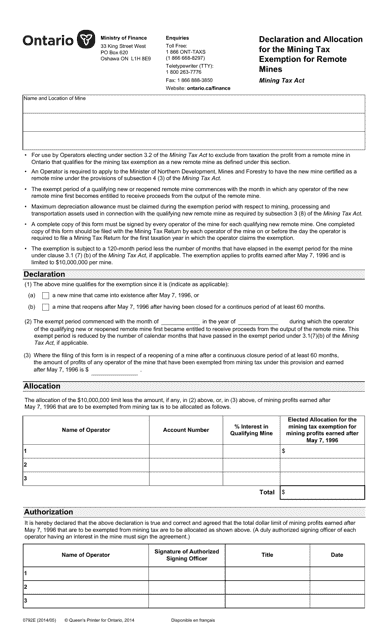

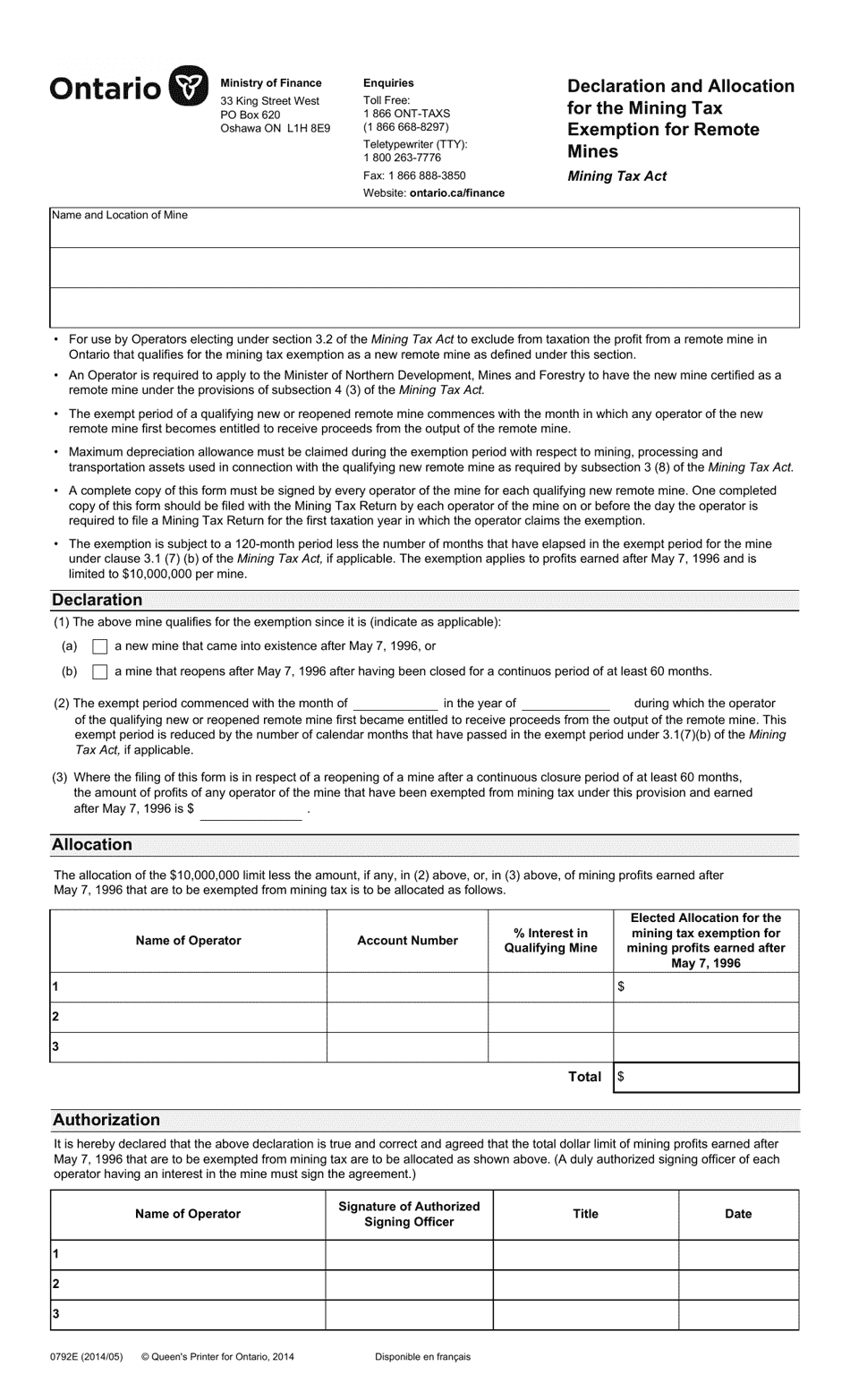

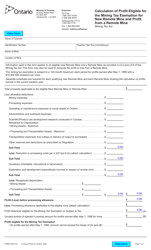

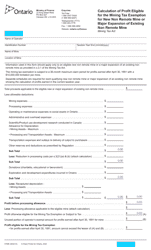

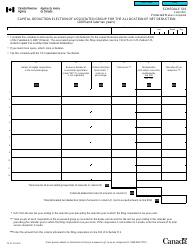

Form 0792E Declaration and Allocation for the Mining Tax Exemption for Remote Mines - Ontario, Canada

Form 0792E Declaration and Allocation for the Mining Tax Exemption for Remote Mines in Ontario, Canada is used for declaring and allocating the mining tax exemption for remote mines in the province of Ontario.

The mining companies operating remote mines in Ontario, Canada are required to file the Form 0792E Declaration and Allocation for the Mining Tax Exemption.

FAQ

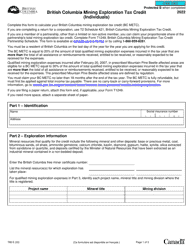

Q: What is Form 0792E?

A: Form 0792E is a declaration and allocation form for the mining tax exemption for remote mines in Ontario, Canada.

Q: Who needs to fill out Form 0792E?

A: Mining companies operating remote mines in Ontario, Canada need to fill out Form 0792E.

Q: What is the purpose of Form 0792E?

A: The purpose of Form 0792E is to claim a tax exemption for mining operations located in remote areas of Ontario, Canada.

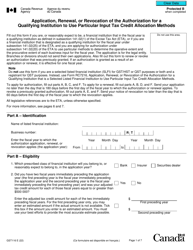

Q: When should Form 0792E be filled out?

A: Form 0792E should be filled out before the start of mining operations or within 30 days of the start of mining operations.