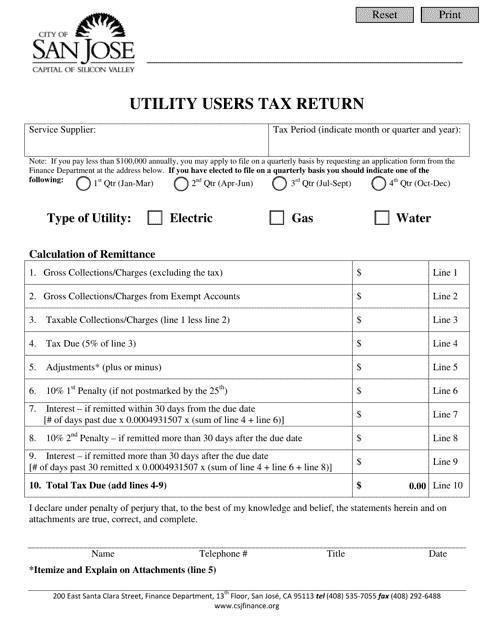

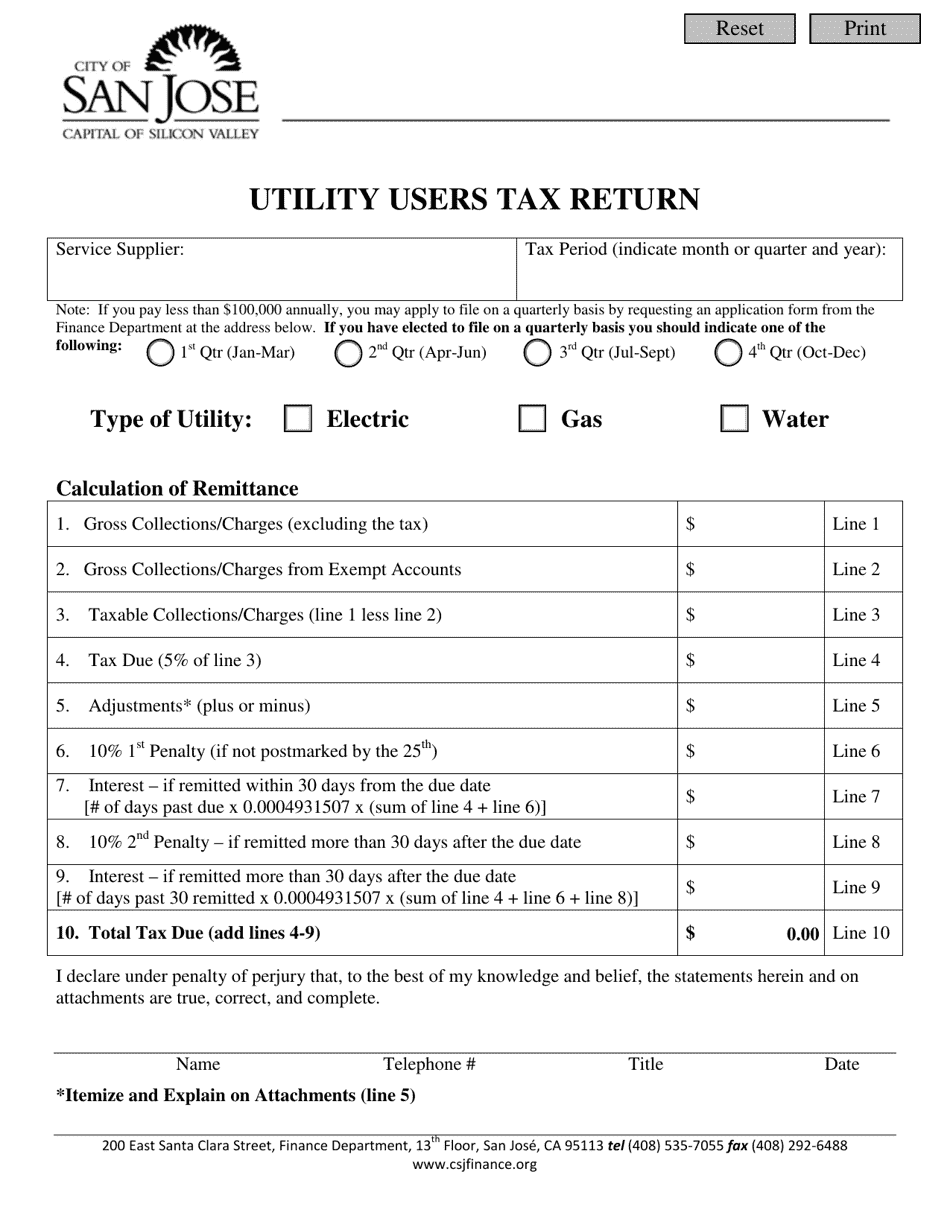

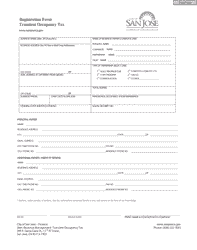

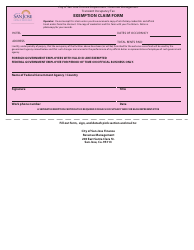

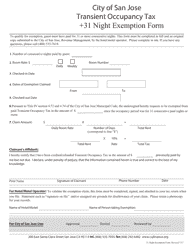

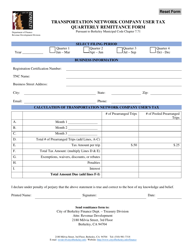

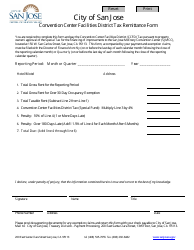

Utility Users Tax Return - City of San Jose, California

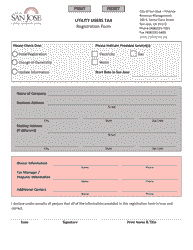

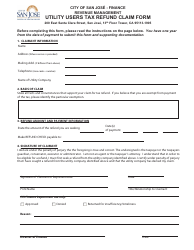

Utility Users Tax Return is a legal document that was released by the Finance Department - City of San Jose, California - a government authority operating within California. The form may be used strictly within City of San Jose.

FAQ

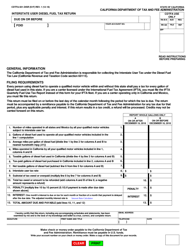

Q: What is the Utility Users Tax?

A: The Utility Users Tax is a tax on certain utility services in the City of San Jose, California.

Q: Who is required to file a Utility Users Tax Return?

A: Any person or business that uses certain utility services in the City of San Jose and meets the tax criteria must file a Utility Users Tax Return.

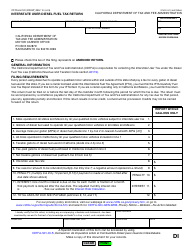

Q: Which utility services are subject to the tax?

A: The tax applies to telecommunications services, video services, and gas/electric services.

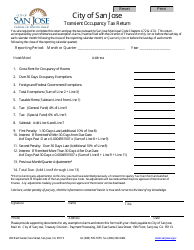

Q: How often do I need to file a Utility Users Tax Return?

A: The return must be filed annually, on or before February 28th.

Q: What is the tax rate for the Utility Users Tax?

A: The tax rate varies depending on the utility service. For telecommunications and video services, it is 5.75%. For gas/electric services, it is 4.78%.

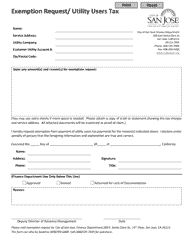

Q: Are there any exemptions or deductions available?

A: Yes, there are certain exemptions and deductions available. Contact the City of San Jose for more information.

Q: What happens if I don't file a Utility Users Tax Return?

A: Failure to file a return may result in penalties and interest.

Form Details:

- The latest edition currently provided by the Finance Department - City of San Jose, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of San Jose, California.