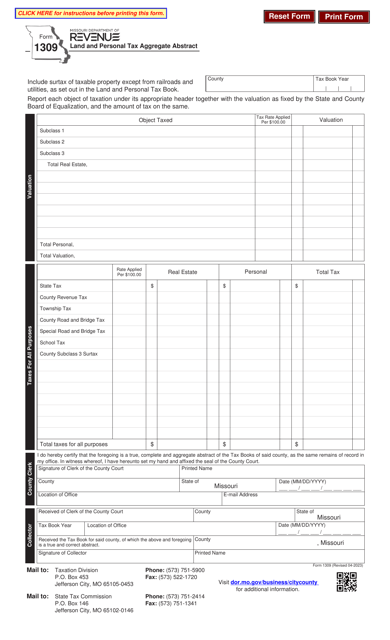

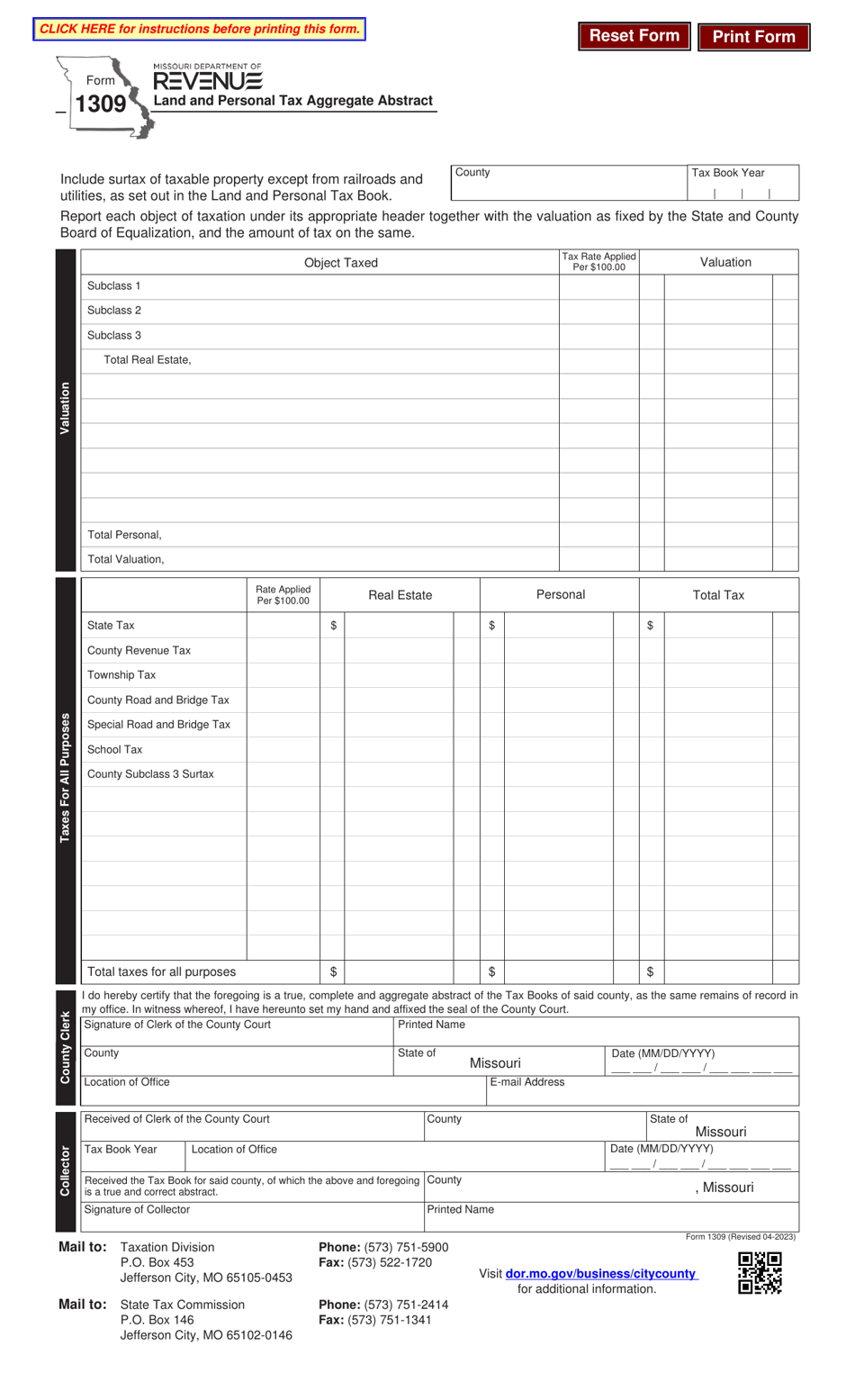

Form 1309 Land and Personal Tax Aggregate Abstract - Missouri

What Is Form 1309?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1309?

A: Form 1309 is the Land and Personal Tax Aggregate Abstract form.

Q: What is the purpose of Form 1309?

A: The purpose of Form 1309 is to report land and personal property taxes in Missouri.

Q: Who needs to fill out Form 1309?

A: Property owners in Missouri who have land and personal property tax obligations need to fill out Form 1309.

Q: When is Form 1309 due?

A: Form 1309 is typically due on or before March 1st of the tax year.

Q: What information is required on Form 1309?

A: Form 1309 requires information such as the property owner's name, address, property description, and the assessed value of the land and personal property.

Q: Are there any penalties for not filing Form 1309?

A: Yes, failure to file Form 1309 or filing it late may result in penalties and interest being assessed.

Q: Can I make changes to my Form 1309 after it has been filed?

A: Yes, you can make changes to your Form 1309 by filing an amended form with the Missouri Department of Revenue.

Q: Is Form 1309 the only form required for property taxes in Missouri?

A: No, there may be additional forms or requirements depending on the specific circumstances of your property and taxes. It is recommended to consult with a tax professional or the Missouri Department of Revenue for guidance.

Form Details:

- Released on April 1, 2023;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1309 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.