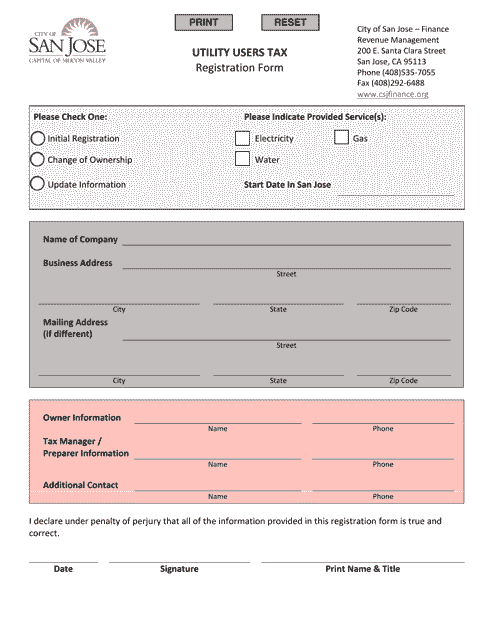

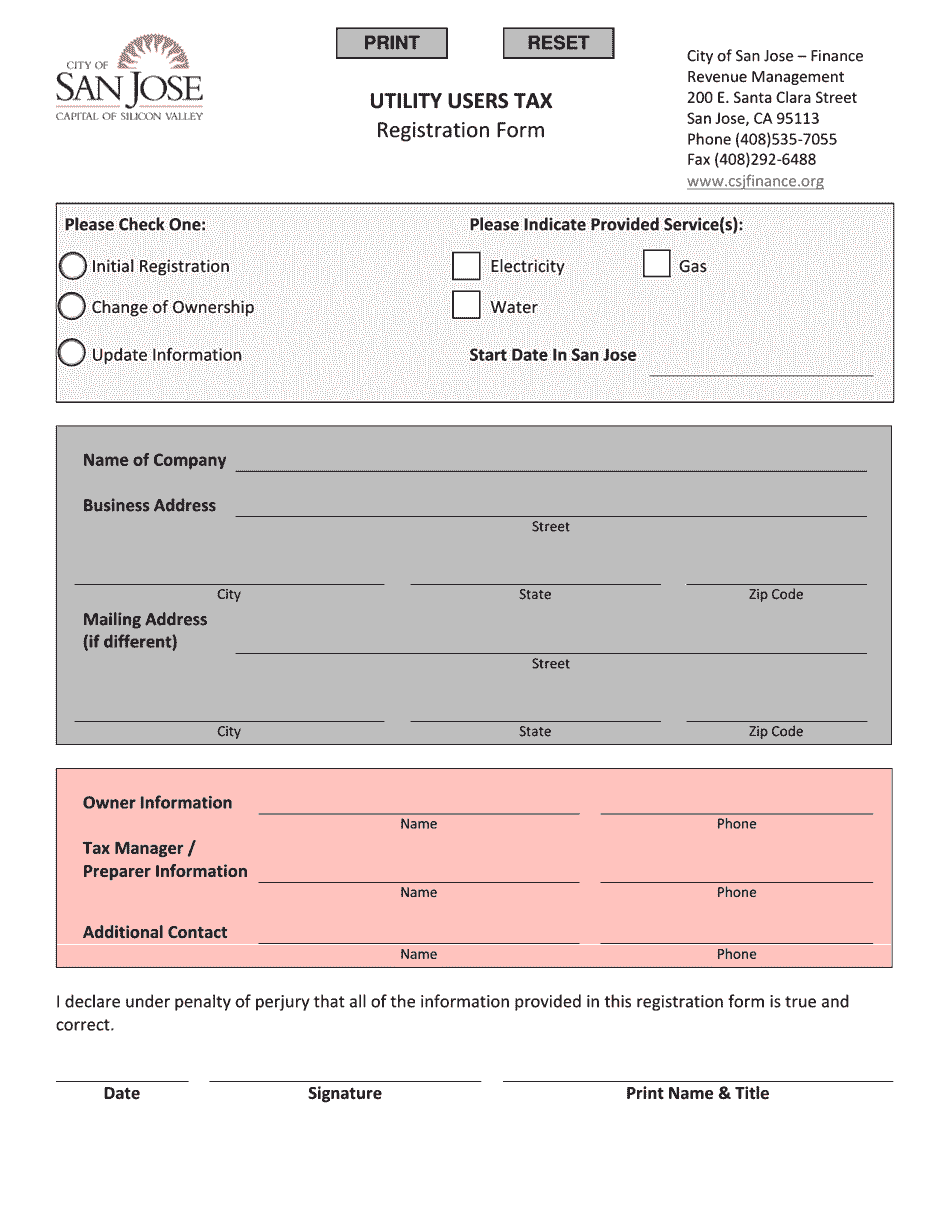

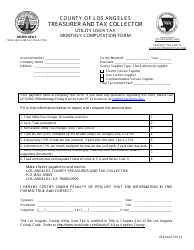

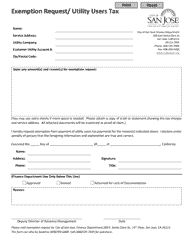

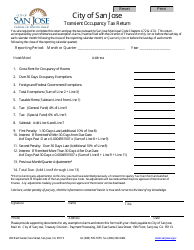

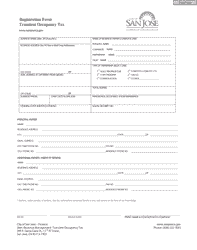

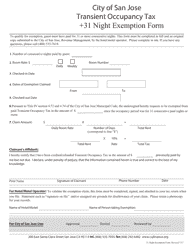

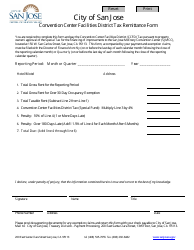

Utility Users Tax Registration Form - City of San Jose, California

Utility Users Tax Registration Form is a legal document that was released by the Finance Department - City of San Jose, California - a government authority operating within California. The form may be used strictly within City of San Jose.

FAQ

Q: What is the Utility Users Tax Registration Form?

A: The Utility Users Tax Registration Form is a form used by residents and businesses in the City of San Jose, California to register for the Utility Users Tax.

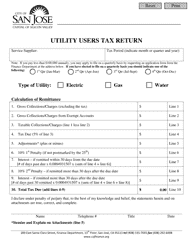

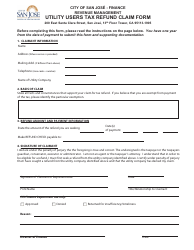

Q: What is the Utility Users Tax?

A: The Utility Users Tax is a tax imposed by the City of San Jose on certain utility services, such as phone, electricity, and gas.

Q: Who needs to file the Utility Users Tax Registration Form?

A: Residents and businesses in the City of San Jose who use taxable utility services need to file the Utility Users Tax Registration Form.

Q: What information is required on the Utility Users Tax Registration Form?

A: The Utility Users Tax Registration Form requires information such as your name, address, contact information, and details about your utility services.

Q: When do I need to file the Utility Users Tax Registration Form?

A: The Utility Users Tax Registration Form should be filed within 30 days of becoming liable for the Utility Users Tax.

Q: What happens if I don't file the Utility Users Tax Registration Form?

A: Failure to file the Utility Users Tax Registration Form may result in penalties and interest being assessed.

Form Details:

- The latest edition currently provided by the Finance Department - City of San Jose, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of San Jose, California.