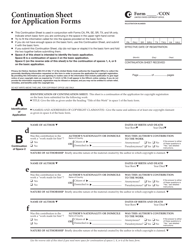

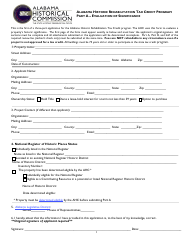

Continuation Sheet - Alabama Historic Rehabilitation Tax Credit Program - Alabama

Continuation Sheet - Alabama Historic Rehabilitation Tax Credit Program is a legal document that was released by the Alabama Historical Commission - a government authority operating within Alabama.

FAQ

Q: What is the Alabama Historic Rehabilitation Tax Credit Program?

A: The Alabama Historic RehabilitationTax Credit Program is a program that provides tax credits to individuals and businesses that invest in the rehabilitation of historic buildings in Alabama.

Q: Who is eligible for the Alabama Historic Rehabilitation Tax Credit?

A: Individuals and businesses that own or plan to invest in a qualified historic building in Alabama are eligible for the tax credit.

Q: What is a qualified historic building?

A: A qualified historic building is a property that is listed on the Alabama Register of Landmarks and Heritage or the National Register of Historic Places.

Q: How much is the tax credit?

A: The tax credit is equal to 25% of the qualified rehabilitation expenditures incurred for the rehabilitation of the historic building.

Q: Are there any limits on the tax credit?

A: Yes, the tax credit is limited to $5 million per property and $20 million per calendar year for all eligible properties.

Q: How can the tax credit be used?

A: The tax credit can be used to offset the taxpayer's Alabama income tax liability.

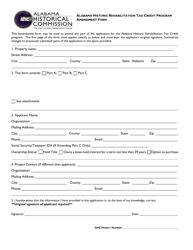

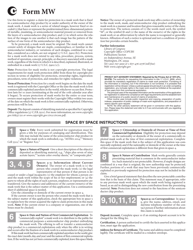

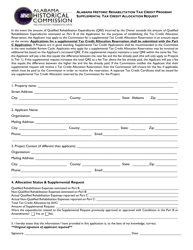

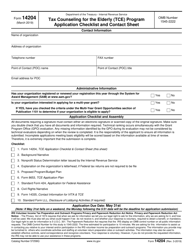

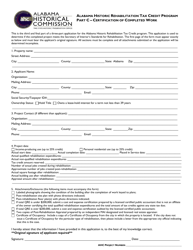

Q: Is there an application process for the tax credit?

A: Yes, there is an application process that requires the submission of documentation and approval by the Alabama Historical Commission.

Q: Can the tax credit be transferred or sold?

A: Yes, the tax credit can be transferred or sold to another taxpayer.

Q: Is there a deadline to apply for the tax credit?

A: Yes, the application must be submitted before the start of the rehabilitation work on the historic building.

Q: Are there any additional requirements for the tax credit?

A: Yes, there are additional requirements including compliance with the Secretary of the Interior's Standards for Rehabilitation and completion of the rehabilitation within 24 months of the credit issuance.

Form Details:

- The latest edition currently provided by the Alabama Historical Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Historical Commission.