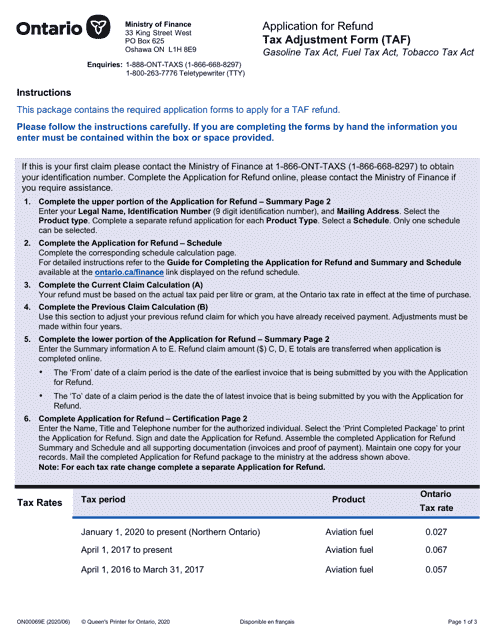

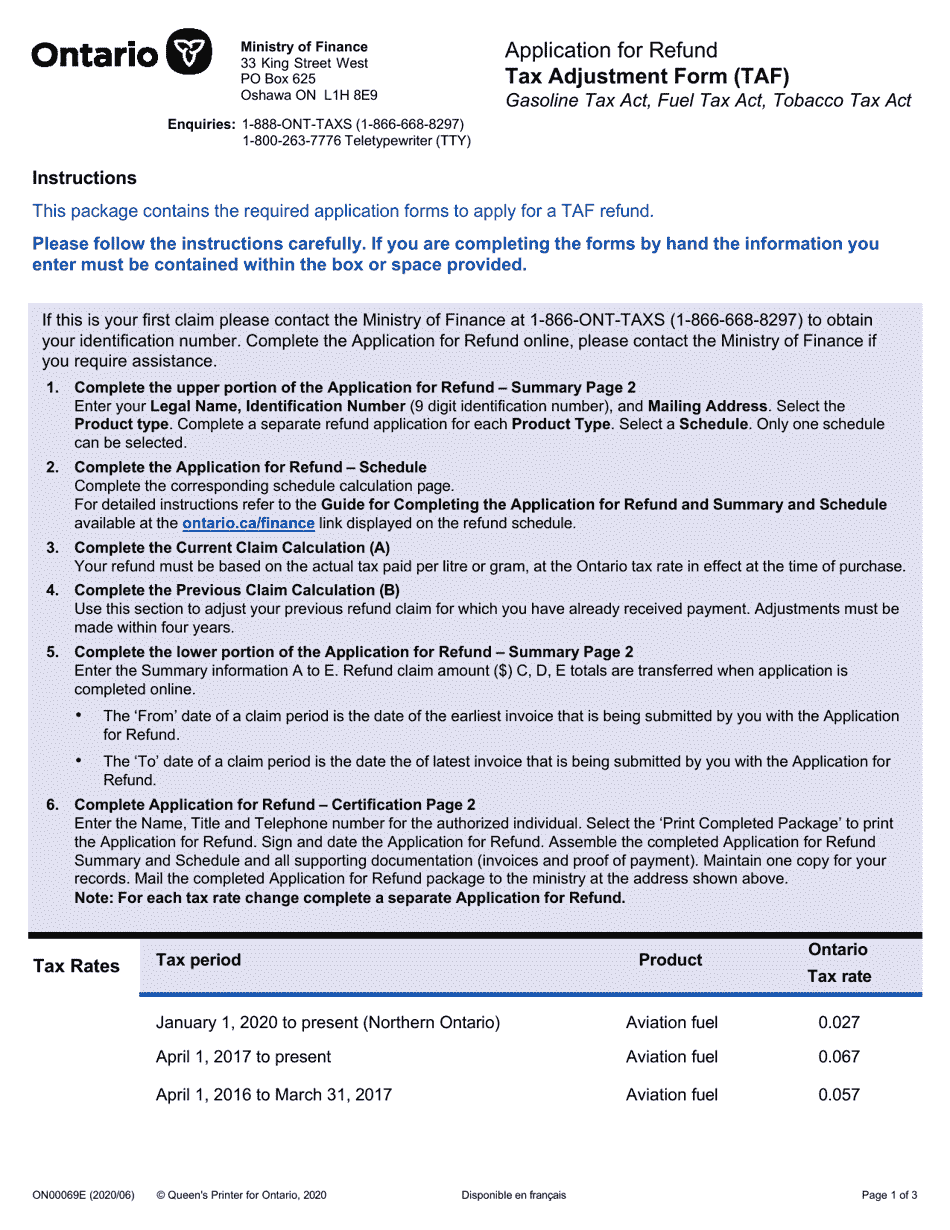

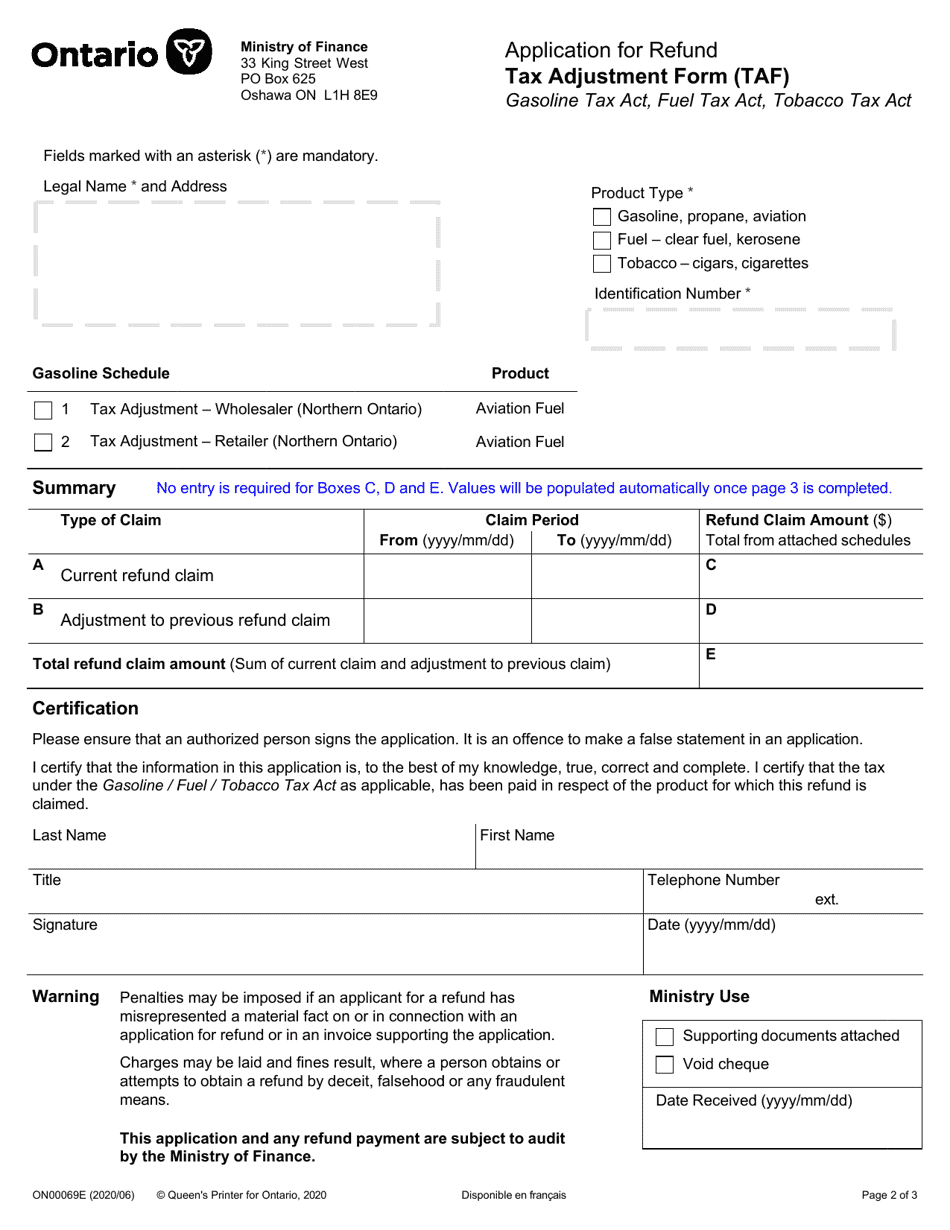

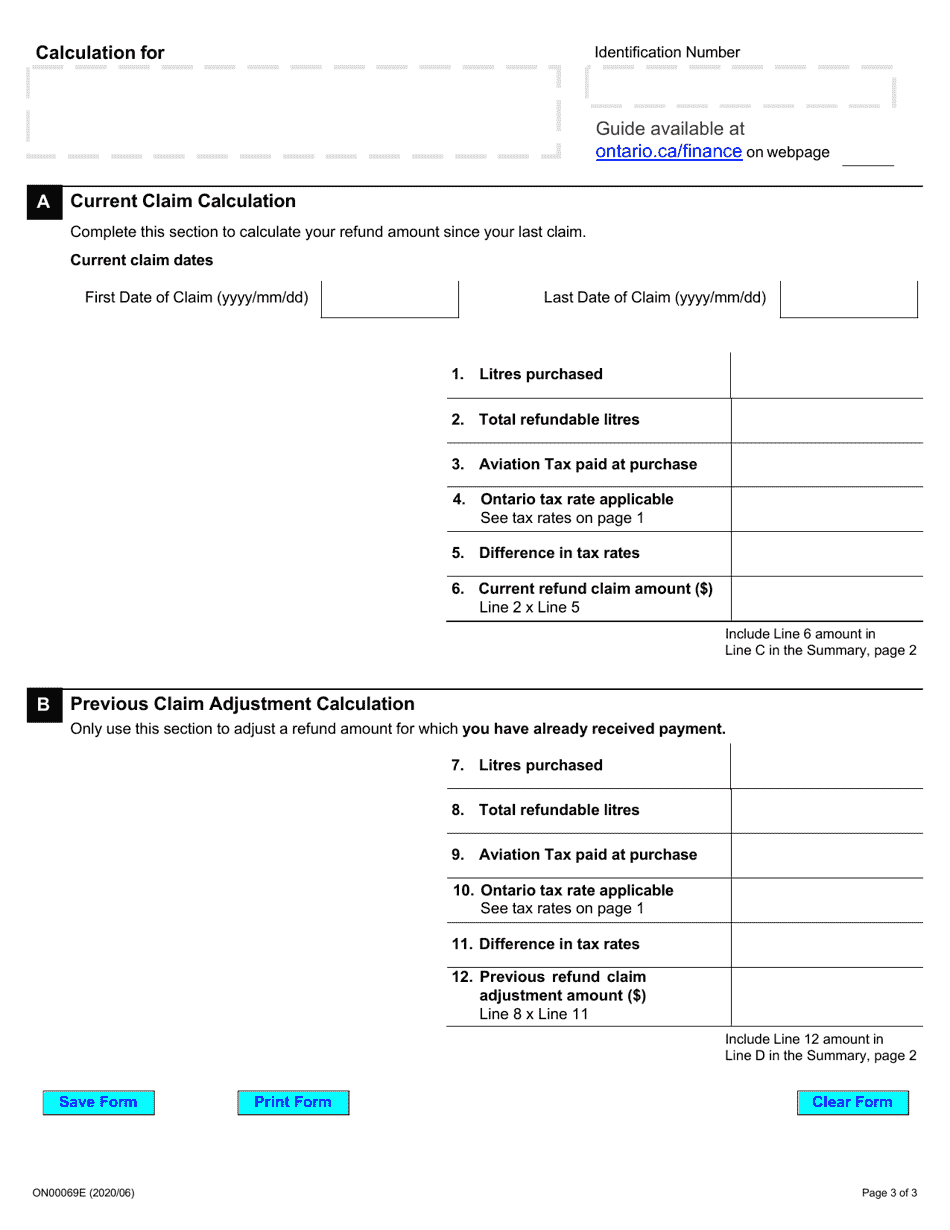

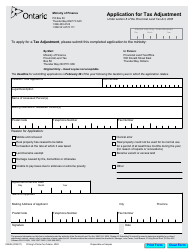

Form ON00069E Application for Refund - Tax Adjustment Form (Taf) - Ontario, Canada

Form ON00069E Application for Refund - Tax Adjustment Form (Taf) in Ontario, Canada is used to apply for a refund of overpaid taxes or to adjust previously filed tax returns. This form is specifically for residents of Ontario who need to request a tax refund or make changes to their tax filing.

The Form ON00069E Application for Refund - Tax Adjustment Form (TAF) in Ontario, Canada is usually filed by individual taxpayers or businesses who are seeking a refund or making adjustments to their taxes.

FAQ

Q: What is ON00069E Application for Refund?

A: ON00069E Application for Refund is a Tax Adjustment Form (TAF) used in Ontario, Canada.

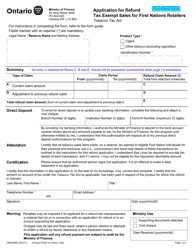

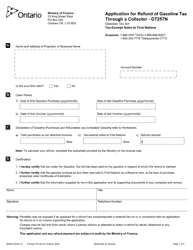

Q: What is the purpose of ON00069E?

A: The purpose of ON00069E Application for Refund is to request a refund or make adjustments to your taxes in Ontario, Canada.

Q: Who can use ON00069E?

A: ON00069E can be used by taxpayers in Ontario, Canada who need to request a refund or make tax adjustments.

Q: Are there any eligibility requirements to use ON00069E?

A: Yes, there may be eligibility requirements to use ON00069E. It is recommended to review the instructions provided with the form or consult with the Canada Revenue Agency (CRA) for specific eligibility criteria.

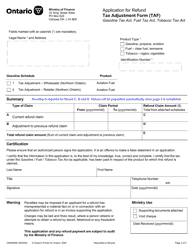

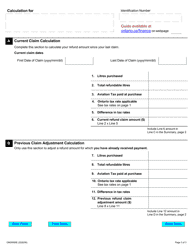

Q: How do I fill out ON00069E?

A: To fill out ON00069E, follow the instructions provided with the form. Make sure to provide accurate and complete information.

Q: Is there a deadline to submit ON00069E?

A: Yes, there may be a deadline to submit ON00069E. It is important to review the instructions provided with the form or consult with the Canada Revenue Agency (CRA) for specific deadlines.