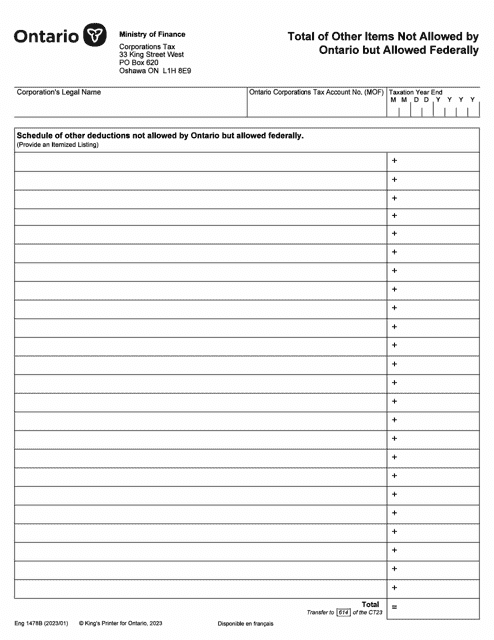

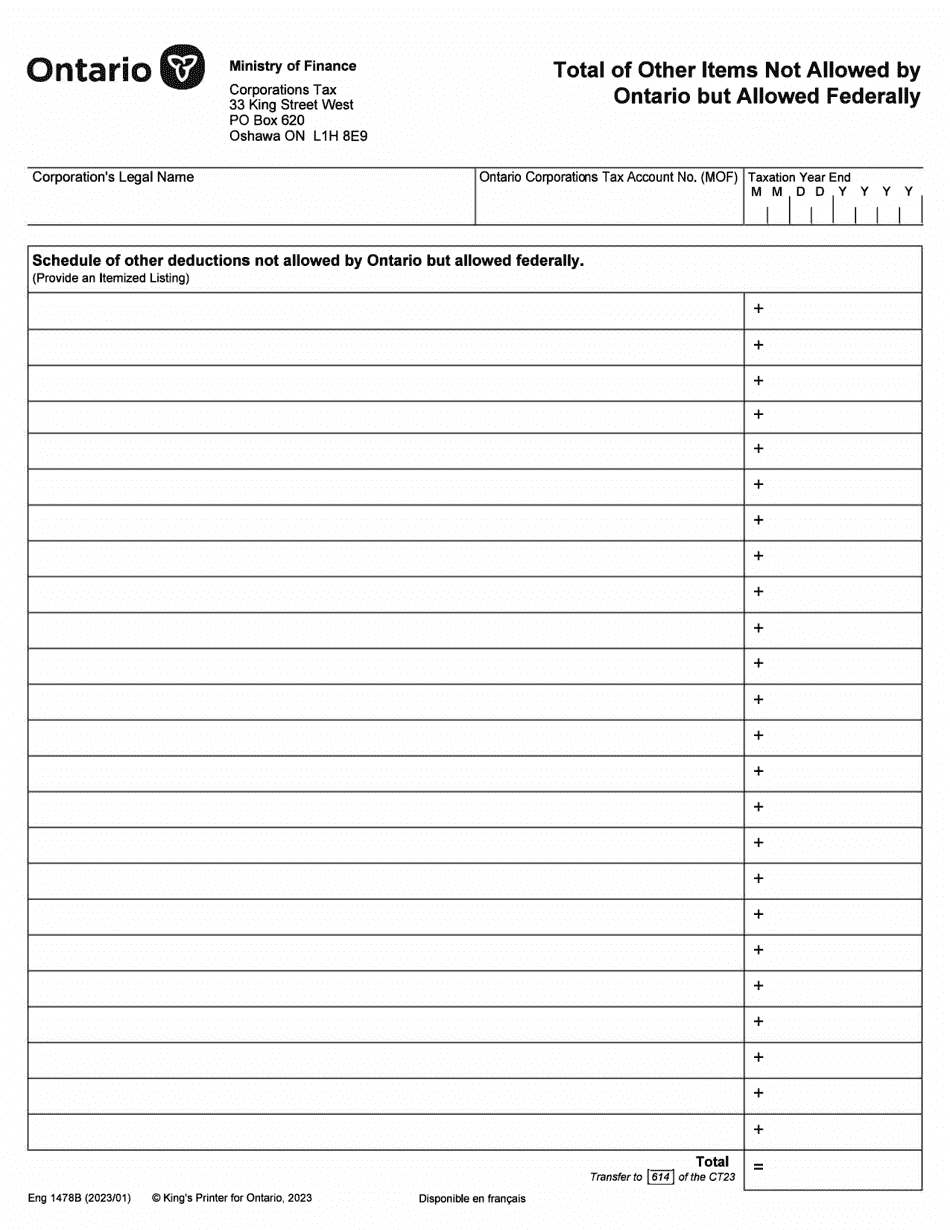

Form 1478B Total of Other Items Not Allowed by Ontario but Allowed Federally - Ontario, Canada

Form 1478B Total of Other Items Not Allowed by Ontario but Allowed Federally - Ontario, Canada is used to report items that are allowed for federal tax purposes but are not allowed for provincial tax purposes in Ontario, Canada. It helps individuals and businesses correctly calculate their tax liability in the province.

The Form 1478B, "Total of Other Items Not Allowed by Ontario but Allowed Federally - Ontario, Canada" is filed by individual taxpayers in Ontario, Canada.

FAQ

Q: What is Form 1478B?

A: Form 1478B is a form used in Ontario, Canada.

Q: What does Form 1478B calculate?

A: Form 1478B is used to calculate the total of other items that are not allowed by Ontario but allowed federally.

Q: What are examples of items not allowed by Ontario but allowed federally?

A: Examples of items not allowed by Ontario but allowed federally include certain deductions or expenses for federal tax purposes.

Q: Who uses Form 1478B?

A: Form 1478B is typically used by individuals or businesses in Ontario, Canada who need to calculate the total of other items not allowed by Ontario but allowed federally.

Q: What is the purpose of Form 1478B?

A: The purpose of Form 1478B is to ensure that individuals or businesses in Ontario correctly calculate their taxes by excluding items that are not allowed by the province but allowed federally.