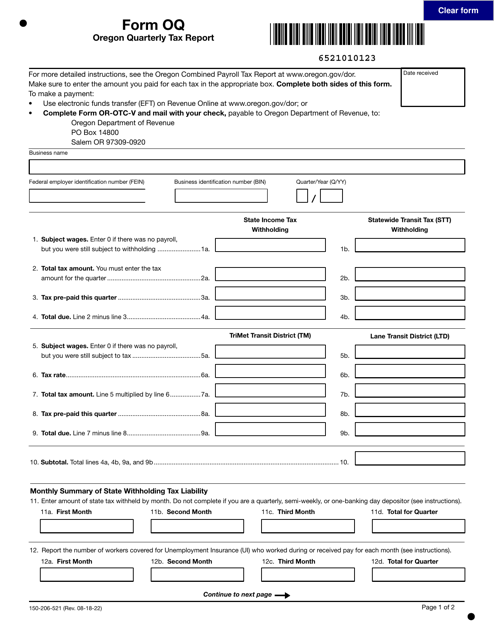

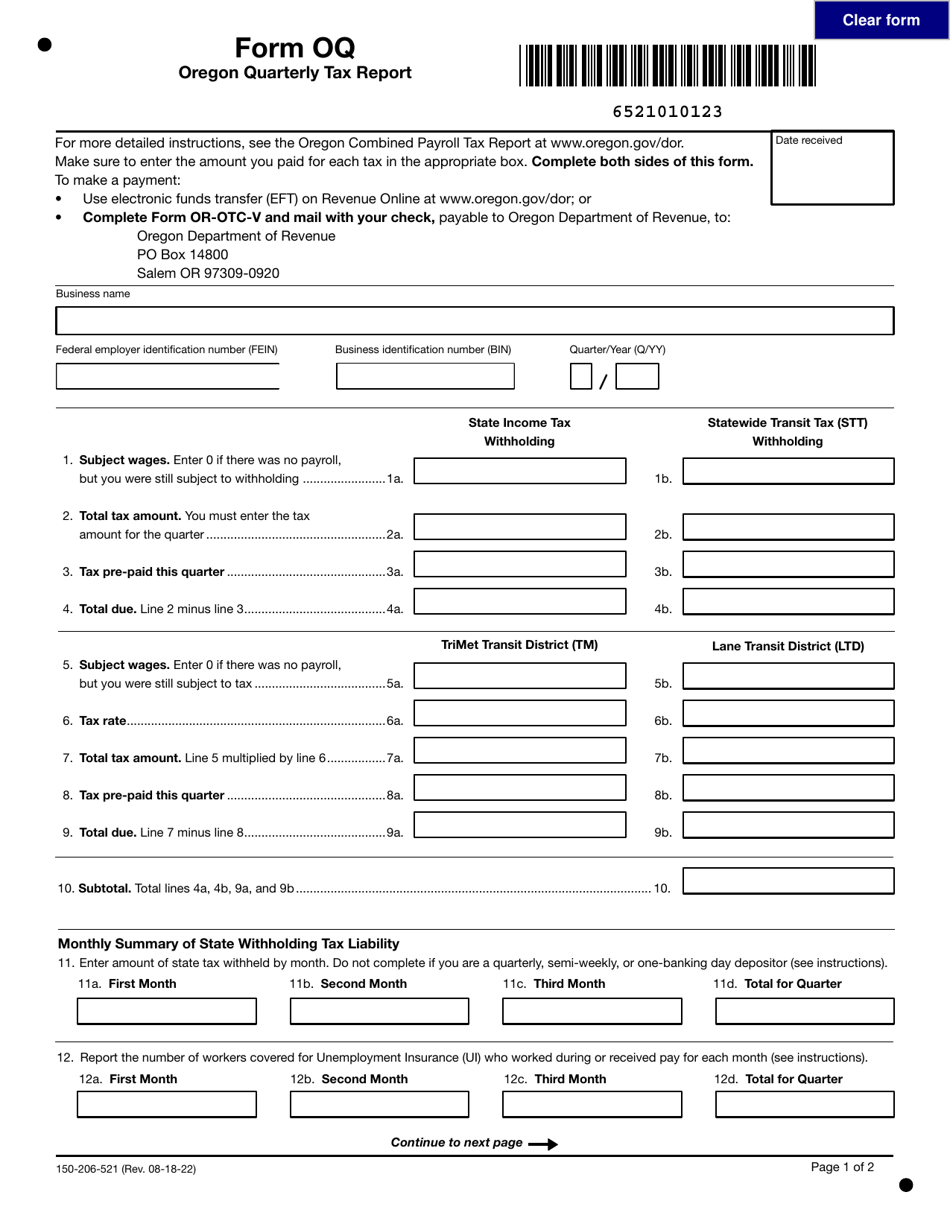

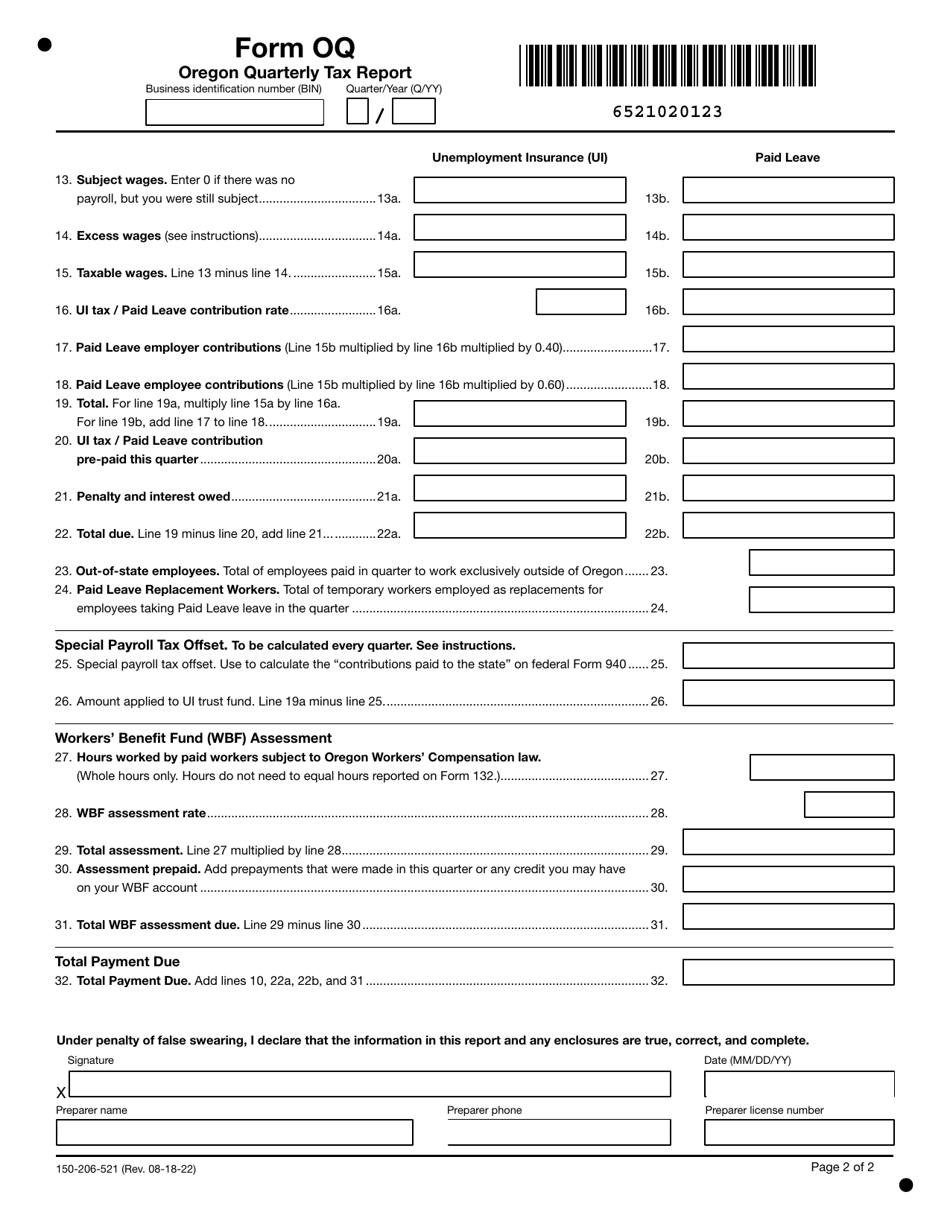

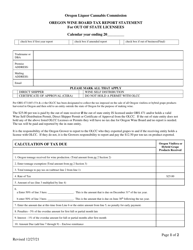

Form OQ (150-206-521) Oregon Quarterly Tax Report - Oregon

What Is Form OQ (150-206-521)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OQ (150-206-521)?

A: Form OQ (150-206-521) is the Oregon Quarterly Tax Report, used by businesses in Oregon to report their quarterly tax liabilities.

Q: Who needs to file Form OQ?

A: Businesses in Oregon who have a tax liability need to file Form OQ.

Q: How often do I need to file Form OQ?

A: Form OQ should be filed quarterly, meaning every three months.

Q: What information do I need to complete Form OQ?

A: You will need to have information related to your business income, deductions, and tax liability for the quarter.

Q: What is the deadline for filing Form OQ?

A: Form OQ must be filed by the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing of Form OQ?

A: Yes, there are penalties for late filing, which may include fines and interest on unpaid taxes.

Form Details:

- Released on August 18, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OQ (150-206-521) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.