This version of the form is not currently in use and is provided for reference only. Download this version of

Form 9988E

for the current year.

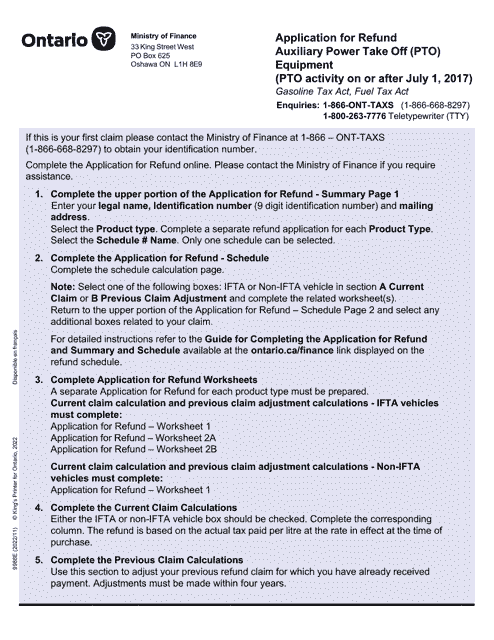

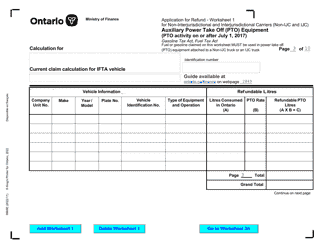

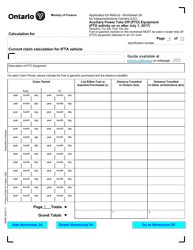

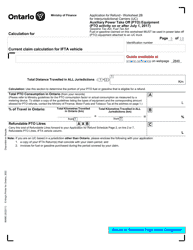

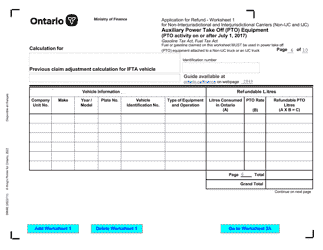

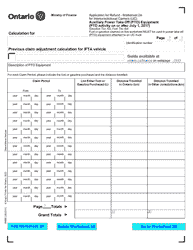

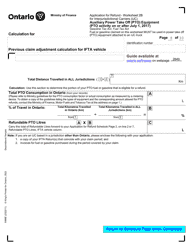

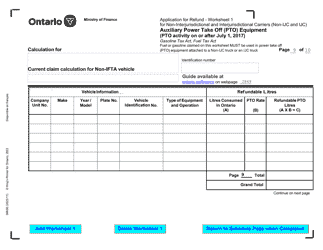

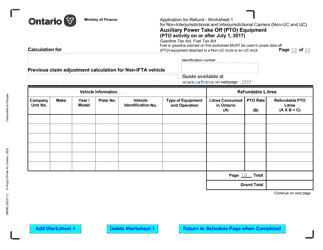

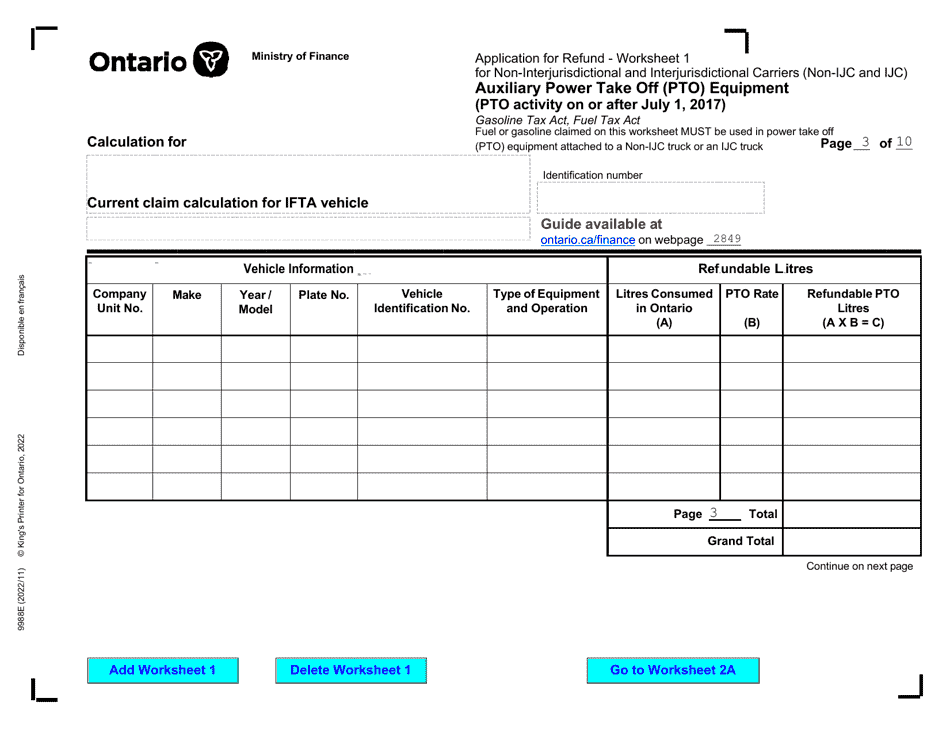

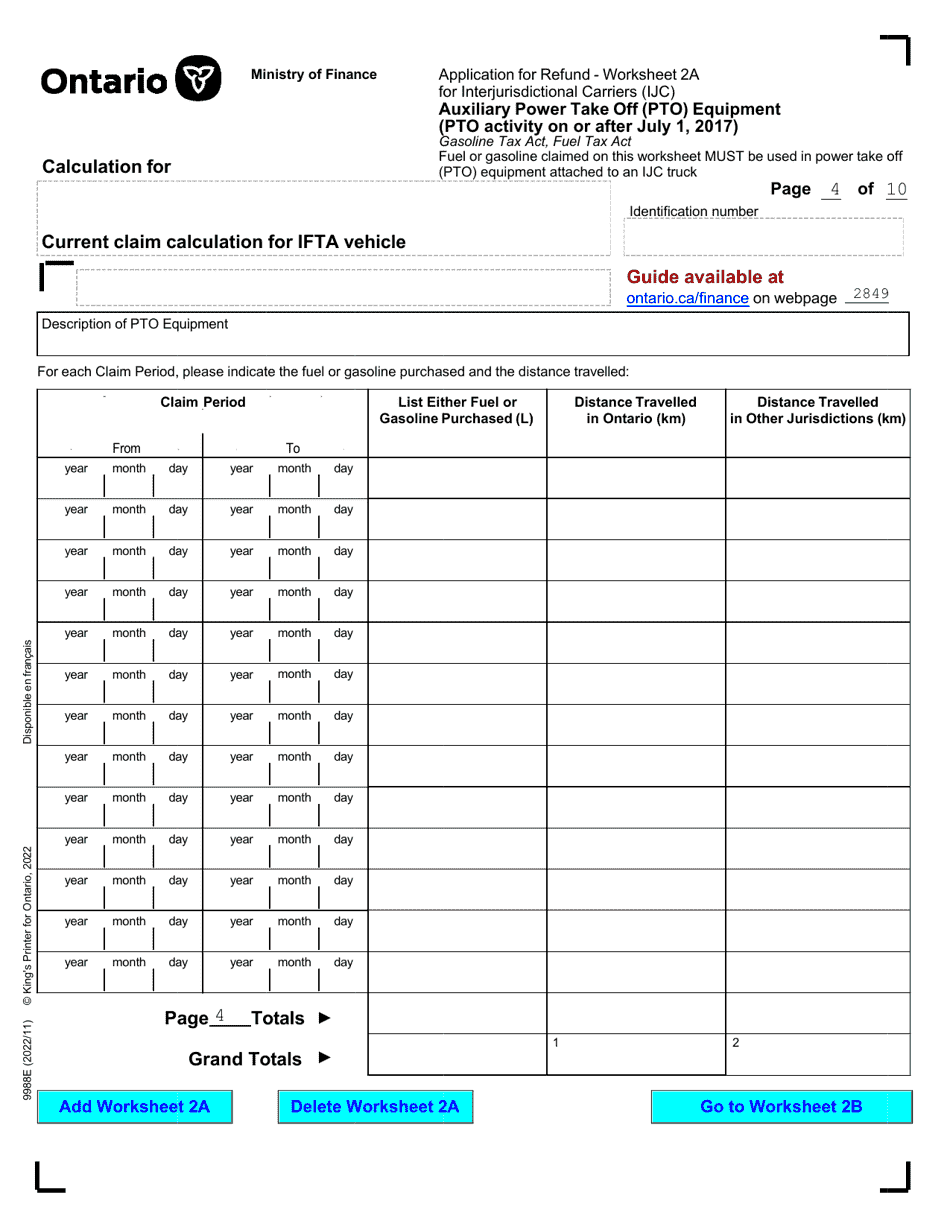

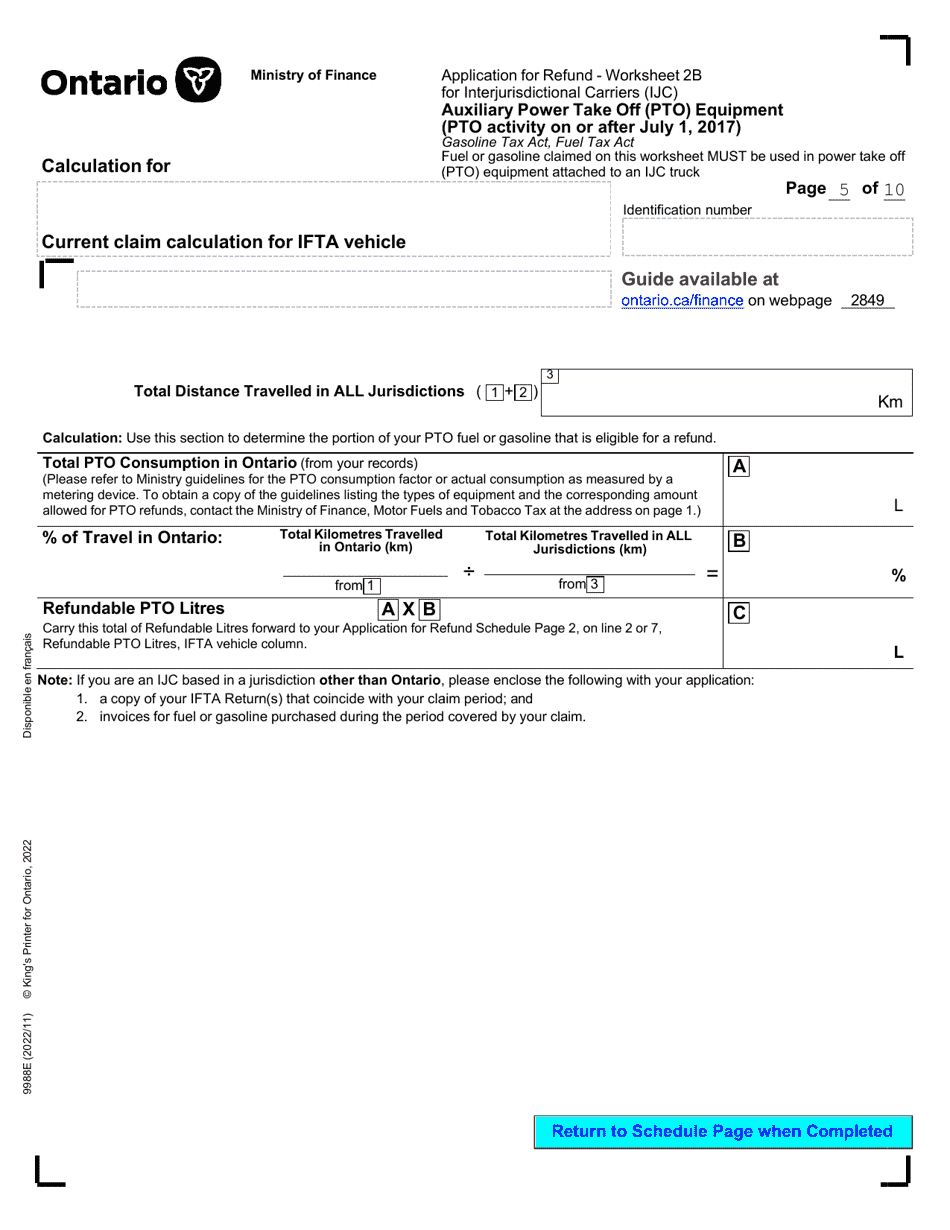

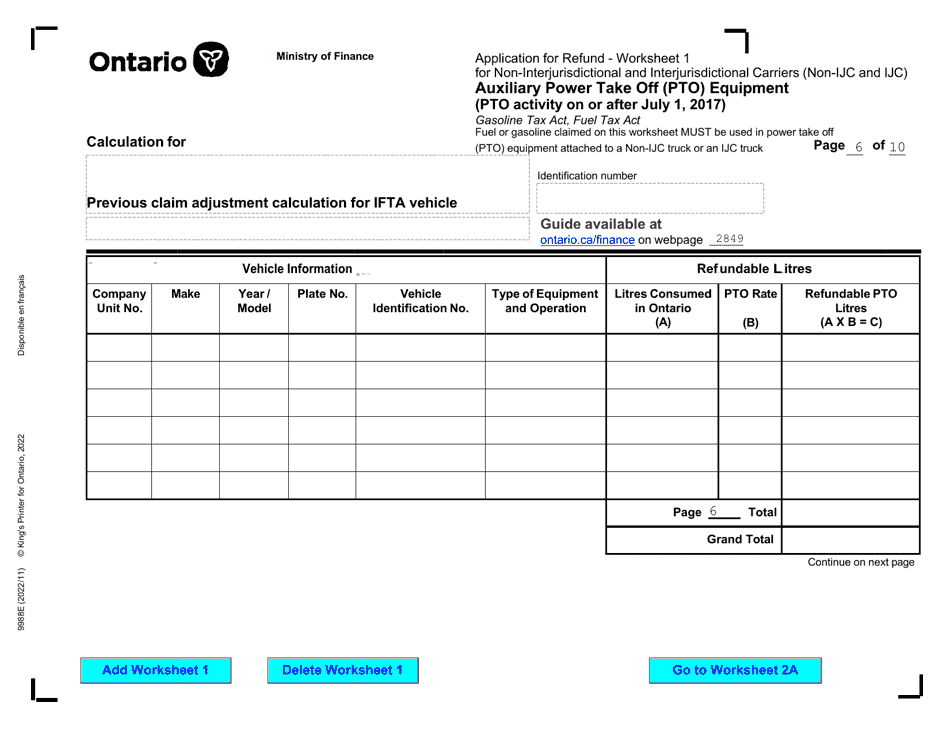

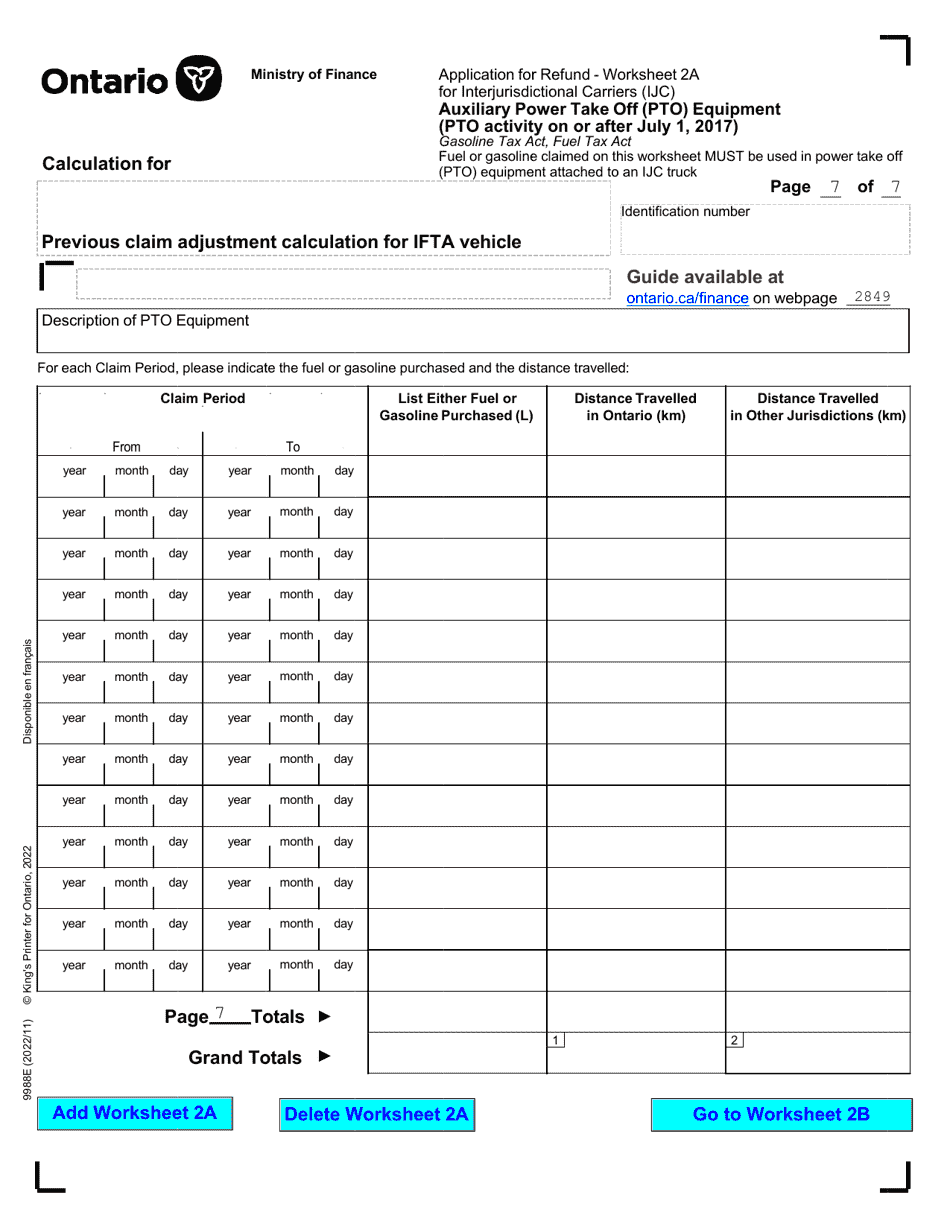

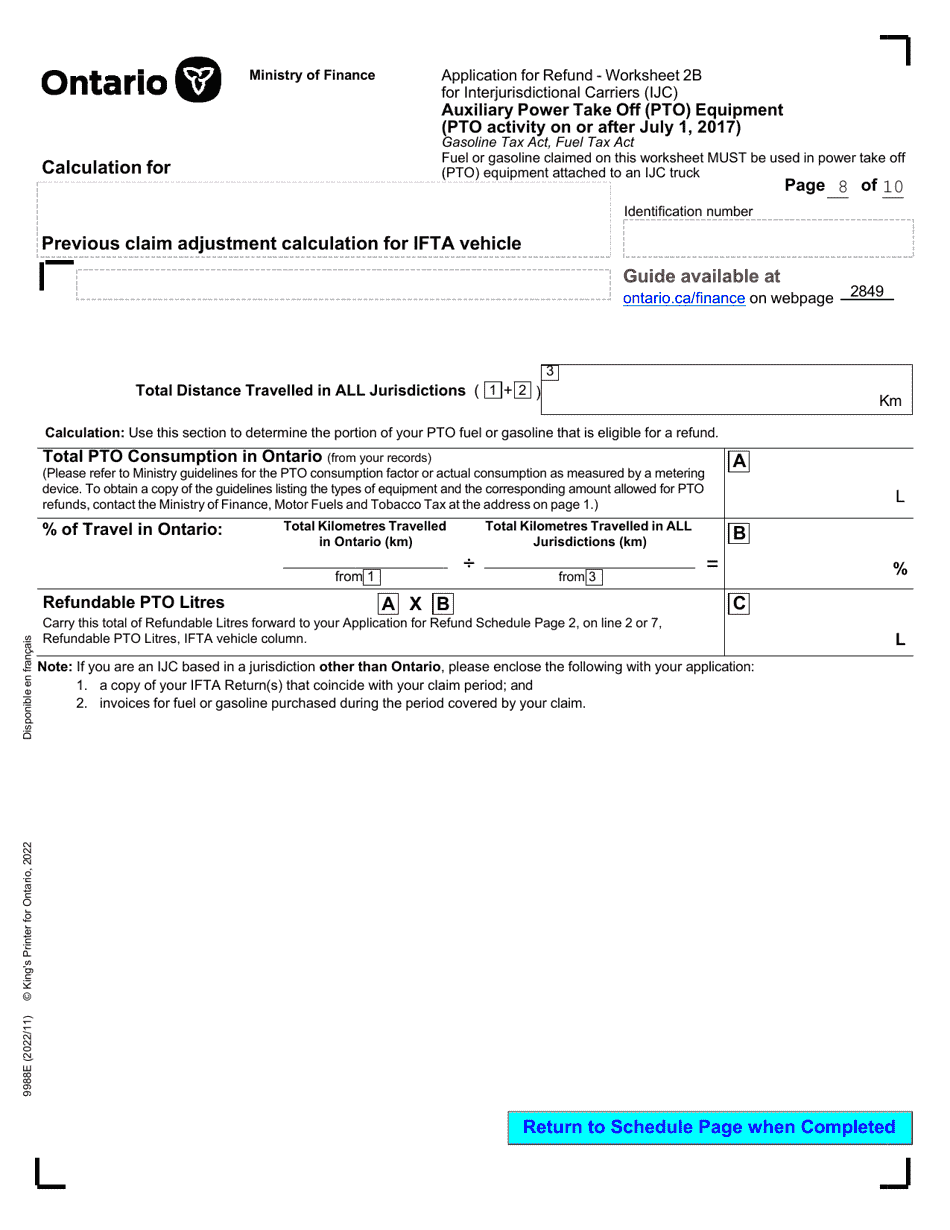

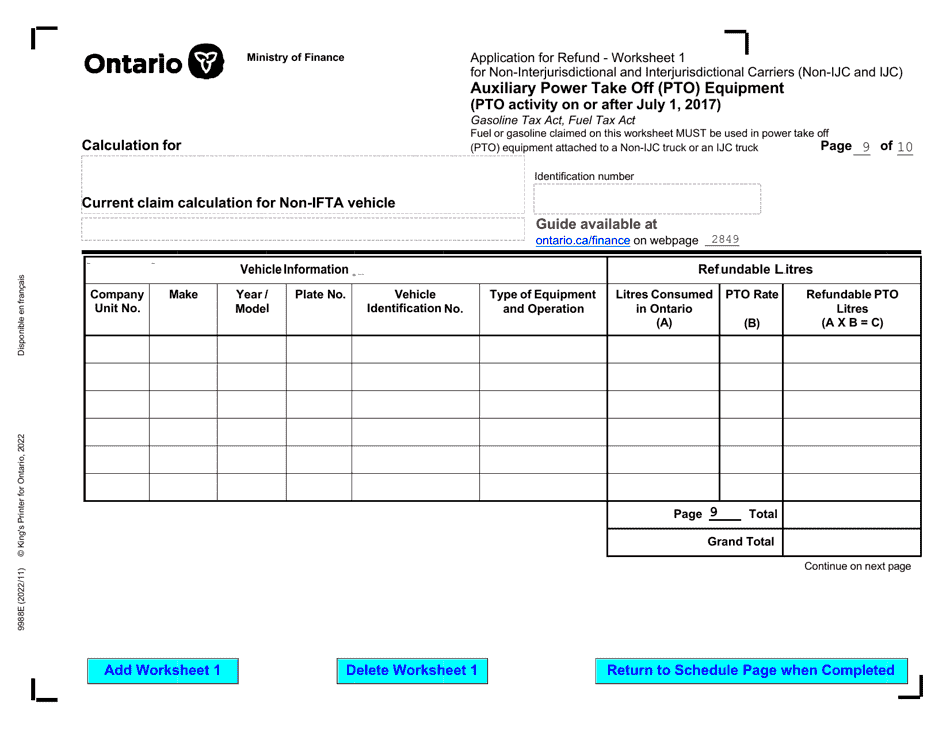

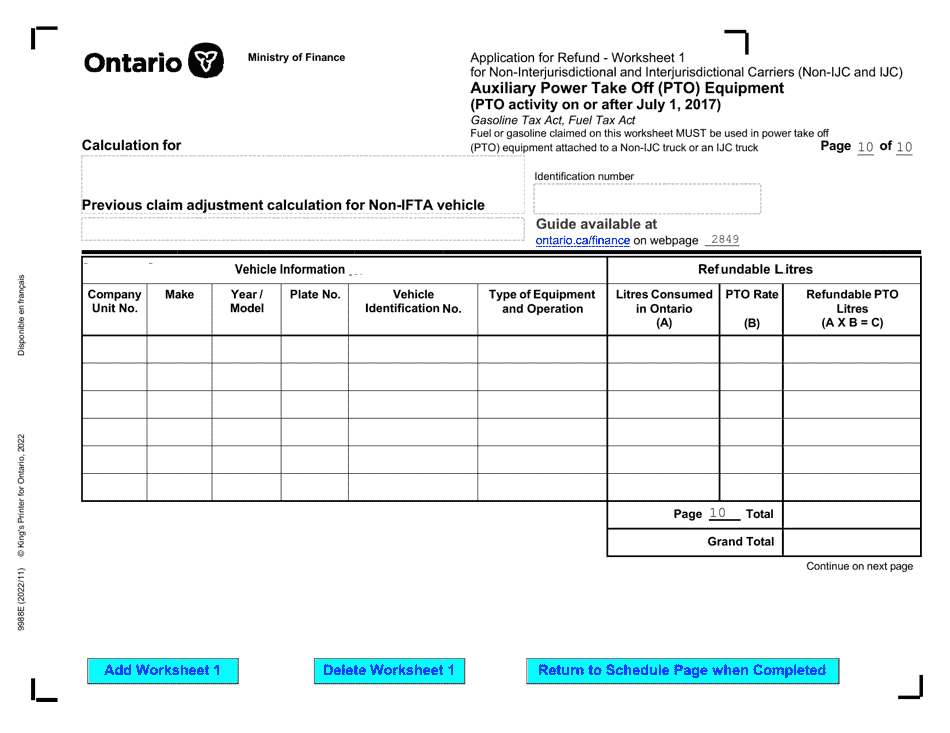

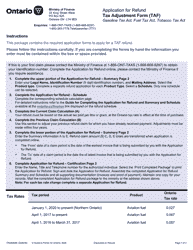

Form 9988E Application for Refund - Summary Auxiliary Power Take off (Pto) Equipment (Pto Activity on or After July 1, 2017) - Ontario, Canada

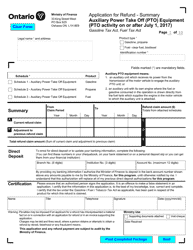

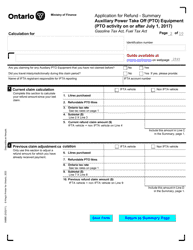

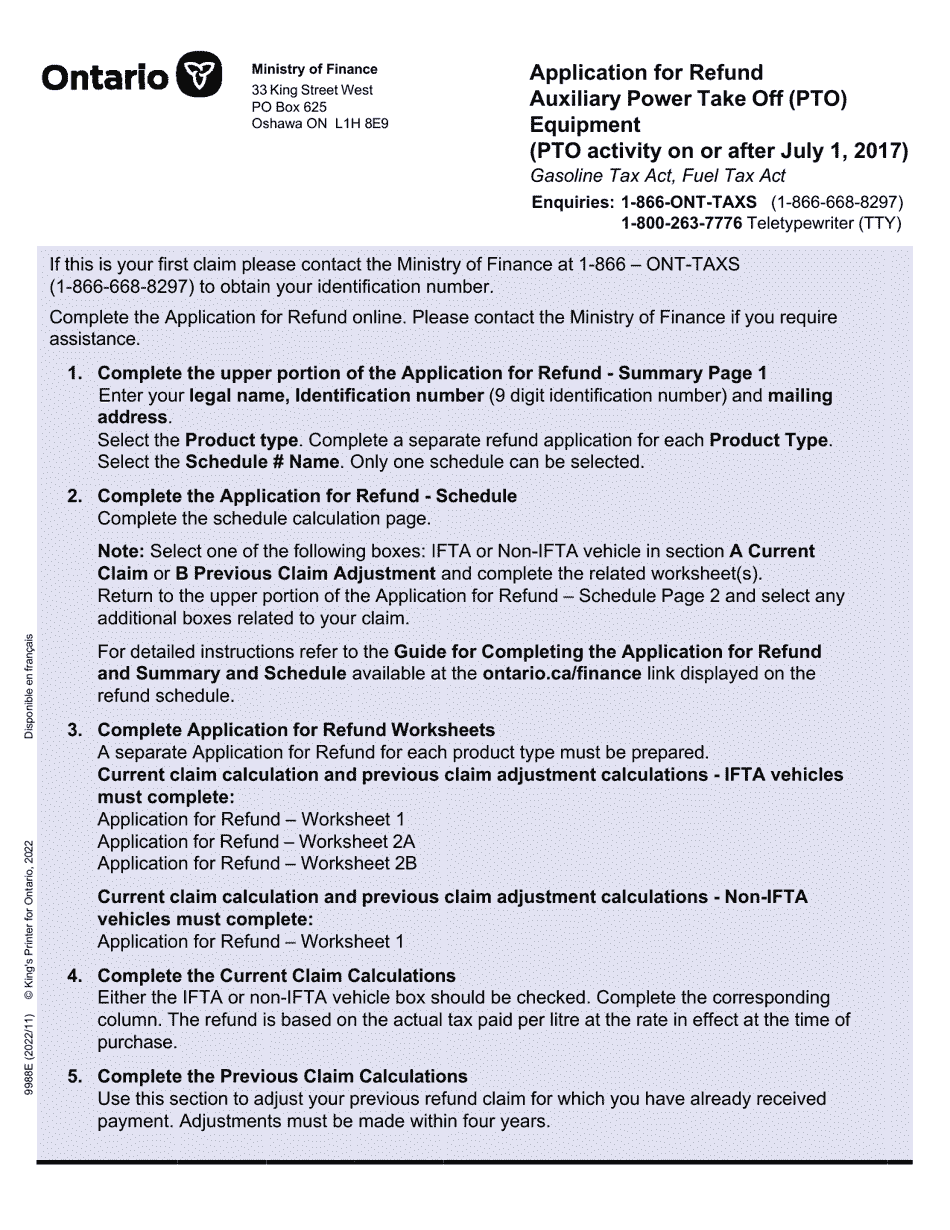

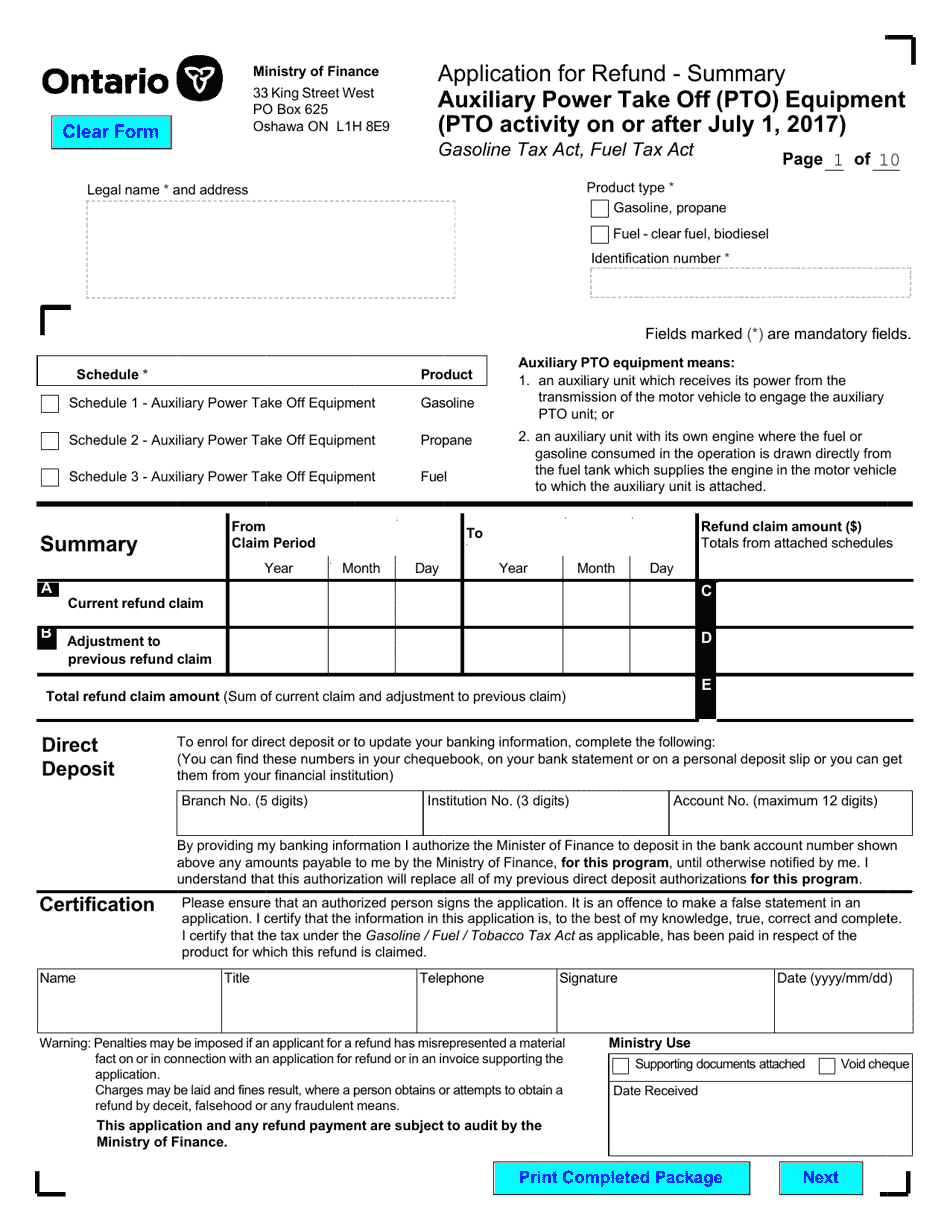

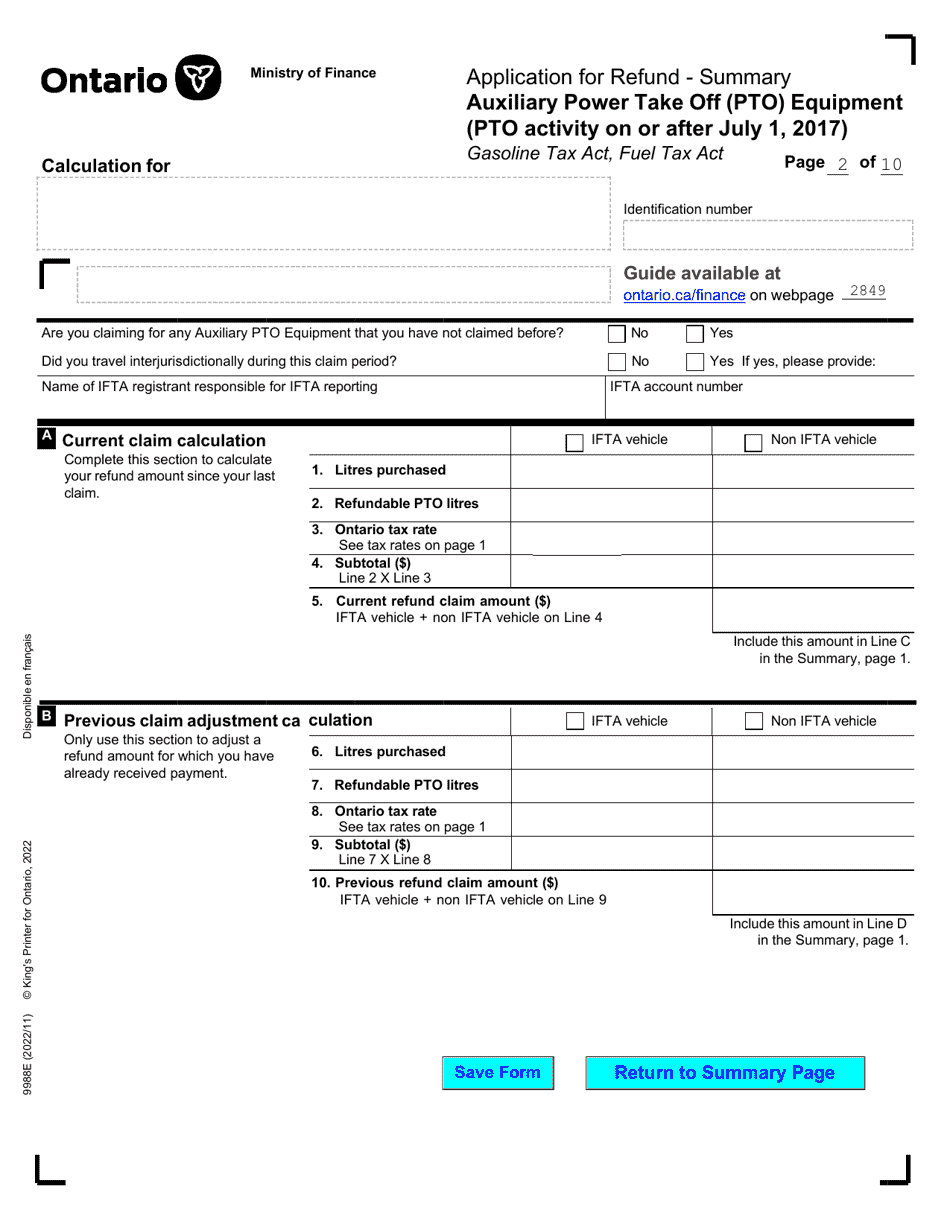

Form 9988E is an application form used in Ontario, Canada for claiming a refund related to Auxiliary Power Take Off (PTO) equipment. It is specifically for PTO activity occurring on or after July 1, 2017.

In Canada, the Form 9988E - Application for Refund of Ontario Retail Sales Tax Paid on the Purchase of Summary Auxiliary Power Take-off (PTO) Equipment (PTO Activity on or After July 1, 2017) is filed by the purchaser of the equipment.

FAQ

Q: What is Form 9988E?

A: Form 9988E is an application for refund related to Auxiliary Power Take off (Pto) Equipment.

Q: What is Auxiliary Power Take off (Pto) Equipment?

A: Auxiliary Power Take off (Pto) Equipment is machinery or equipment that is used to transfer power from a vehicle's engine to other auxiliary equipment.

Q: What is the purpose of Form 9988E?

A: The purpose of Form 9988E is to apply for a refund of tax related to Pto Activity on or after July 1, 2017 in Ontario, Canada.

Q: Who can apply for a refund using Form 9988E?

A: Individuals or businesses that have paid tax related to Pto Activity in Ontario, Canada on or after July 1, 2017 can apply for a refund using Form 9988E.

Q: What activities are eligible for a refund using Form 9988E?

A: Pto Activity on or after July 1, 2017 in Ontario, Canada is eligible for a refund using Form 9988E.

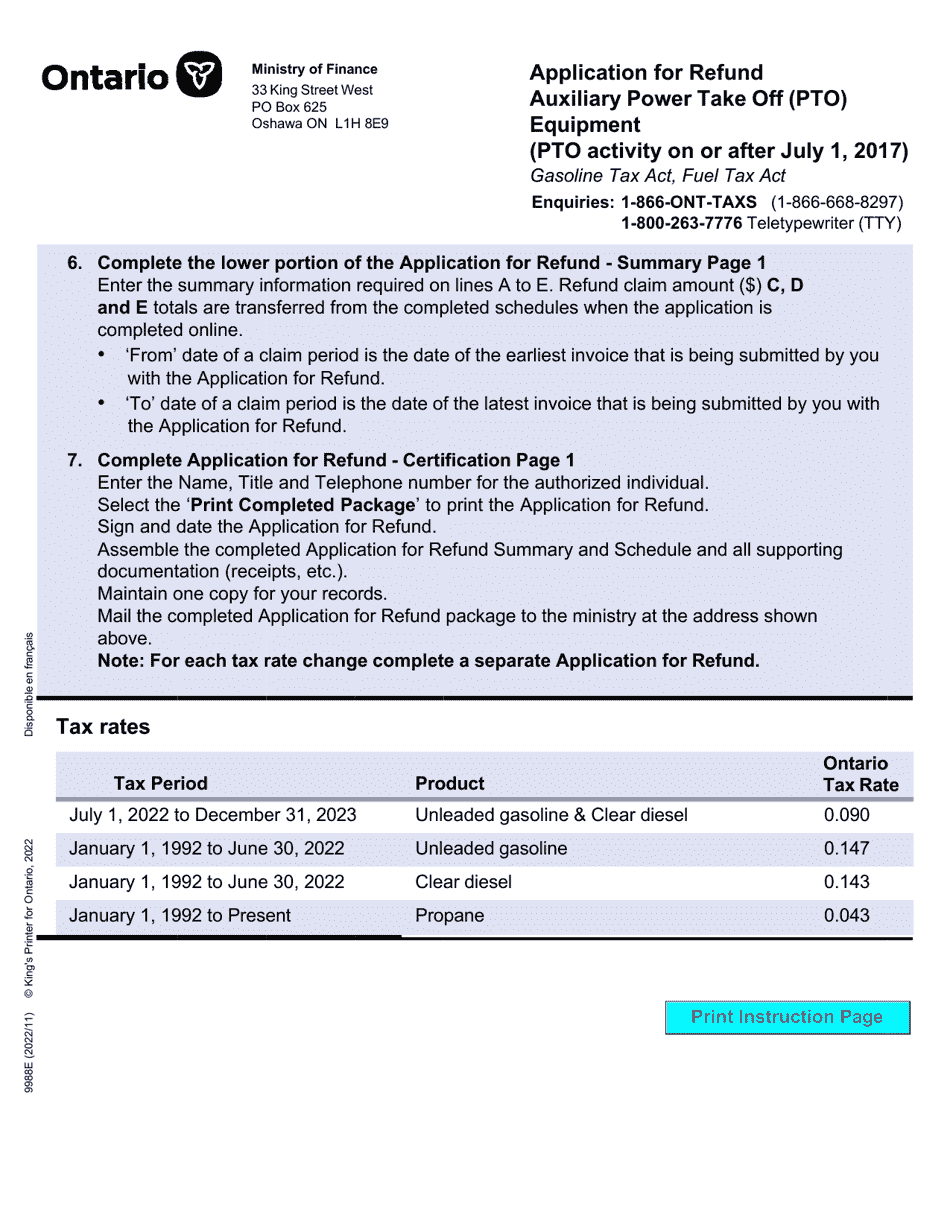

Q: What is the deadline to submit Form 9988E?

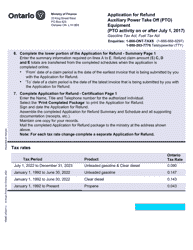

A: The deadline to submit Form 9988E is within four years from the date of the tax payment.

Q: Can I apply for a refund if my Pto Activity was before July 1, 2017?

A: No, Form 9988E is specifically for Pto Activity on or after July 1, 2017.

Q: How long does it take to process the refund application?

A: The processing time for a refund application can vary, but it typically takes several weeks to process a complete and accurate application.