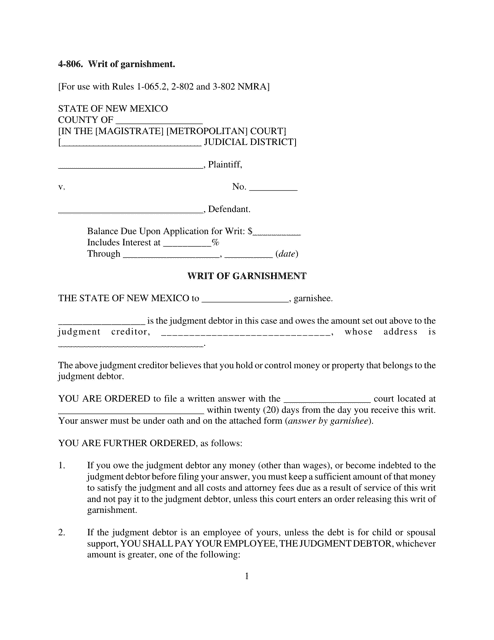

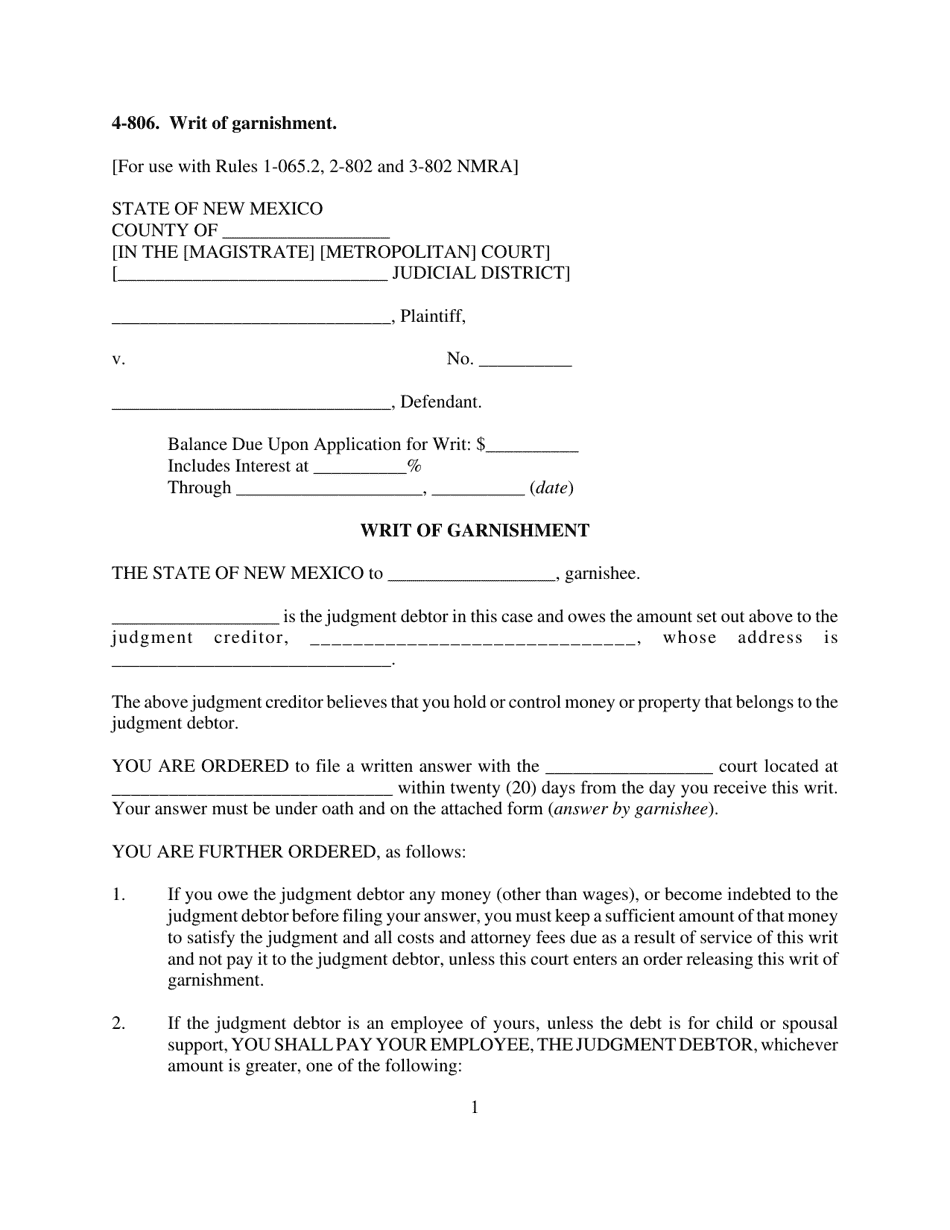

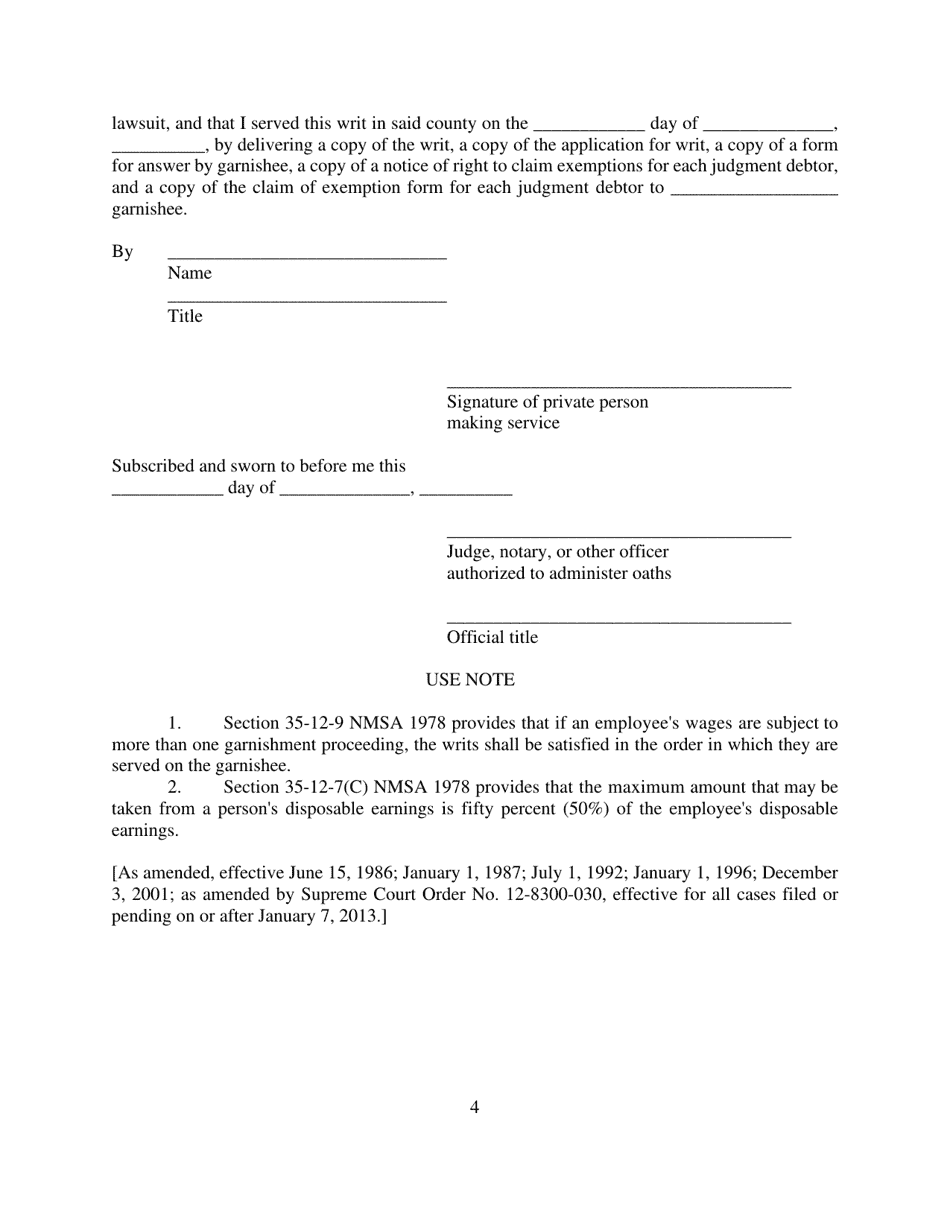

Form 4-806 Writ of Garnishment - New Mexico

What Is Form 4-806?

This is a legal form that was released by the New Mexico Courts - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 4-806 Writ of Garnishment?

A: A Form 4-806 Writ of Garnishment is a legal document used in New Mexico to collect a debt from a debtor's wages or bank account.

Q: Who can use a Form 4-806 Writ of Garnishment?

A: Any individual or entity that is owed money by a debtor can use a Form 4-806 Writ of Garnishment to collect the debt.

Q: How does a Form 4-806 Writ of Garnishment work?

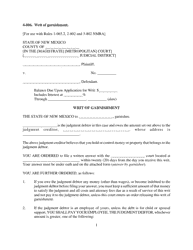

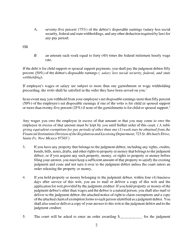

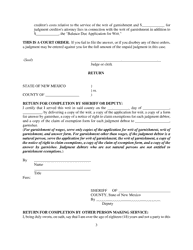

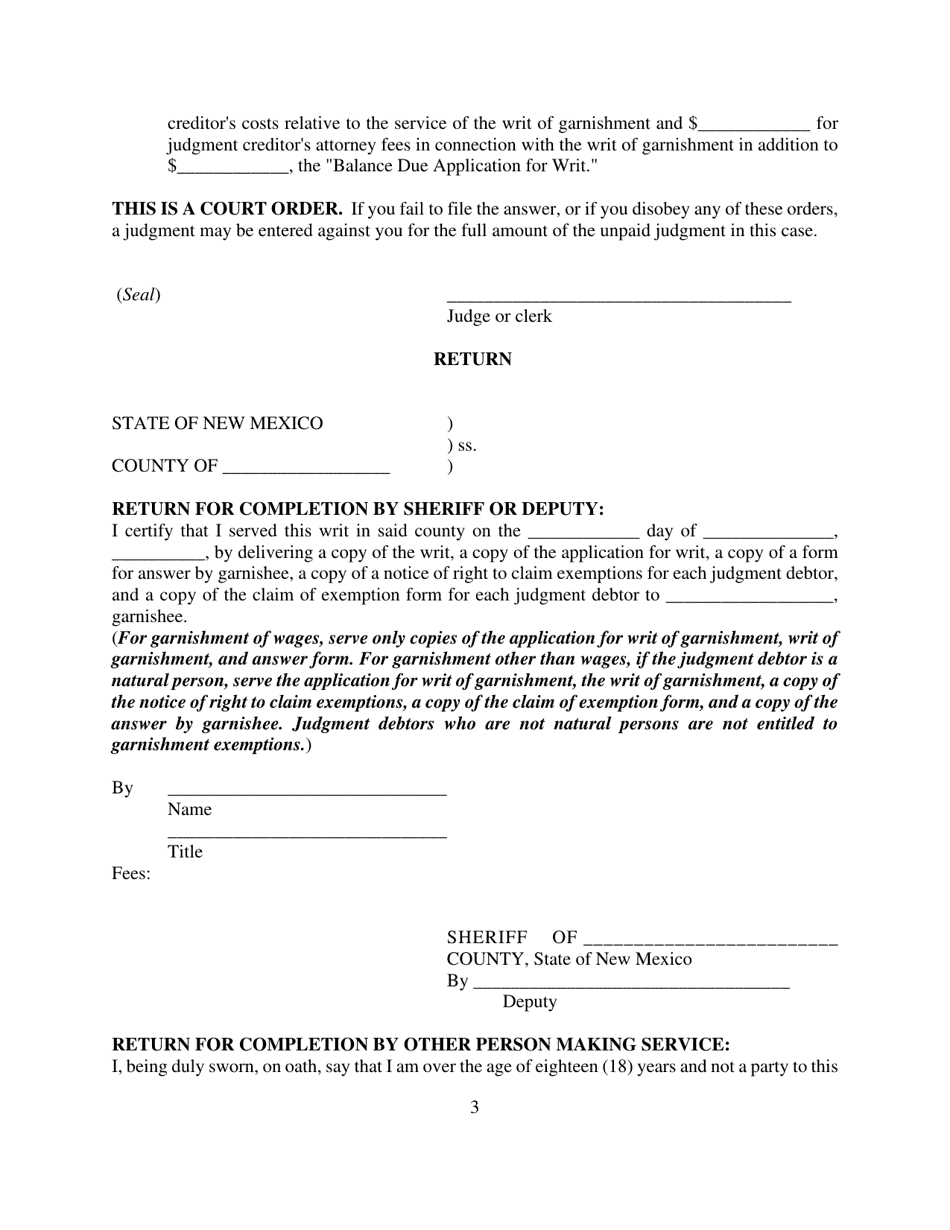

A: The creditor files the writ with the court, and if approved, it is served to the garnishee (the debtor's employer or bank). The garnishee is then required to withhold a portion of the debtor's wages or freeze their bank account to satisfy the debt.

Q: What information is required in a Form 4-806 Writ of Garnishment?

A: The writ should include the debtor's name, address, employment information, and the amount of the debt owed.

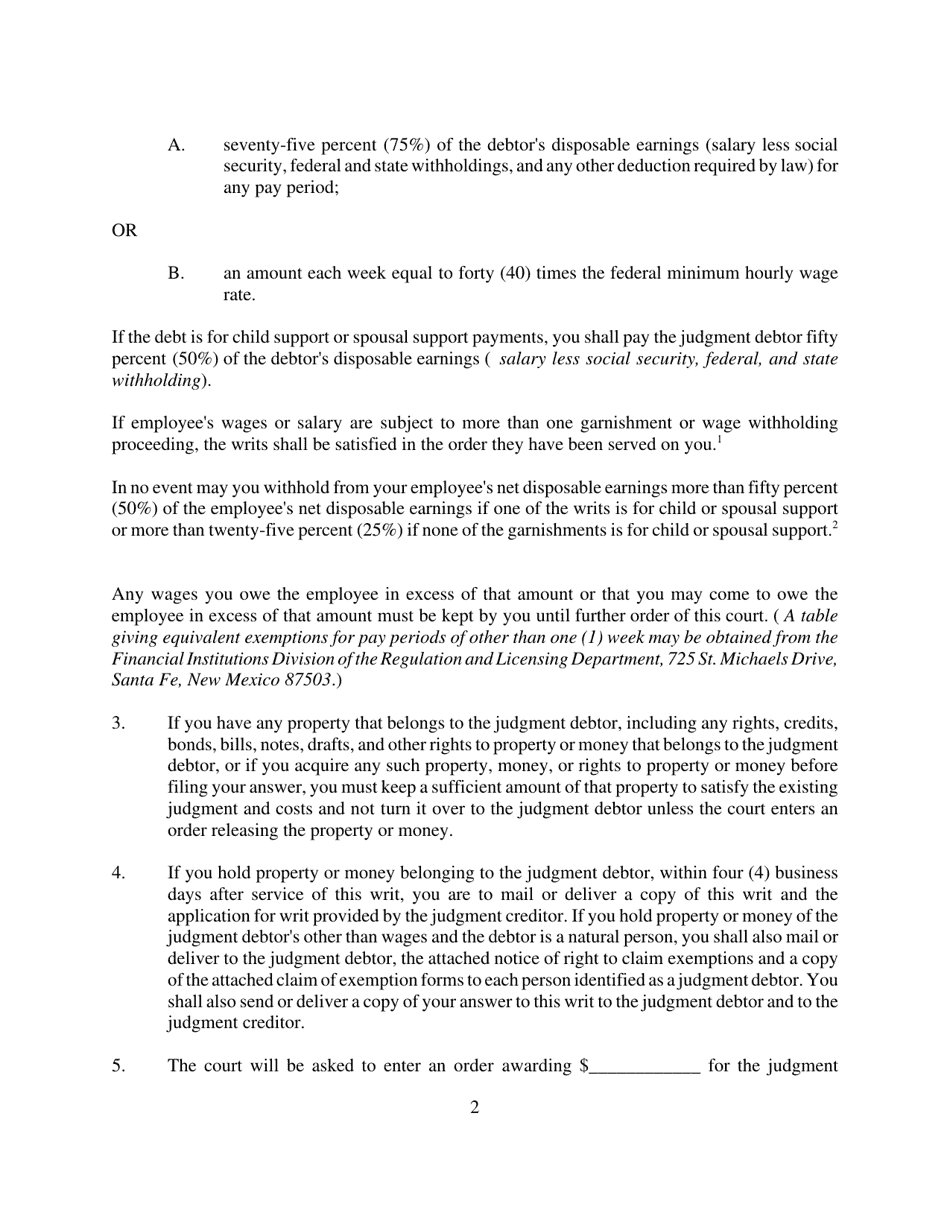

Q: Are there any limitations on garnishment in New Mexico?

A: Yes, New Mexico limits the amount that can be garnished from a debtor's wages to 25% of their disposable earnings, or the amount by which their earnings exceed 40 times the minimum wage, whichever is less.

Form Details:

- The latest edition provided by the New Mexico Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4-806 by clicking the link below or browse more documents and templates provided by the New Mexico Courts.