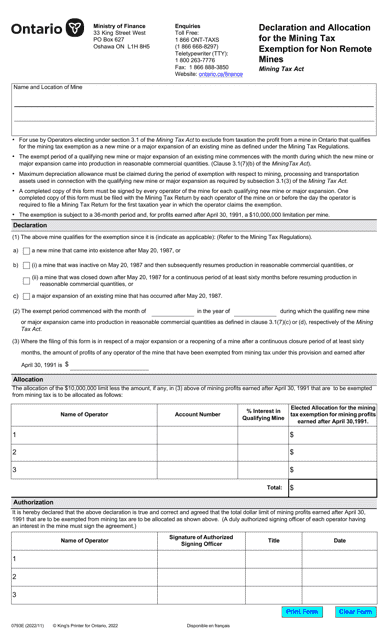

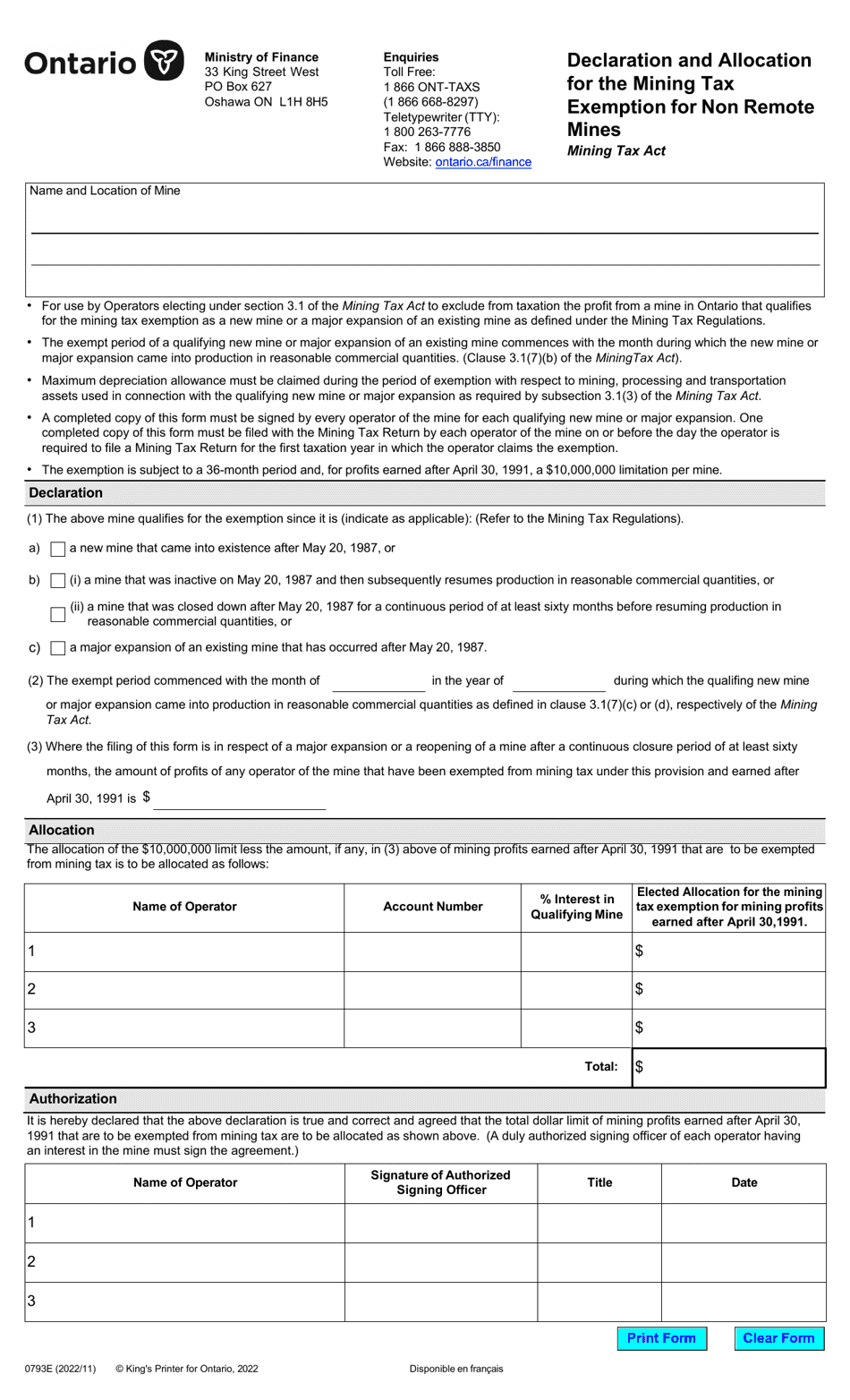

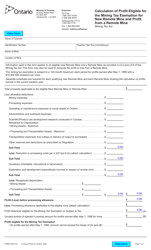

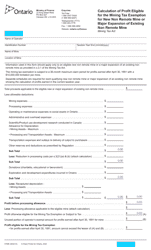

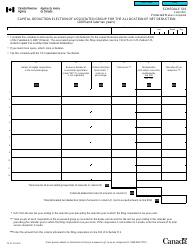

Form 0793F Declaration and Allocation for the Mining Tax Exemption for Non Remote Mines - Ontario, Canada

The Form 0793F Declaration and Allocation for the Mining Tax Exemption for Non Remote Mines in Ontario, Canada is used to declare and allocate the tax exemption for mining operations that are not classified as remote mines. This form helps mining companies claim exemptions on certain taxes related to their non-remote mining operations in Ontario.

The mining company operating the non-remote mines in Ontario, Canada files the Form 0793F Declaration and Allocation for the Mining Tax Exemption.

FAQ

Q: What is Form 0793F?

A: Form 0793F is the Declaration and Allocation for the Mining Tax Exemption for Non Remote Mines form in Ontario, Canada.

Q: Who needs to fill out Form 0793F?

A: Non remote mines in Ontario, Canada need to fill out Form 0793F.

Q: What is the purpose of Form 0793F?

A: The purpose of Form 0793F is to declare and allocate the mining tax exemption for non remote mines in Ontario, Canada.

Q: Is Form 0793F specific to Ontario?

A: Yes, Form 0793F is specific to Ontario, Canada and is used to claim the mining tax exemption in Ontario.

Q: Are remote mines eligible for the tax exemption?

A: No, Form 0793F is specifically for non remote mines. Remote mines may have different tax exemption procedures.