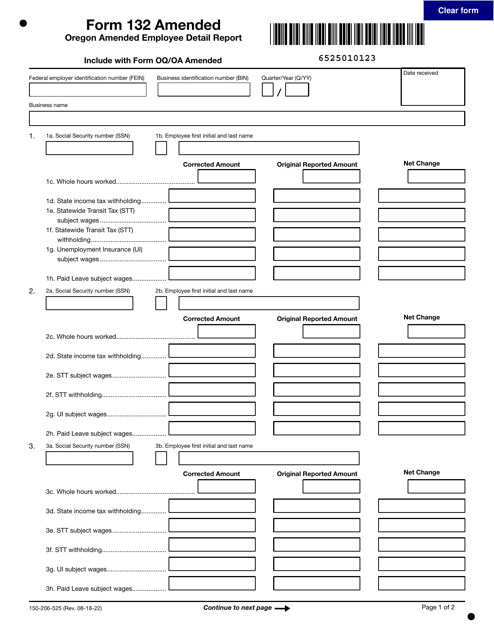

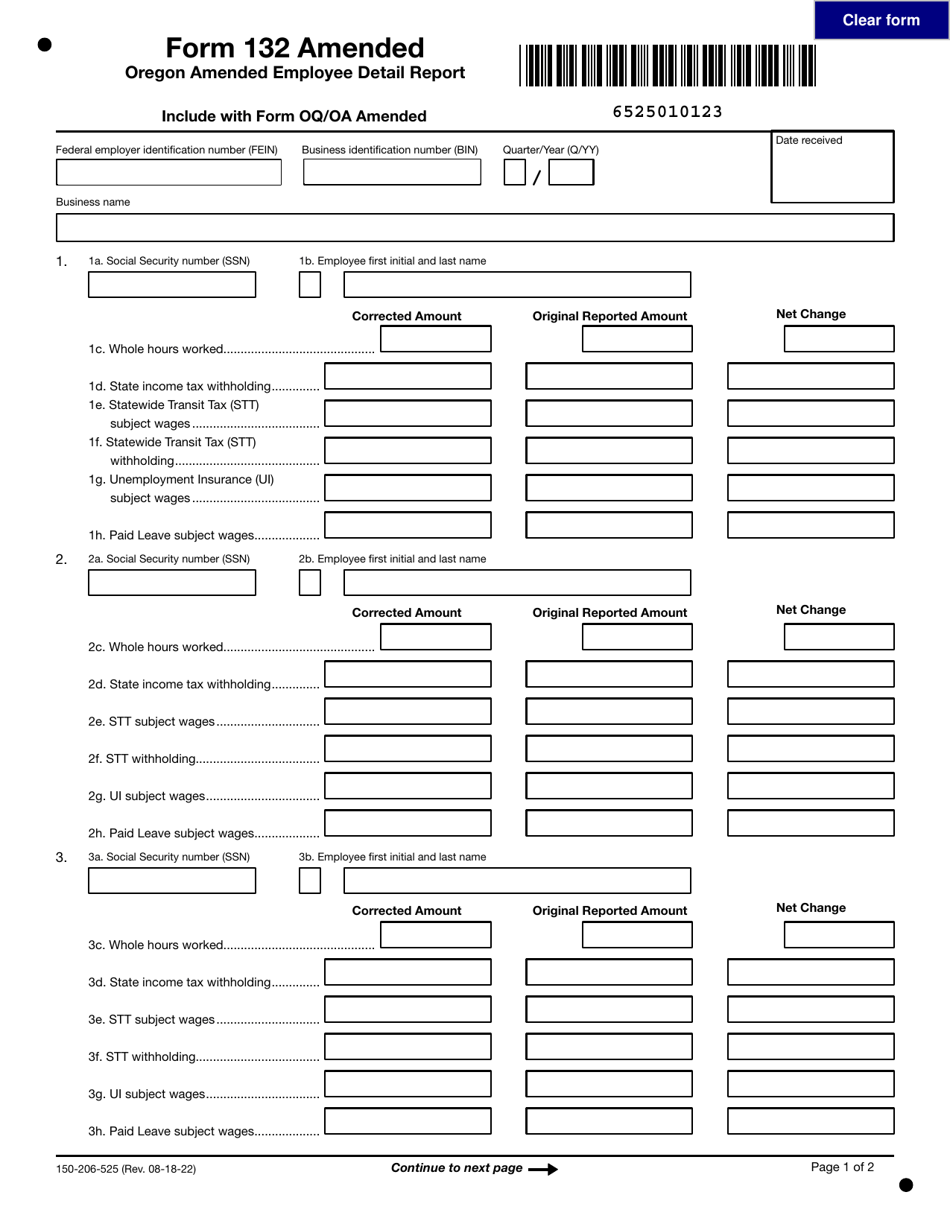

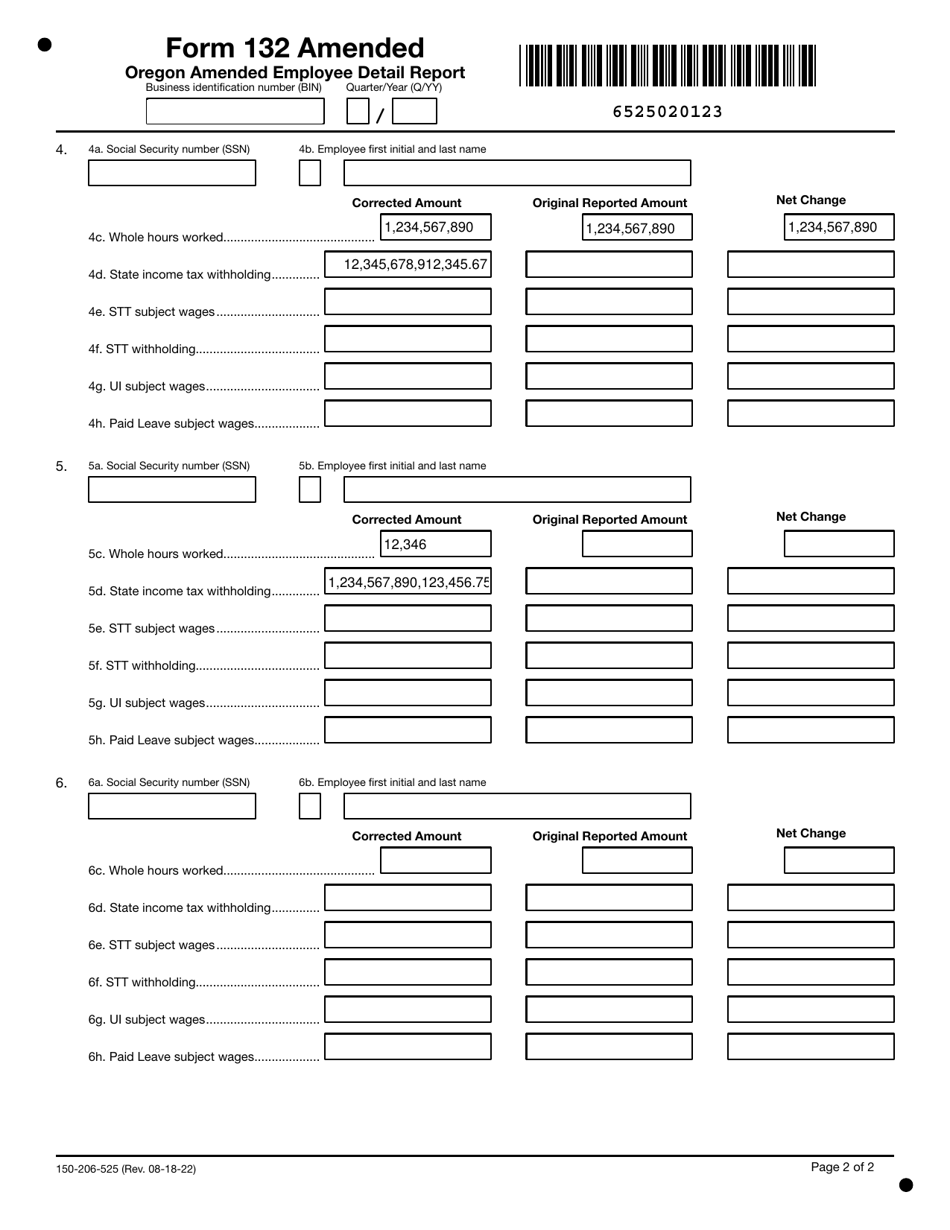

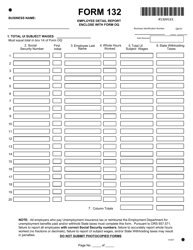

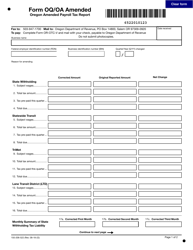

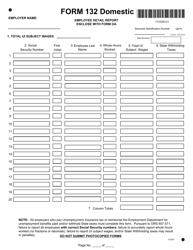

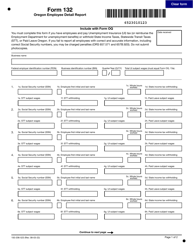

Form 132 AMENDED (150-206-525) Oregon Amended Employee Detail Report - Oregon

What Is Form 132 AMENDED (150-206-525)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 132 AMENDED?

A: Form 132 AMENDED is a report in Oregon that is used to amend employee details.

Q: What is the purpose of Form 132 AMENDED?

A: The purpose of Form 132 AMENDED is to correct and update employee details.

Q: Who uses Form 132 AMENDED?

A: Employers in Oregon use Form 132 AMENDED.

Q: When should Form 132 AMENDED be filed?

A: Form 132 AMENDED should be filed when there are changes or errors in employee details that need to be corrected.

Q: Are there any fees associated with filing Form 132 AMENDED?

A: No, there are no fees associated with filing Form 132 AMENDED.

Q: What information is required on Form 132 AMENDED?

A: Form 132 AMENDED requires information such as the employer's name, address, and tax identification number, as well as the employee's name, social security number, and corrected details.

Q: What should I do if I make a mistake on Form 132 AMENDED?

A: If you make a mistake on Form 132 AMENDED, you should file another amended form with the corrected information.

Q: Is Form 132 AMENDED specific to Oregon?

A: Yes, Form 132 AMENDED is specific to the state of Oregon.

Form Details:

- Released on August 18, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 132 AMENDED (150-206-525) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.