This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-856-A

for the current year.

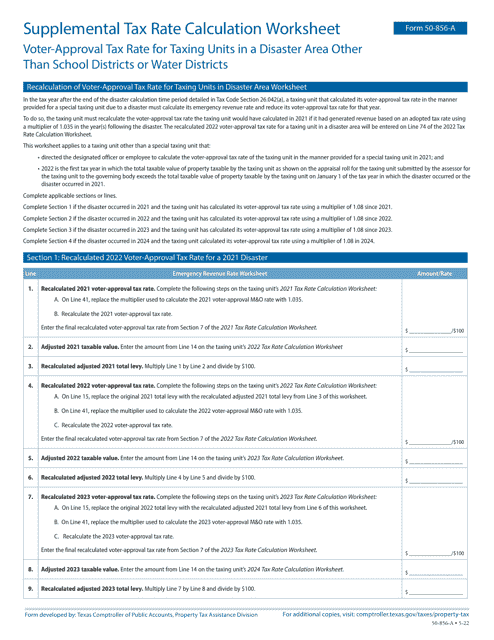

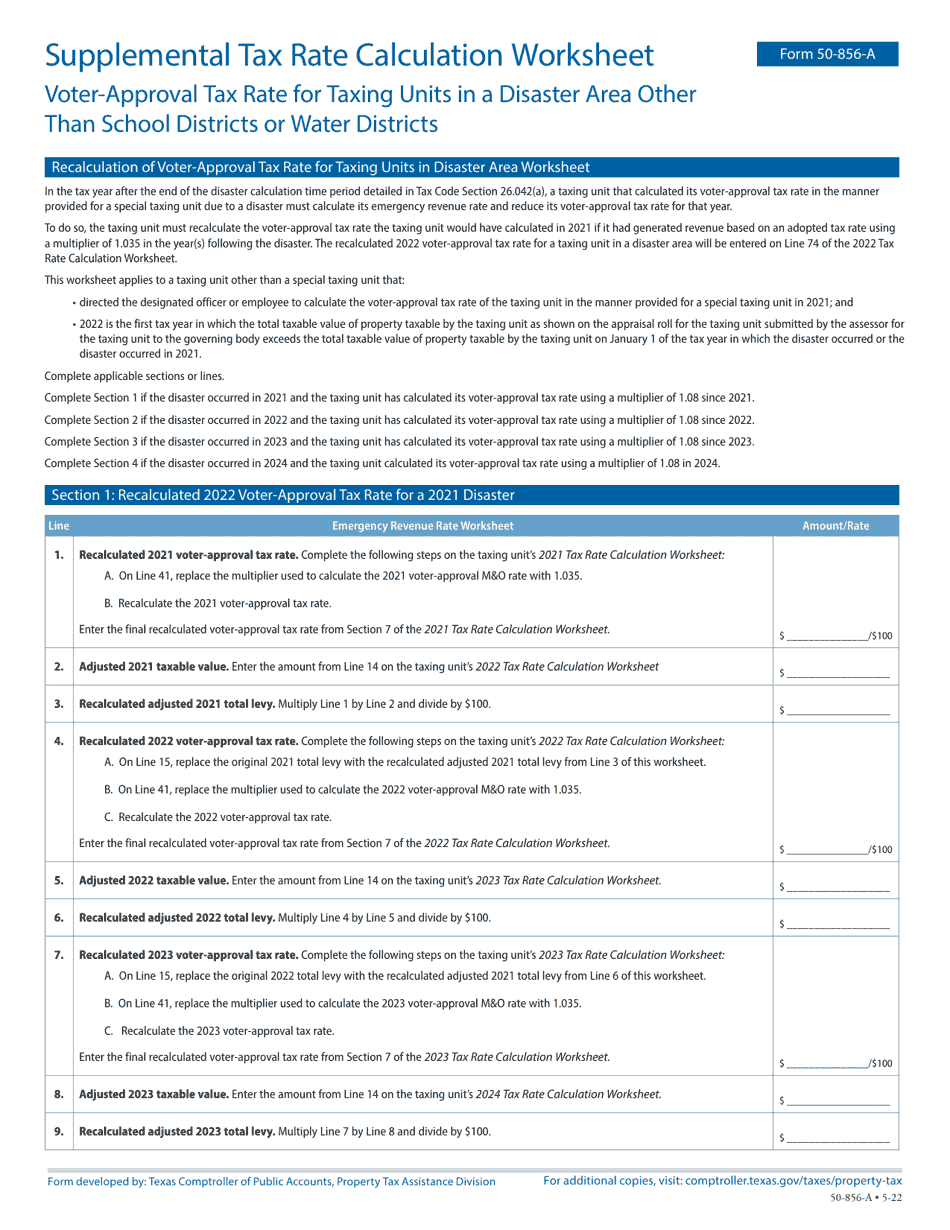

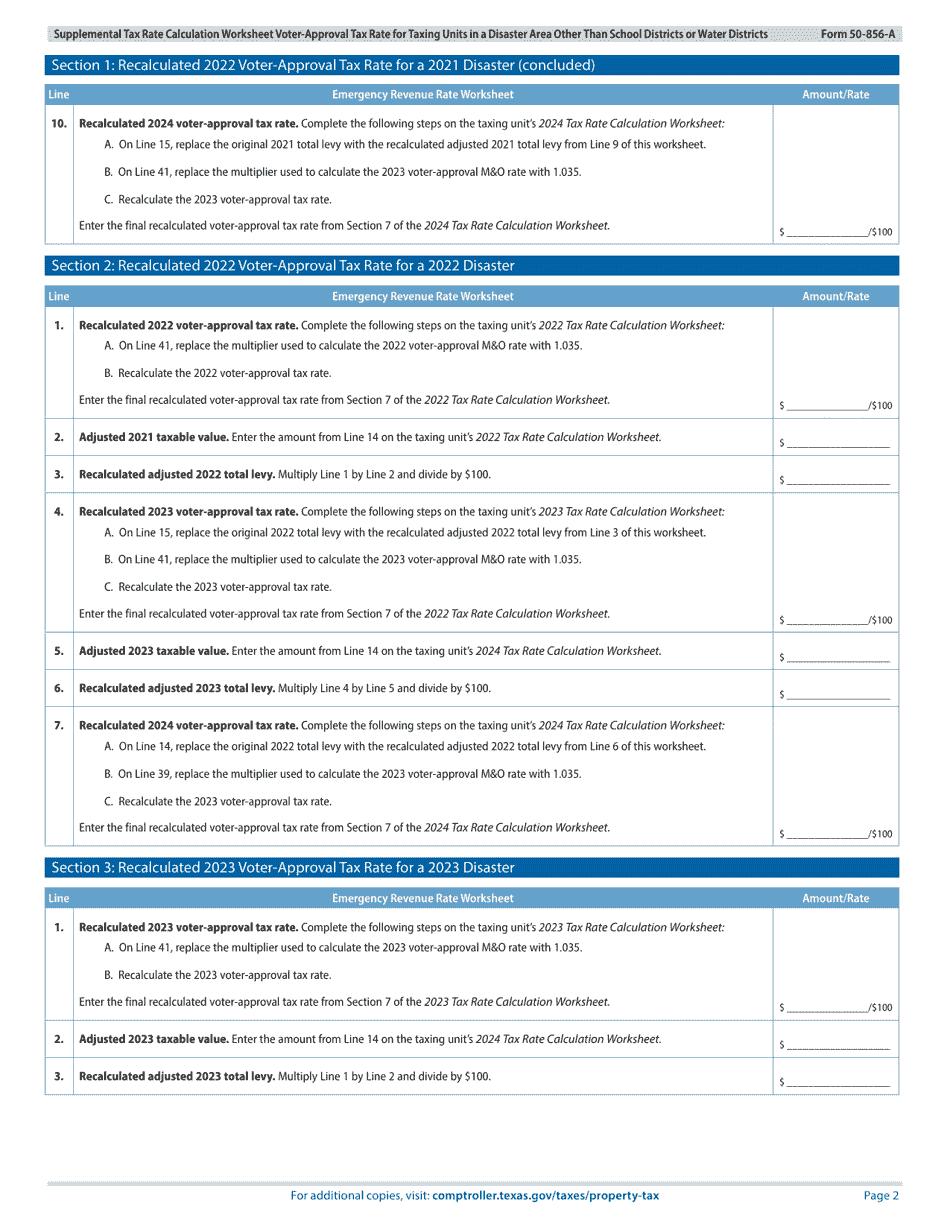

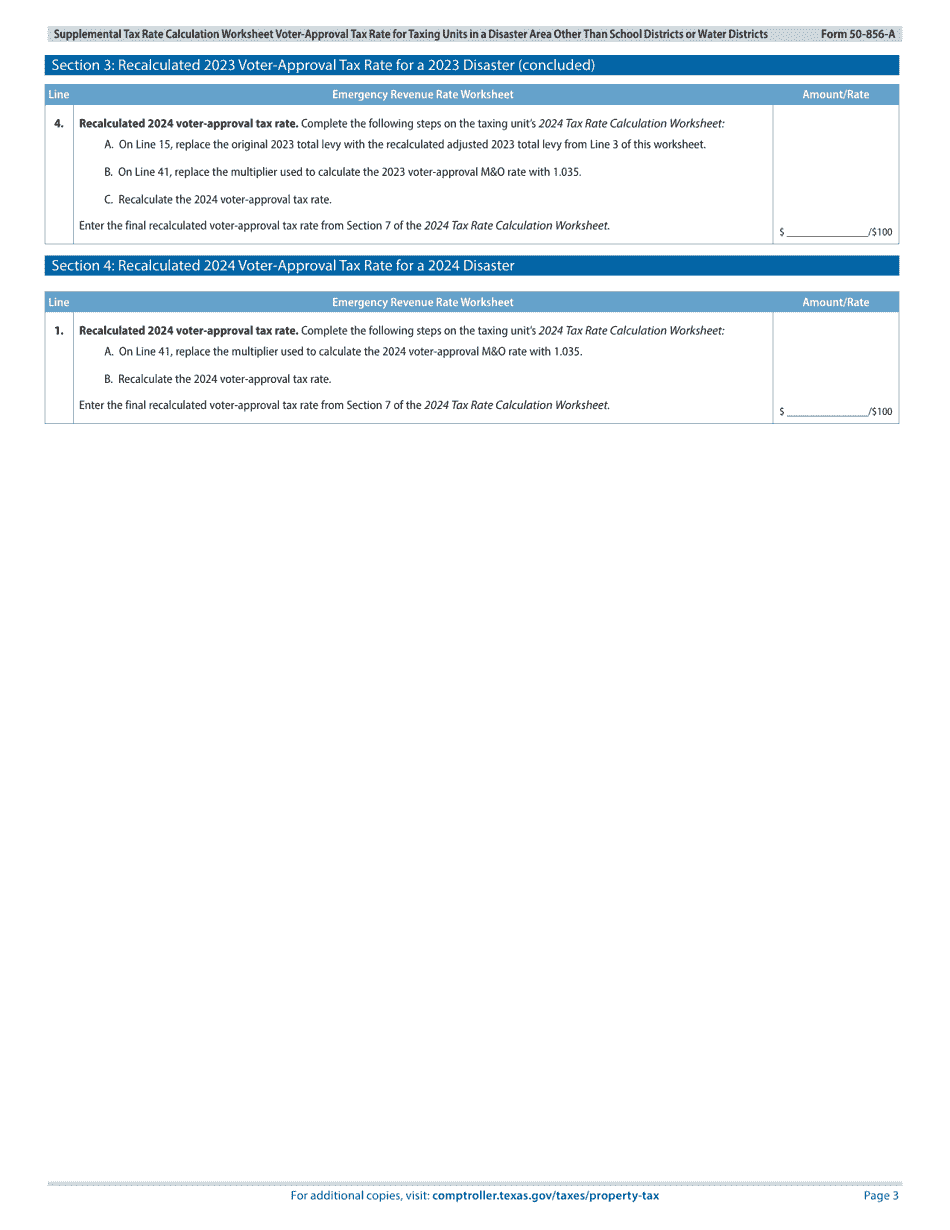

Form 50-856-A Supplemental Tax Rate Calculation Worksheet Voter-Approval Tax Rate for Taxing Units in a Disaster Area Other Than School Districts or Water Districts - Texas

What Is Form 50-856-A?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 50-856-A?

A: Form 50-856-A is the Supplemental Tax Rate Calculation Worksheet for voter-approval tax rate for taxing units in a disaster area other thanschool districts or water districts in Texas.

Q: What is the purpose of Form 50-856-A?

A: The purpose of Form 50-856-A is to calculate the supplemental tax rate for taxing units in a disaster area.

Q: Who needs to use Form 50-856-A?

A: Taxing units in a disaster area, other than school districts or water districts, in Texas need to use Form 50-856-A.

Q: What does the form calculate?

A: The form calculates the voter-approval tax rate for taxing units in a disaster area.

Q: Are school districts and water districts included in this form?

A: No, this form is specifically for taxing units in a disaster area other than school districts or water districts.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-856-A by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.