This version of the form is not currently in use and is provided for reference only. Download this version of

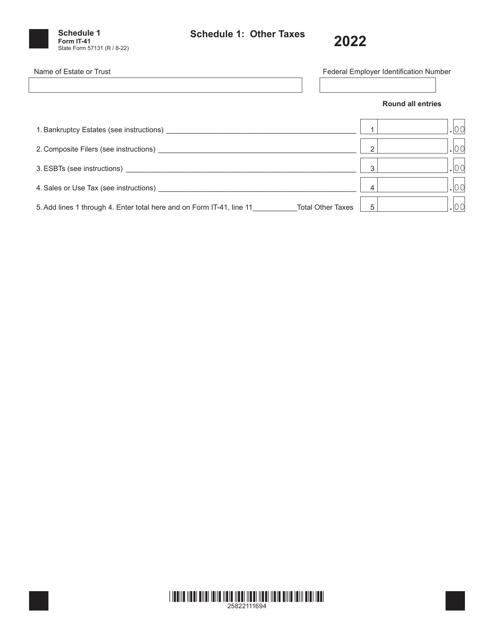

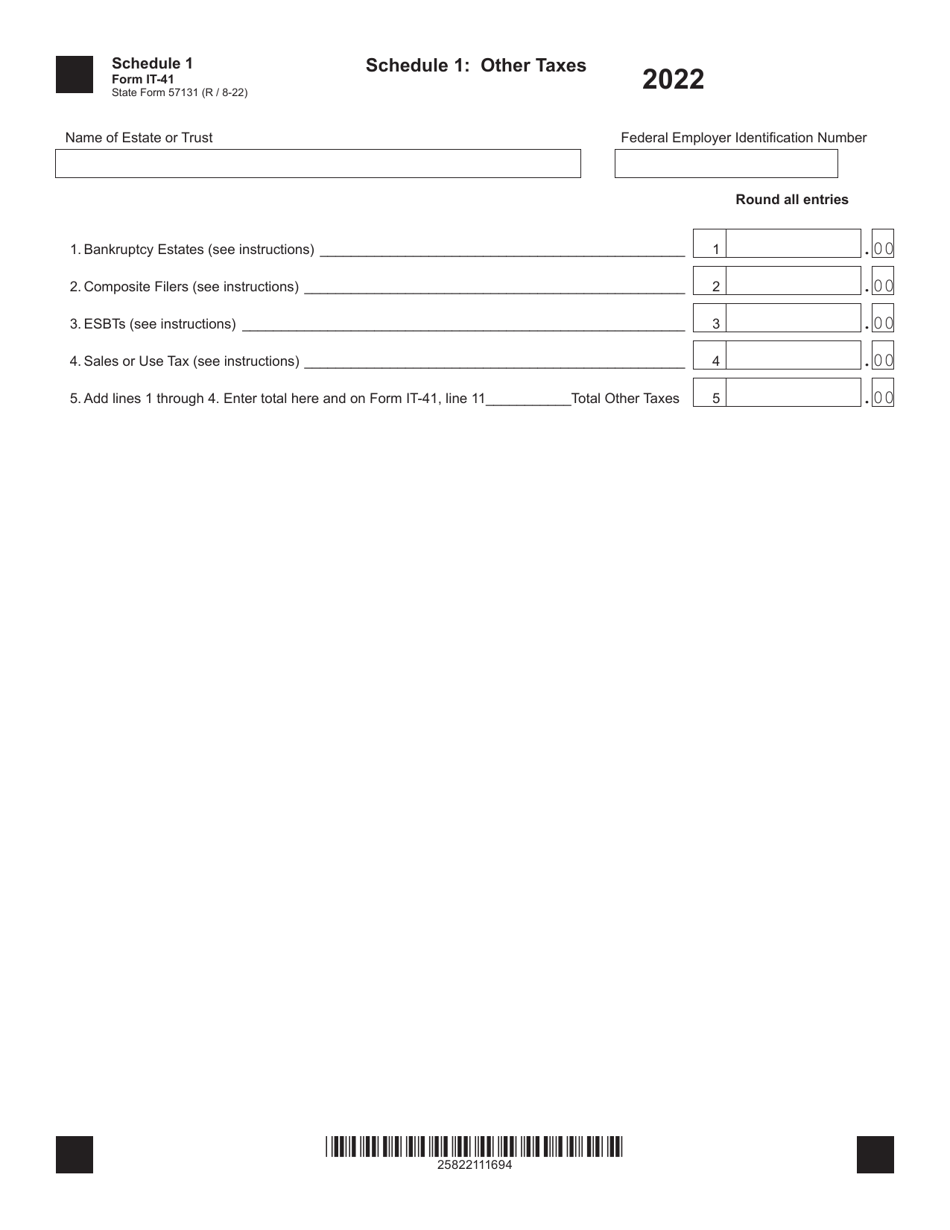

Form IT-41 (State Form 57131) Schedule 1

for the current year.

Form IT-41 (State Form 57131) Schedule 1 Other Taxes - Indiana

What Is Form IT-41 (State Form 57131) Schedule 1?

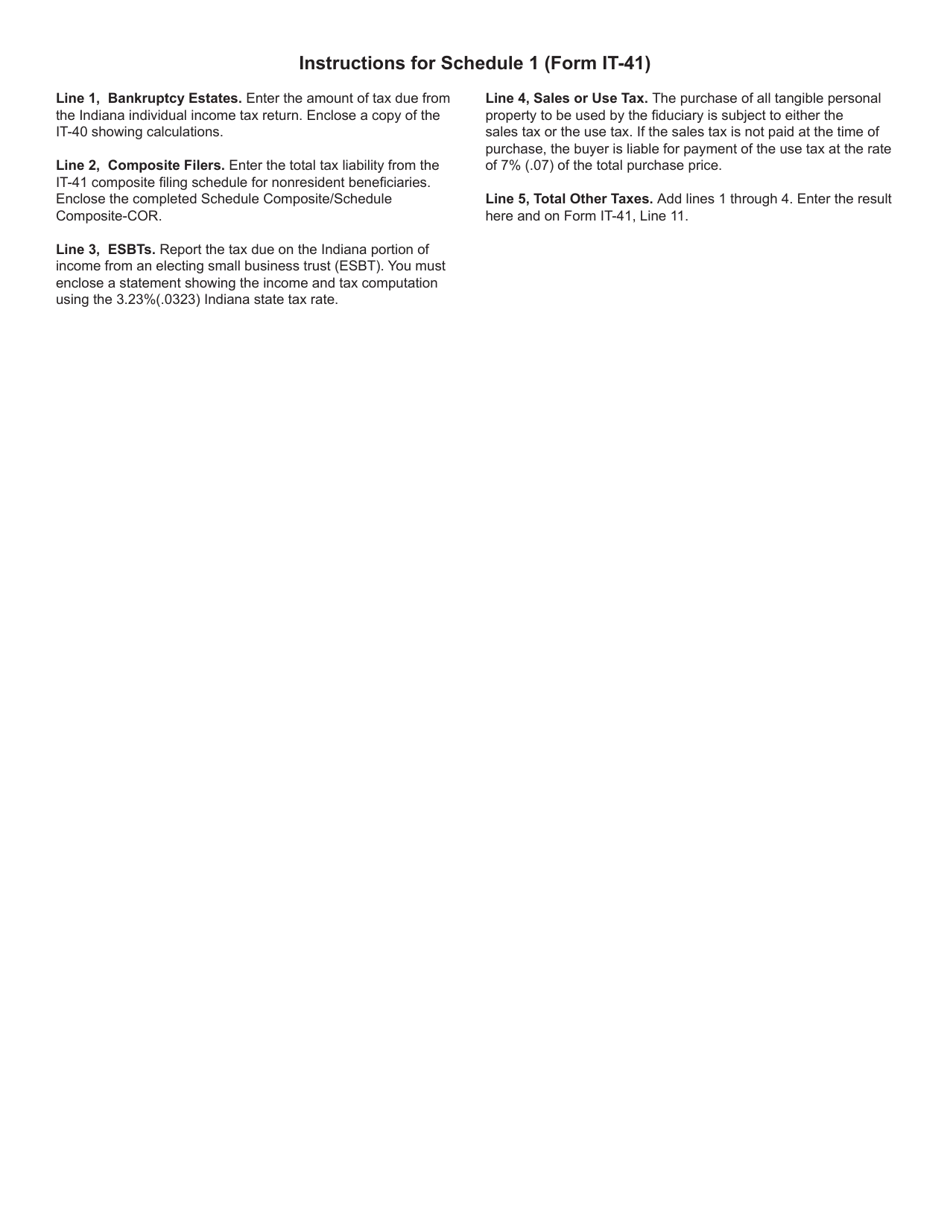

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-41, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-41?

A: Form IT-41 is the tax form used in Indiana to file state income taxes.

Q: What is Schedule 1?

A: Schedule 1 is a section of Form IT-41 specifically used to report other taxes owed in Indiana.

Q: Which taxes should be reported on Schedule 1?

A: Schedule 1 should be used to report any additional taxes owed in Indiana, such as use tax or county tax.

Q: Is Schedule 1 mandatory to fill out?

A: Schedule 1 is only necessary to fill out if you owe other taxes in Indiana.

Q: What happens if I don't file Schedule 1?

A: If you owe other taxes in Indiana and do not file Schedule 1, you may face penalties or interest charges.

Q: Can I e-file Form IT-41 and Schedule 1?

A: Yes, you can e-file Form IT-41 and Schedule 1 if you prefer to file your taxes electronically.

Q: Can I mail Form IT-41 and Schedule 1?

A: Yes, you can mail Form IT-41 and Schedule 1 to the Indiana Department of Revenue if you prefer to file your taxes by mail.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-41 (State Form 57131) Schedule 1 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.