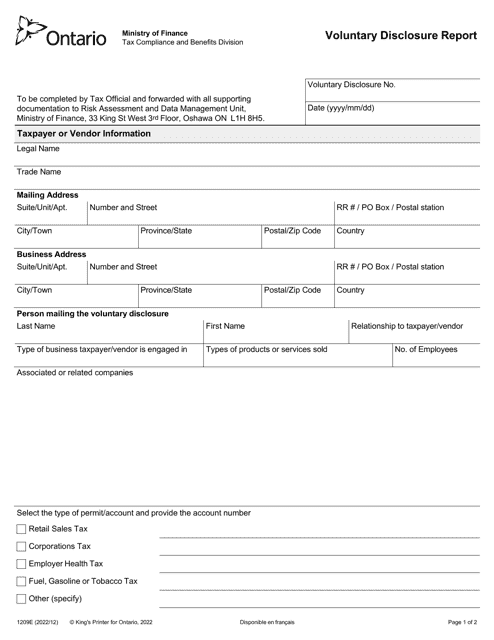

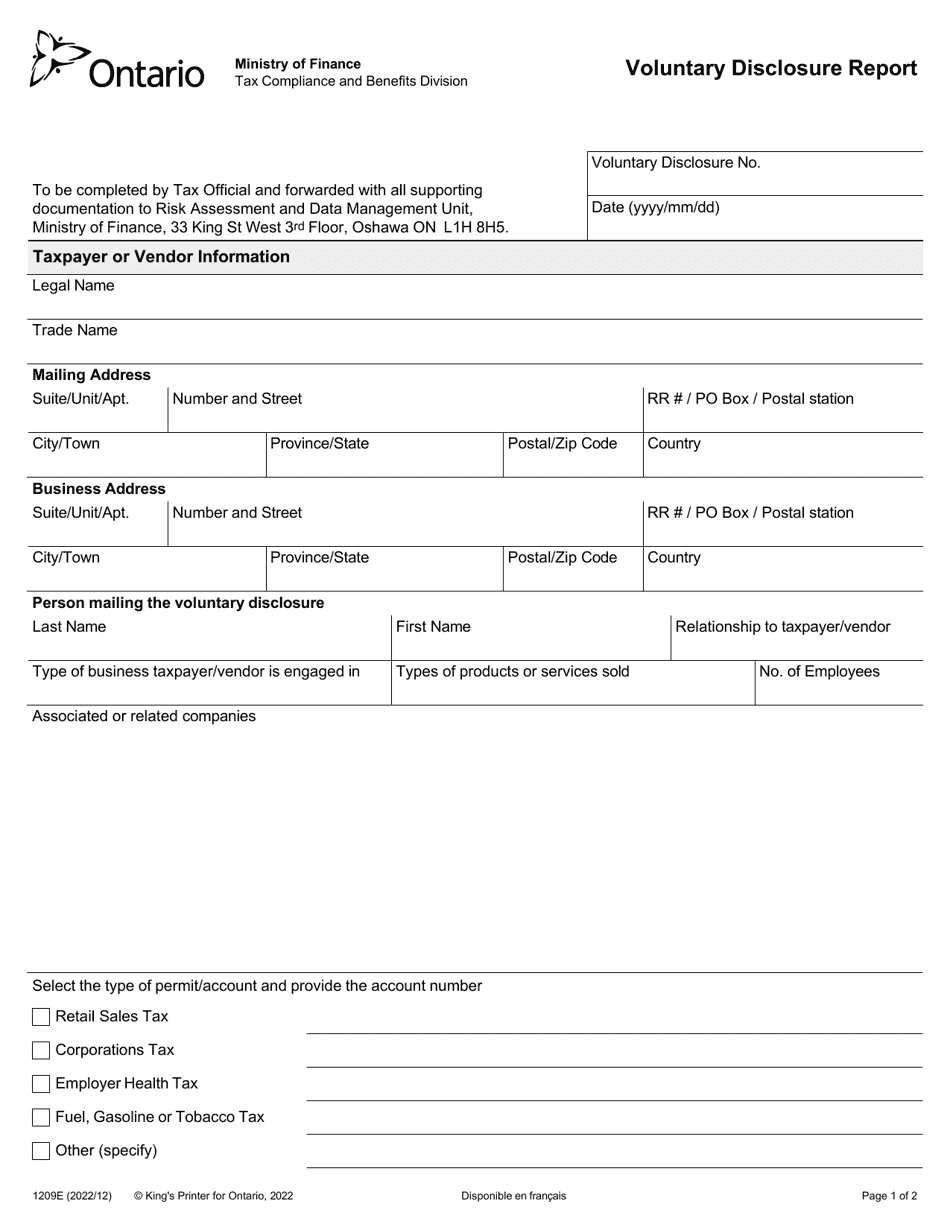

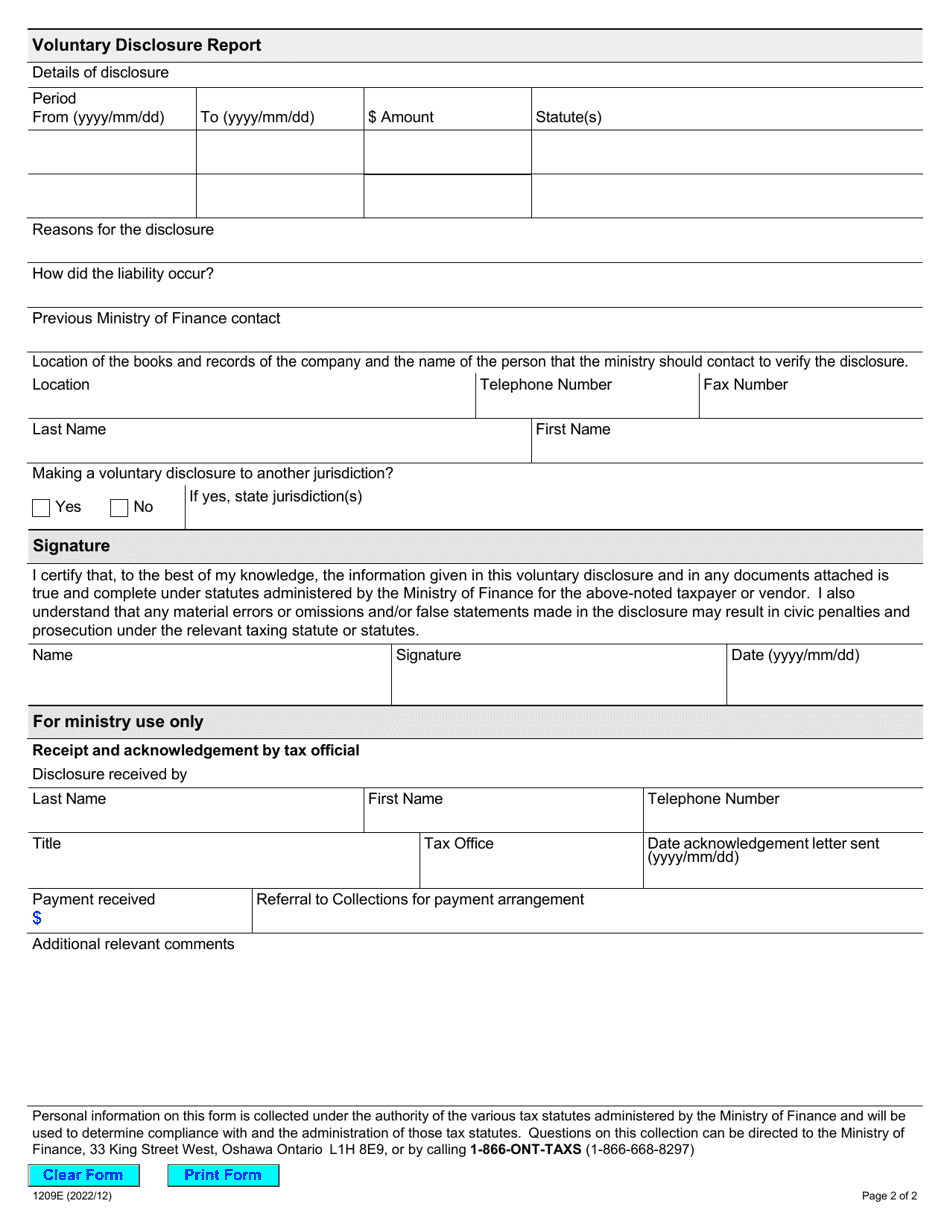

Form 1209E Voluntary Disclosure Report - Ontario, Canada

Form 1209E Voluntary Disclosure Report in Ontario, Canada is used to voluntarily disclose unreported or underreported taxes or to correct inaccurate information on previous tax filings. It allows taxpayers to come forward and resolve their tax obligations, while potentially avoiding penalties or prosecution.

FAQ

Q: What is Form 1209E Voluntary Disclosure Report?

A: Form 1209E Voluntary Disclosure Report is a form used in Ontario, Canada to disclose previously unreported information or correct incorrect information on a previously filed tax return.

Q: Who can use Form 1209E Voluntary Disclosure Report?

A: Any individual or business entity who has unreported or incorrect information on a previously filed tax return in Ontario, Canada can use Form 1209E Voluntary Disclosure Report.

Q: What is the purpose of Form 1209E Voluntary Disclosure Report?

A: The purpose of Form 1209E Voluntary Disclosure Report is to voluntarily disclose, correct, or revise information that was not properly reported in a previous tax return in Ontario, Canada.

Q: How do I fill out Form 1209E Voluntary Disclosure Report?

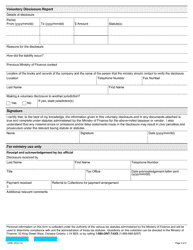

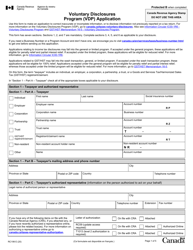

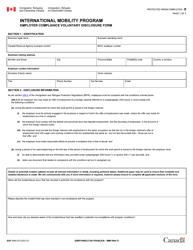

A: You will need to provide your personal or business information, specify the tax type and the periods being disclosed, explain the nature of the error or omission, and attach supporting documents to fill out Form 1209E Voluntary Disclosure Report.

Q: What happens after I submit Form 1209E Voluntary Disclosure Report?

A: Ontario Ministry of Finance will review your voluntary disclosure submission and assess any additional taxes, interest, or penalties that may be owing. They may also contact you for additional information or clarification if needed.