This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

Minnesotacare Estimated Tax Instructions - Wholesale Drug Distributor Tax - Minnesota

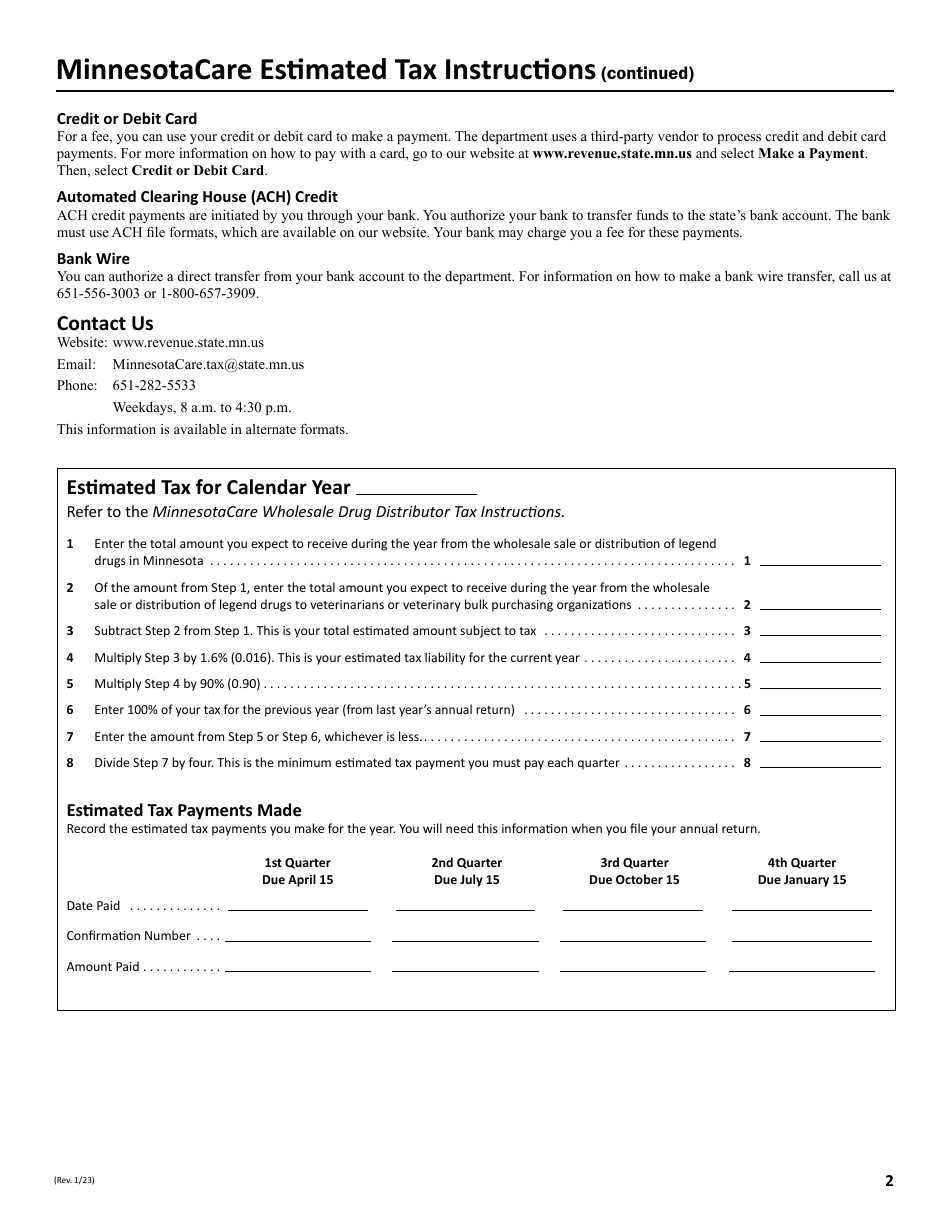

The Minnesotacare Estimated Tax Instructions - Wholesale Drug Distributor Tax - Minnesota document gives guidelines on how to calculate and pay estimated taxes for wholesale drug distributors in Minnesota. This tax applies to the distribution of legend drugs, and the funds collected are used to support the Minnesotacare health care insurance program in Minnesota. It details the methods of payment, calculating tax obligations, due dates, where to file, and other instructions needed to correctly pay the Wholesale Drug Distributor Tax.

The Minnesota Department of Revenue handles the filing of Minnesotacare Estimated Tax Instructions, specifically for the Wholesale Drug Distributor Tax. This department is responsible for managing all tax-related operations within the state of Minnesota, including but not limited to income tax, sales tax, and specialty taxes such as the Wholesale Drug Distributor Tax. For in-depth specifics or guidance, it is recommended to visit the official Minnesota Department of Revenue website or get in touch with a professional tax advisor.

FAQ

Q: What is MinnesotaCare?

A: MinnesotaCare is a health care program in the state of Minnesota for residents who do not have access to affordable health insurance. It is funded by state and federal taxes, along with member premiums.

Q: What is the Wholesale Drug Distributor Tax in Minnesota?

A: The Wholesale Drug Distributor Tax in Minnesota is a tax that is imposed on the gross revenues of wholesale drug distributors. The revenue from this tax is used to fund the MinnesotaCare program.

Q: Who is subject to the Wholesale Drug Distributor Tax in Minnesota?

A: All entities that distribute drugs at wholesale in Minnesota are subject to this tax. This includes entities outside of Minnesota that distribute drugs within the state.

Q: How is the Wholesale Drug Distributor Tax in Minnesota calculated?

A: The tax is calculated based on the gross revenues of the wholesale drug distributor. The tax rate is 2% of the gross revenues.

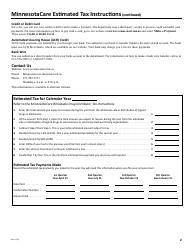

Q: How do I estimate my MinnesotaCare taxes?

A: To estimate your MinnesotaCare taxes, you would need to calculate 2% of your gross revenues from wholesale drug distribution. The Minnesota Department of Revenue provides an estimator tool on their website.