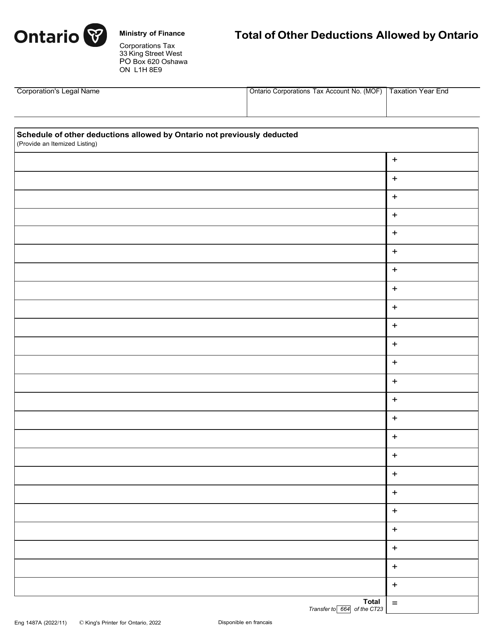

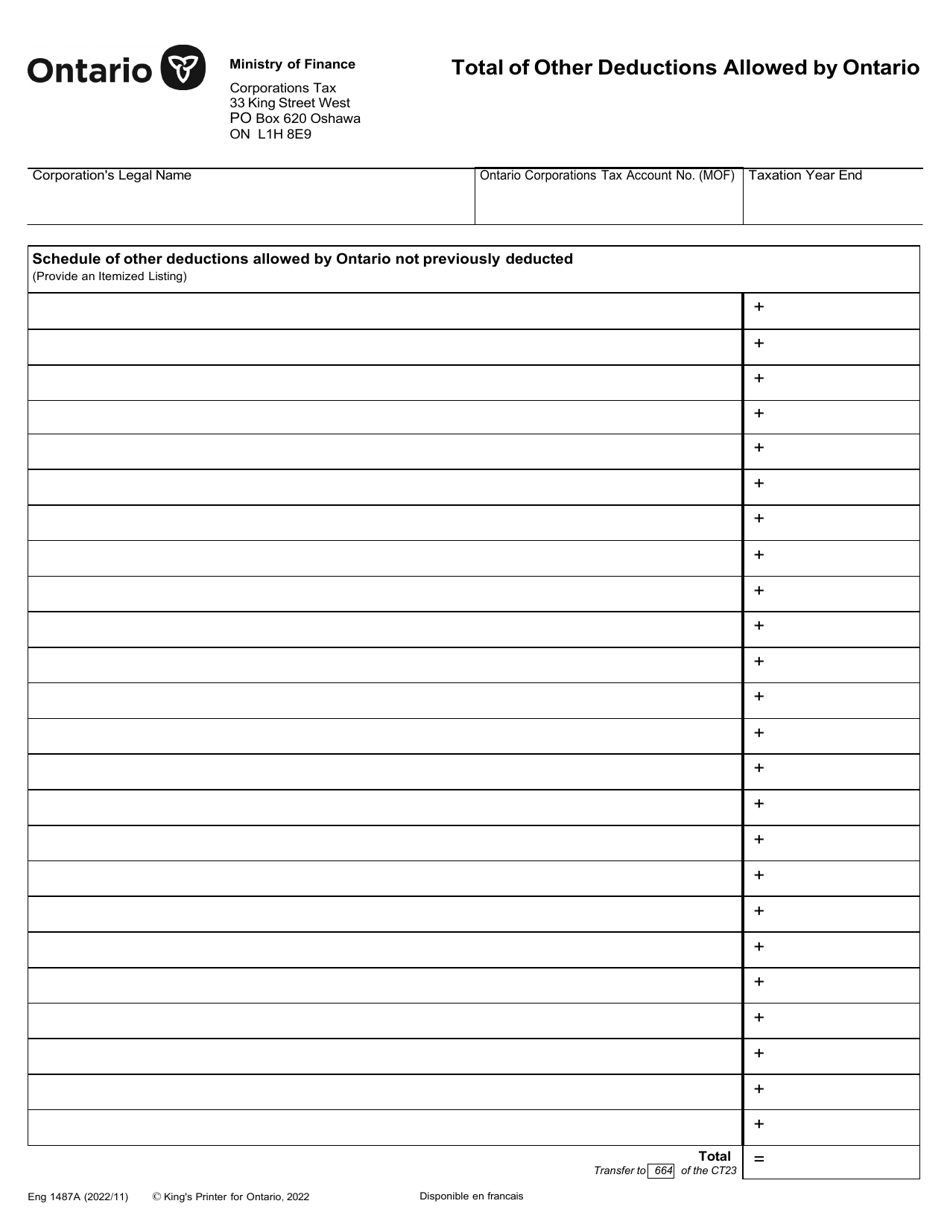

Form 1487A Total of Other Deductions Allowed by Ontario - Ontario, Canada

Form 1487A is used in Ontario, Canada to report the total amount of other deductions that are allowed on an individual's tax return. Some examples of these deductions include certain employment expenses, carrying charges and interest expenses, and other deductions that are specific to Ontario.

The Form 1487A for the total of other deductions allowed by Ontario in Ontario, Canada is filed by the individual or business claiming the deductions on their tax return.

FAQ

Q: What is Form 1487A?

A: Form 1487A is a form used in Ontario, Canada.

Q: What does Form 1487A calculate?

A: Form 1487A calculates the total of other deductions allowed in Ontario.

Q: What are other deductions?

A: Other deductions are deductions that may be claimed in addition to the standard deductions.

Q: Who can use Form 1487A?

A: Form 1487A can be used by individuals and businesses in Ontario who are eligible for other deductions.