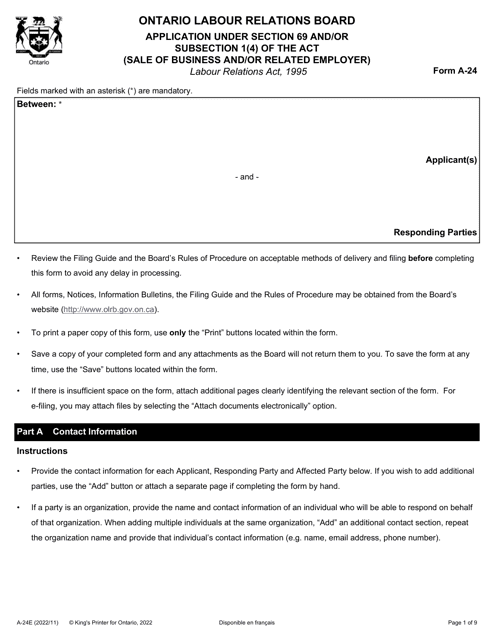

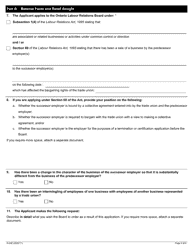

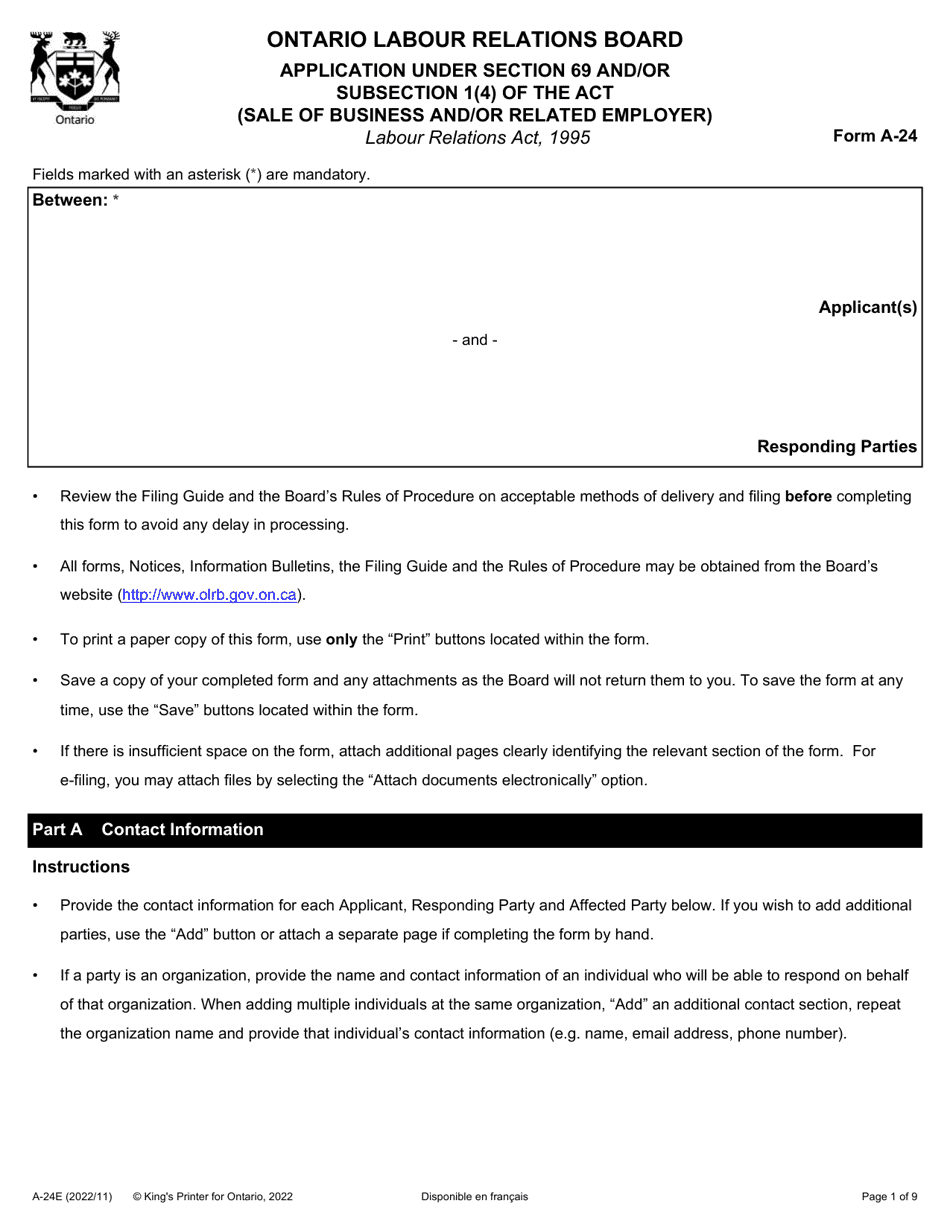

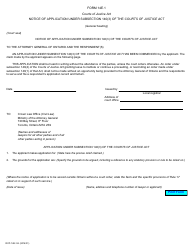

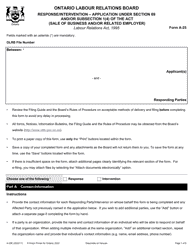

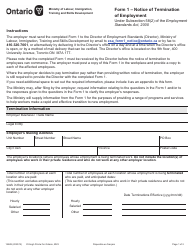

Form A-24 Application Under Section 69 and / or Subsection 1(4) of the Act (Sale of Business and / or Related Employer) - Ontario, Canada

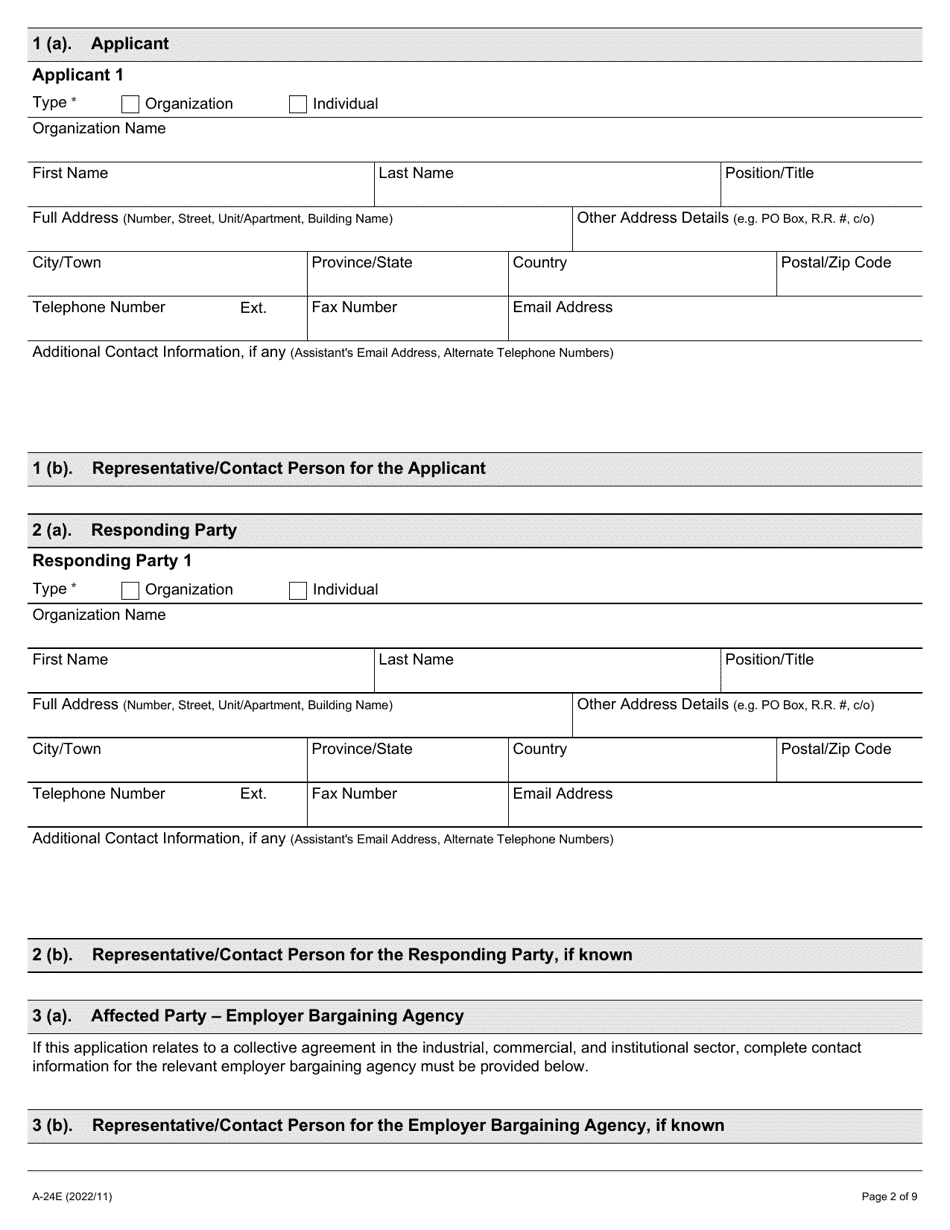

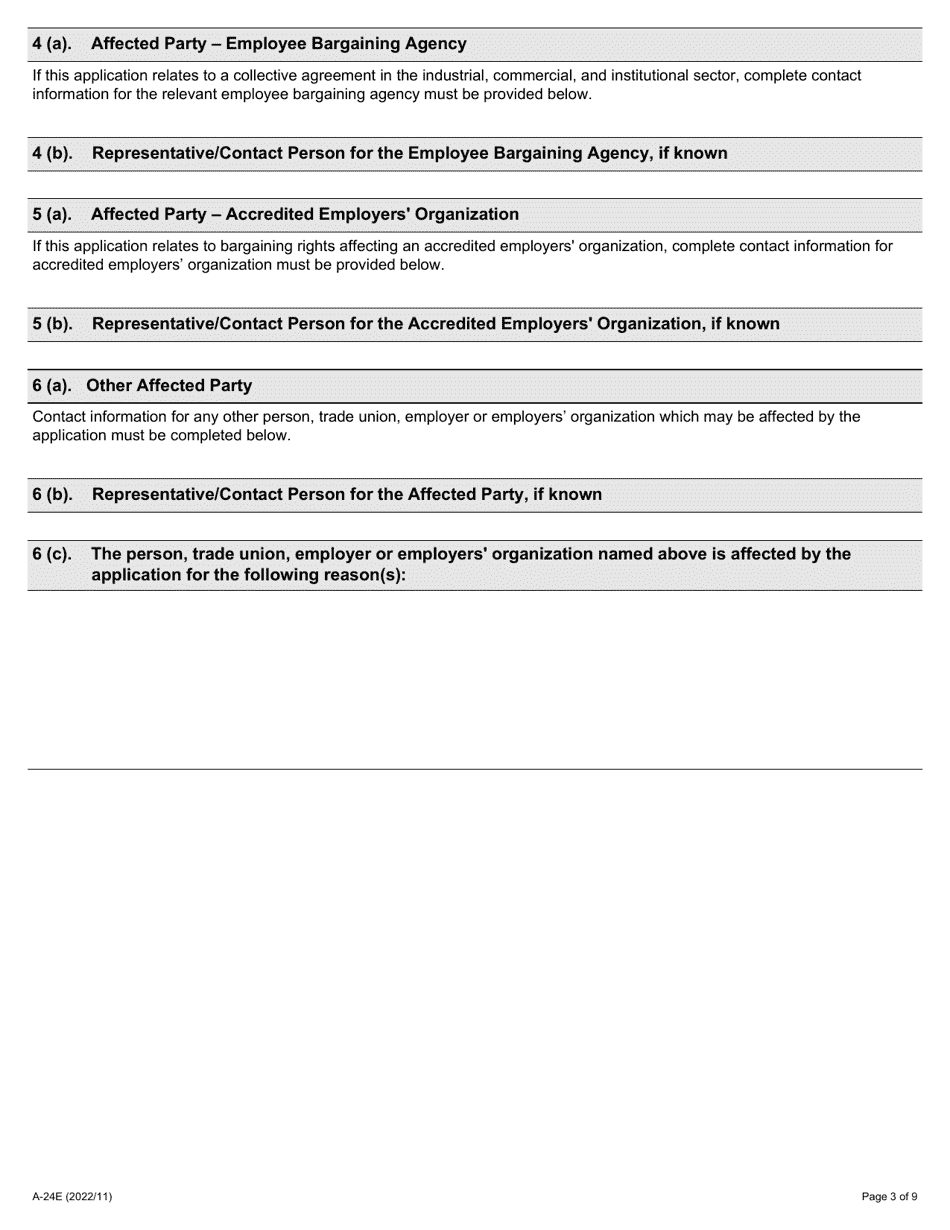

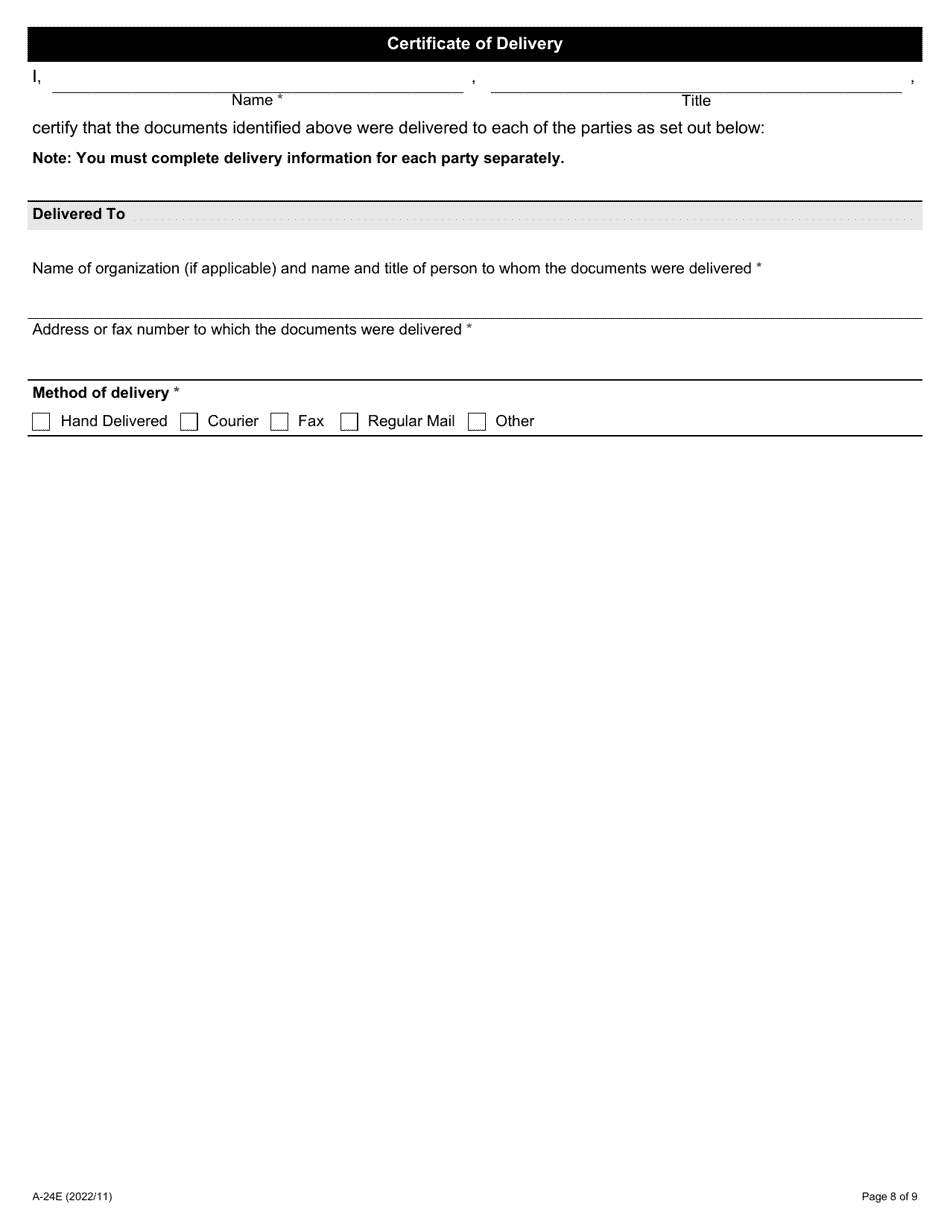

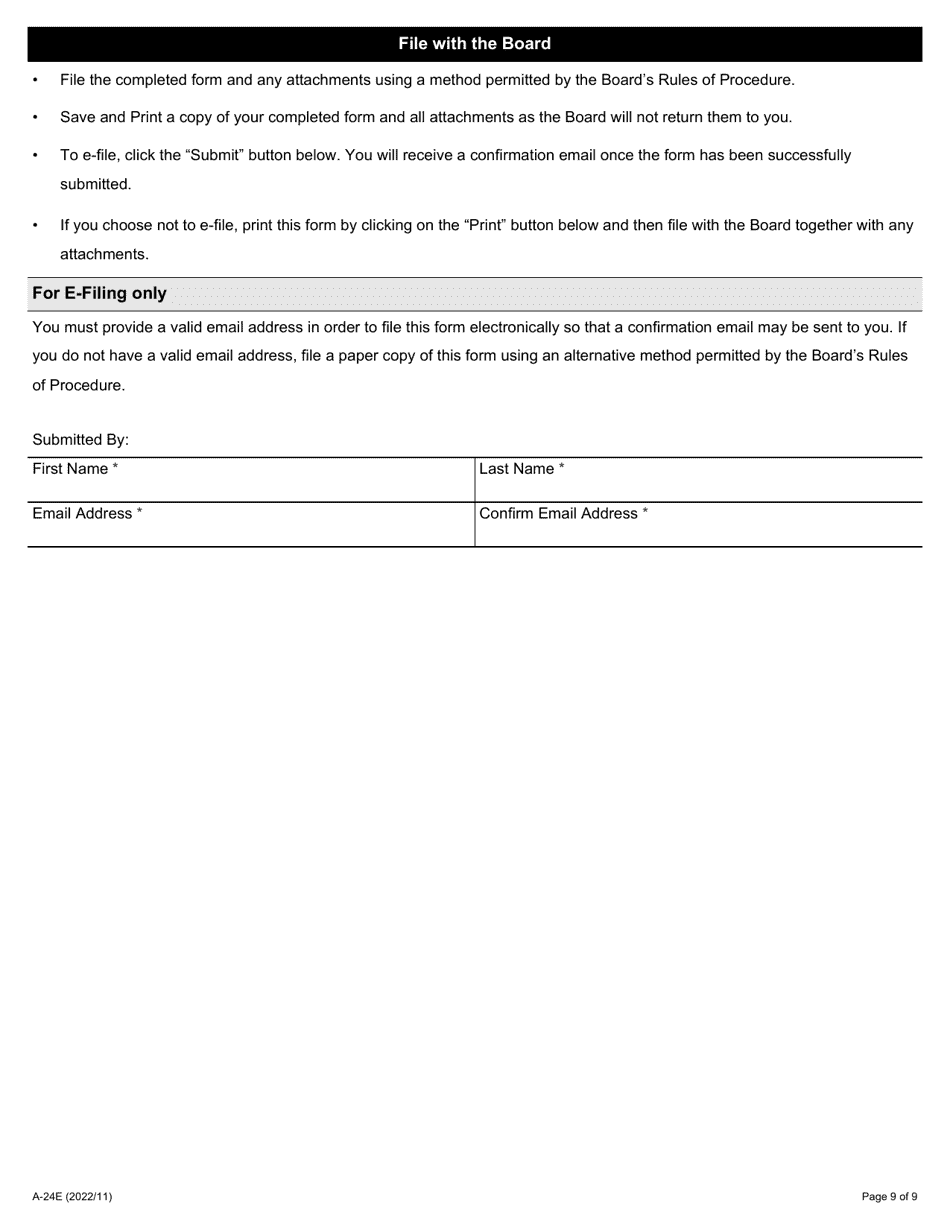

Form A-24 Application Under Section 69 and/or Subsection 1(4) of the Act (Sale of Business and/or Related Employer) in Ontario, Canada is used for applying for approval of the sale of a business or transfer of employees to a related employer.

The employer files the Form A-24 application under Section 69 and/or Subsection 1(4) of the Act (Sale of Business and/or Related Employer) in Ontario, Canada.

FAQ

Q: What is Form A-24?

A: Form A-24 is an application form in Ontario, Canada.

Q: What is the purpose of Form A-24?

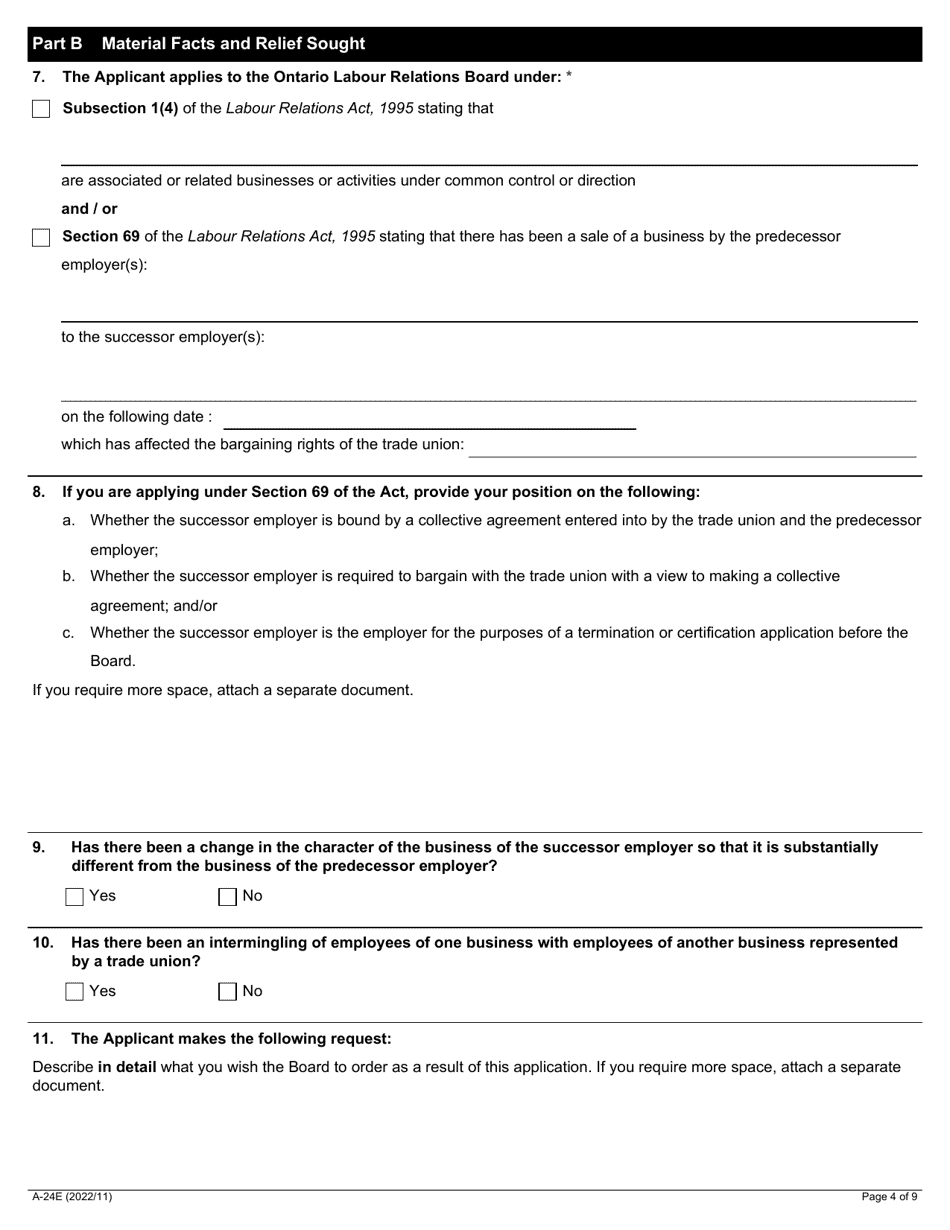

A: Form A-24 is used for applying under Section 69 and/or Subsection 1(4) of the Act for the sale of business and/or related employer in Ontario, Canada.

Q: Who should use Form A-24?

A: Anyone who wants to apply for the sale of a business and/or related employer in Ontario, Canada should use Form A-24.

Q: What is Section 69 of the Act?

A: Section 69 of the Act refers to a specific section in the legislation that governs the sale of business and/or related employer in Ontario, Canada.

Q: What is Subsection 1(4) of the Act?

A: Subsection 1(4) of the Act refers to a specific subsection in the legislation that governs the sale of business and/or related employer in Ontario, Canada.

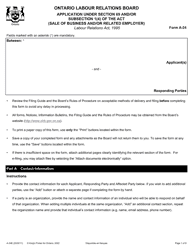

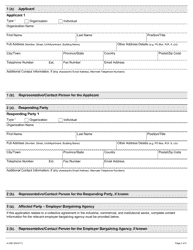

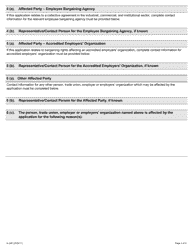

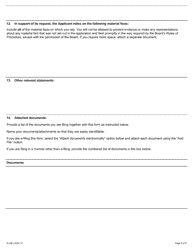

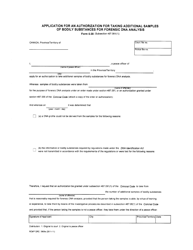

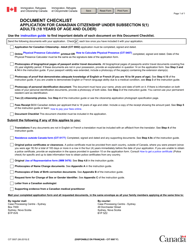

Q: What should I include in my Form A-24 application?

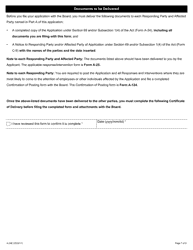

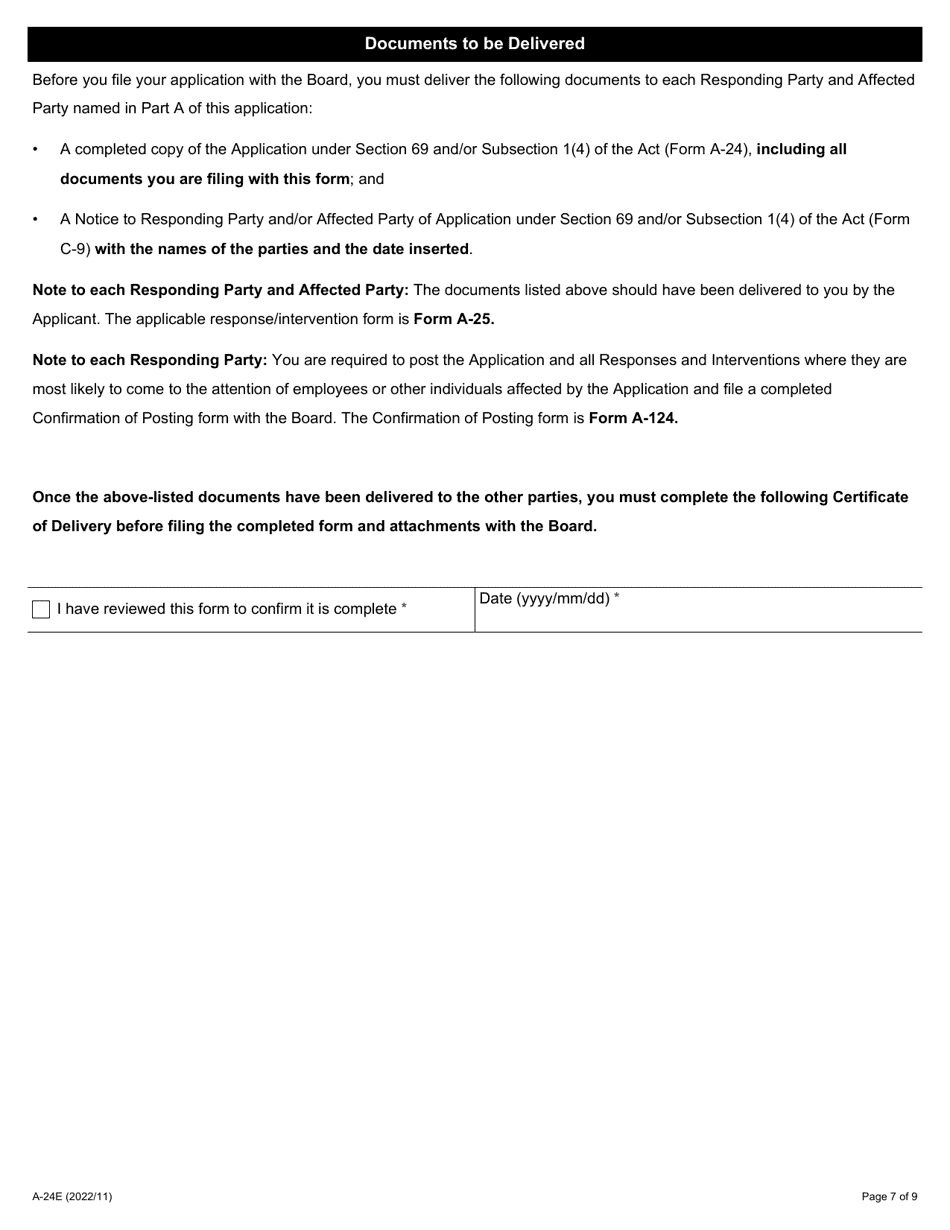

A: The specific requirements for Form A-24 may vary. Generally, you will need to provide information about the sale of the business and/or related employer, along with any supporting documents requested by the relevant authority in Ontario, Canada.

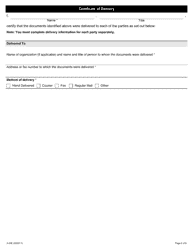

Q: What happens after I submit Form A-24?

A: After you submit Form A-24, the relevant authority in Ontario, Canada will review your application. They will notify you of the outcome and any further steps that need to be taken.

Q: Can I get legal advice when filling out Form A-24?

A: Yes, you can seek legal advice when filling out Form A-24 in Ontario, Canada. It may be helpful to consult with a lawyer who specializes in business and employment law.