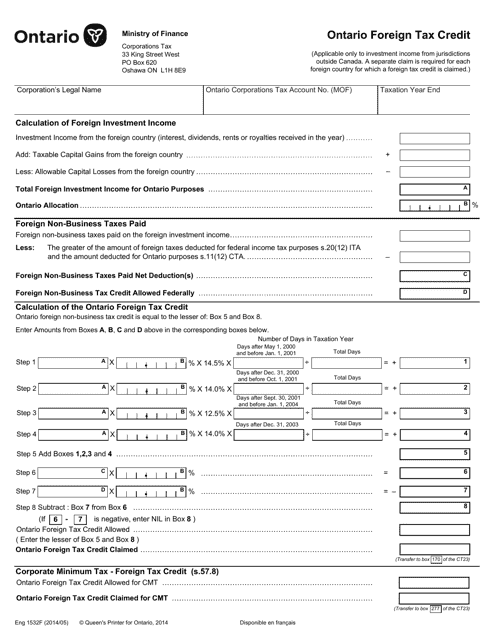

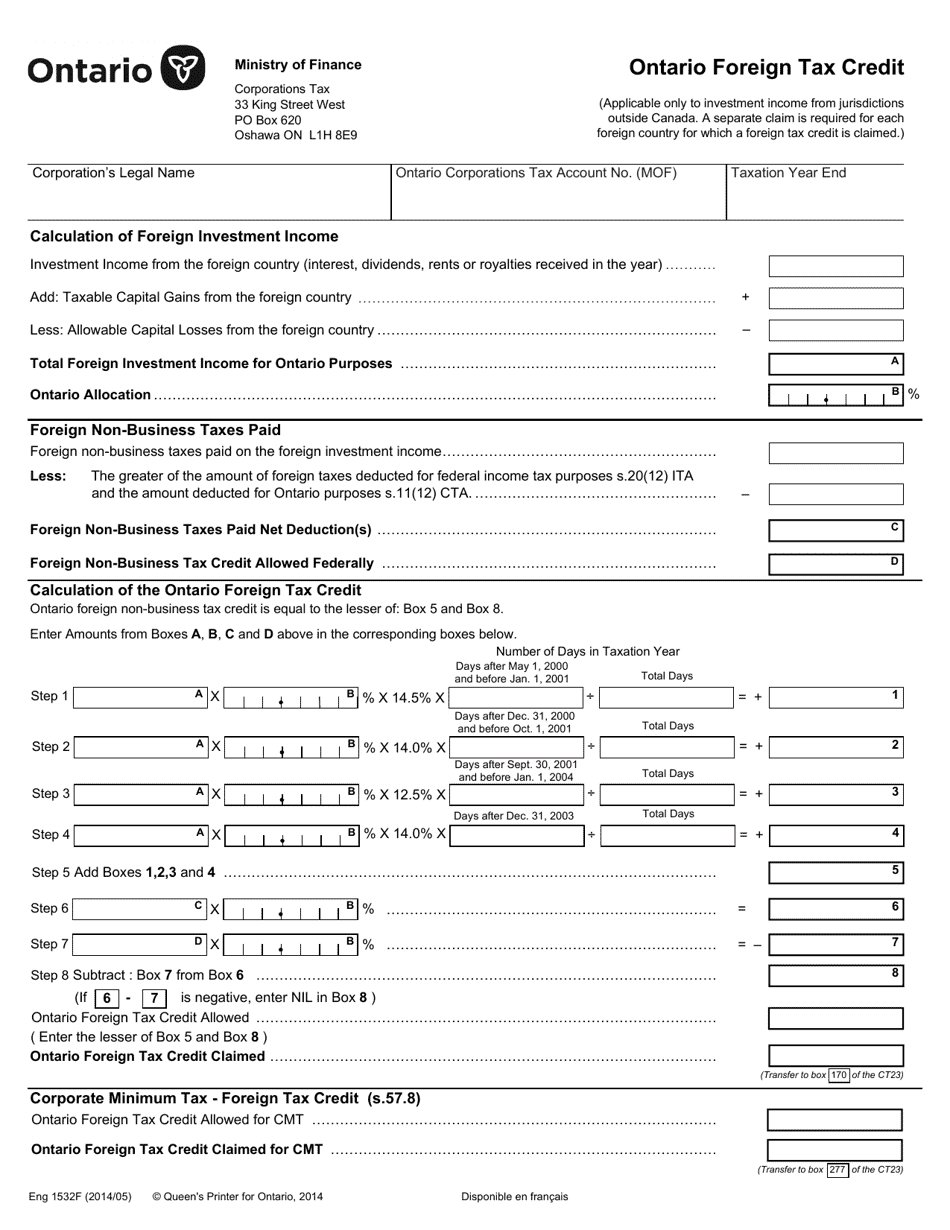

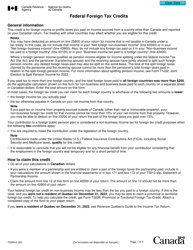

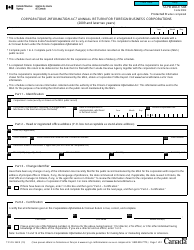

Form 1532E Ontario Foreign Tax Credit - Ontario, Canada

Form 1532E Ontario Foreign Tax Credit is used by individuals in Ontario, Canada to claim a credit for foreign taxes paid on their income.

The Form 1532E Ontario Foreign Tax Credit in Ontario, Canada is filed by individuals who want to claim a credit for foreign taxes paid on their income.

FAQ

Q: What is Form 1532E?

A: Form 1532E is a tax form used in Ontario, Canada to claim the foreign tax credit.

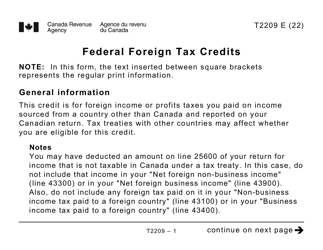

Q: What is the purpose of Form 1532E?

A: The purpose of Form 1532E is to calculate and claim the foreign tax credit to reduce double taxation for Ontario residents on their foreign income.

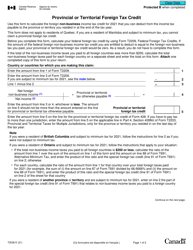

Q: Who should use Form 1532E?

A: Form 1532E should be used by Ontario residents who have paid foreign taxes on their foreign income and wish to claim a credit for those taxes.

Q: What information is required to complete Form 1532E?

A: To complete Form 1532E, you will need information such as the type of foreign income, the amount of foreign taxes paid, and any applicable tax treaties.

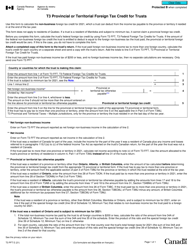

Q: When is the deadline to file Form 1532E?

A: The deadline to file Form 1532E is generally the same as the deadline for your personal income tax return, which is April 30th for most individuals.

Q: Do I need to include supporting documents with Form 1532E?

A: You may be required to include supporting documents, such as proof of foreign taxes paid, when filing Form 1532E. It is important to keep these documents for your records.

Q: What happens after I file Form 1532E?

A: After you file Form 1532E, the CRA will review your claim and determine if you are eligible for the foreign tax credit. If approved, the credit will be applied towards your tax liability.

Q: Can I amend my Form 1532E if I made a mistake?

A: Yes, if you made a mistake on your Form 1532E, you can amend it by filing a T1 Adjustment Request with the CRA.