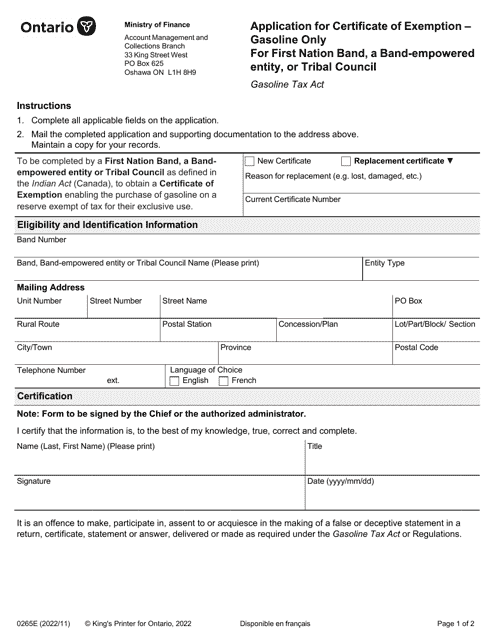

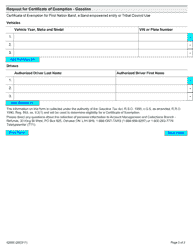

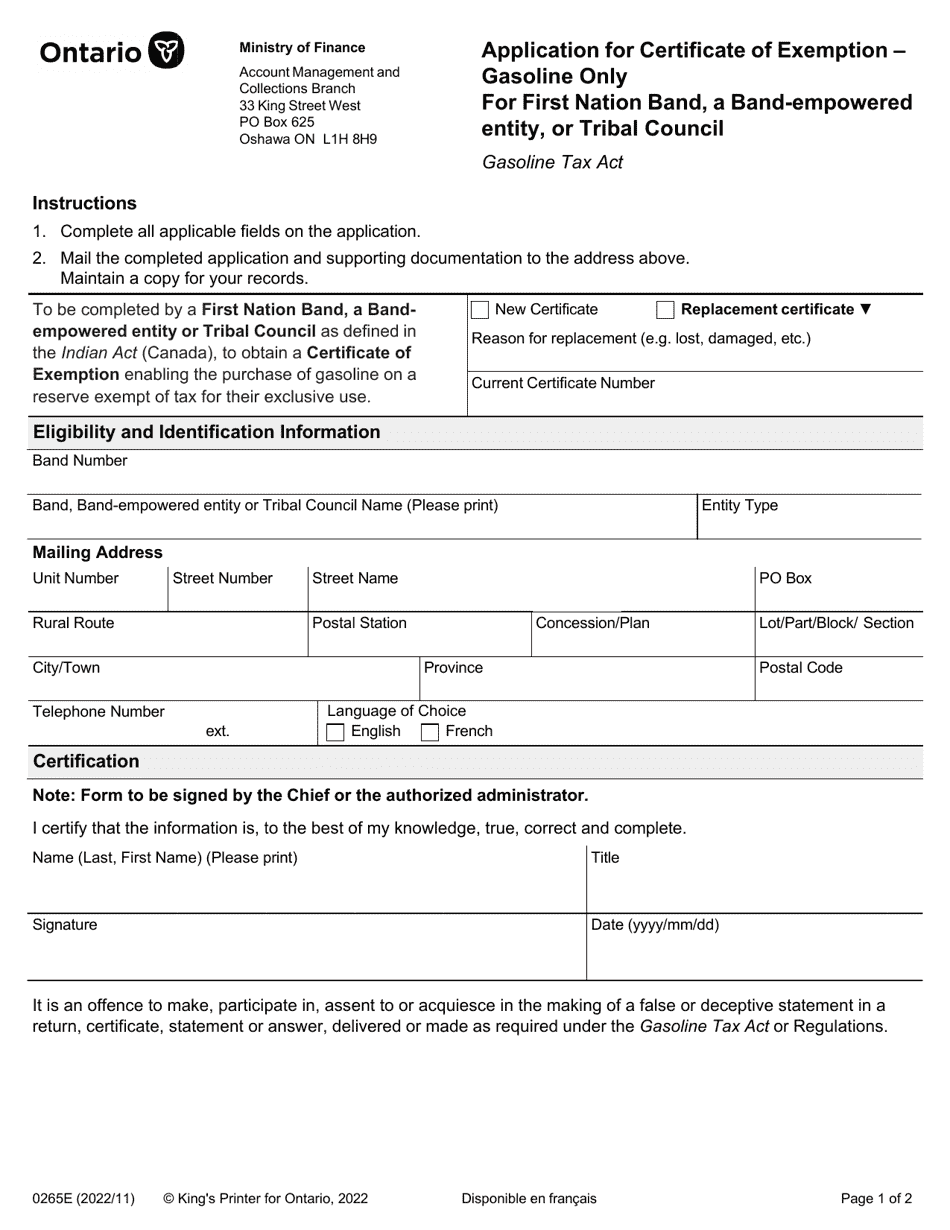

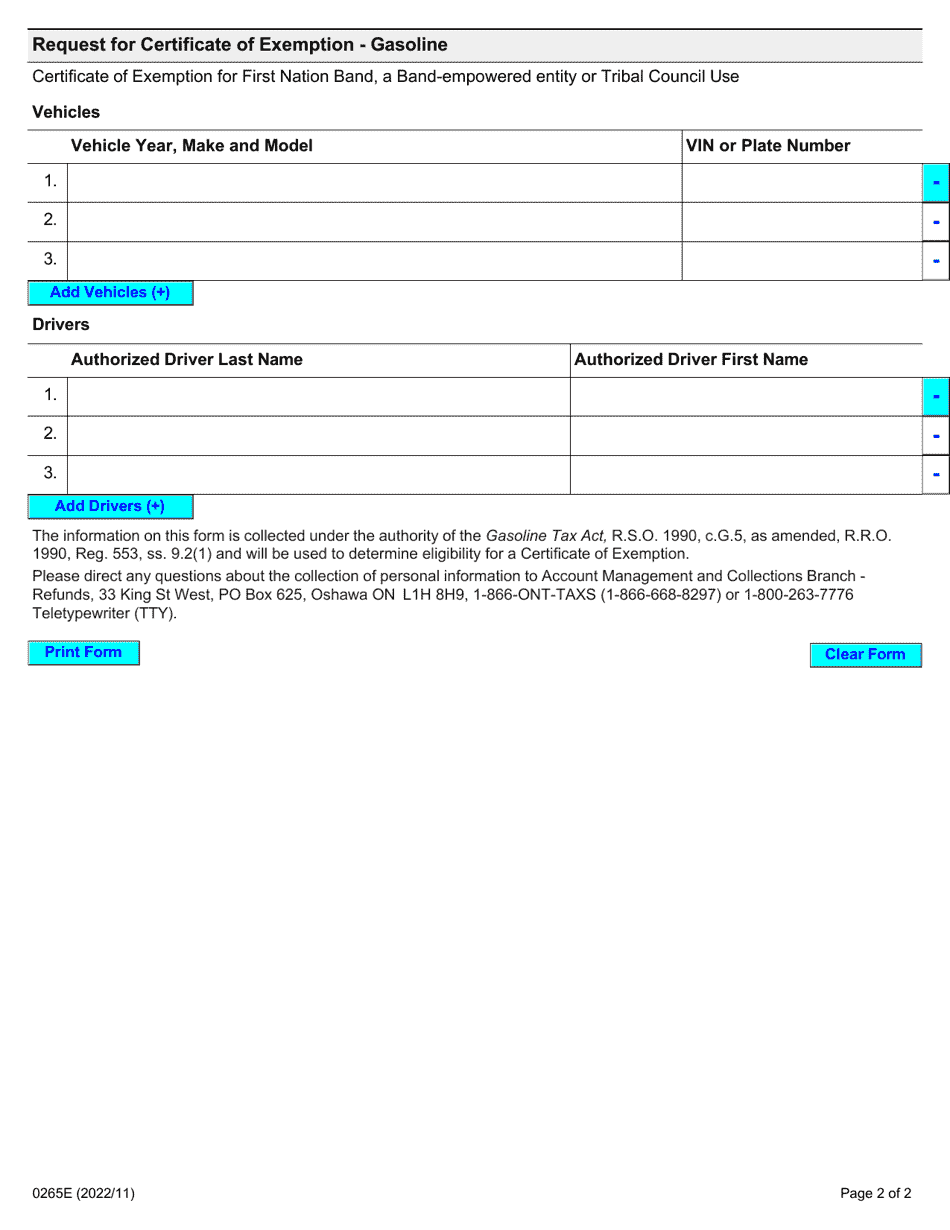

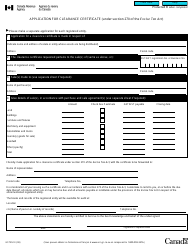

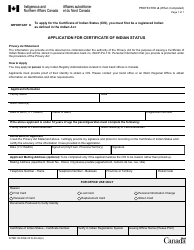

Form 0265E Application for Certificate of Exemption - Gasoline Only for First Nation Band, a Band-Empowered Entity, or Tribal Council - Ontario, Canada

Form 0265E Application for Certificate of Exemption - Gasoline Only for First Nation Band, a Band-Empowered Entity, or Tribal Council - Ontario, Canada is used to apply for a certificate of exemption for gasoline taxes for these specific entities in Ontario, Canada.

FAQ

Q: What is Form 0265E?

A: Form 0265E is an application for a Certificate of Exemption - Gasoline Only for First Nation Band, a Band-Empowered Entity, or Tribal Council in Ontario, Canada.

Q: Who can use Form 0265E?

A: First Nation Bands, Band-Empowered Entities, or Tribal Councils in Ontario, Canada can use Form 0265E.

Q: What is the purpose of Form 0265E?

A: The purpose of Form 0265E is to apply for a Certificate of Exemption for gasoline only.

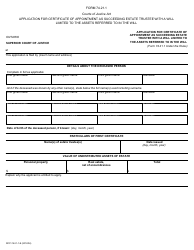

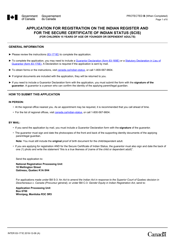

Q: What does the Certificate of Exemption - Gasoline Only allow?

A: The Certificate of Exemption - Gasoline Only allows the holder to purchase gasoline without paying the applicable taxes.

Q: Is the Certificate of Exemption - Gasoline Only specific to First Nation Bands, Band-Empowered Entities, or Tribal Councils?

A: Yes, the Certificate of Exemption - Gasoline Only is specific to First Nation Bands, Band-Empowered Entities, or Tribal Councils in Ontario, Canada.

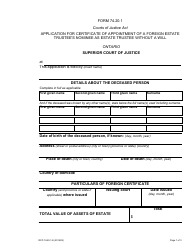

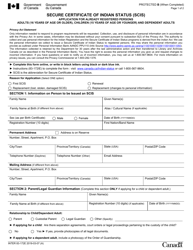

Q: Are there any eligibility requirements for obtaining the Certificate of Exemption - Gasoline Only?

A: Yes, there are eligibility requirements that First Nation Bands, Band-Empowered Entities, or Tribal Councils must meet in order to obtain the Certificate of Exemption - Gasoline Only.

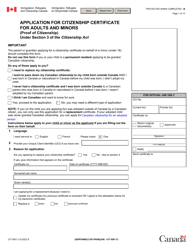

Q: What should I do once I have completed Form 0265E?

A: Once you have completed Form 0265E, you should submit it to the relevant authorities in Ontario, Canada.