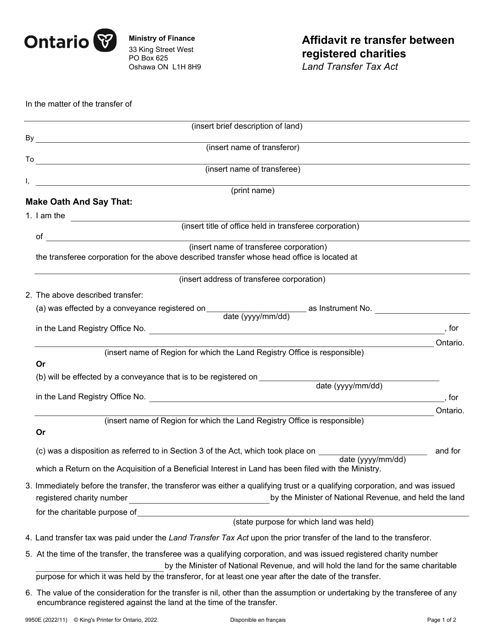

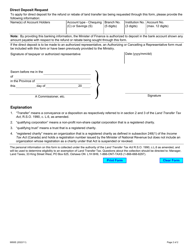

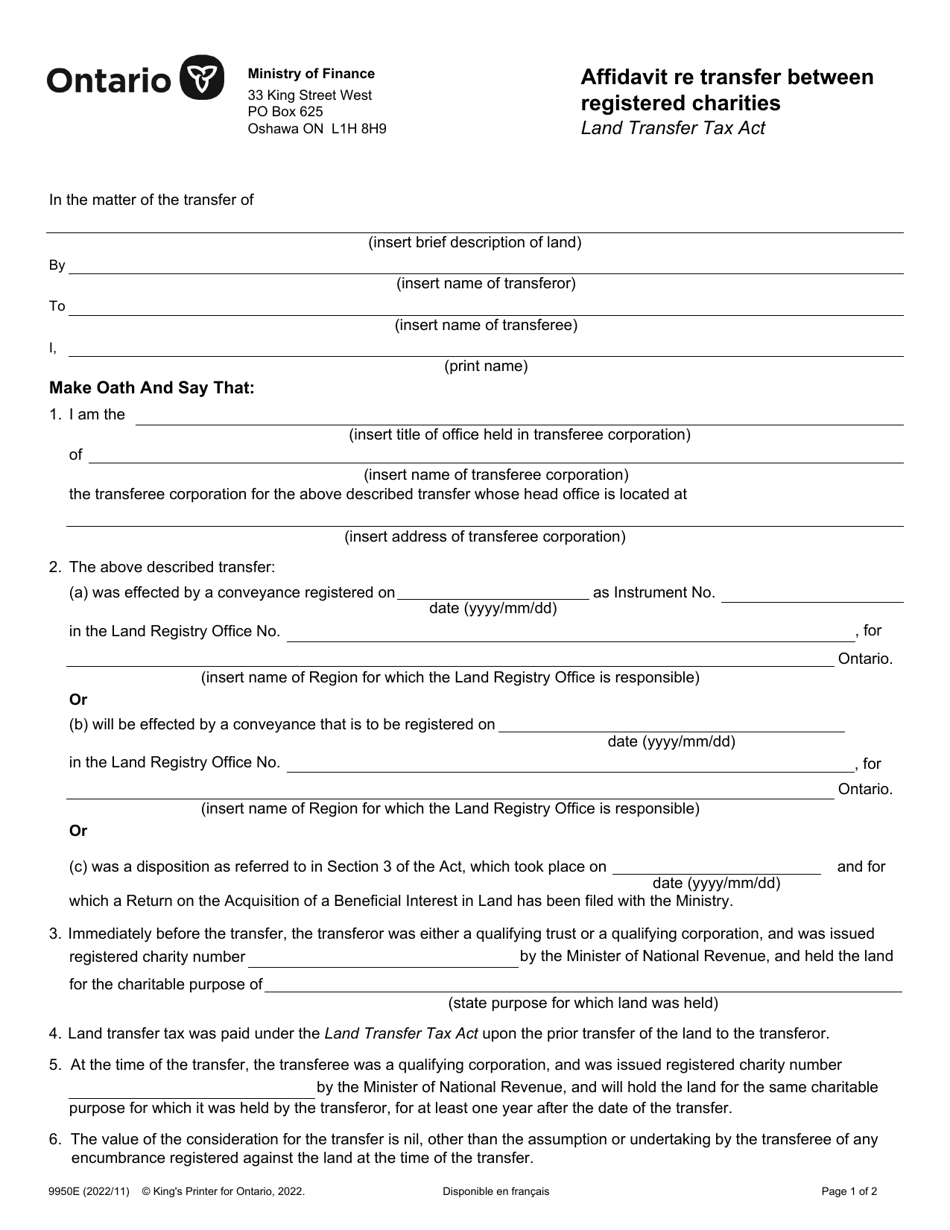

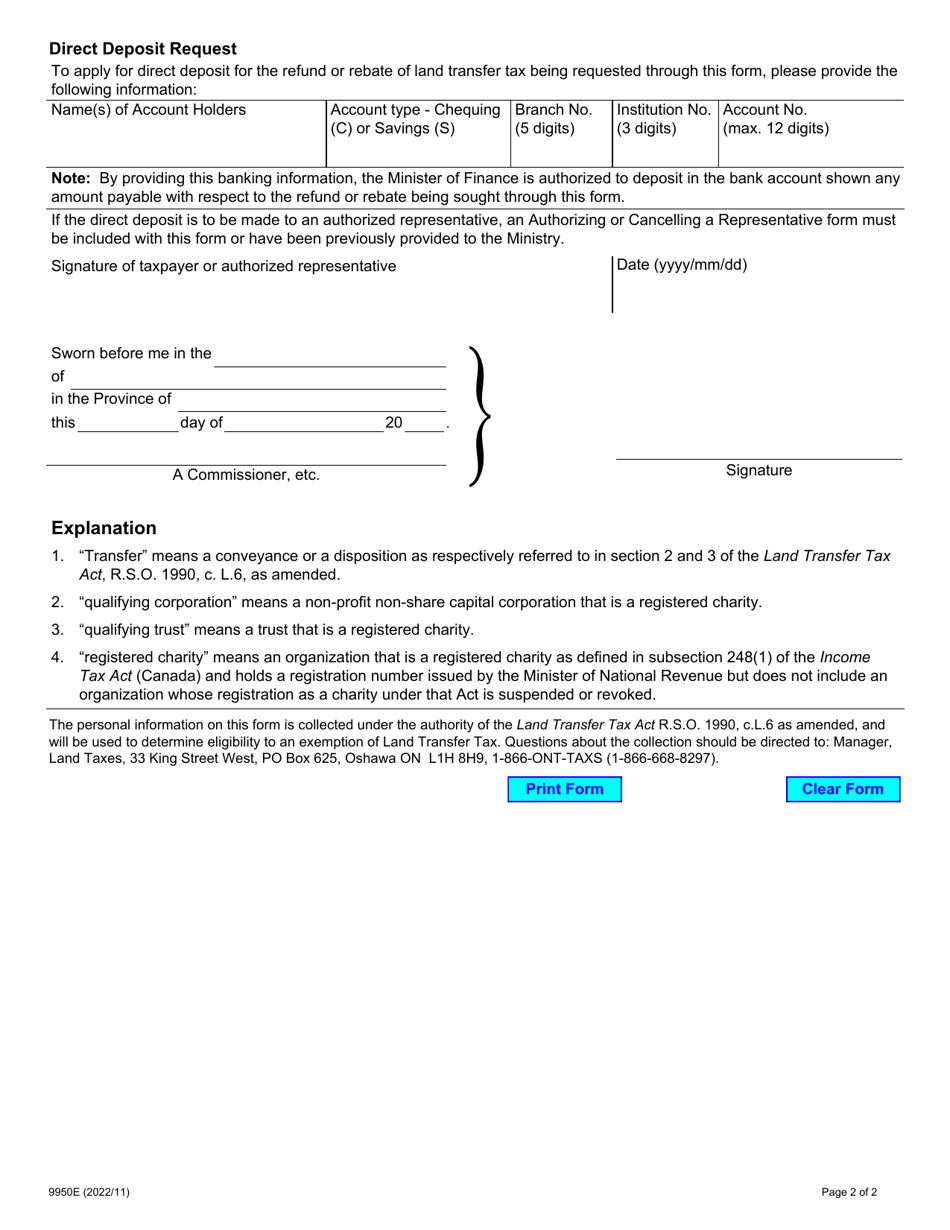

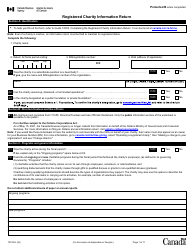

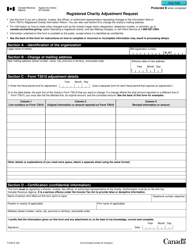

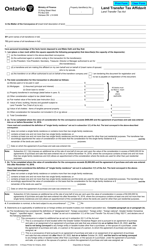

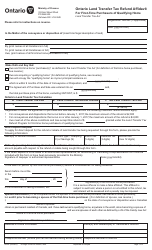

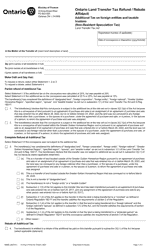

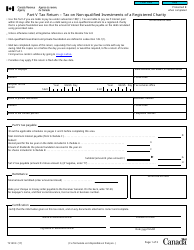

Form 9950E Affidavit Re Transfer Between Registered Charities - Ontario, Canada

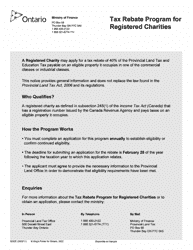

Form 9950E Affidavit Re Transfer Between Registered Charities is used in Ontario, Canada for transferring assets between registered charities. The form serves as a legal declaration stating the details of the transfer and is required by the Ontario Ministry of Finance.

In Ontario, Canada, the Form 9950E Affidavit Re Transfer Between Registered Charities is filed by the transferring charity.

FAQ

Q: What is Form 9950E?

A: Form 9950E is an affidavit used for transfer between registered charities in Ontario, Canada.

Q: When is Form 9950E used?

A: Form 9950E is used when registered charities in Ontario want to transfer assets between each other.

Q: Can Form 9950E be used for transfers outside of Ontario?

A: No, Form 9950E can only be used for transfers between registered charities within Ontario, Canada.

Q: What information is required in Form 9950E?

A: Form 9950E requires details about the transferring charity, receiving charity, and the assets being transferred.

Q: Are there any fees associated with submitting Form 9950E?

A: No, there are no fees associated with submitting Form 9950E.

Q: What happens after submitting Form 9950E?

A: After submitting Form 9950E, the CRA will review the application and may contact the charities for further information.

Q: Is it mandatory to use Form 9950E for transfers between registered charities in Ontario?

A: Yes, using Form 9950E is mandatory for transfers between registered charities in Ontario.

Q: Are there any penalties for not using Form 9950E?

A: Yes, not using Form 9950E for transfers between registered charities in Ontario may result in penalties or consequences.

Q: Can individuals or non-charitable organizations use Form 9950E?

A: No, Form 9950E is specifically designed for transfers between registered charities in Ontario, and cannot be used by individuals or non-charitable organizations.