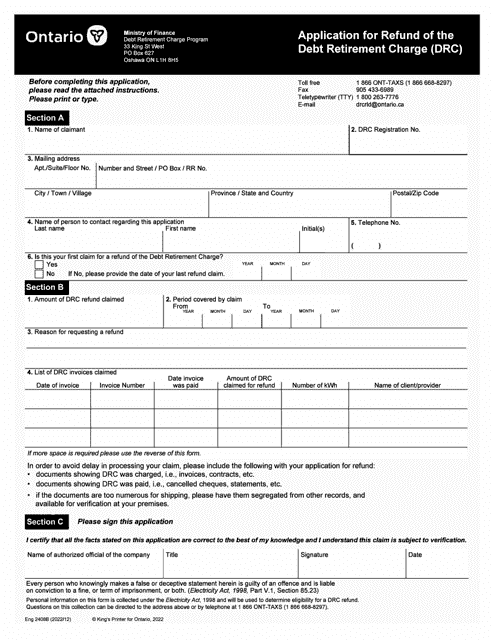

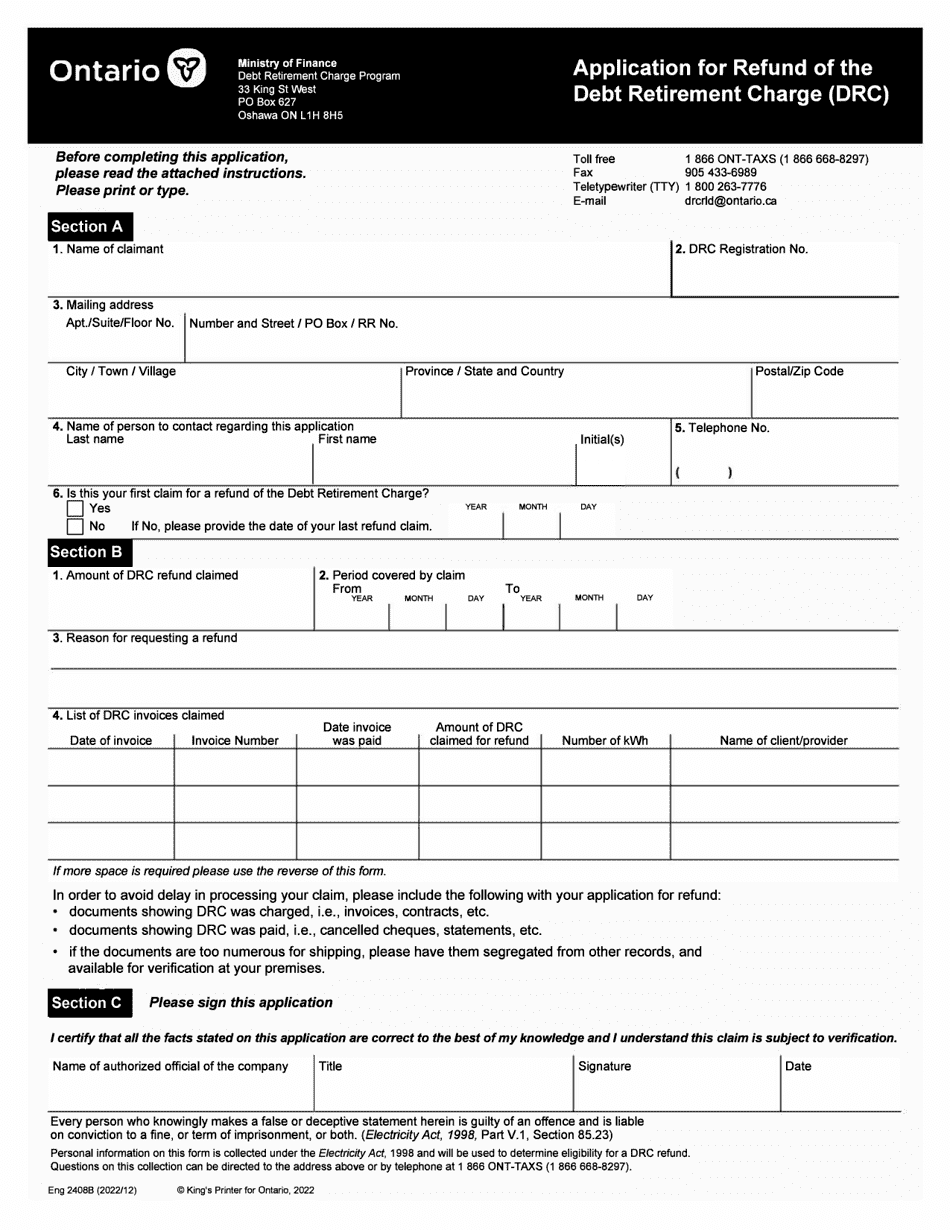

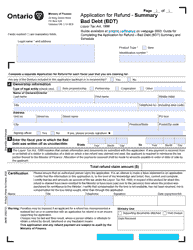

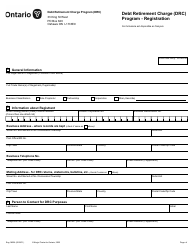

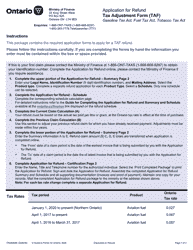

Form 2408B Application for Refund of the Debt Retirement Charge (Drc) - Ontario, Canada

Form 2408B Application for Refund of the Debt Retirement Charge (DRC) in Ontario, Canada is used to request a refund of the Debt Retirement Charge, which is a fee that was charged to consumers in Ontario to help retire the debt from the former Ontario Hydro.

The Form 2408B for Application for Refund of the Debt Retirement Charge (DRC) in Ontario, Canada can be filed by eligible individuals or businesses who have paid the DRC and are seeking a refund.

FAQ

Q: What is Form 2408B?

A: Form 2408B is an application form for refund of the Debt Retirement Charge (DRC) in Ontario, Canada.

Q: What is the Debt Retirement Charge (DRC)?

A: The Debt Retirement Charge (DRC) is a fee imposed on electricity consumers in Ontario to help retire the debt of the former Ontario Hydro.

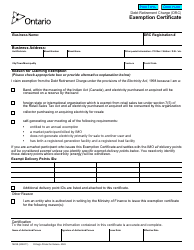

Q: Who is eligible for a refund of the Debt Retirement Charge?

A: Electricity consumers in Ontario who meet certain criteria are eligible for a refund of the Debt Retirement Charge.

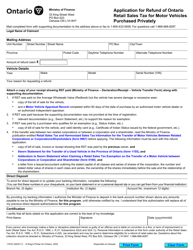

Q: What is the purpose of the refund application?

A: The purpose of the refund application is to request a refund of the Debt Retirement Charge that has been overpaid or incorrectly charged.

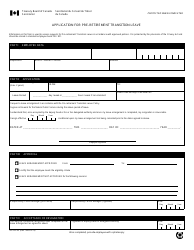

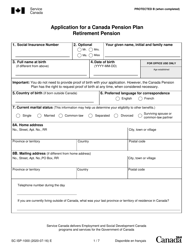

Q: What documents do I need to submit with the refund application?

A: You may need to submit supporting documents such as electricity bills and proof of residency with your refund application.

Q: How long does it take to process the refund application?

A: The processing time for refund applications can vary, but it typically takes several weeks to process.

Q: Is there a deadline for submitting the refund application?

A: Yes, there is a deadline for submitting the refund application. It is important to check the application form or contact the Ontario Ministry of Finance for the specific deadline.

Q: Can I get a refund for previous years' Debt Retirement Charge?

A: Yes, you may be eligible for a refund for previous years' Debt Retirement Charge if you meet the criteria and file the refund application within the specified time frame.