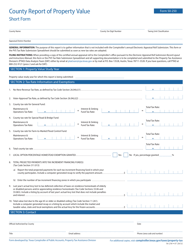

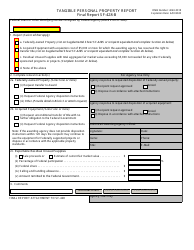

This version of the form is not currently in use and is provided for reference only. Download this version of

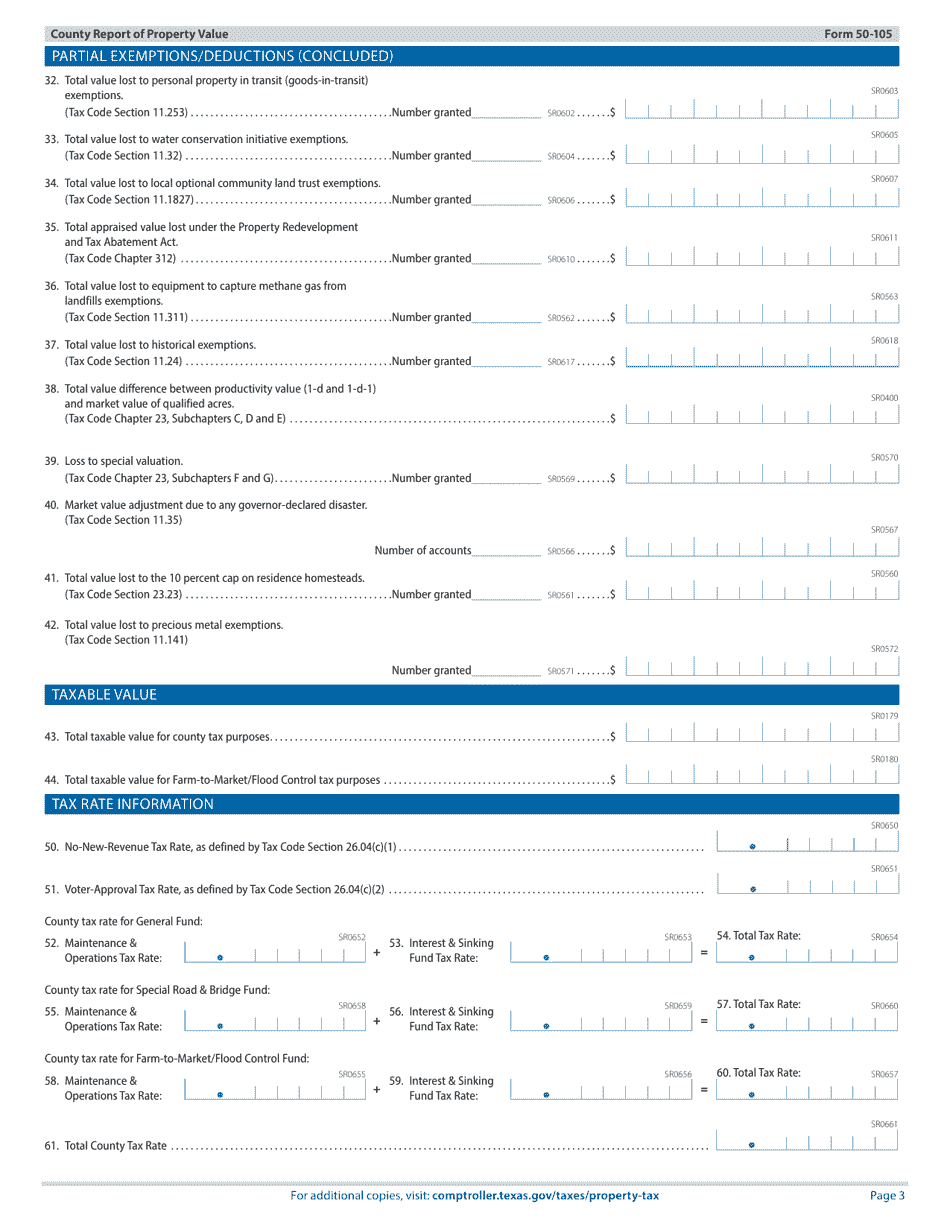

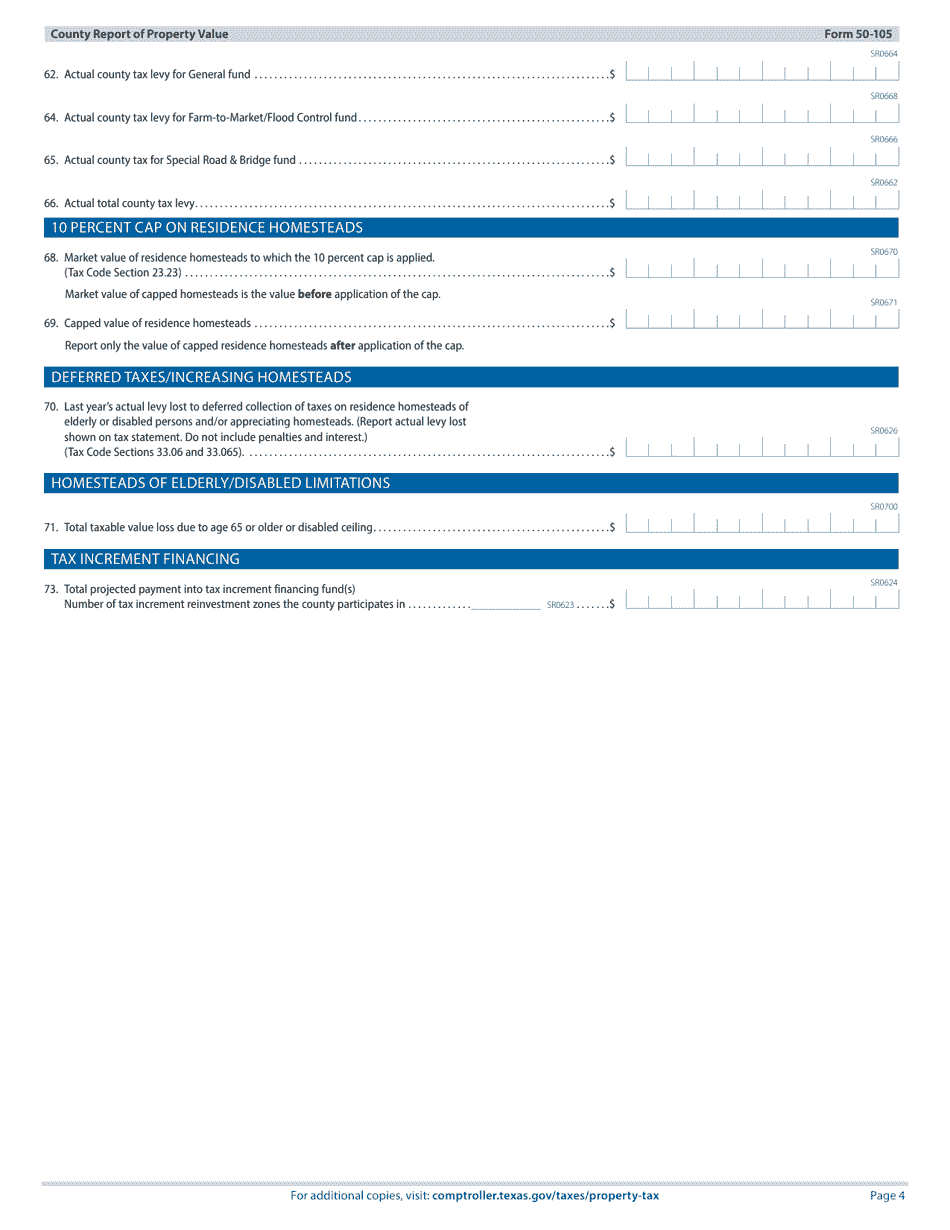

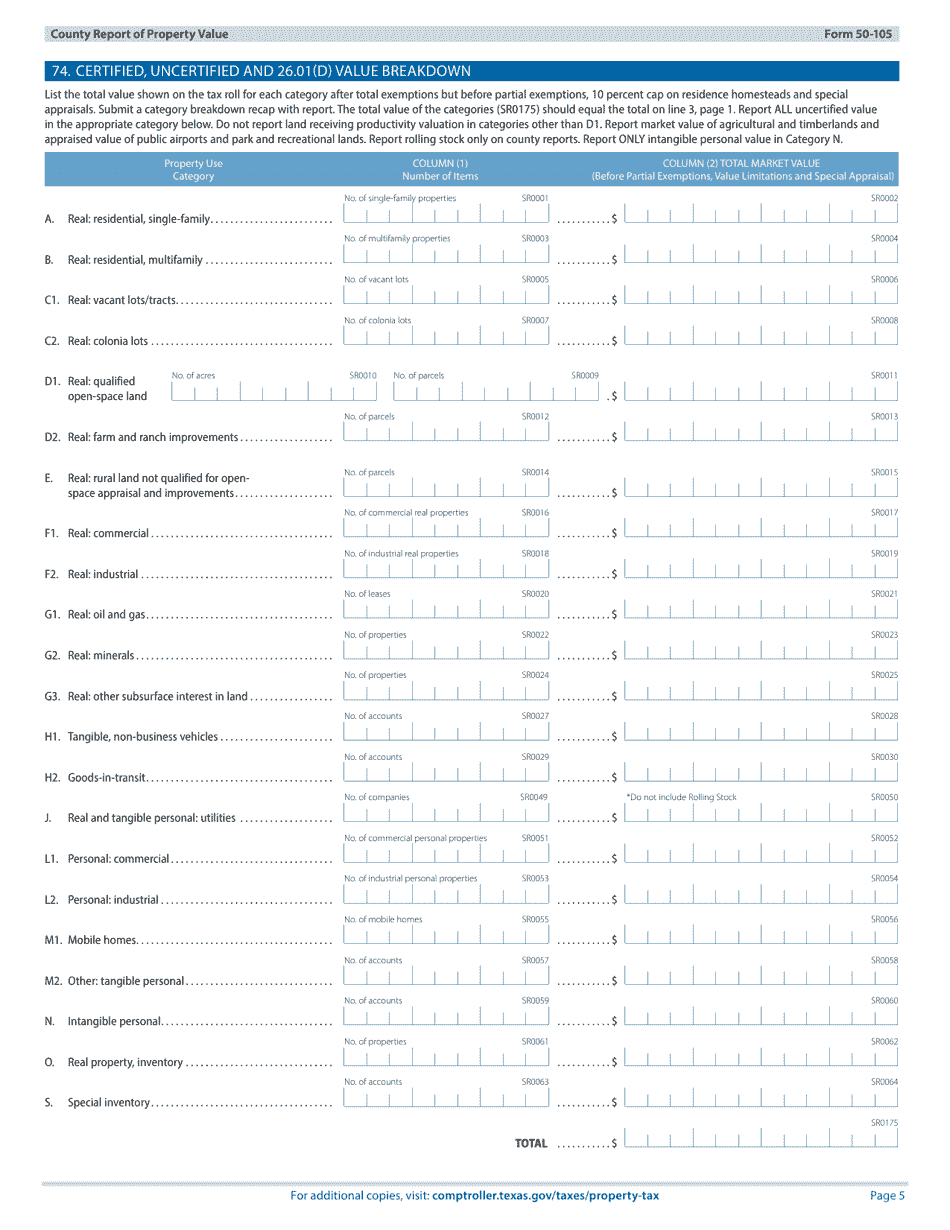

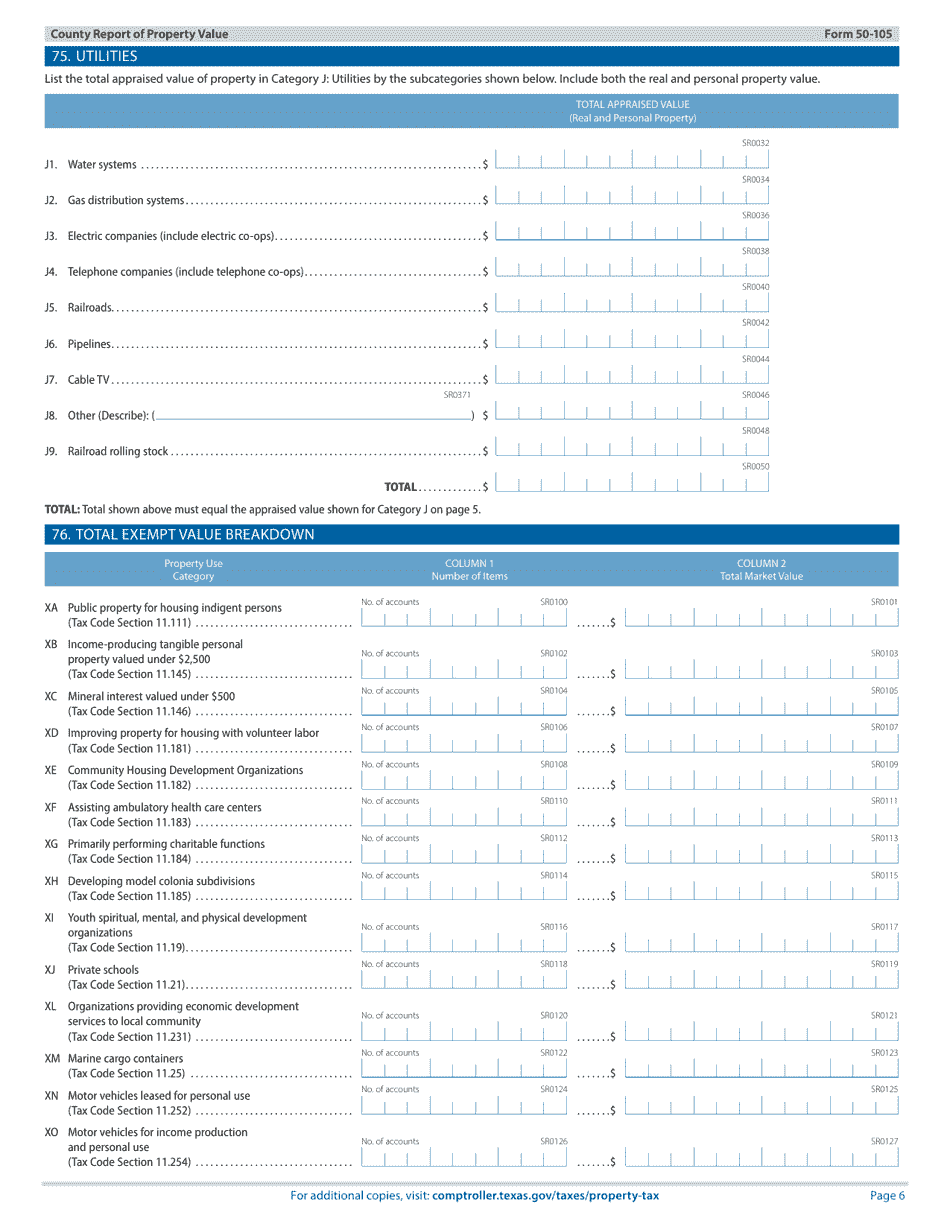

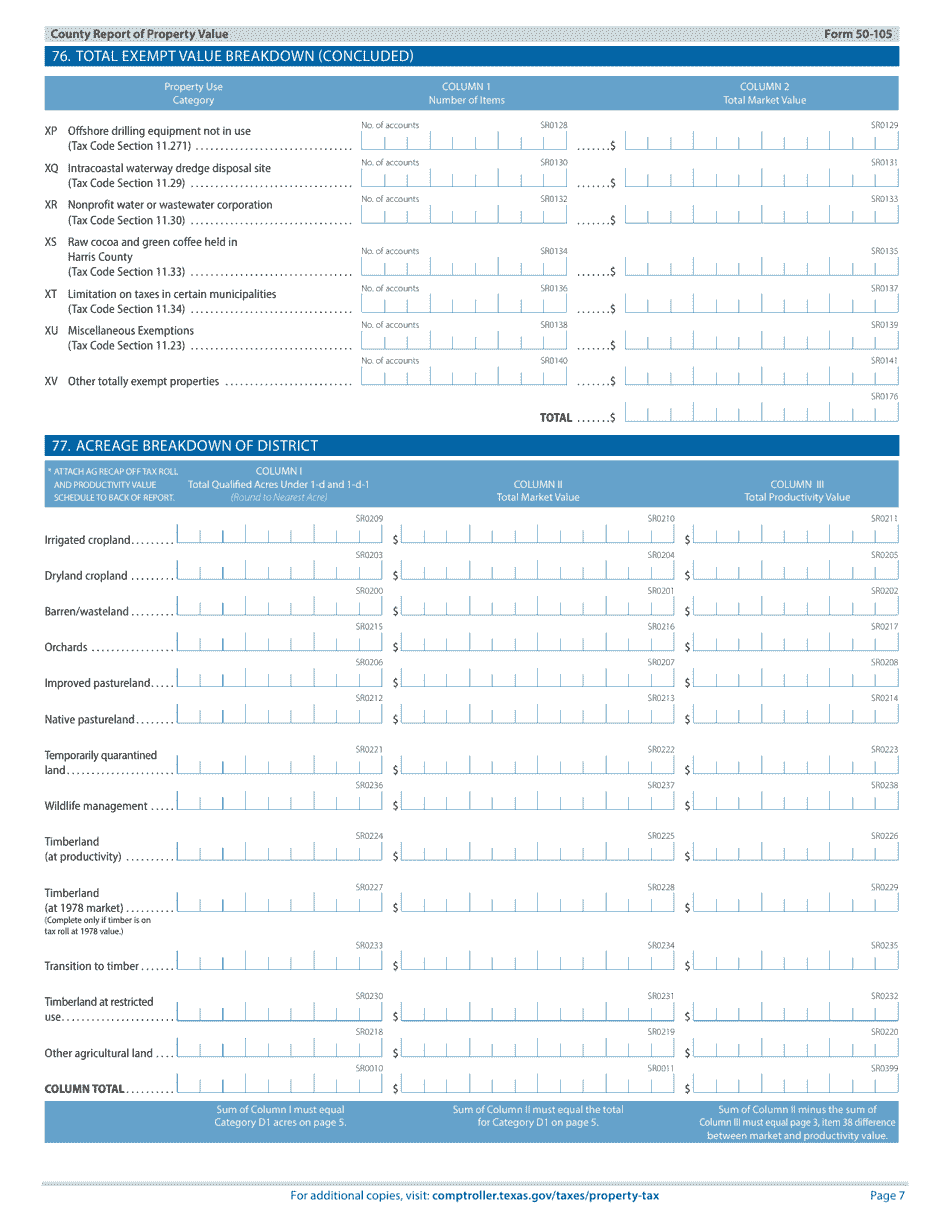

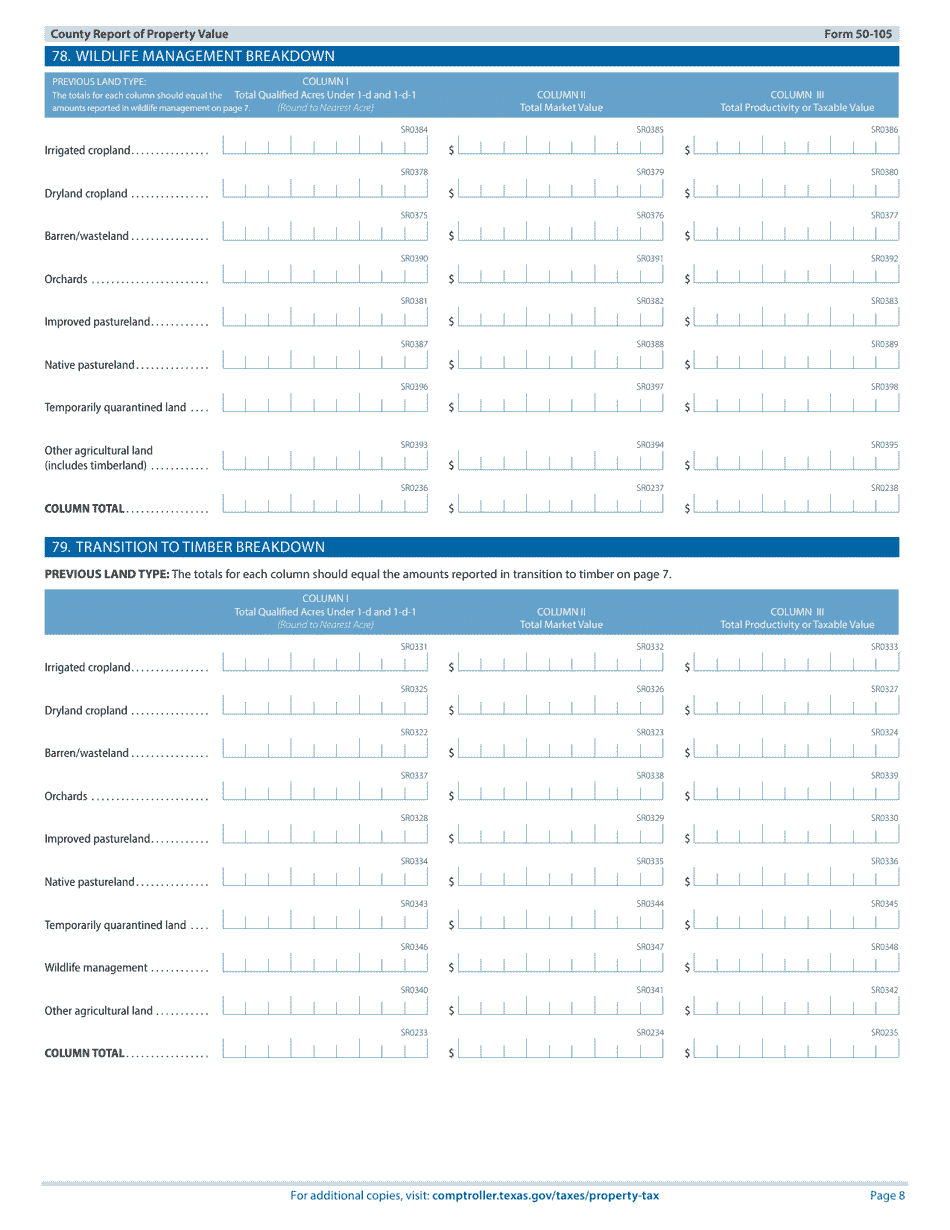

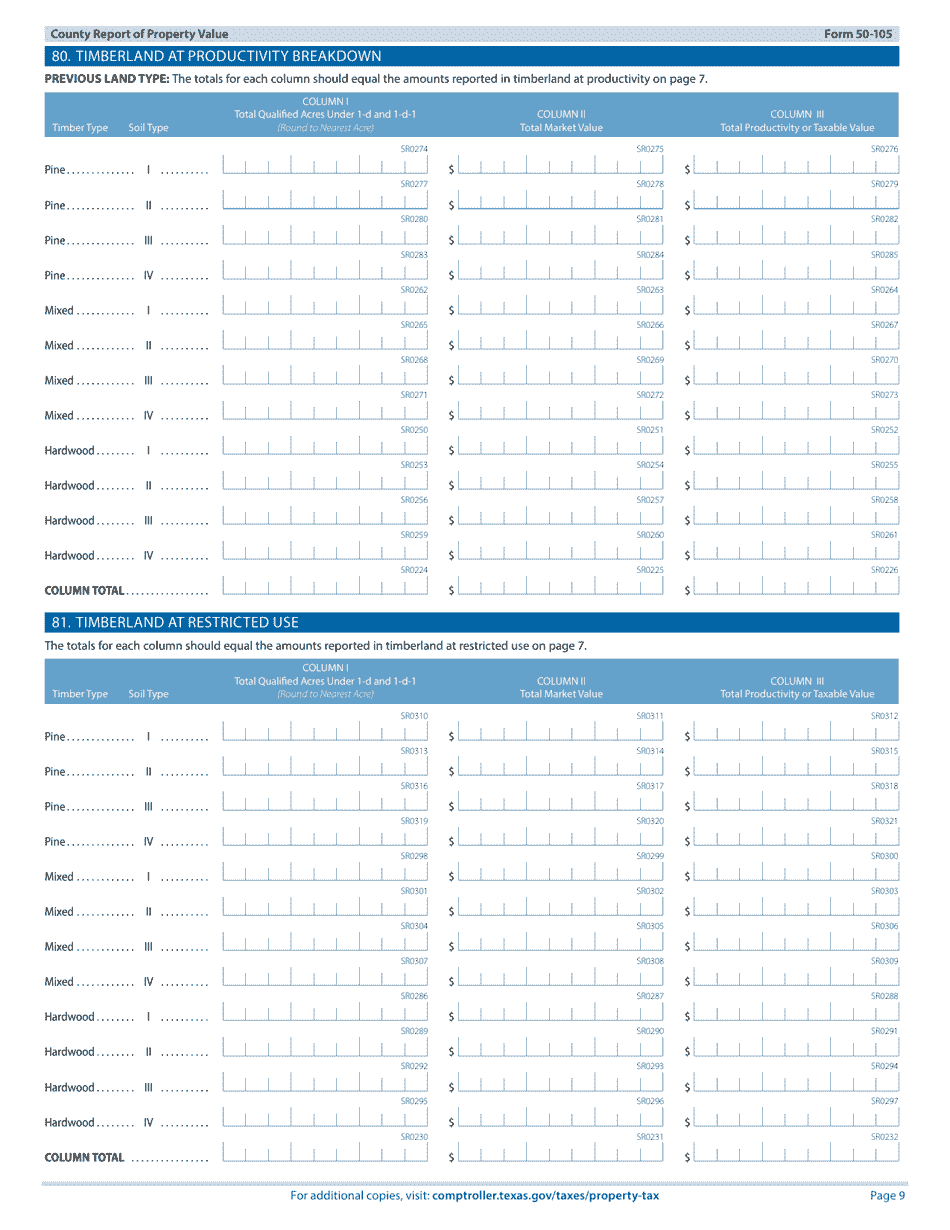

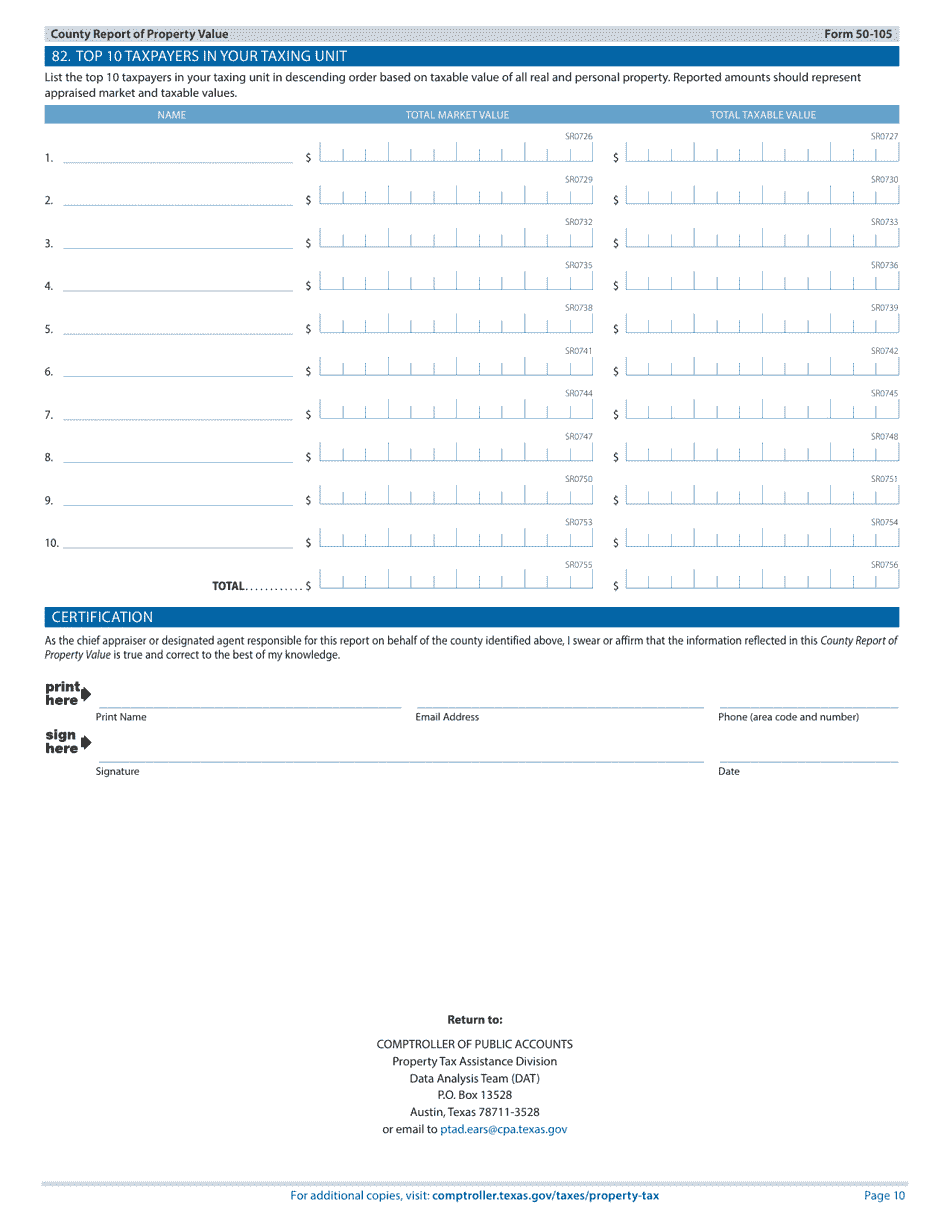

Form 50-105

for the current year.

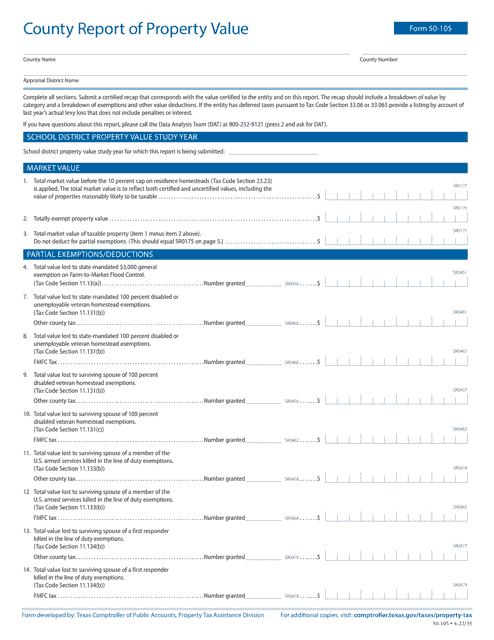

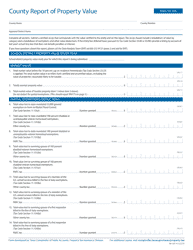

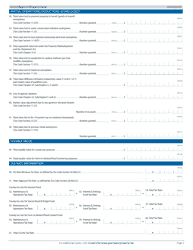

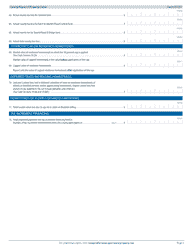

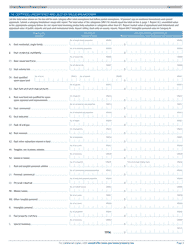

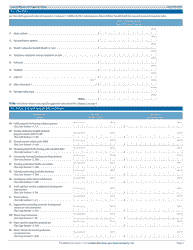

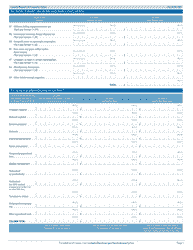

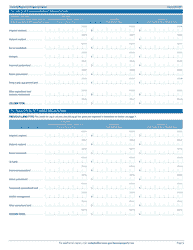

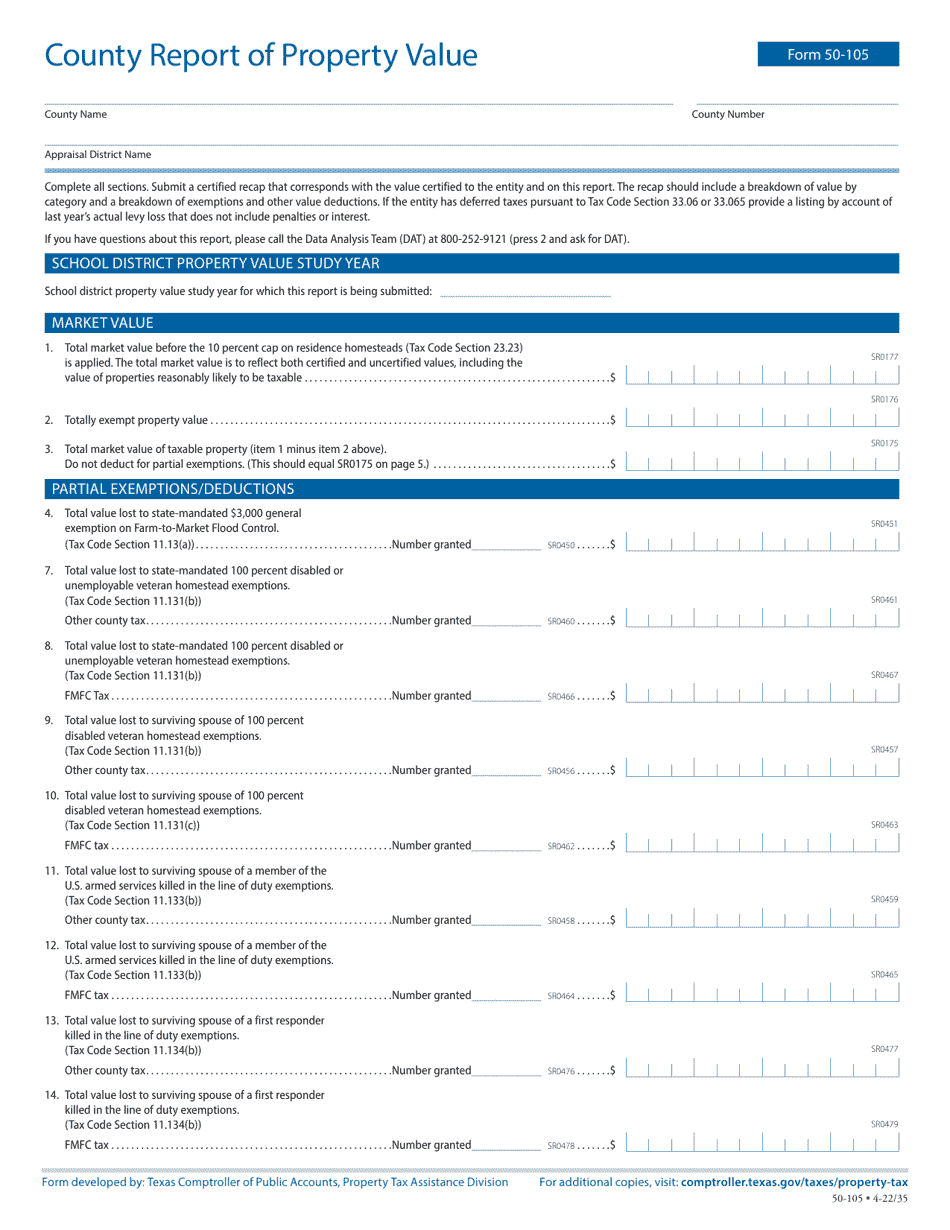

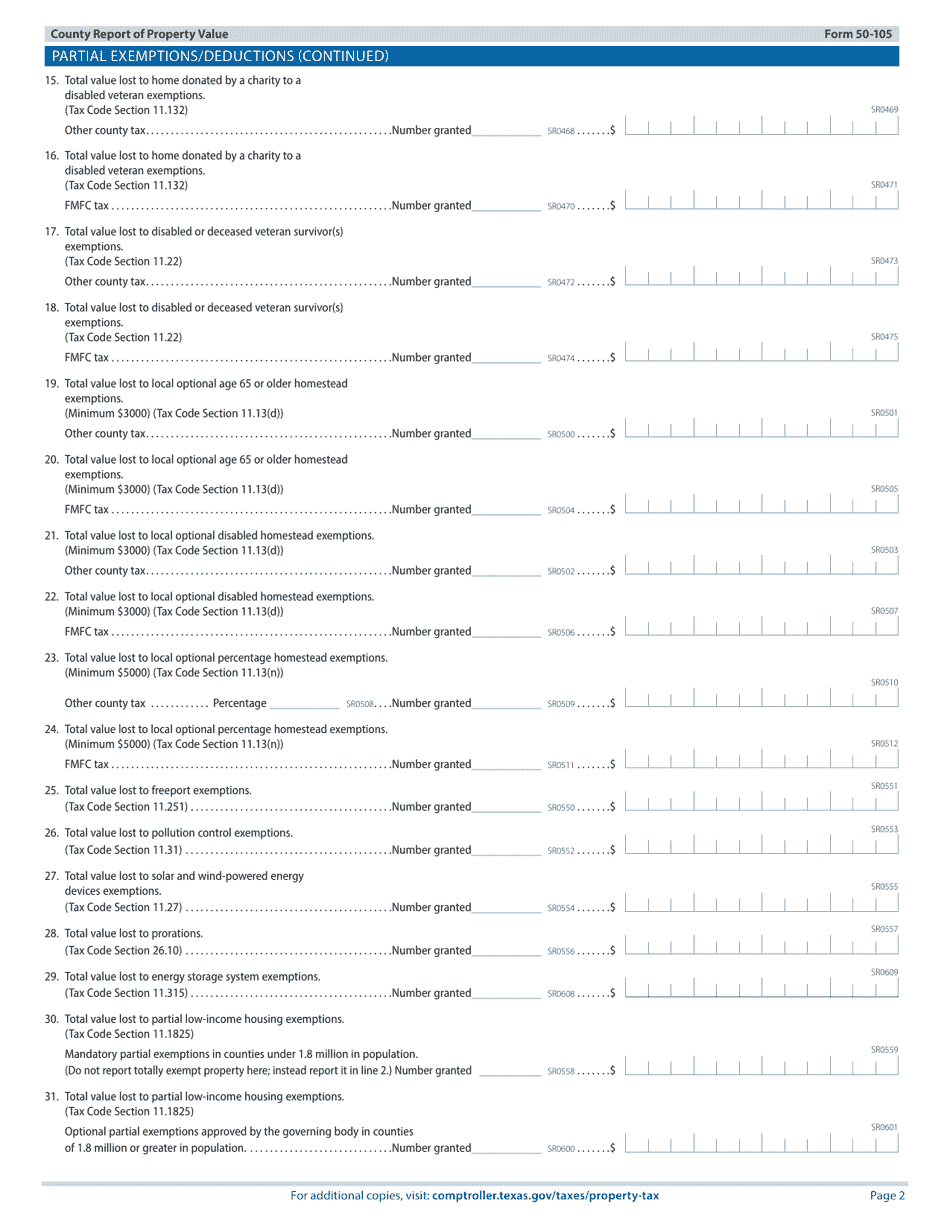

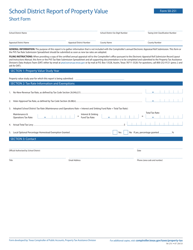

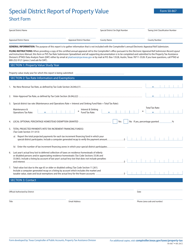

Form 50-105 County Report of Property Value - Texas

What Is Form 50-105?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-105?

A: Form 50-105 is the County Report of Property Value in Texas.

Q: Who needs to file Form 50-105?

A: Property owners in Texas.

Q: What is the purpose of Form 50-105?

A: Form 50-105 is used to report the value of property for taxation purposes.

Q: When is Form 50-105 due?

A: Form 50-105 is due on April 15th each year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing, including a 10% penalty on the appraised value of the property.

Q: Is Form 50-105 required for all types of property?

A: No, Form 50-105 is not required for all types of property. It is generally used for business personal property and certain types of real property.

Q: What should I do if I have questions about Form 50-105?

A: If you have questions about Form 50-105, you should contact your local county appraisal district or the Texas Comptroller's office for assistance.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-105 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.