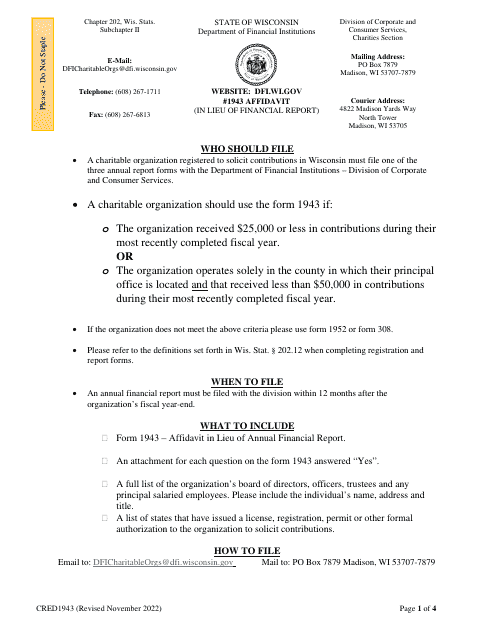

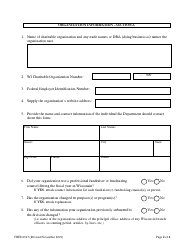

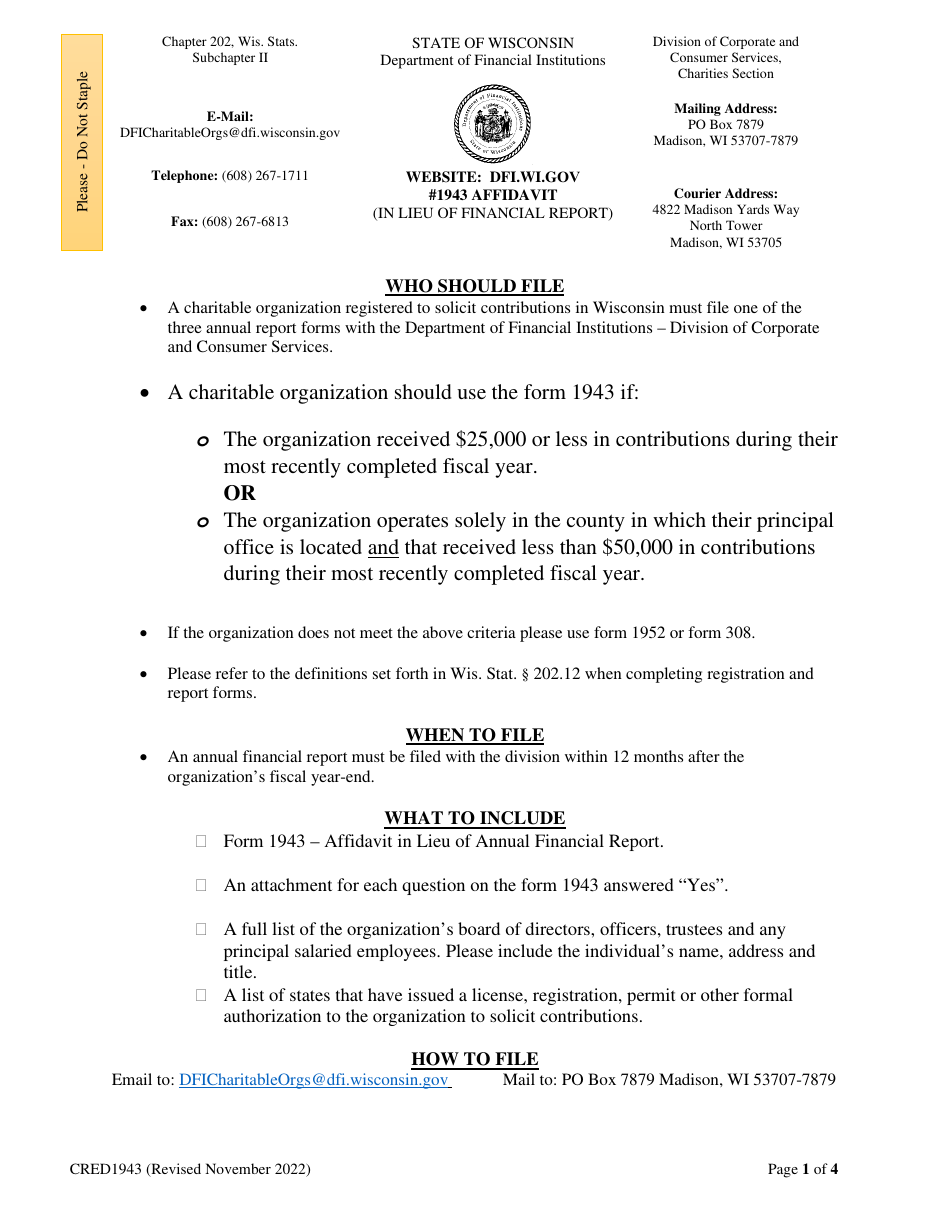

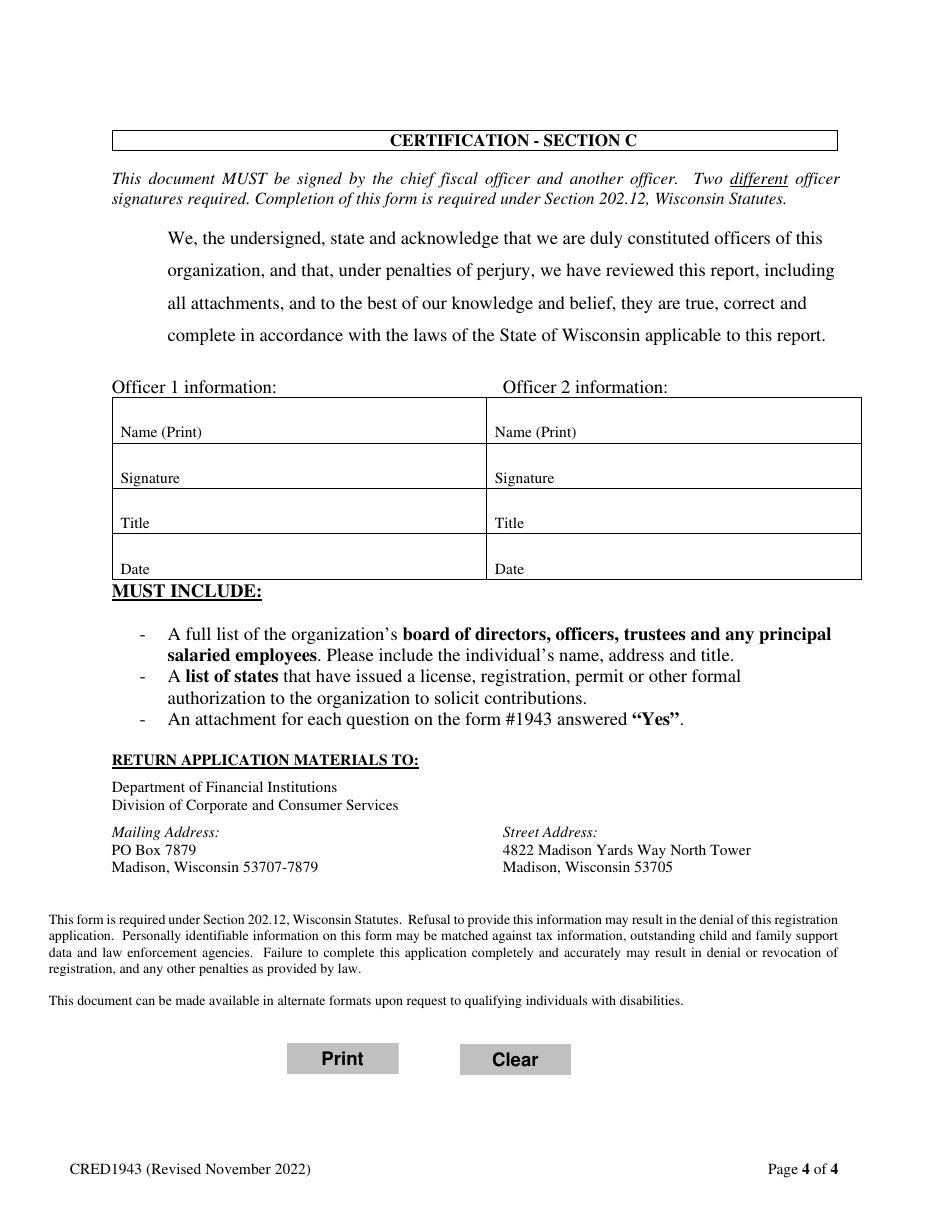

Form CRED1943 Affidavit in Lieu of Annual Financial Report - Wisconsin

What Is Form CRED1943?

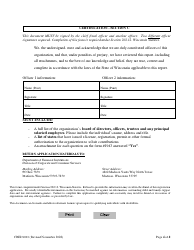

This is a legal form that was released by the Wisconsin Department of Financial Institutions - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CRED1943?

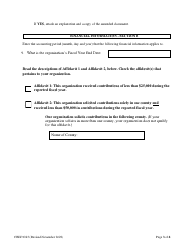

A: Form CRED1943 is an Affidavit in Lieu of Annual Financial Report.

Q: What is the purpose of Form CRED1943?

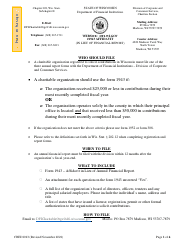

A: The purpose of Form CRED1943 is to provide an alternative way for certain small nonstock corporations in Wisconsin to fulfill their annual financial reporting requirements.

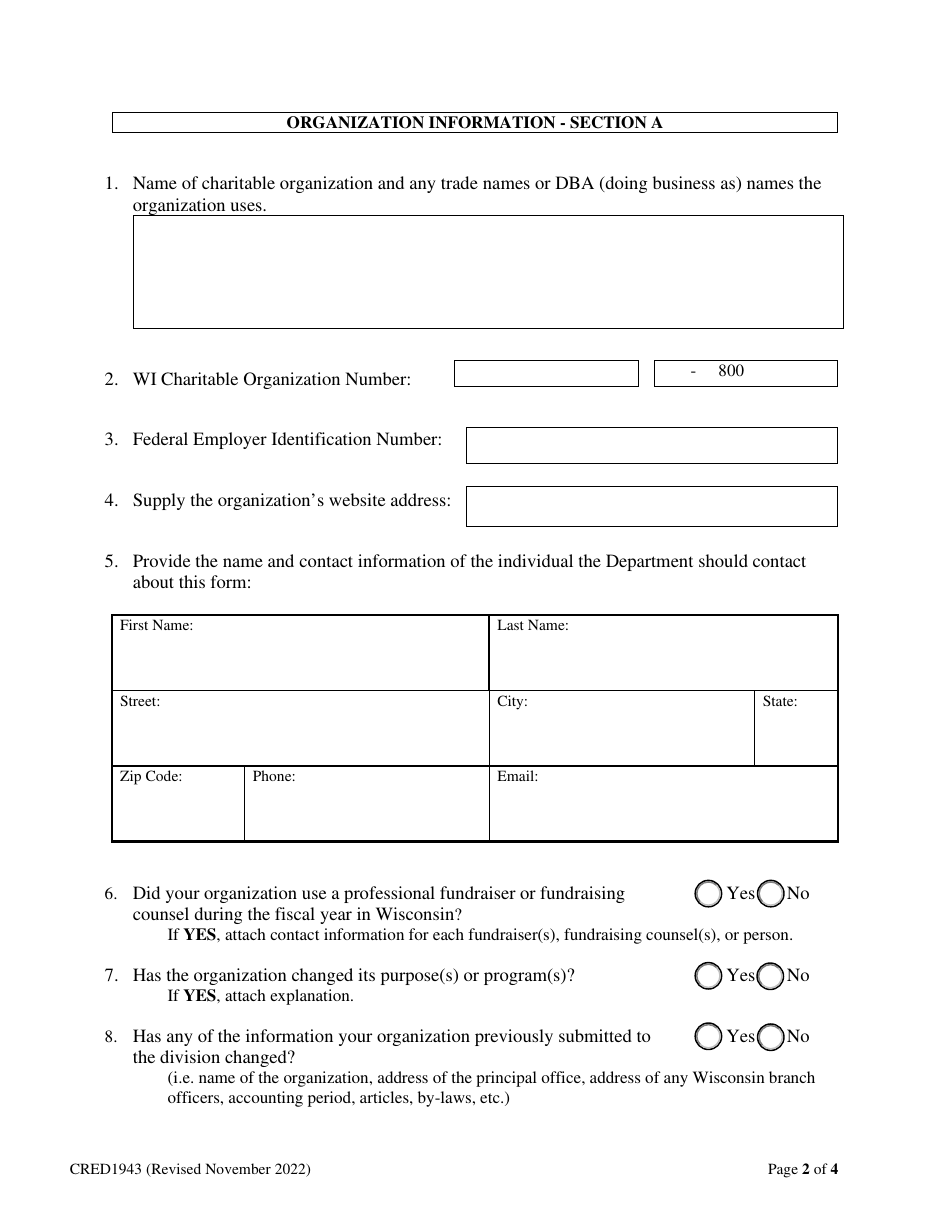

Q: Who needs to file Form CRED1943?

A: Certain small nonstock corporations in Wisconsin are required to file Form CRED1943 instead of the regular Annual Financial Report.

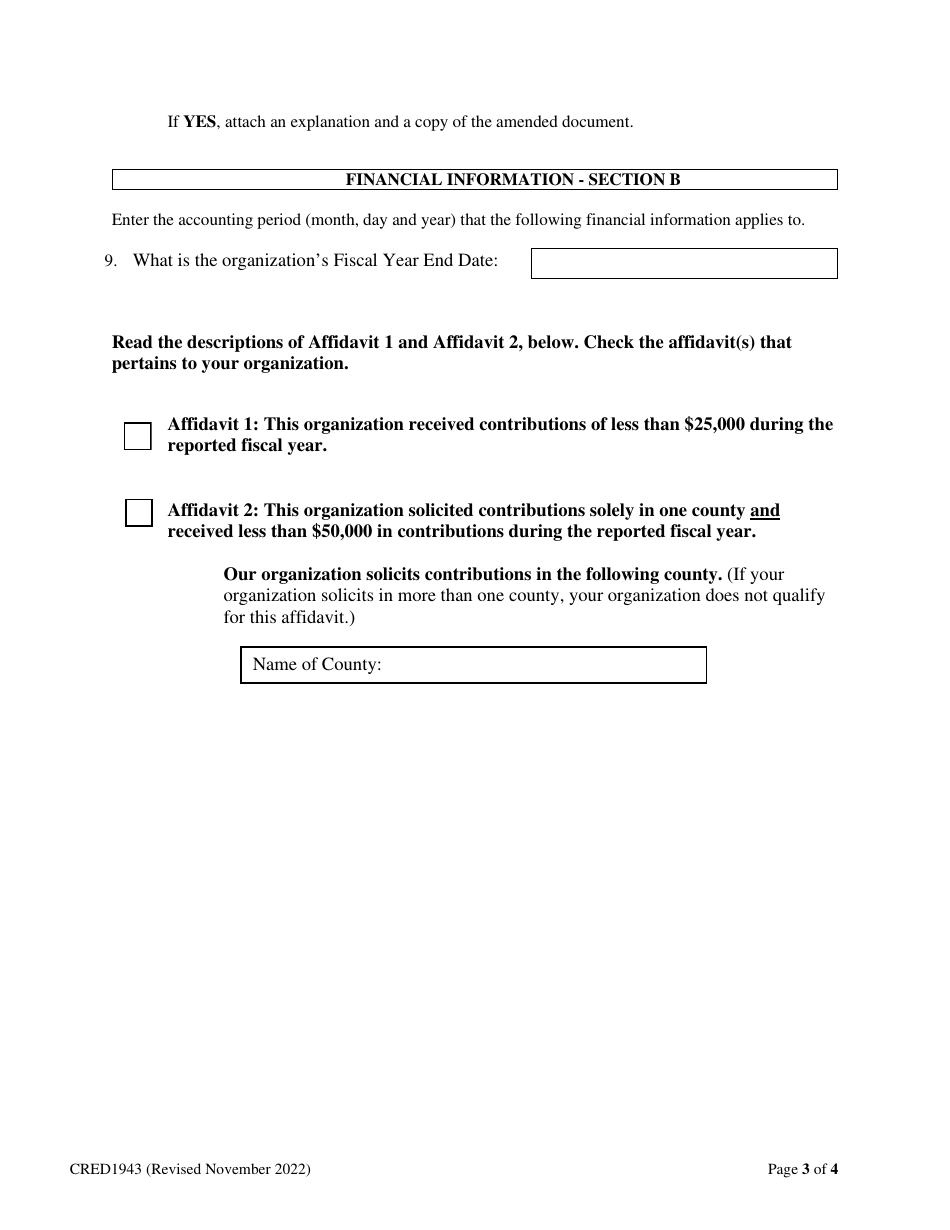

Q: What are the criteria for filing Form CRED1943?

A: To be eligible to file Form CRED1943, a nonstock corporation must have total assets of $500,000 or less and total liabilities of $500,000 or less at the end of its fiscal year.

Q: When is Form CRED1943 due?

A: Form CRED1943 is due within 120 days after the close of the corporation's fiscal year.

Q: Are there any filing fees for Form CRED1943?

A: No, there are no filing fees for Form CRED1943.

Q: Is there a penalty for not filing Form CRED1943?

A: Yes, a nonstock corporation that fails to file Form CRED1943 may be subject to dissolution or other penalties by the DFI.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Wisconsin Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CRED1943 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Financial Institutions.