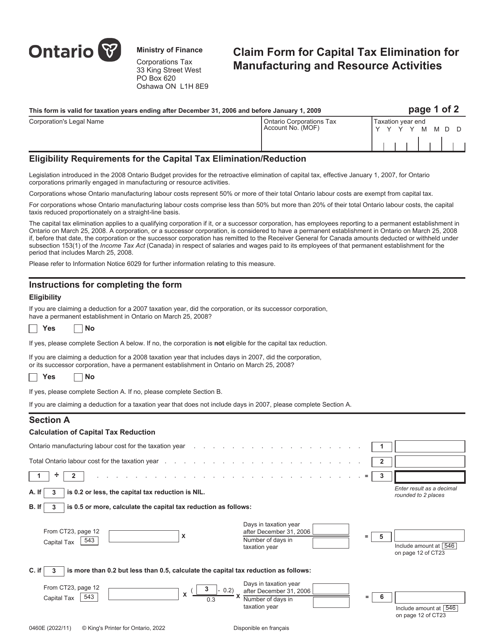

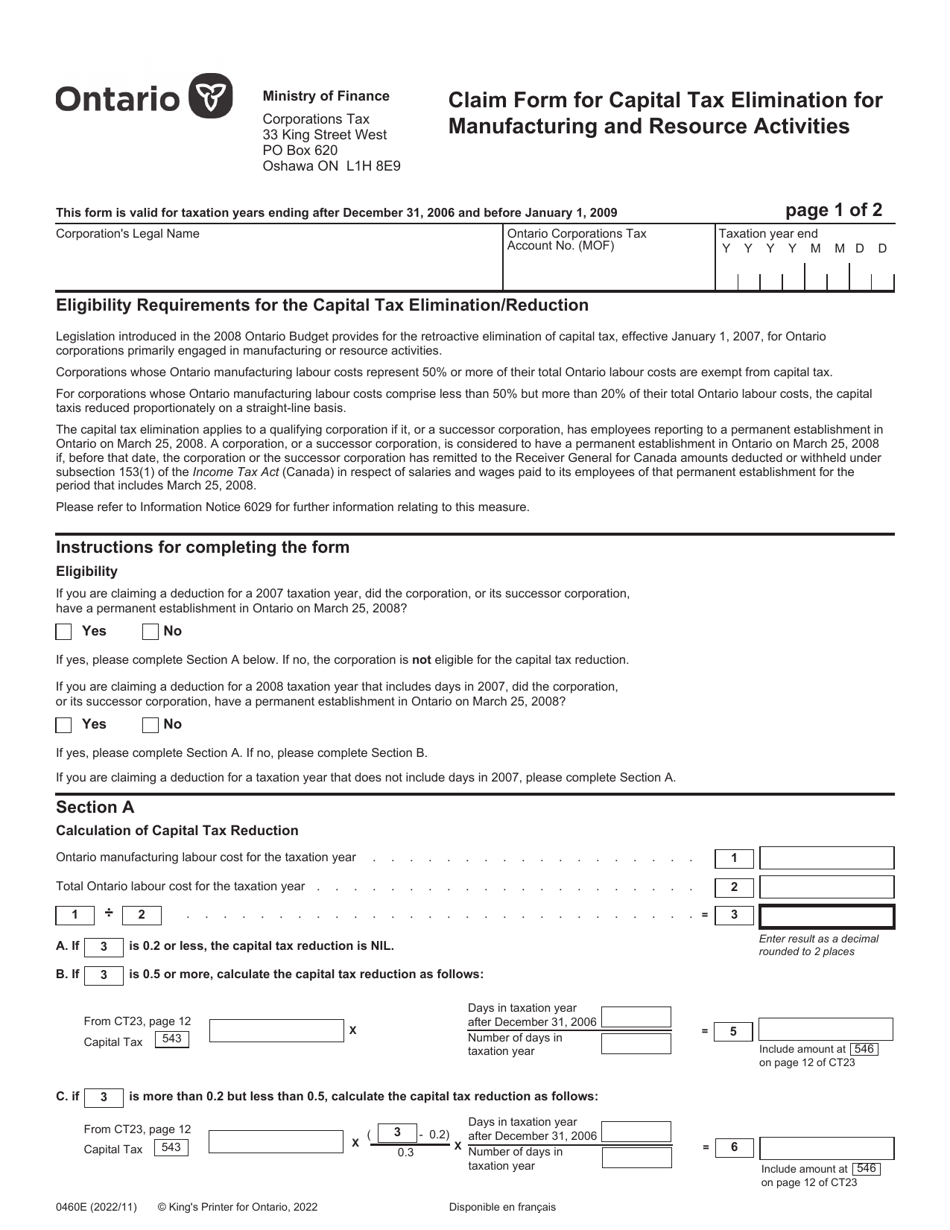

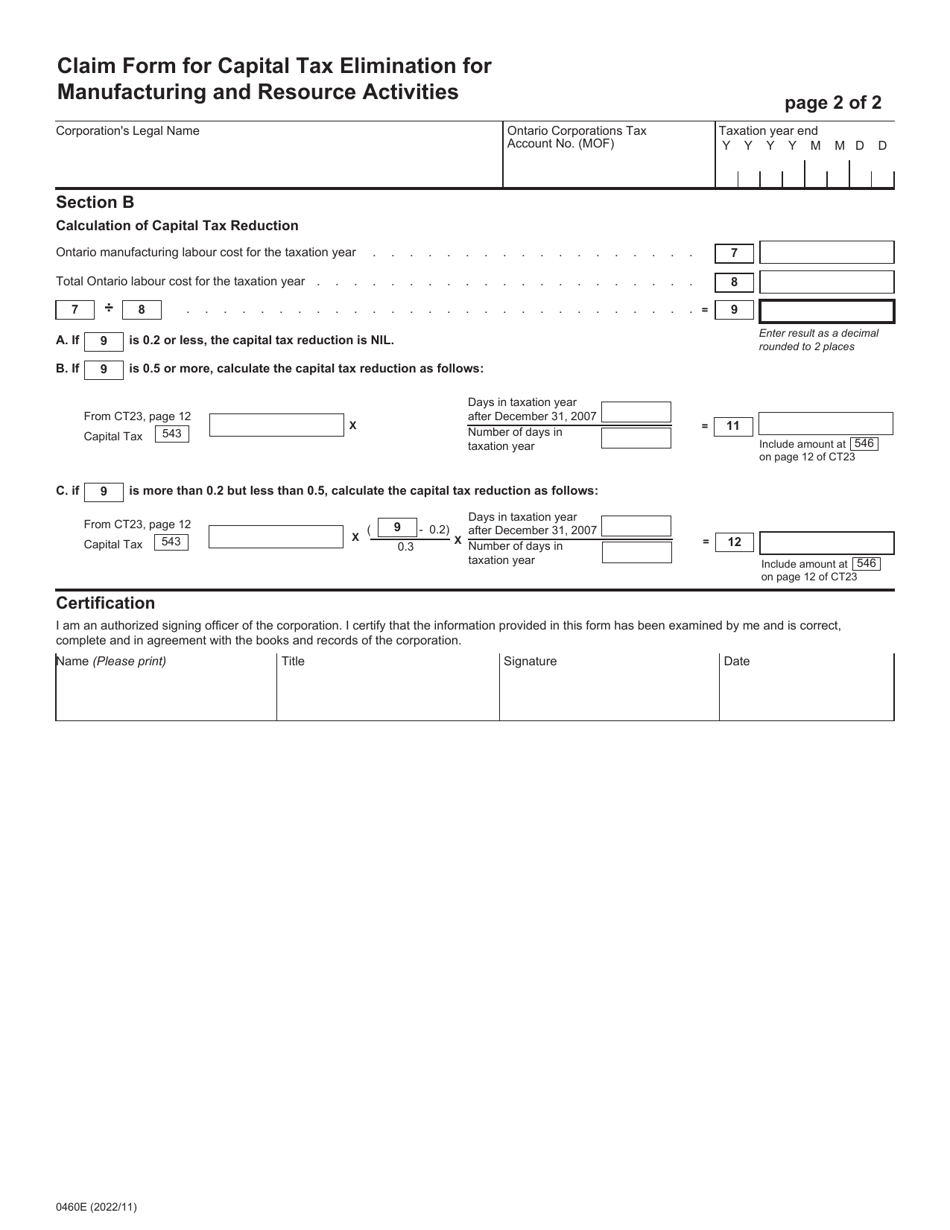

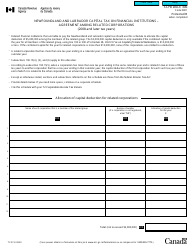

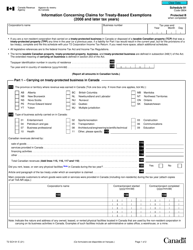

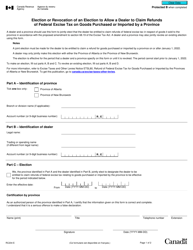

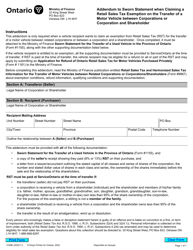

Form 0460E Claim Form for Capital Tax Elimination for Manufacturing and Resource Activities - Ontario, Canada

Form 0460E Claim Form for Capital Tax Elimination for Manufacturing and Resource Activities in Ontario, Canada is used to apply for tax elimination for manufacturing and resource activities in the province of Ontario.

The form 0460E Claim Form for Capital Tax Elimination for Manufacturing and Resource Activities in Ontario, Canada is filed by businesses engaged in manufacturing and resource activities.

FAQ

Q: What is the Form 0460E?

A: Form 0460E is a claim form for capital tax elimination for manufacturing and resource activities in Ontario, Canada.

Q: Who can use Form 0460E?

A: Manufacturing and resource companies in Ontario, Canada can use Form 0460E.

Q: What is the purpose of Form 0460E?

A: The purpose of Form 0460E is to claim capital tax elimination for manufacturing and resource activities in Ontario, Canada.

Q: What activities are eligible for capital tax elimination with Form 0460E?

A: Manufacturing and resource activities in Ontario, Canada are eligible for capital tax elimination with Form 0460E.

Q: What information is required on Form 0460E?

A: Form 0460E requires information about the company, its activities, and the amount of capital tax being claimed.

Q: Is there a deadline for submitting Form 0460E?

A: Yes, there is a deadline for submitting Form 0460E. The specific deadline can be found on the form or by contacting the Ontario Ministry of Finance.

Q: Are there any fees associated with submitting Form 0460E?

A: No, there are no fees associated with submitting Form 0460E.

Q: What should I do if I have questions about Form 0460E?

A: If you have questions about Form 0460E, you can contact the Ontario Ministry of Finance for assistance.