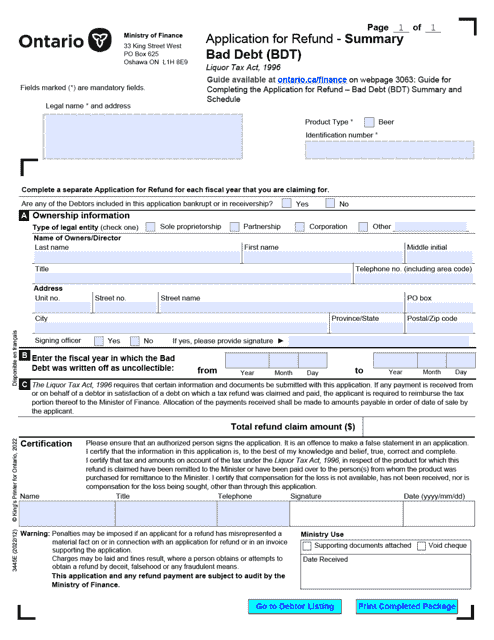

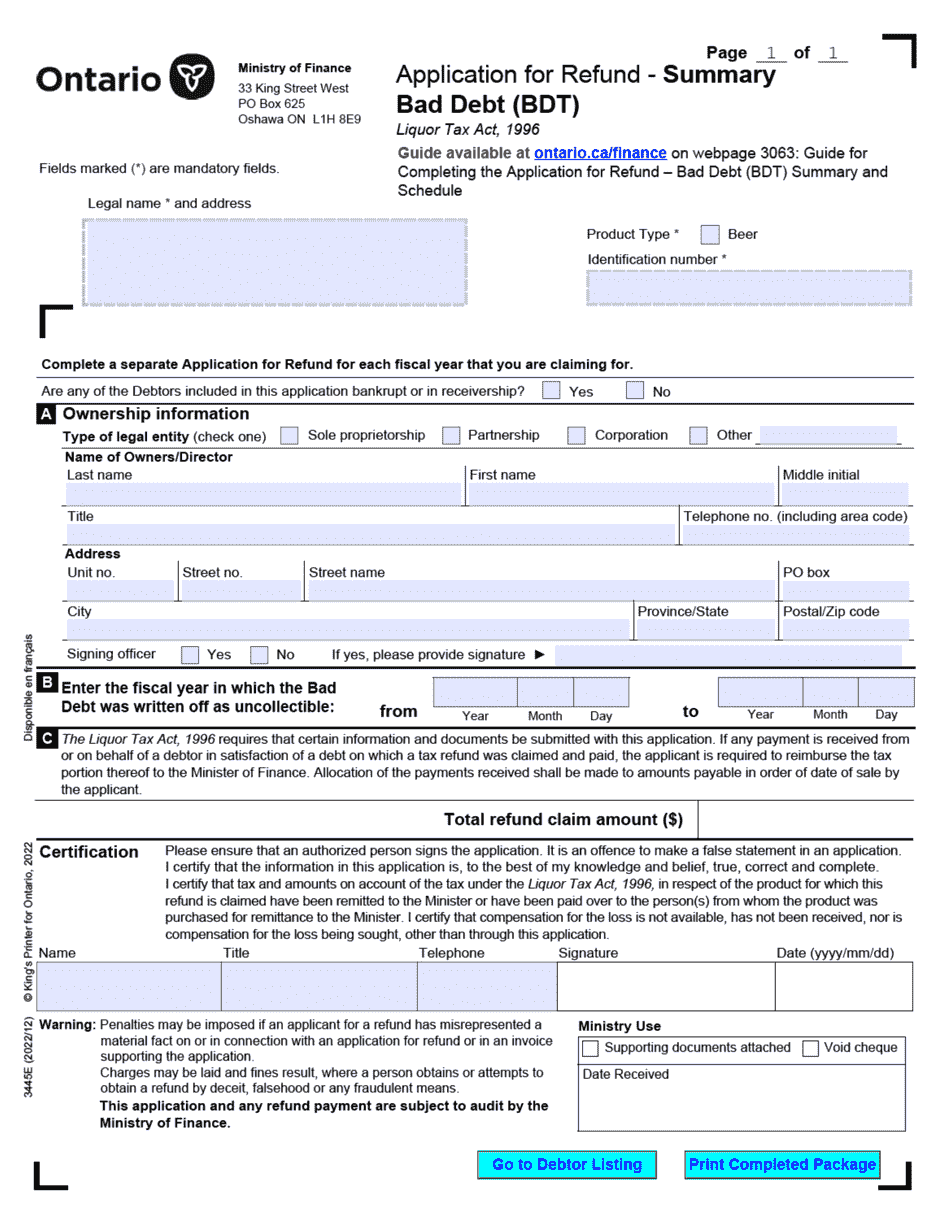

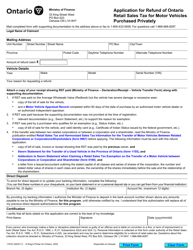

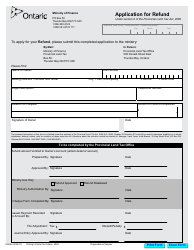

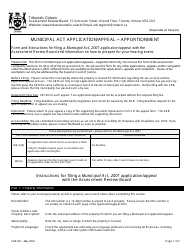

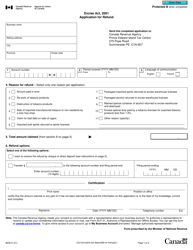

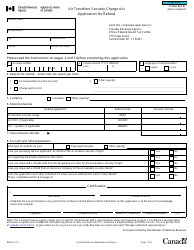

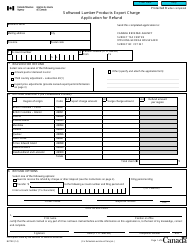

Form 3445E Application for Refund - Bad Debt (Bdt) - Ontario, Canada

Form 3445E Application for Refund - Bad Debt (Bdt) in Ontario, Canada is used to apply for a refund on bad debts that have been written off for business purposes.

In Ontario, Canada, the application for refund for bad debt (Form 3445E) is typically filed by the business or individual who incurred the bad debt.

FAQ

Q: What is Form 3445E?

A: Form 3445E is an application form for claiming a refund related to bad debt in Ontario, Canada.

Q: What is a bad debt refund?

A: A bad debt refund is a refund that can be claimed when a debt becomes uncollectible.

Q: Who can use Form 3445E?

A: Form 3445E can be used by individuals or businesses in Ontario, Canada who want to claim a refund for bad debt.

Q: What information is required on Form 3445E?

A: Form 3445E requires information such as the debtor's name, address, amount of debt, and evidence of attempts to collect the debt.

Q: How do I submit Form 3445E?

A: Form 3445E can be submitted by mail or in person to the Ontario Ministry of Finance.

Q: Is there a deadline for submitting Form 3445E?

A: Yes, Form 3445E must be submitted within four years from the end of the year in which the debt became uncollectible.

Q: How long does it take to process a bad debt refund application?

A: The processing time for a bad debt refund application can vary, but it generally takes several weeks to months.

Q: Can I claim a refund for bad debt incurred outside of Ontario?

A: No, Form 3445E is specifically for refunds related to bad debt incurred in Ontario, Canada.

Q: Are there any fees associated with filing Form 3445E?

A: No, there are no fees for filing Form 3445E.