This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

Minnesotacare Estimated Tax Instructions - Hospital and Surgical Center Taxes - Minnesota

The Minnesotacare Estimated Tax Instructions - Hospital and Surgical Center Taxes - Minnesota is a document issued by the Minnesota Department of Revenue. It provides instructions for hospitals and surgical centers in Minnesota on how to estimate, calculate, and pay their taxes to the state. This document is specifically useful for healthcare institutions in the state as it explains the nitty-gritty of complying with MinnesotaCare Tax Laws. The tax helps fund the MinnesotaCare program, which provides affordable health care coverage to low-income residents of Minnesota.

The Minnesota Department of Revenue is responsible for filing the "Minnesotacare Estimated Tax Instructions - Hospital and Surgical Center Taxes" in Minnesota. These instructions are intended for hospitals and surgical centers that are subject to Minnesotacare taxes. These entities must estimate their tax liabilities for the year and make quarterly payments.

FAQ

Q: What is Minnesotacare?

A: Minnesotacare is a tax program in the U.S. state of Minnesota for funding healthcare services for low income residents who don't have access to affordable health insurance.

Q: Who pays the Minnesotacare tax?

A: The Minnesotacare tax is paid by hospitals, surgical centers, wholesale drug distributors, and healthcare providers such as doctors, dentists, and chiropractors.

Q: What is the purpose of the Minnesotacare tax?

A: The purpose of the Minnesotacare tax is to help fund healthcare services for those without access to affordable health insurance.

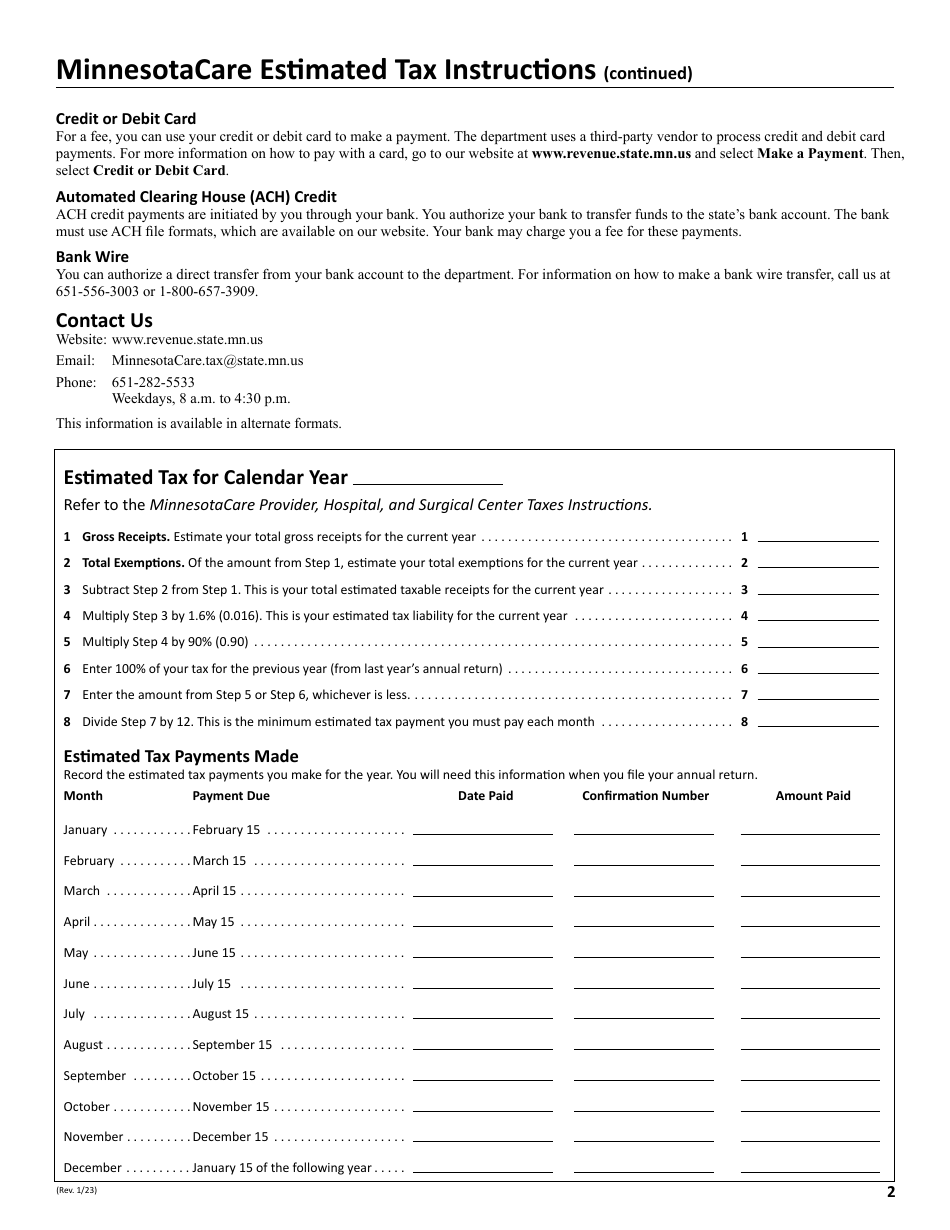

Q: How is the Minnesotacare tax calculated?

A: The Minnesotacare tax is calculated as a percentage of the total gross revenues for hospitals, surgical centers, and healthcare providers. The tax rate varies depending on the type of healthcare service provided.

Q: When is the Minnesotacare tax due?

A: The Minnesotacare tax is due on a quarterly basis. Hospitals, surgical centers, and healthcare providers are required to estimate their tax liabilities for the year and make payments each quarter.