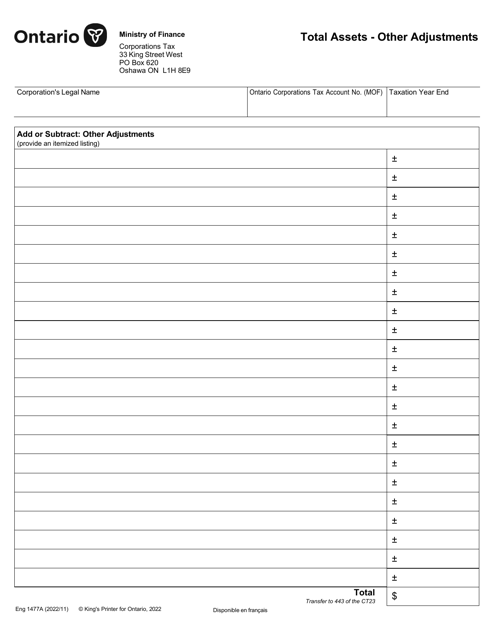

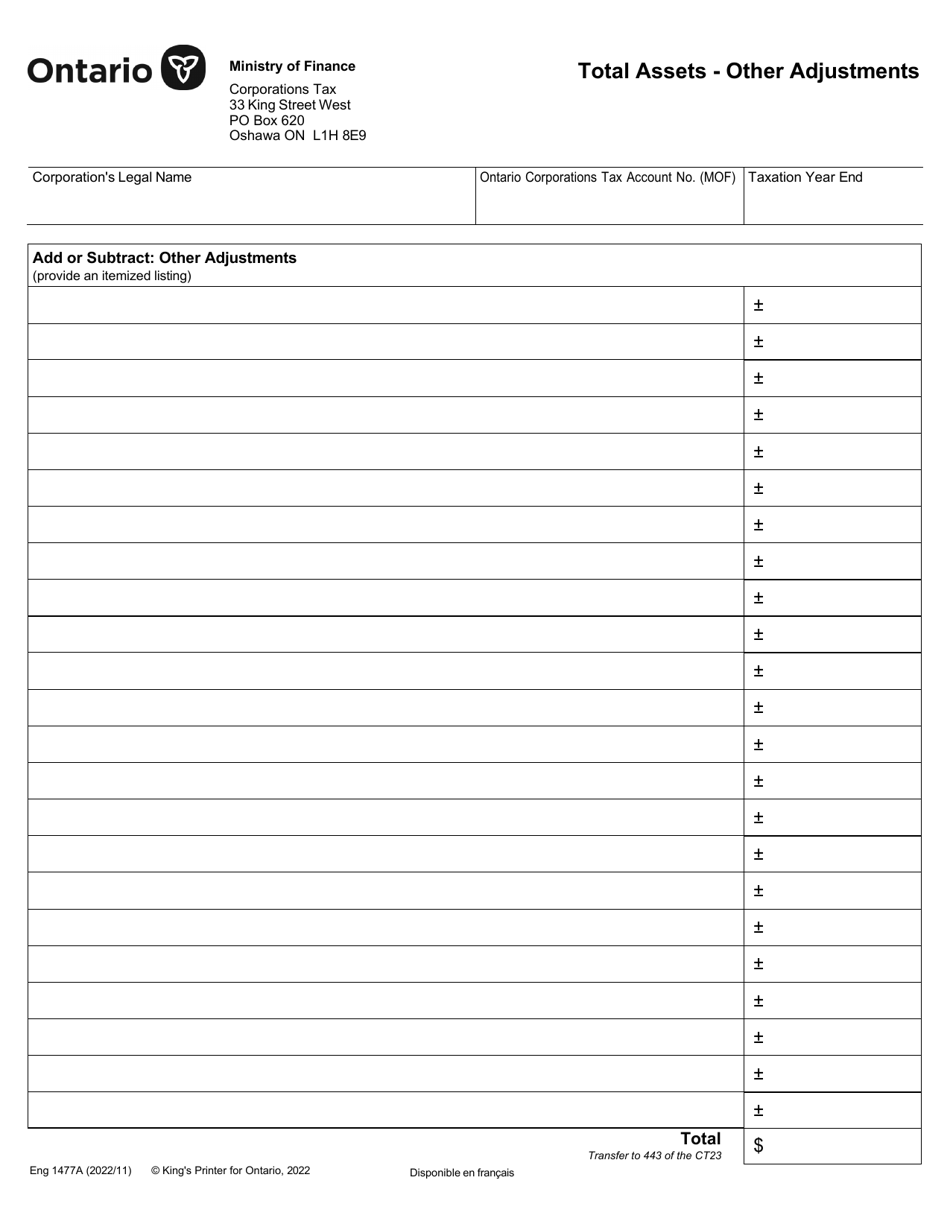

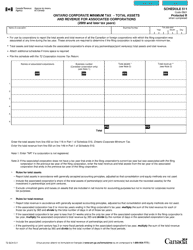

Form 1477A Total Assets - Other Adjustments - Ontario, Canada

Form 1477A Total Assets - Other Adjustments - Ontario, Canada is used to report any adjustments made to the total assets value in Ontario, Canada.

FAQ

Q: What is Form 1477A?

A: Form 1477A is a form used to report Total Assets and Other Adjustments in the province of Ontario, Canada.

Q: What does Total Assets refer to?

A: Total Assets refers to the sum of all the assets owned by an individual or a business.

Q: What are Other Adjustments?

A: Other Adjustments refer to changes or modifications made to the reported Total Assets, such as exclusions or additions.

Q: Who needs to fill out Form 1477A?

A: Individuals or businesses in Ontario, Canada who are required to report their Total Assets and Other Adjustments.

Q: Are there any deadlines for submitting Form 1477A?

A: Yes, the deadlines for submitting Form 1477A may vary depending on the specific requirements set by the Ontario Ministry of Finance. It is important to check the instructions provided with the form or consult with the ministry directly.

Q: What happens if I don't submit Form 1477A?

A: Failure to submit Form 1477A or providing false or misleading information may result in penalties or legal consequences as specified by the Ontario Ministry of Finance.

Q: Are there any fees associated with Form 1477A?

A: There are no fees associated with submitting Form 1477A.