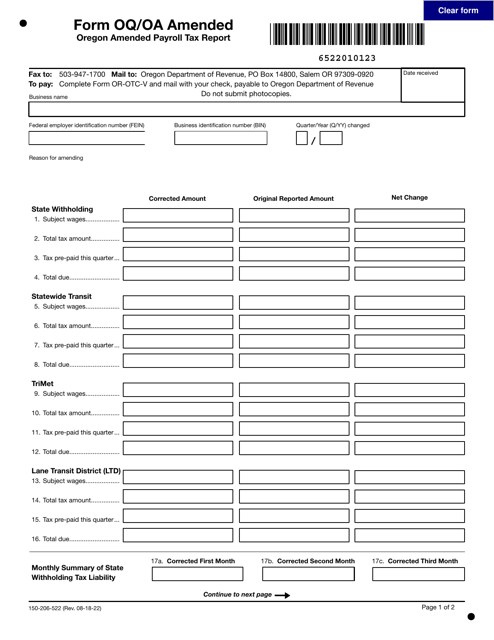

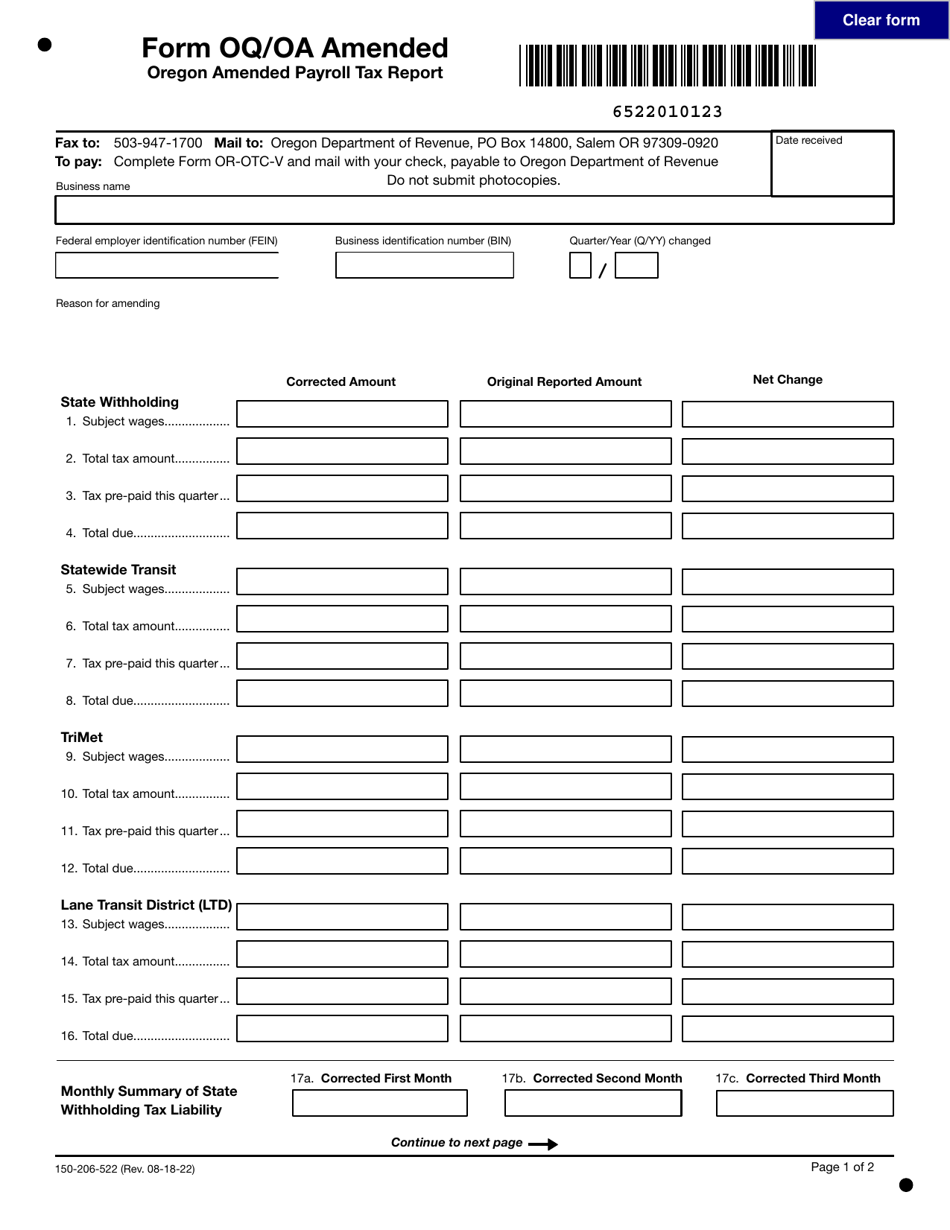

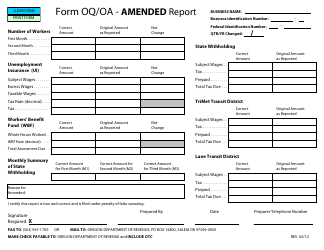

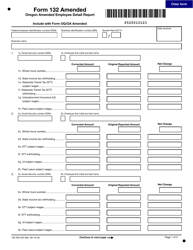

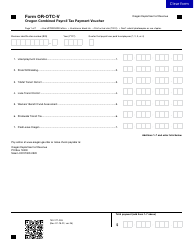

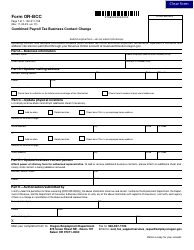

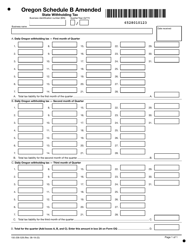

Form OQ / OA AMENDED (150-206-522) Oregon Amended Payroll Tax Report - Oregon

What Is Form OQ/OA AMENDED (150-206-522)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OQ/OA AMENDED (150-206-522)?

A: Form OQ/OA AMENDED (150-206-522) is the Oregon Amended Payroll Tax Report.

Q: What is the purpose of Form OQ/OA AMENDED?

A: The purpose of Form OQ/OA AMENDED is to report any changes or corrections to a previously filed Oregon Payroll Tax Report.

Q: Who needs to file Form OQ/OA AMENDED?

A: Anyone who needs to make changes or corrections to a previously filed Oregon Payroll Tax Report needs to file Form OQ/OA AMENDED.

Q: When should Form OQ/OA AMENDED be filed?

A: Form OQ/OA AMENDED should be filed as soon as possible after discovering the error or change that needs to be reported.

Q: Are there any fees associated with filing Form OQ/OA AMENDED?

A: No, there are no fees associated with filing Form OQ/OA AMENDED.

Q: Are there any penalties for not filing Form OQ/OA AMENDED?

A: Yes, there may be penalties for not filing Form OQ/OA AMENDED or for filing it late, depending on the circumstances.

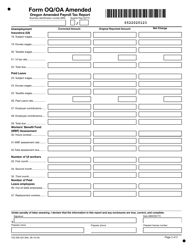

Q: What information is required to complete Form OQ/OA AMENDED?

A: The information required to complete Form OQ/OA AMENDED includes details of the changes or corrections being made, as well as any relevant payroll tax information.

Q: Is Form OQ/OA AMENDED specific to Oregon payroll taxes?

A: Yes, Form OQ/OA AMENDED is specific to Oregon payroll taxes and should not be used for payroll tax reporting in other states.

Form Details:

- Released on August 18, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OQ/OA AMENDED (150-206-522) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.