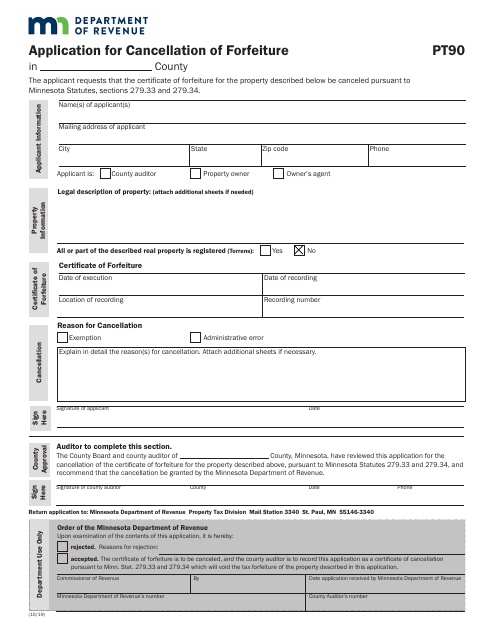

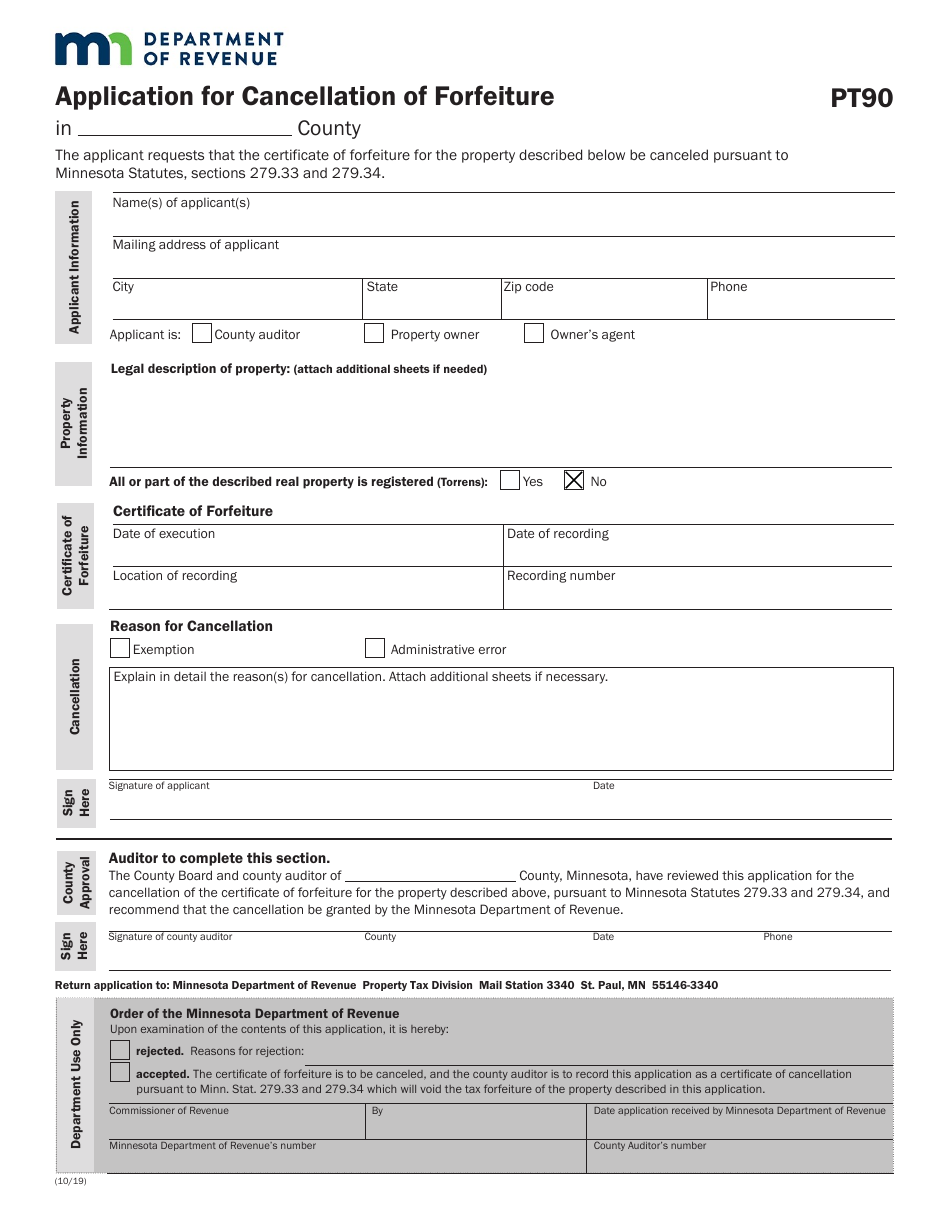

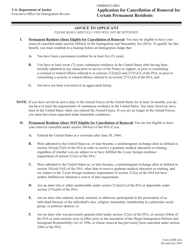

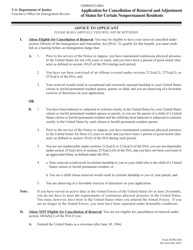

Form PT90 Application for Cancellation of Forfeiture - Minnesota

What Is Form PT90?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT90?

A: Form PT90 is the Application for Cancellation of Forfeiture in Minnesota.

Q: What is the purpose of Form PT90?

A: The purpose of Form PT90 is to apply for the cancellation of forfeiture in Minnesota.

Q: Who can use Form PT90?

A: Anyone who wants to apply for the cancellation of forfeiture in Minnesota can use Form PT90.

Q: What information is required on Form PT90?

A: Form PT90 requires information about the property subject to forfeiture, the owner of the property, and the reason for the forfeiture cancellation.

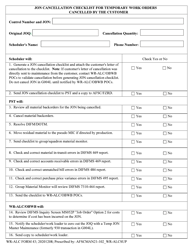

Q: Are there any fees for submitting Form PT90?

A: There may be fees associated with submitting Form PT90. It is best to check with the local county office for the exact fee amount.

Q: How long does it take to process Form PT90?

A: The processing time for Form PT90 can vary. It is recommended to contact the local county office for an estimated processing time.

Q: What happens after submitting Form PT90?

A: After submitting Form PT90, the application will be reviewed by the appropriate authorities. They will then decide whether to approve or deny the cancellation of forfeiture.

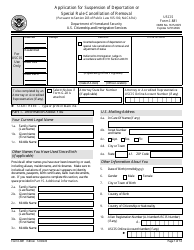

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT90 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.