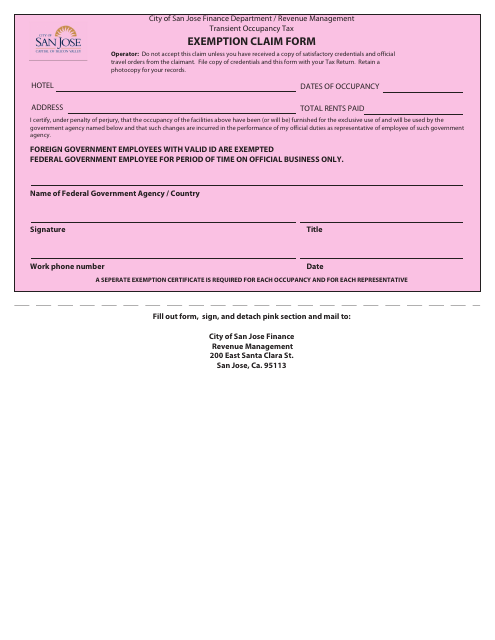

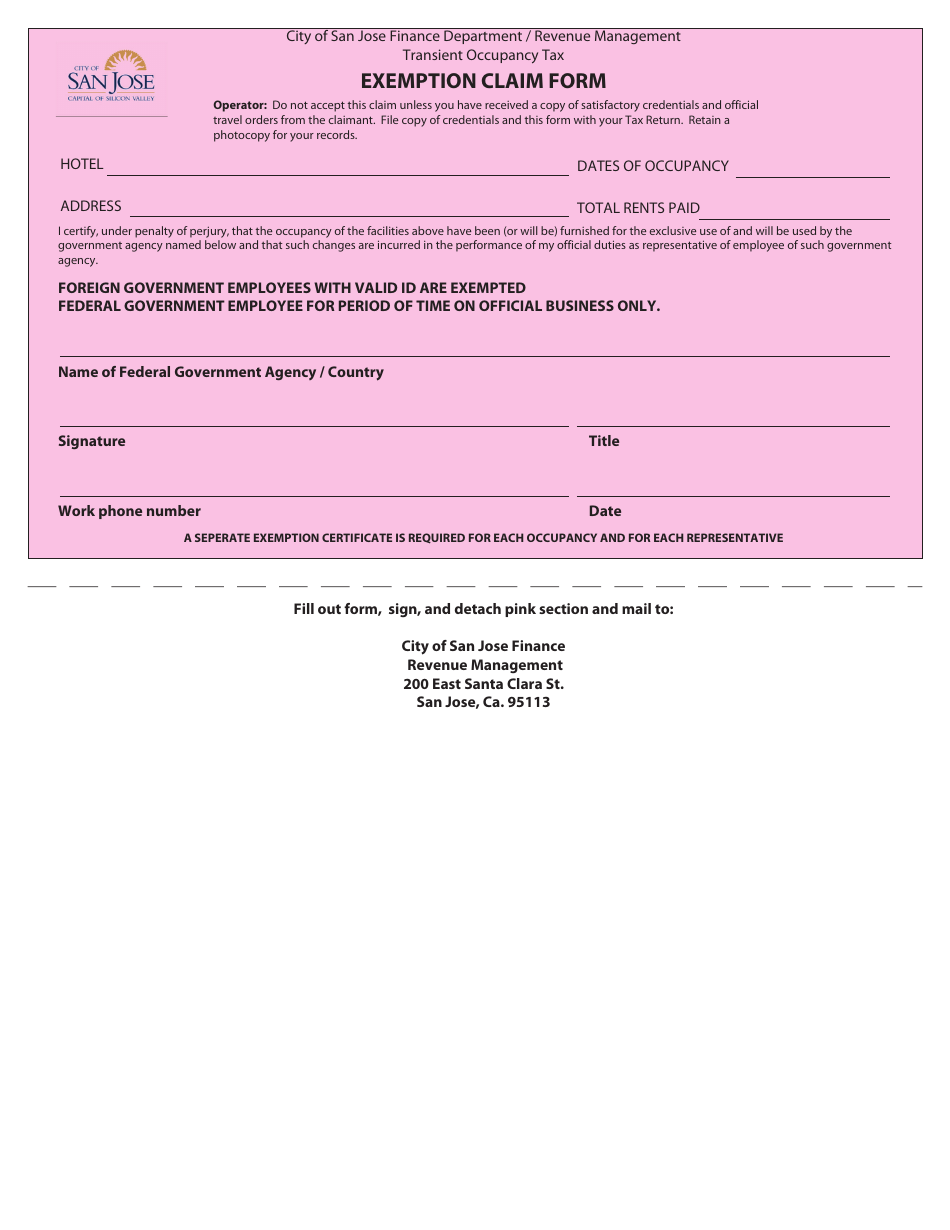

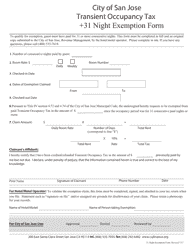

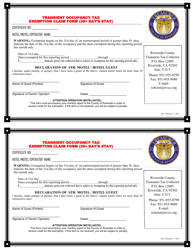

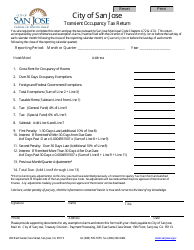

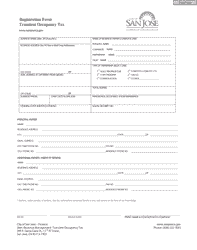

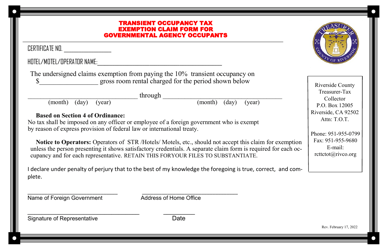

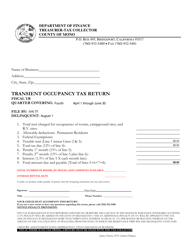

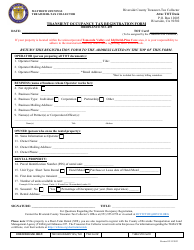

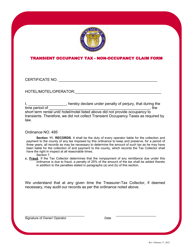

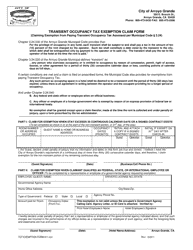

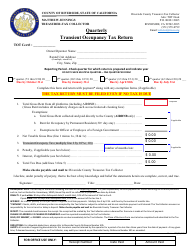

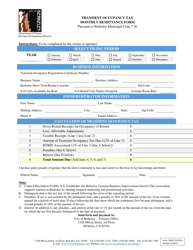

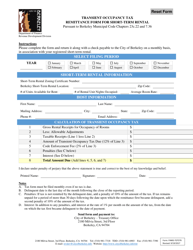

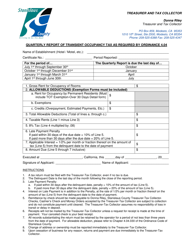

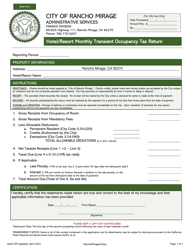

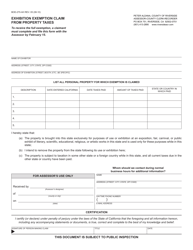

Transient Occupancy Tax Exemption Claim Form - City of San Jose, California

Transient Exemption Claim Form is a legal document that was released by the Finance Department - City of San Jose, California - a government authority operating within California. The form may be used strictly within City of San Jose.

FAQ

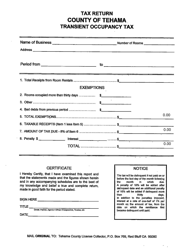

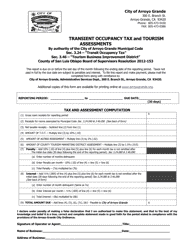

Q: What is the Transient Occupancy Tax?

A: The Transient Occupancy Tax is a tax imposed on visitors staying in hotels and other short-term accommodations.

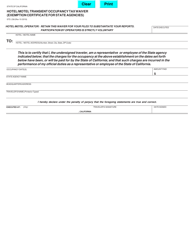

Q: Who is eligible for the Transient Occupancy Tax Exemption?

A: Individuals or organizations hosting exempted events or qualifying guests may be eligible for the exemption.

Q: What events or guests qualify for the Transient Occupancy Tax Exemption?

A: Certain events such as government meetings, charitable events, and qualifying guests such as certain sports team members may qualify for the exemption.

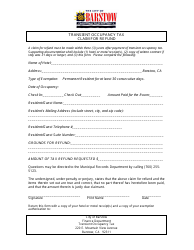

Q: How do I claim the Transient Occupancy Tax Exemption?

A: You need to complete and submit the Transient Occupancy Tax Exemption Claim Form to the City of San Jose.

Q: Are there any deadlines for submitting the Transient Occupancy Tax Exemption Claim Form?

A: Yes, you must submit the form within 90 days of the end of the event or guest's stay.

Q: What documents do I need to include when submitting the Transient Occupancy Tax Exemption Claim Form?

A: You may need to include supporting documentation such as event contracts, guest lists, and proof of exemption eligibility.

Q: What happens after I submit the Transient Occupancy Tax Exemption Claim Form?

A: The City of San Jose will review your claim and notify you of their decision regarding the exemption.

Q: What should I do if my Transient Occupancy Tax Exemption claim is denied?

A: You can contact the City of San Jose's tax office for further clarification or to appeal the decision.

Q: Can I claim the Transient Occupancy Tax Exemption for future events or stays?

A: No, the exemption is only applicable for past events or stays that meet the eligibility criteria.

Form Details:

- The latest edition currently provided by the Finance Department - City of San Jose, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of San Jose, California.