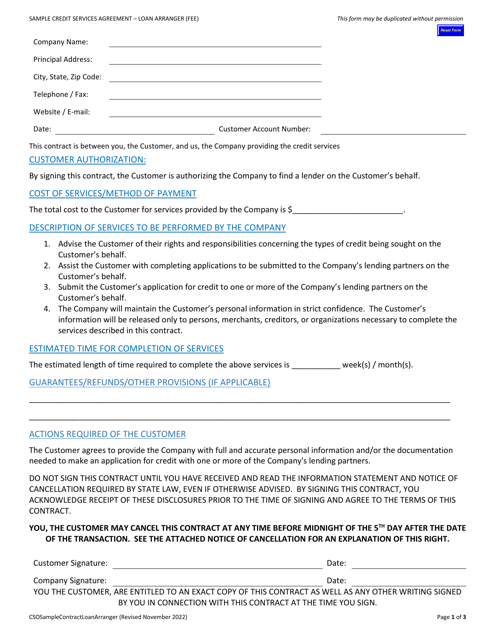

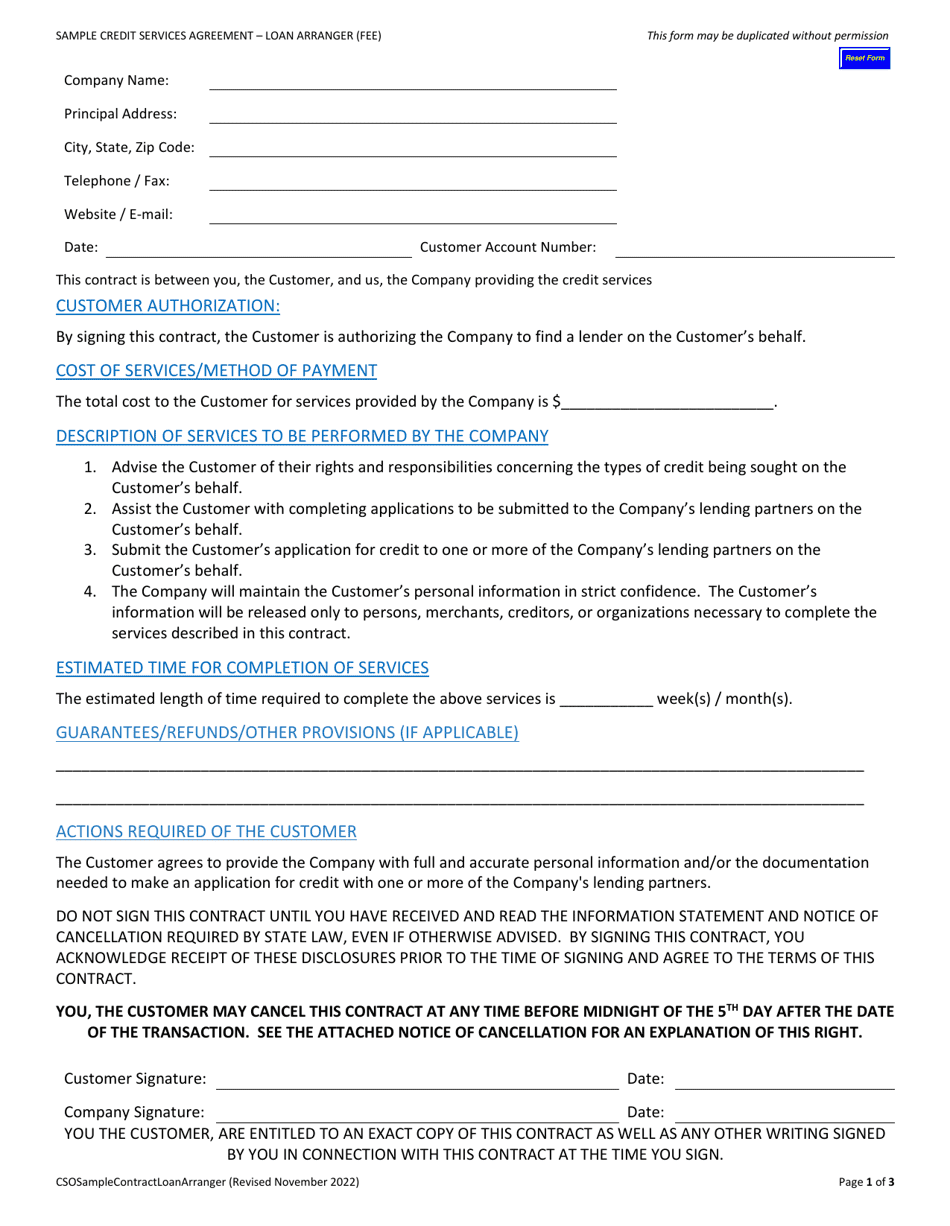

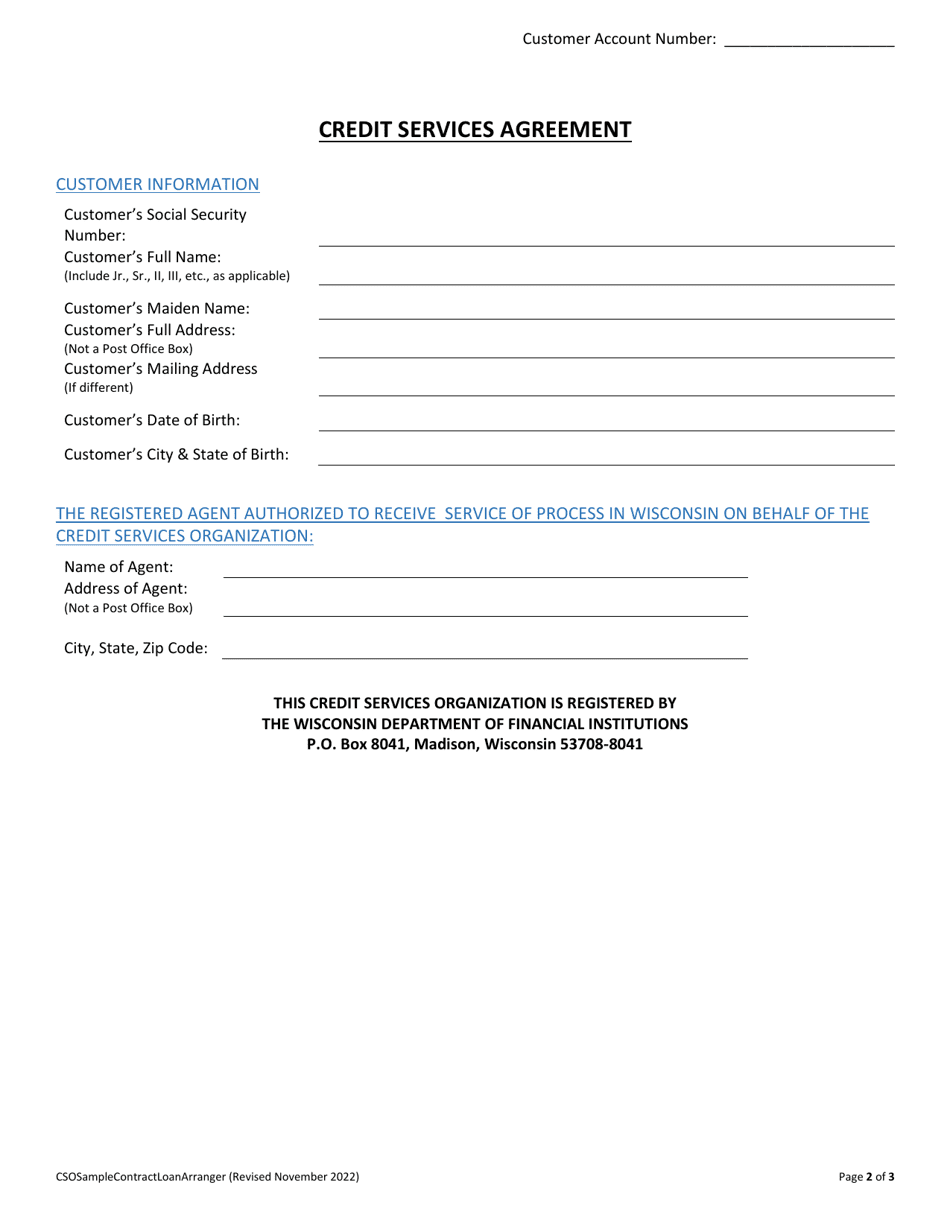

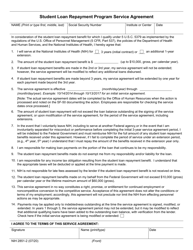

Credit Services Agreement for Loan Arrangers - Wisconsin

Credit Services Agreement for Loan Arrangers is a legal document that was released by the Wisconsin Department of Financial Institutions - a government authority operating within Wisconsin.

FAQ

Q: What is a Credit Services Agreement?

A: A Credit Services Agreement is a contract between a loan arranger and a borrower.

Q: What is the role of a loan arranger?

A: A loan arranger helps borrowers find and secure loans.

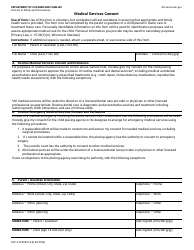

Q: Who can enter into a Credit Services Agreement in Wisconsin?

A: Any individual or business who needs assistance in obtaining a loan can enter into a Credit Services Agreement.

Q: What services are provided by a loan arranger?

A: A loan arranger assists in loan applications, finding suitable lenders, and negotiating loan terms.

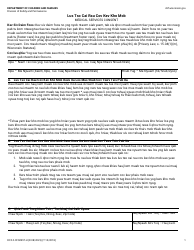

Q: Is a loan arranger required to be licensed in Wisconsin?

A: Yes, loan arrangers need to be licensed by the Wisconsin Department of Financial Institutions.

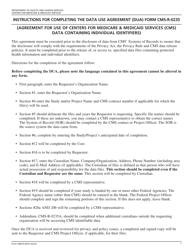

Q: What information should be included in the Credit Services Agreement?

A: The agreement should specify the services to be provided, fees, and responsibilities of both parties.

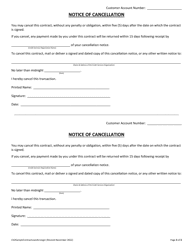

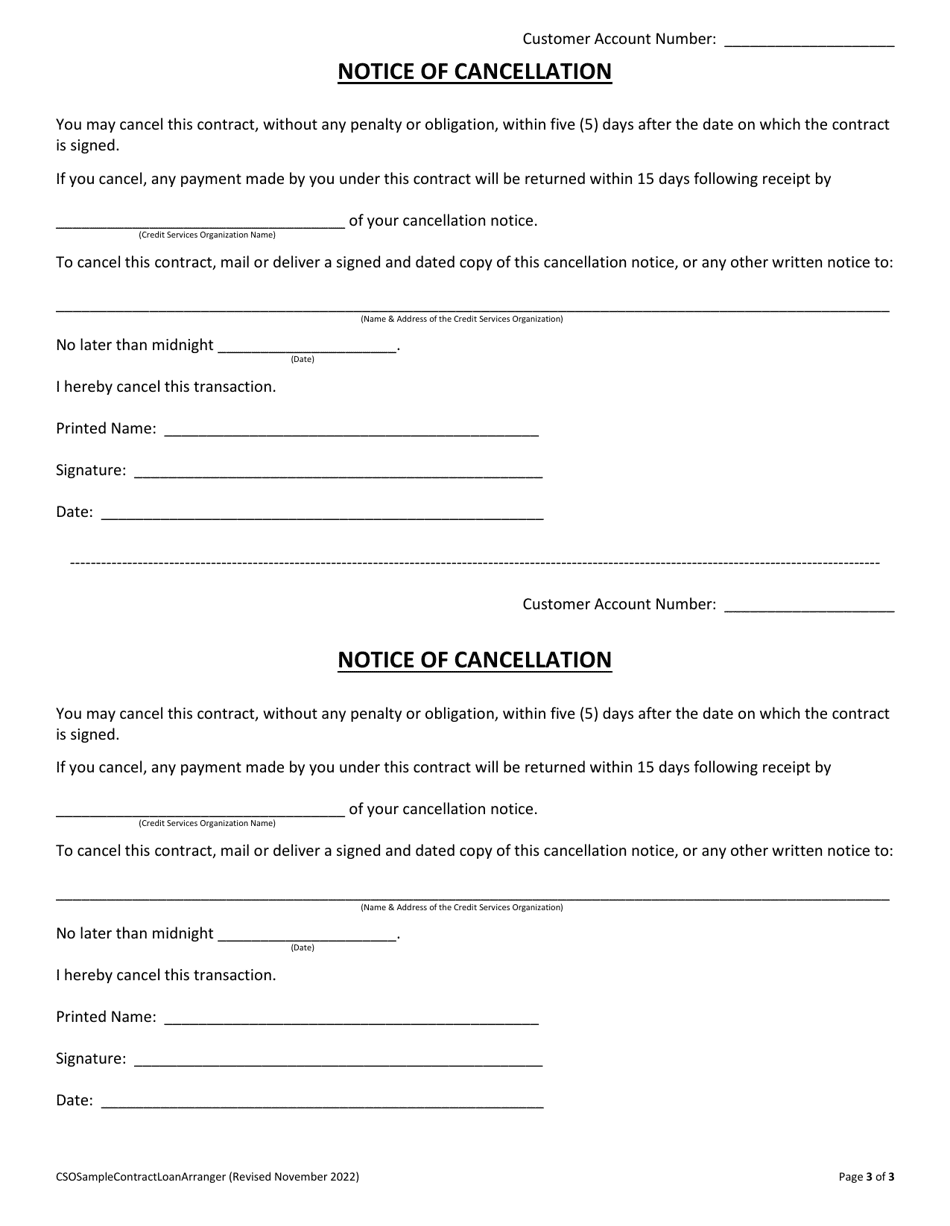

Q: Can a borrower cancel a Credit Services Agreement?

A: Yes, borrowers have the right to cancel the agreement within a certain period, usually three days.

Q: What happens if a loan arranger violates the Credit Services Agreement?

A: If a loan arranger violates the agreement, the borrower may be entitled to damages or a refund of fees.

Q: Are there any legal requirements for advertising credit services in Wisconsin?

A: Yes, loan arrangers must comply with the advertising restrictions set forth in the Wisconsin Consumer Act.

Q: Is there a cooling-off period for a Credit Services Agreement?

A: Yes, borrowers have a three-day cooling-off period during which they can cancel the agreement without any penalty.

Form Details:

- Released on November 1, 2022;

- The latest edition currently provided by the Wisconsin Department of Financial Institutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Financial Institutions.