This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

Minnesotacare Estimated Tax Instructions - Provider Tax - Minnesota

The Minnesotacare Estimated Tax Instructions - Provider Tax - Minnesota is an official document designed to guide healthcare providers in the state of Minnesota, USA, on how to calculate, estimate, and pay the MinnesotaCare Provider Tax. This tax is levied on hospitals, surgical centers, or healthcare practitioners providing certain medical services within the jurisdiction of Minnesota. The Estimated Tax Instructions provide the necessary details for understanding the calculations, exemptions, payment dates, possible penalties, and other pertinent details. It is important to use these instructions as a guide to stay in compliance with state tax laws.

The Minnesotacare Estimated Tax Instructions - Provider Tax - Minnesota is filed by healthcare providers operating within the state of Minnesota. This includes hospitals, surgery centers, wholesale drug distributors, and certain healthcare practitioners. These providers are required to pay a tax on the revenues they receive from providing certain kinds of healthcare services, as stipulated by the Minnesota Department of Revenue.

FAQ

Q: What is Minnesotacare?

A: MinnesotaCare is a health insurance program in the U.S. state of Minnesota that provides coverage to individuals and families who do not have access to employer-sponsored health insurance and don't qualify for other insurance programs due to higher income.

Q: Who is subject to the Minnesota Provider Tax?

A: The Minnesota Provider Tax is typically applied to healthcare professionals like physicians, dentists, chiropractors, and therapists. It also applies to hospitals, surgical centers, and wholesale drug distributors in Minnesota.

Q: Are there any exemptions from the Minnesota Provider Tax?

A: Yes, there are certain exemptions to the Minnesota Provider Tax. Some of these include services like psychological and psychological testing, ambulance services, hospice care, and some non-profit healthcare centers.

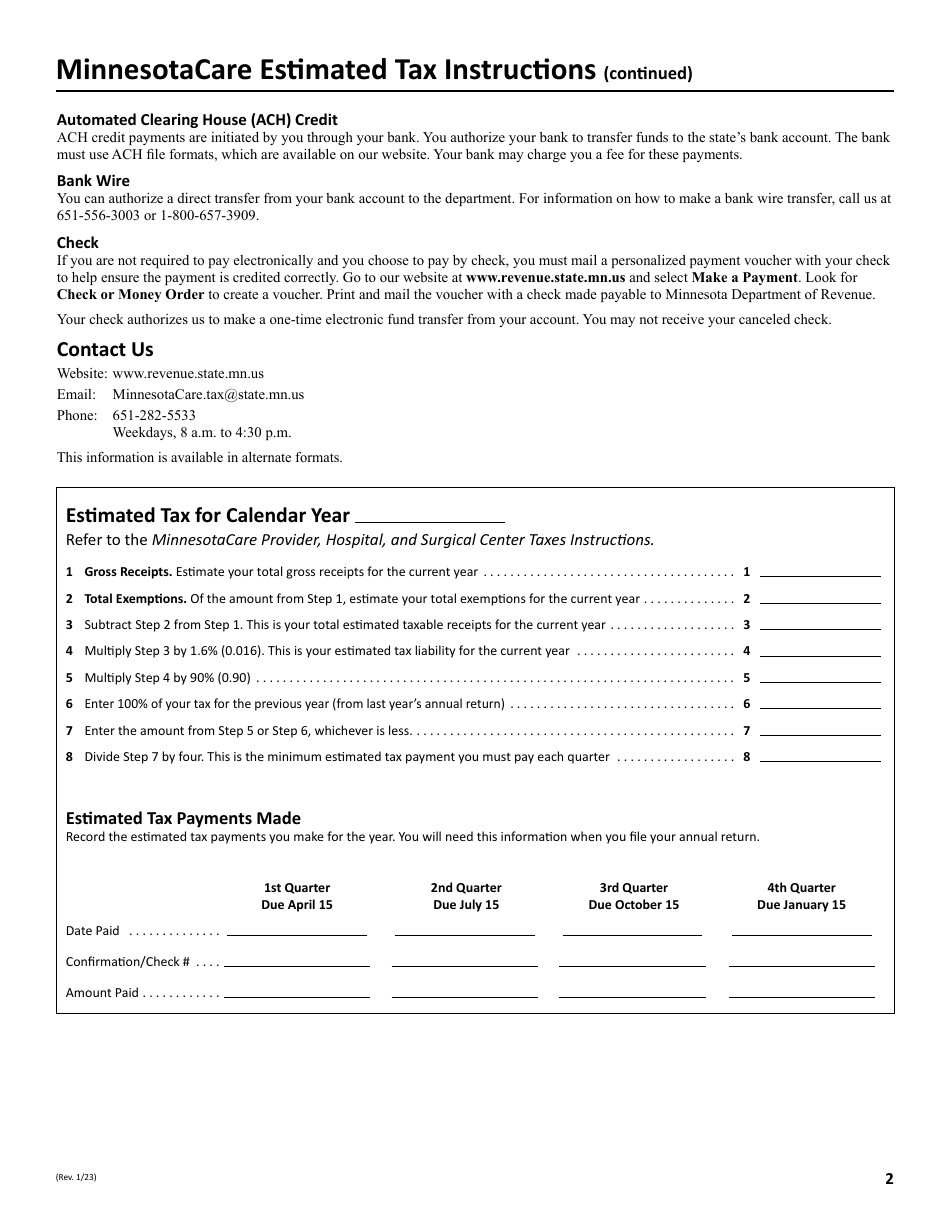

Q: How do I estimate my amount for Minnesota Provider Tax?

A: The Minnesota Provider Tax is typically estimated based on the gross revenues of the healthcare provider's practice. They can calculate the tax by multiplying the applicable percentage rate by their gross revenues.

Q: When are estimated provider tax payments due in Minnesota?

A: Estimated Minnesota provider tax payments are usually due in four installments, with deadlines typically falling on the 15th of April, June, September, and January.

Q: What are the consequences of not paying the Minnesota Provider Tax?

A: If the Minnesota Provider Tax isn't paid, this could result in late payment penalties and interest charges. In severe cases, it may lead to the loss of licenses to conduct business.

Q: How does Minnesotacare use funds from the Provider Tax?

A: Revenues from the Minnesota Provider Tax are used to fund the MinnesotaCare program, which provides health care to people who don't have access to affordable health care coverage.