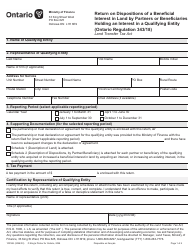

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 0300E

for the current year.

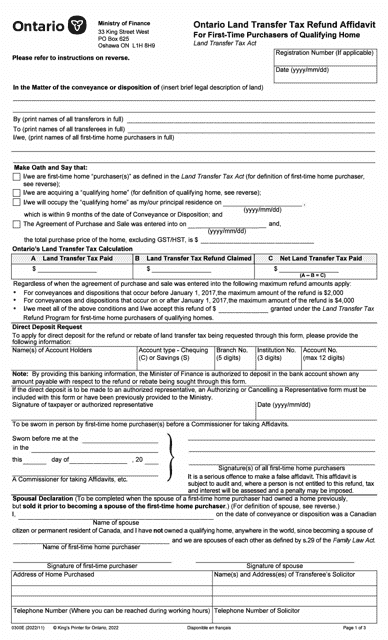

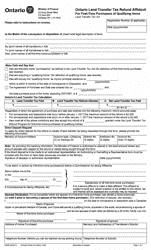

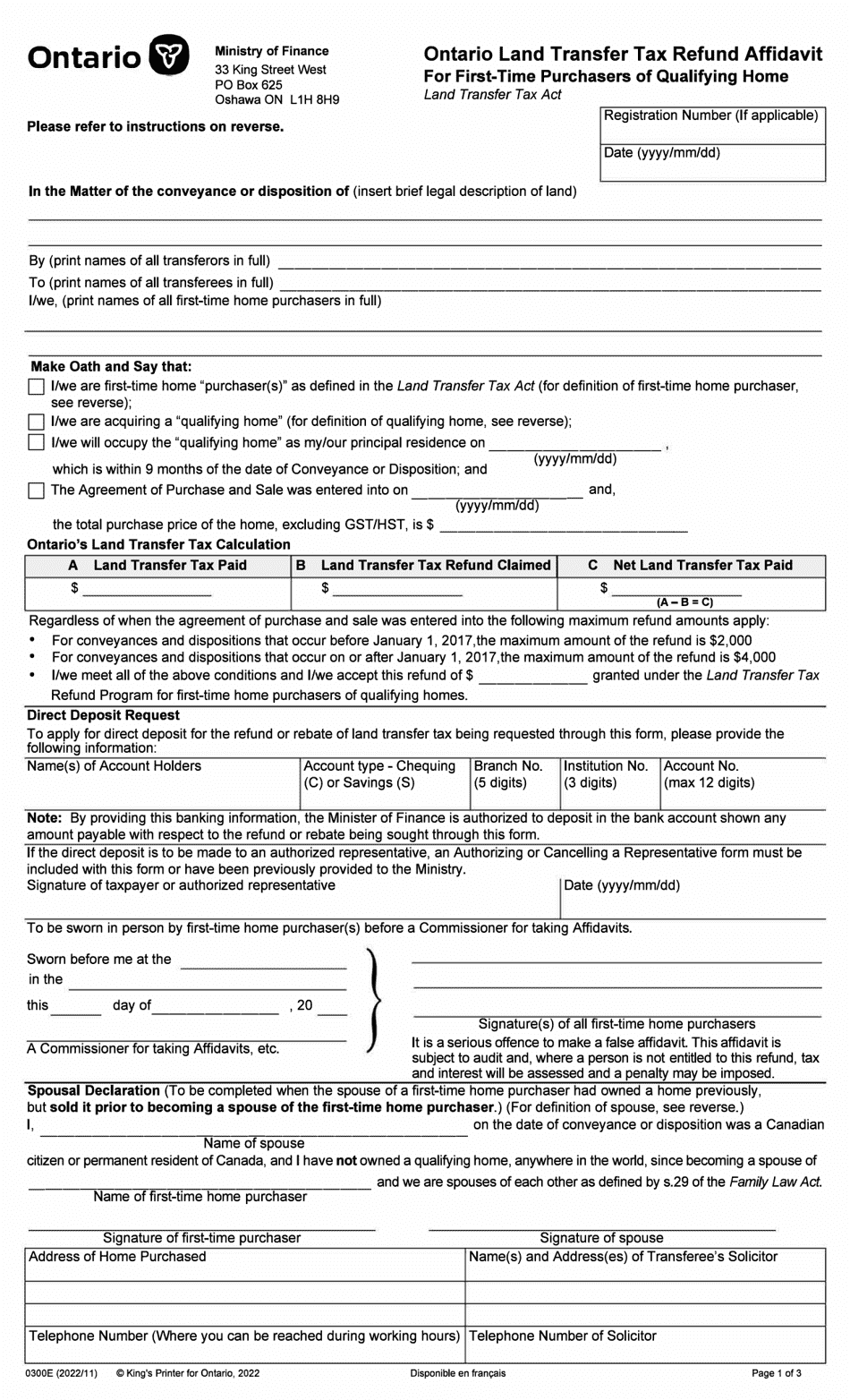

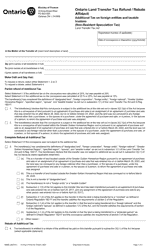

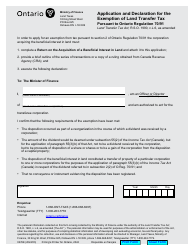

Form 0300E Ontario Land Transfer Tax Refund Affidavit for First-Time Purchasers of Eligible Homes - Ontario, Canada

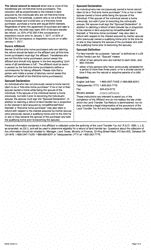

Form 0300E Ontario Land Transfer Tax Refund Affidavit for First-Time Purchasers of Eligible Homes is used in Ontario, Canada for claiming a refund on the land transfer tax for first-time home buyers who meet certain eligibility criteria.

The first-time purchasers of eligible homes in Ontario, Canada, are responsible for filing the Form 0300E Ontario Land Transfer Tax Refund Affidavit.

FAQ

Q: What is Form 0300E?

A: Form 0300E is the Ontario Land Transfer Tax Refund Affidavit for First-Time Purchasers of Eligible Homes.

Q: Who should use Form 0300E?

A: First-time purchasers of eligible homes in Ontario, Canada should use Form 0300E.

Q: What is the purpose of Form 0300E?

A: The purpose of Form 0300E is to apply for a refund of the land transfer tax paid when purchasing an eligible home for the first time.

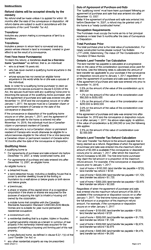

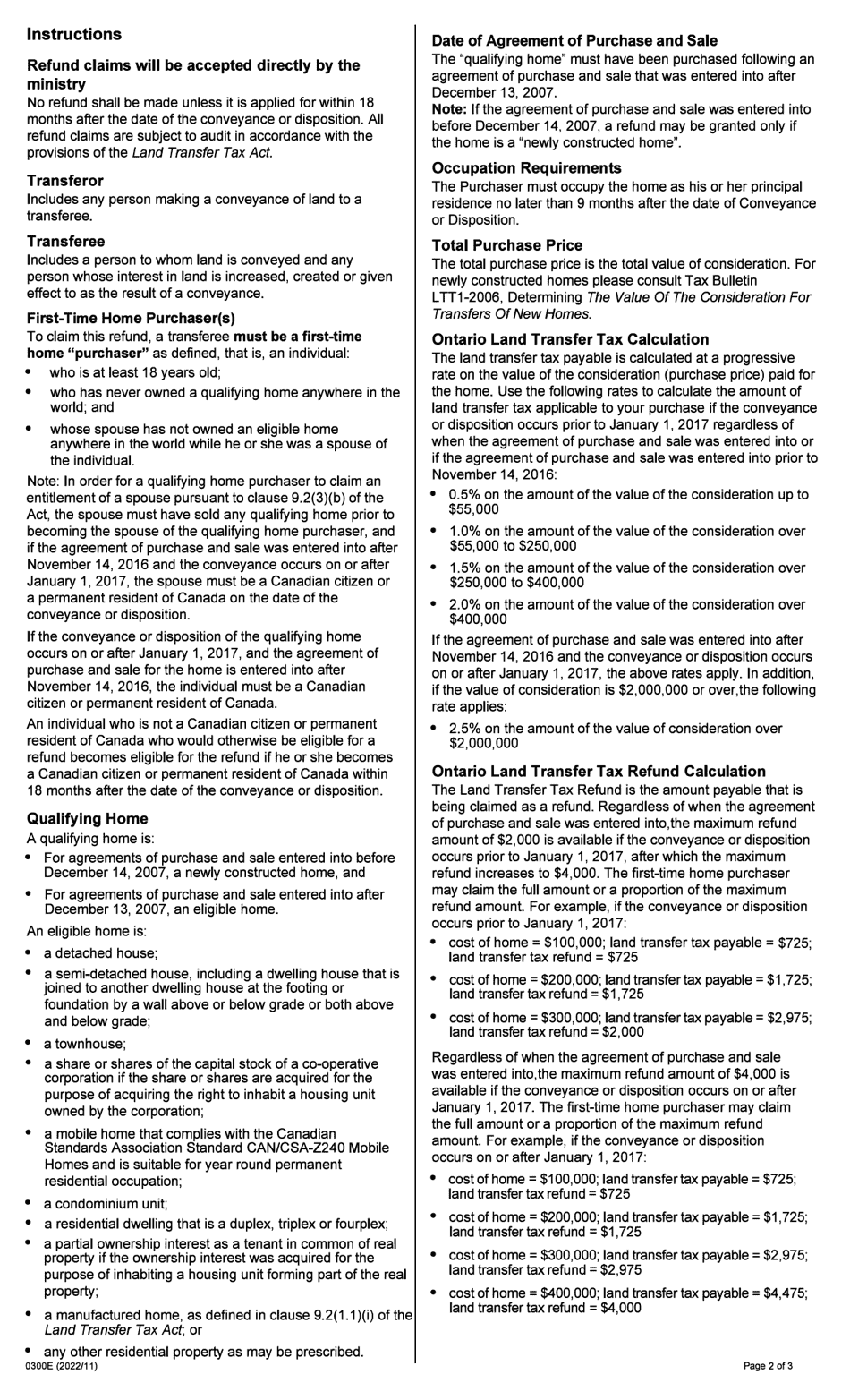

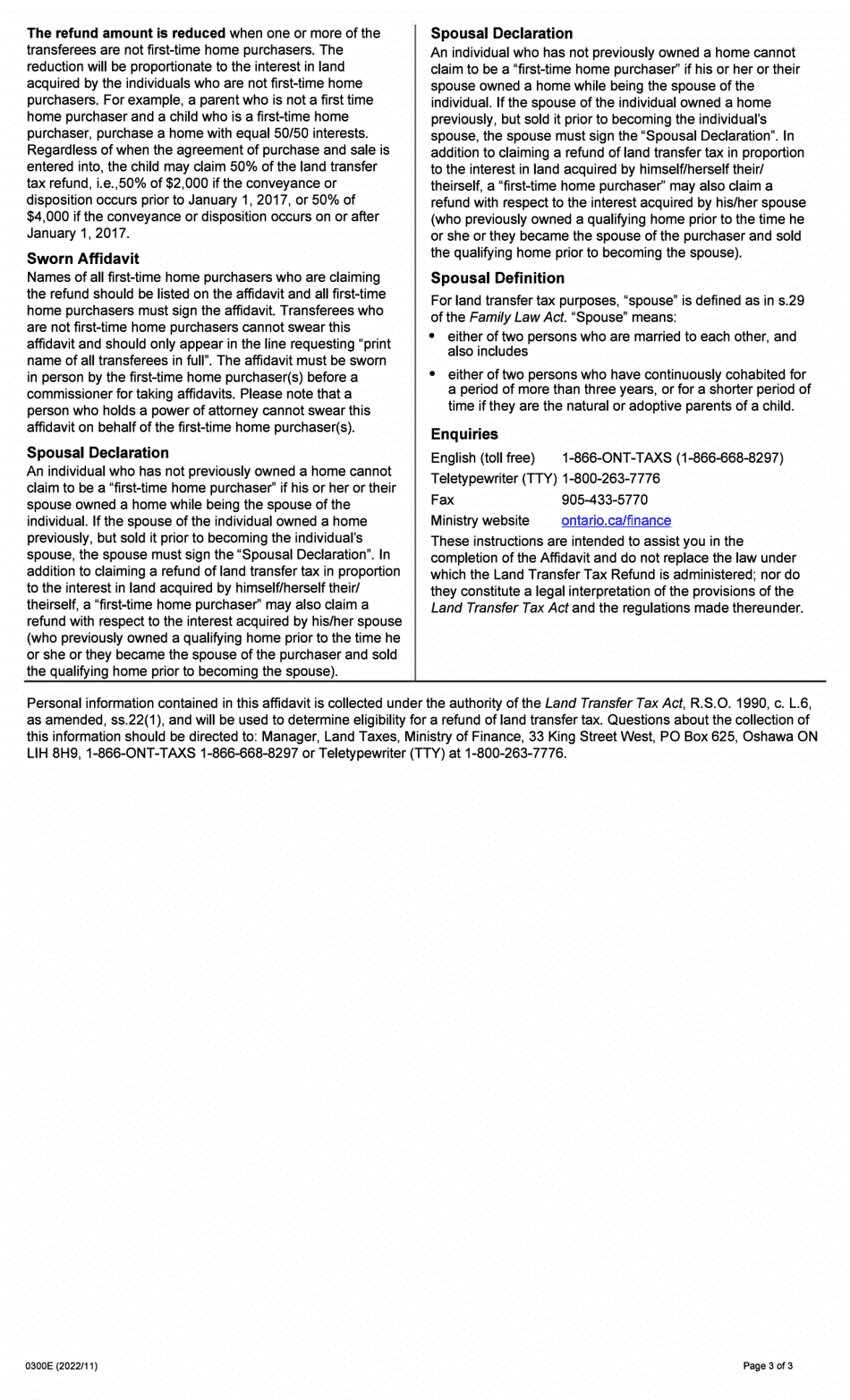

Q: How do I qualify as a first-time purchaser?

A: To qualify as a first-time purchaser, you must not have owned a home, or an interest in a home, anywhere in the world, and you must be at least 18 years of age.

Q: What types of homes are considered eligible?

A: Eligible homes include newly constructed homes, resale homes, condominium units, and mobile homes.

Q: How much refund can I receive?

A: The maximum refund amount is $4,000.

Q: What supporting documents do I need to include with Form 0300E?

A: You will need to include a copy of your Agreement of Purchase and Sale, as well as any other supporting documents requested on the form.

Q: Is there a deadline for submitting Form 0300E?

A: Yes, you must submit Form 0300E within 18 months after the date of the transfer of land.