This version of the form is not currently in use and is provided for reference only. Download this version of

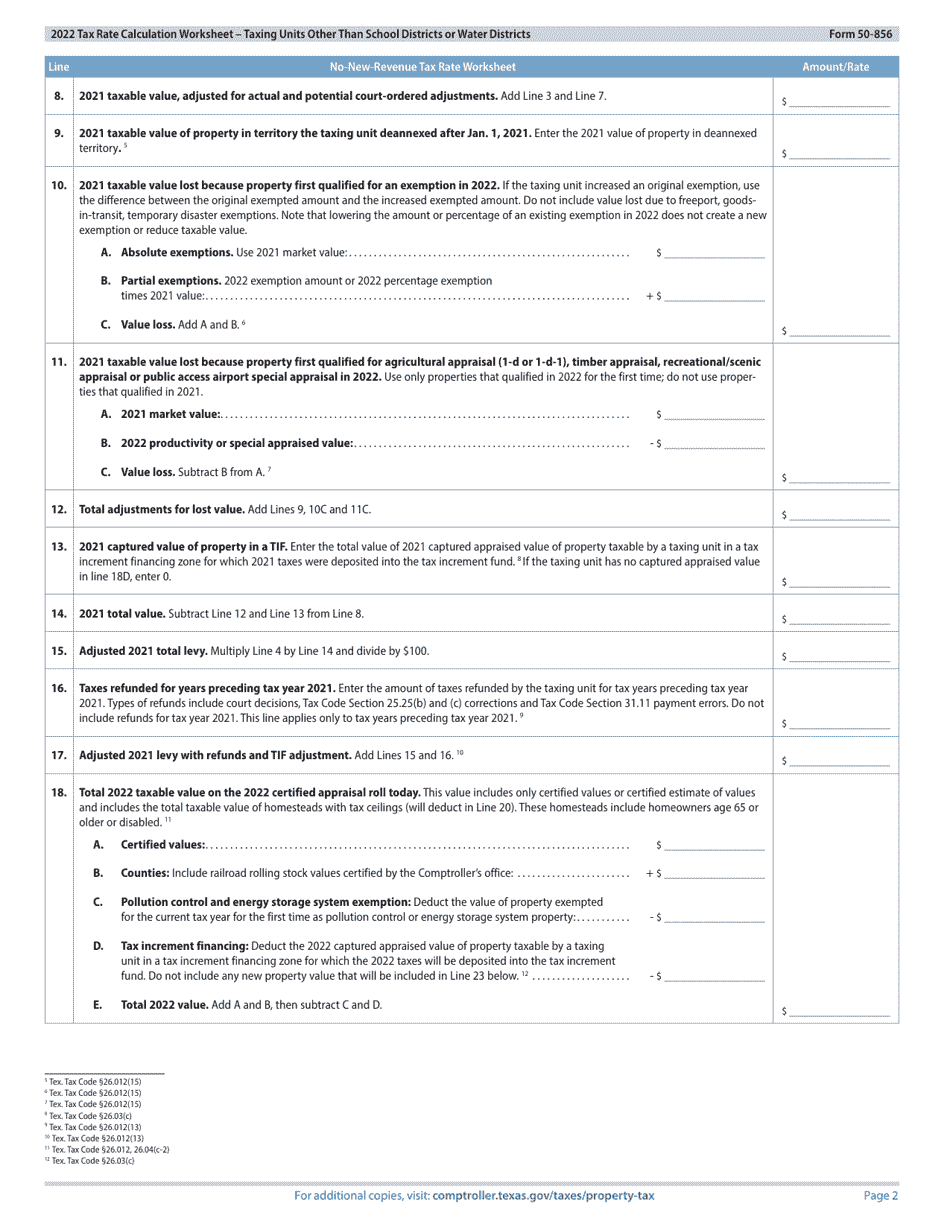

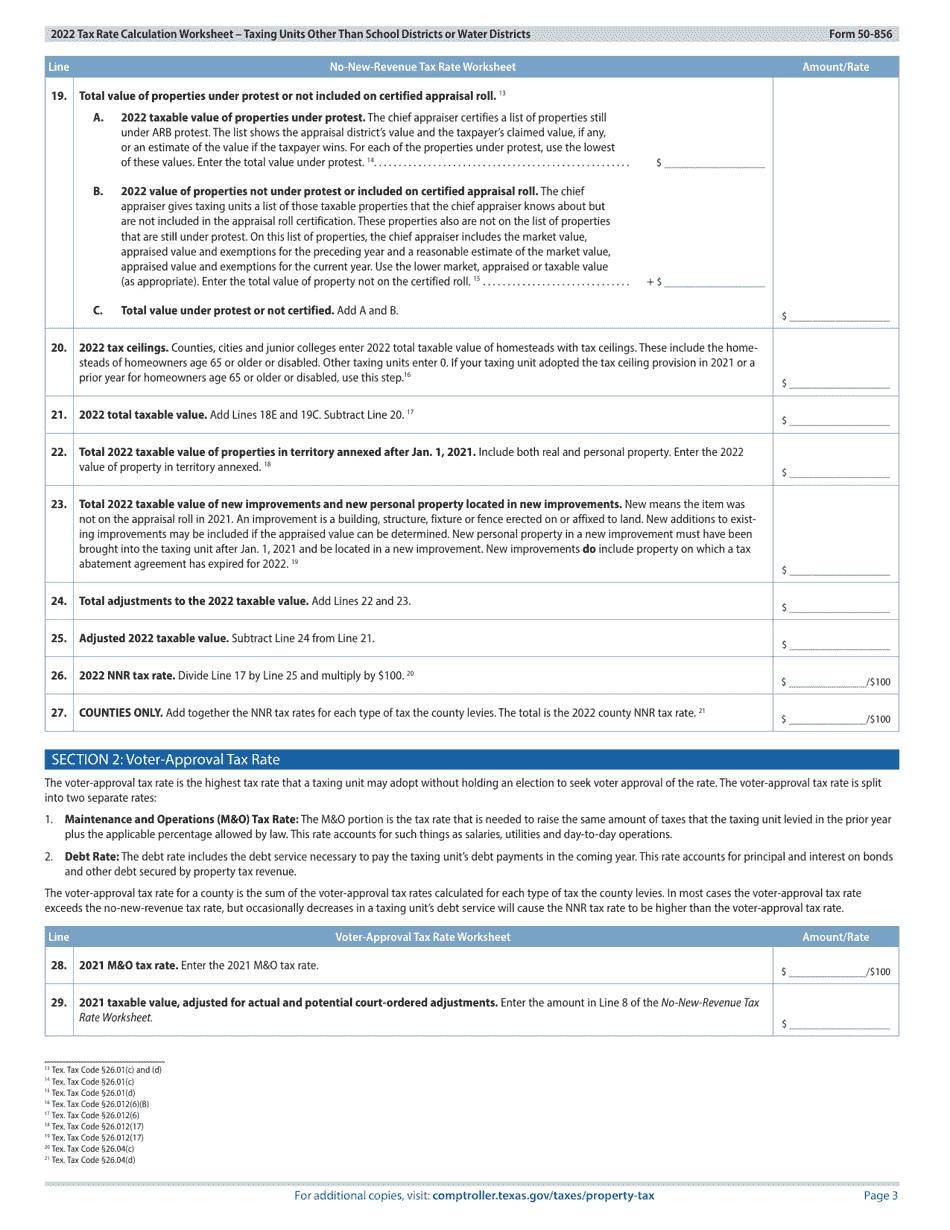

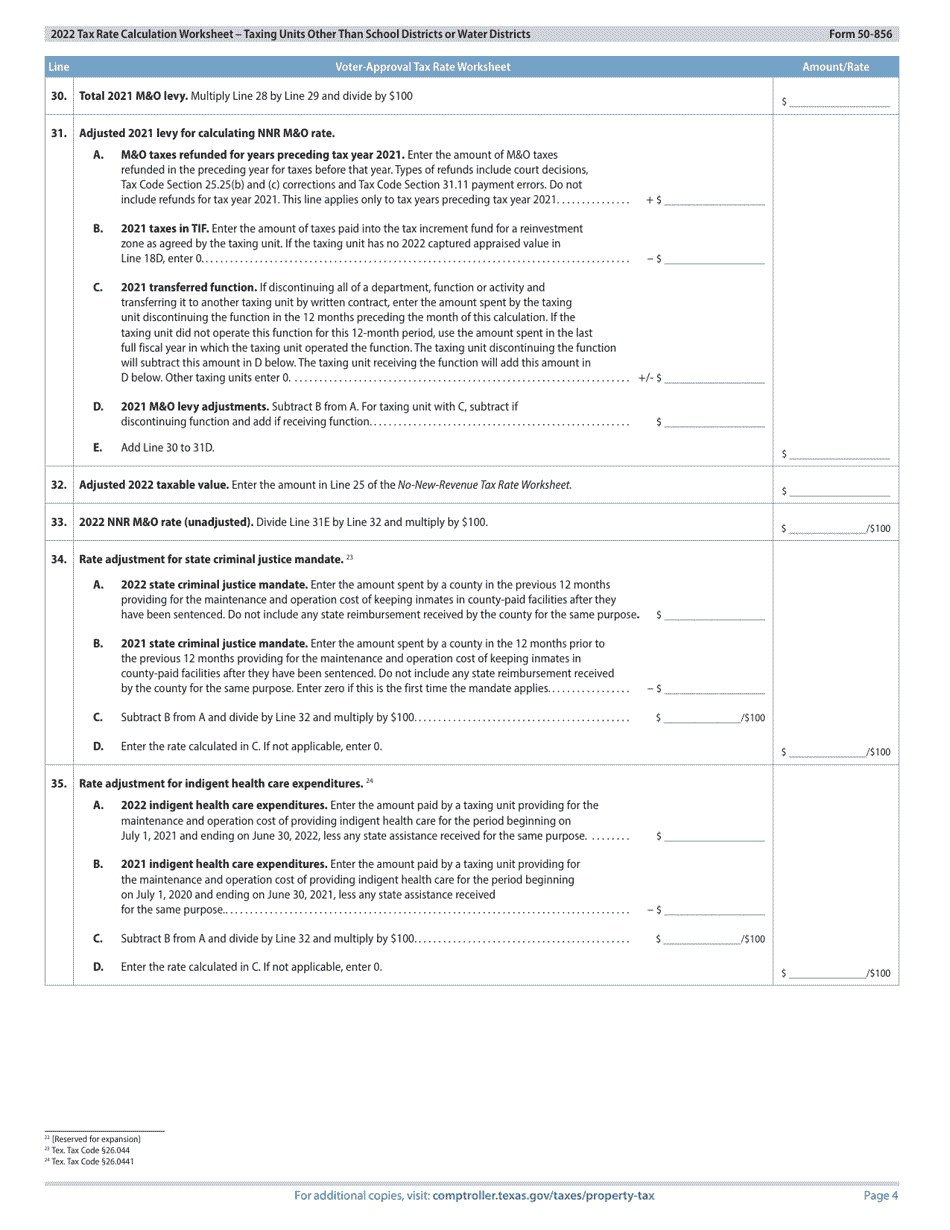

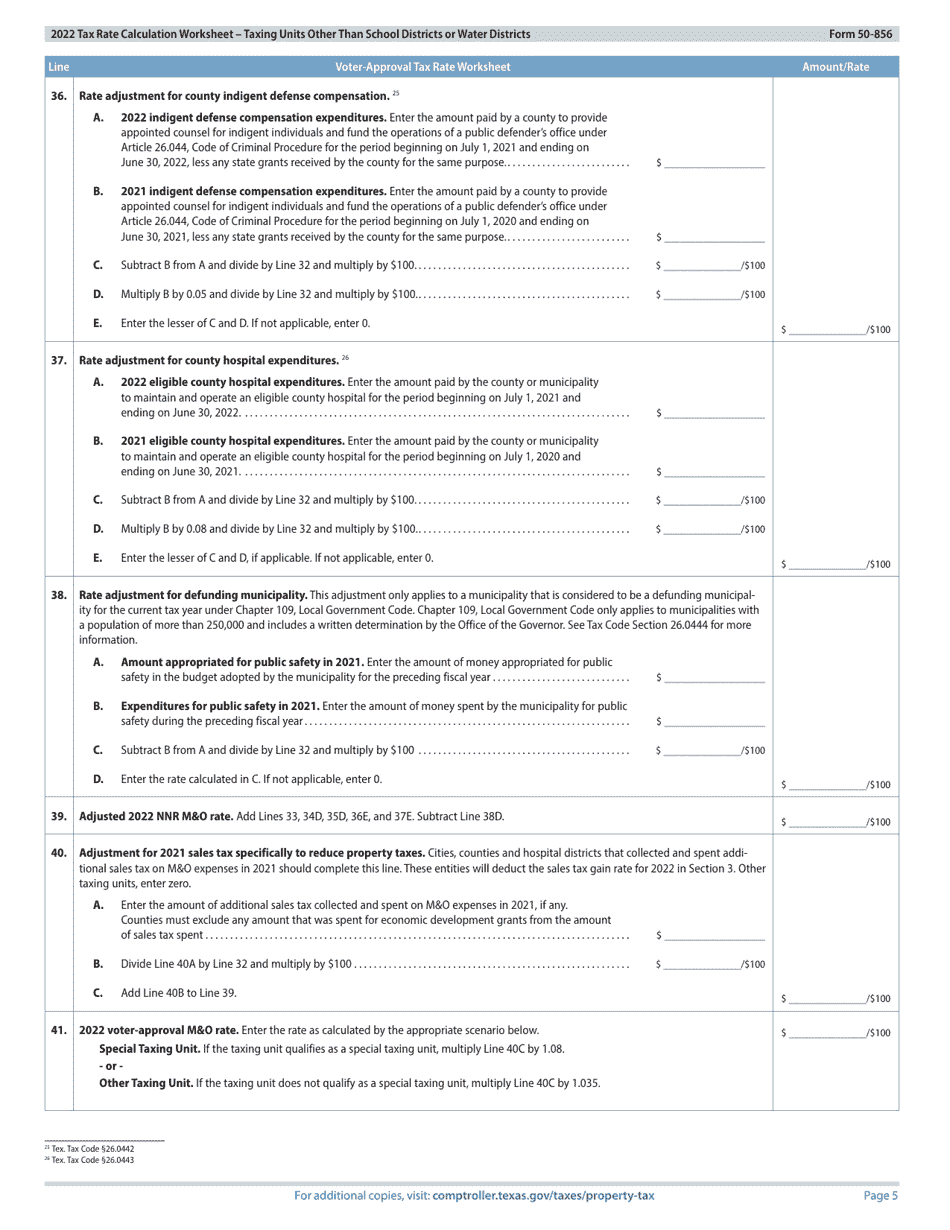

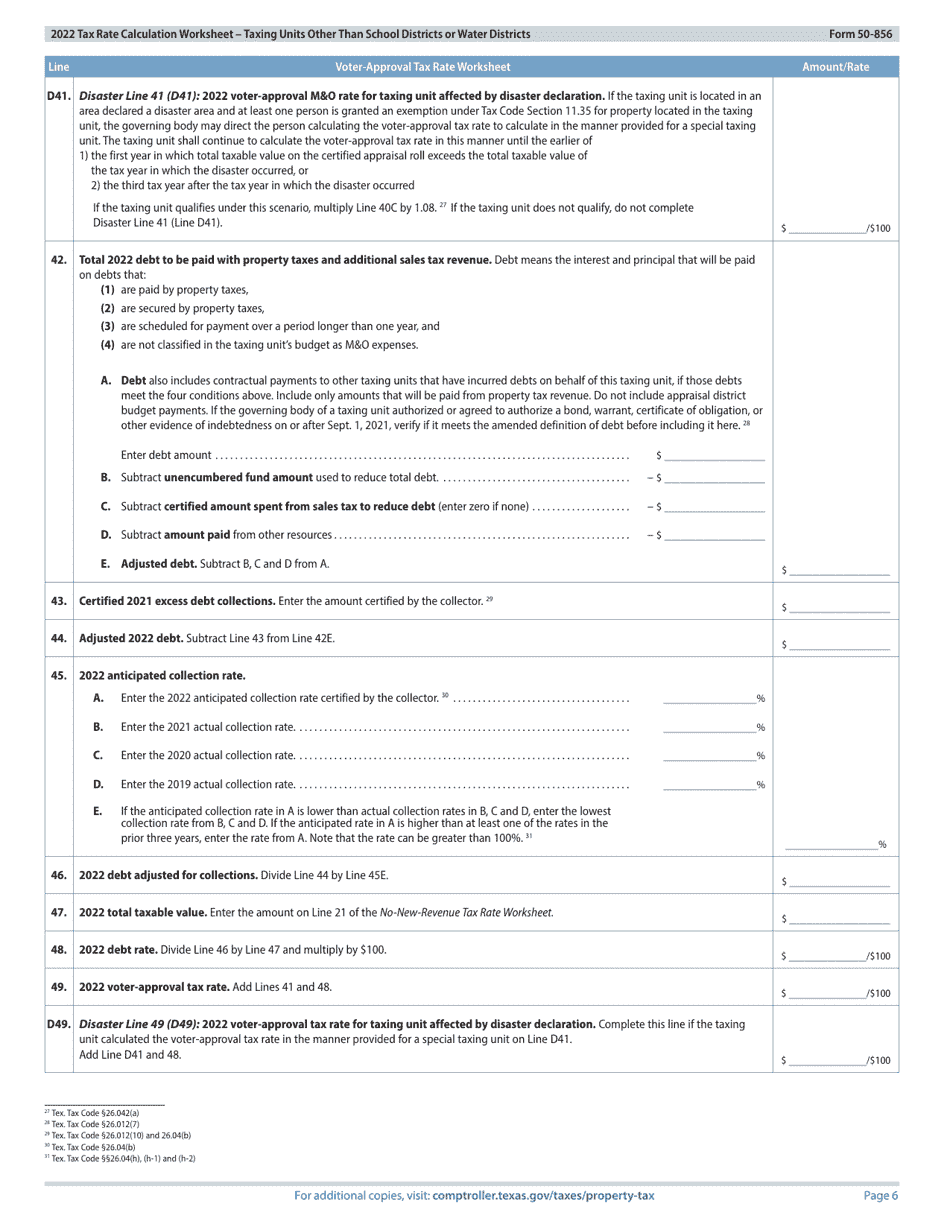

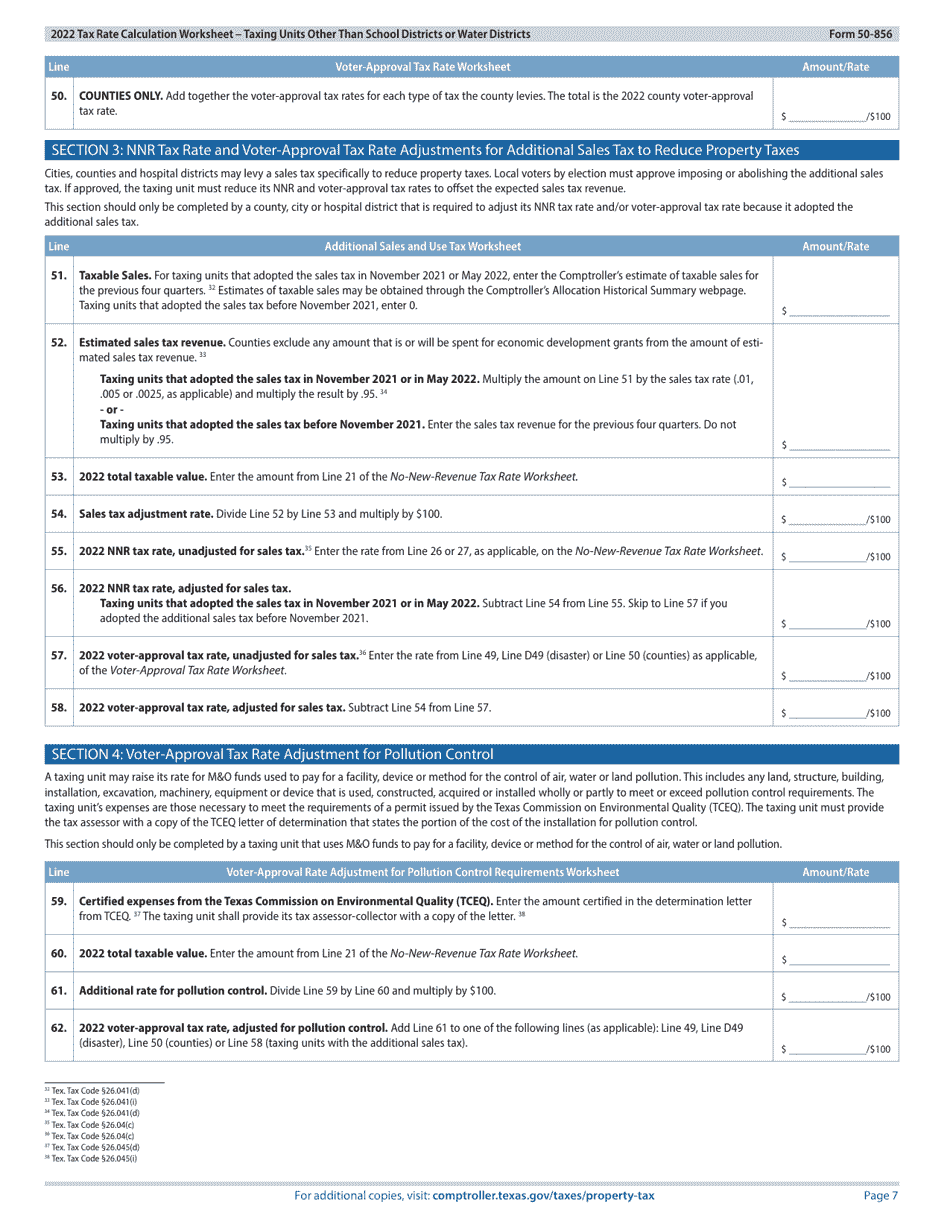

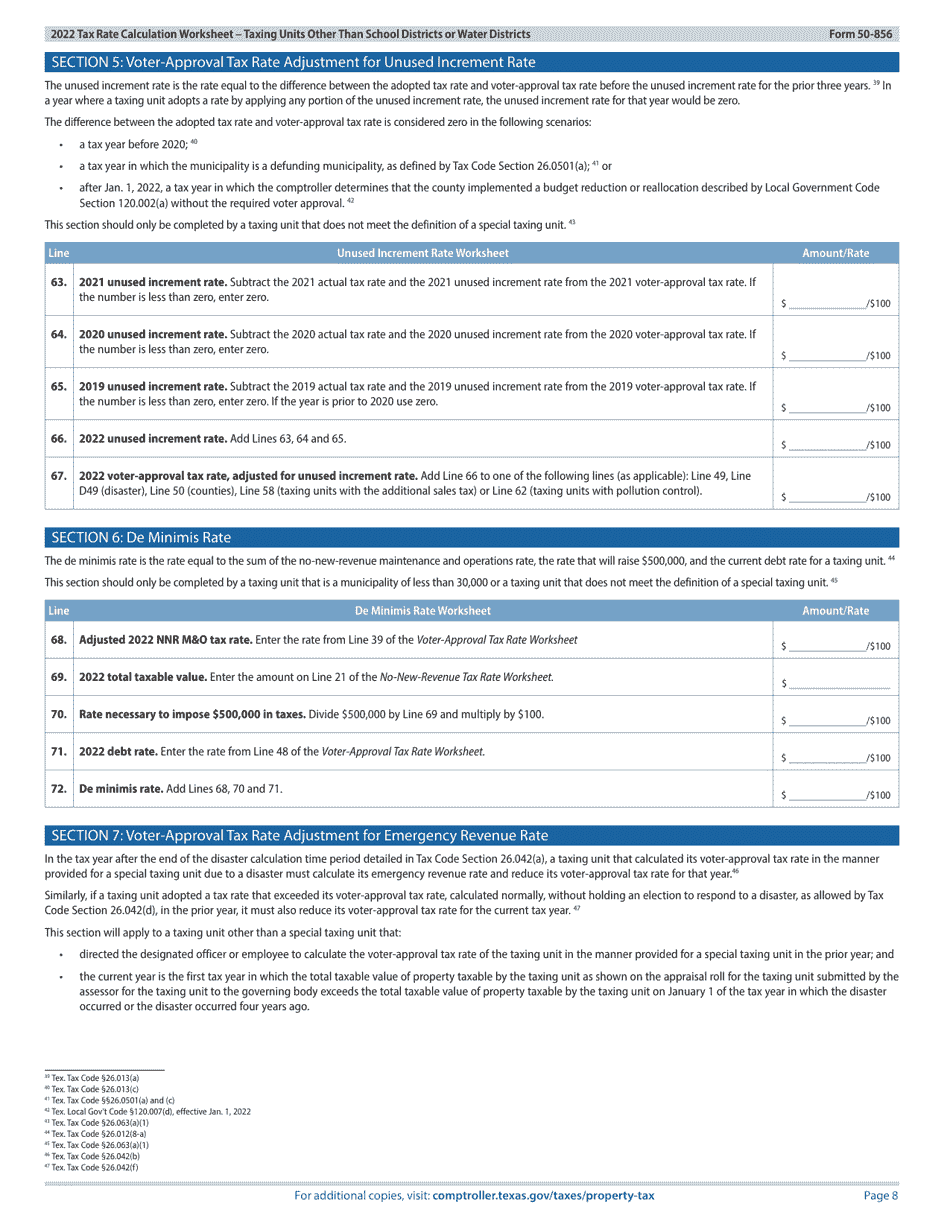

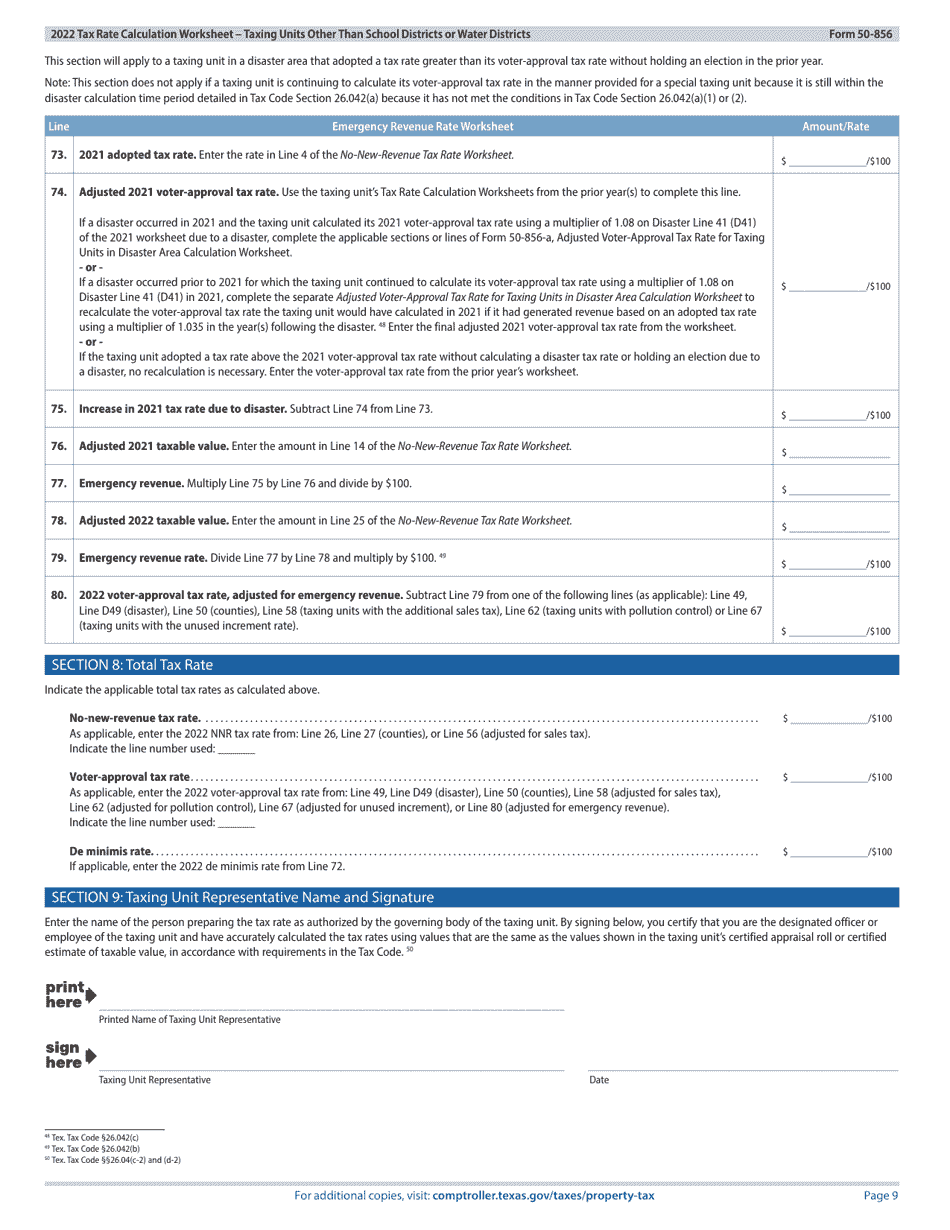

Form 50-856

for the current year.

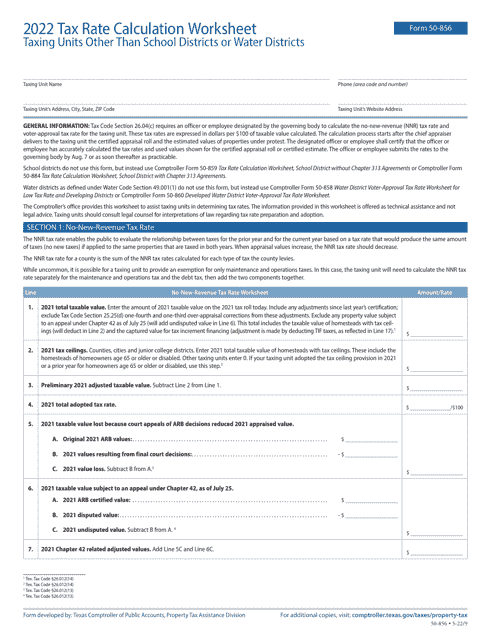

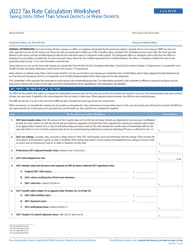

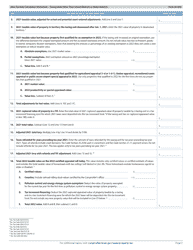

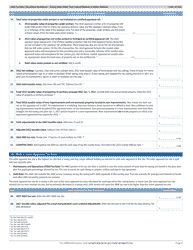

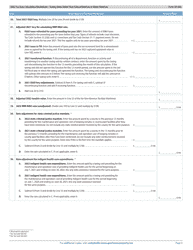

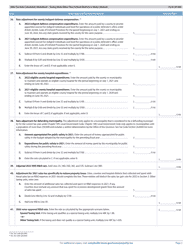

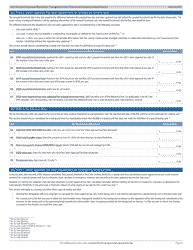

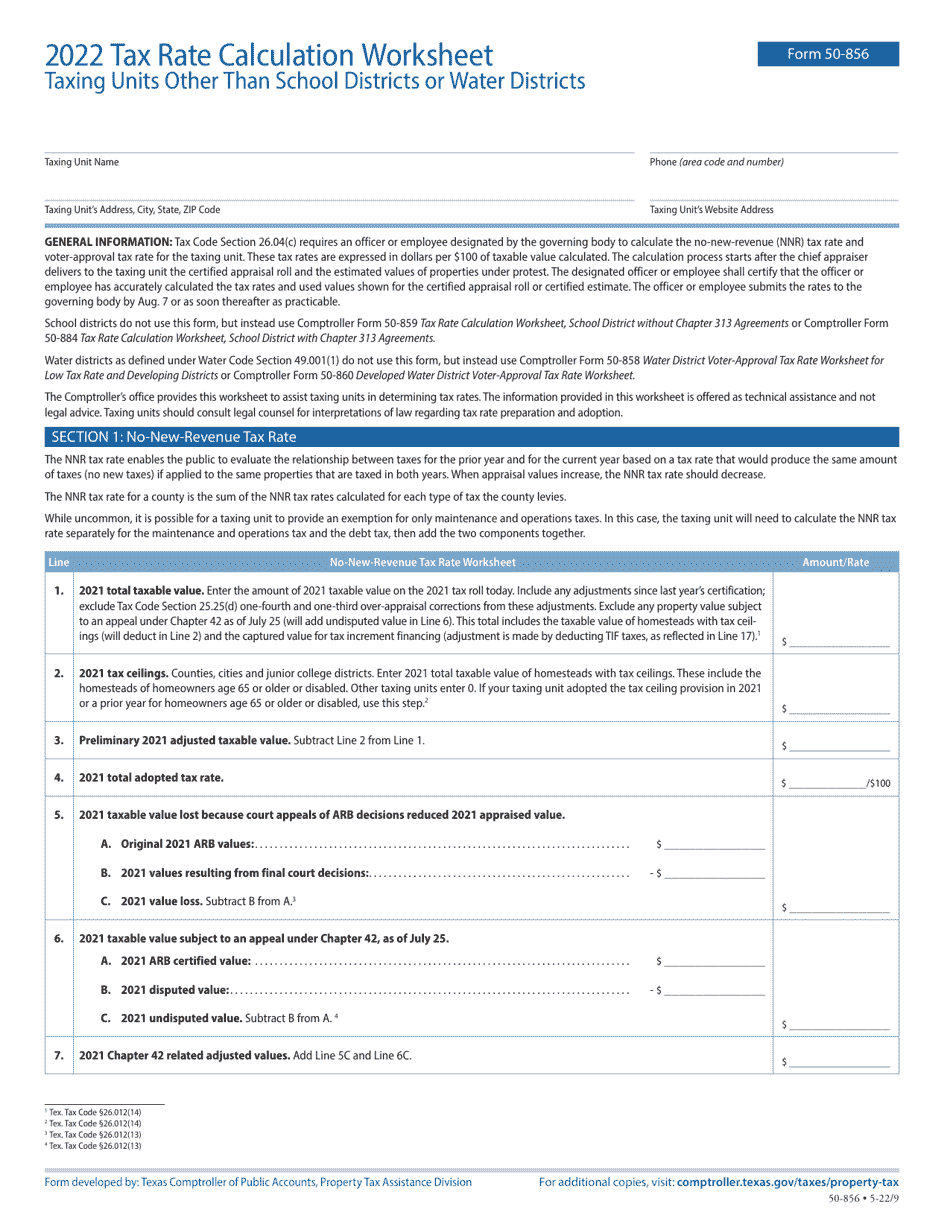

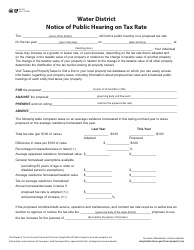

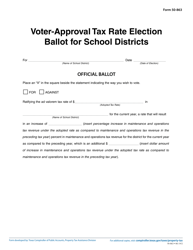

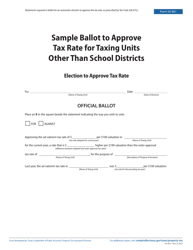

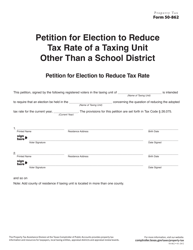

Form 50-856 Tax Rate Calculation Worksheet - Taxing Units Other Than School Districts or Water Districts - Texas

What Is Form 50-856?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-856?

A: Form 50-856 is a tax rate calculation worksheet used for taxing units other thanschool districts or water districts in Texas.

Q: Who should use Form 50-856?

A: Taxing units other than school districts or water districts in Texas should use Form 50-856.

Q: What is the purpose of Form 50-856?

A: The purpose of Form 50-856 is to calculate the tax rate for taxing units in Texas.

Q: What information is needed to complete Form 50-856?

A: To complete Form 50-856, you will need information about the taxing unit's budget, property values, and any debt obligations.

Q: Are there any filing deadlines for Form 50-856?

A: Yes, the deadline for filing Form 50-856 varies depending on the type of taxing unit. It is recommended to check with the Texas Comptroller of Public Accounts for specific deadlines.

Q: Is Form 50-856 used for all taxing units in Texas?

A: No, Form 50-856 is specifically for taxing units other than school districts or water districts. School districts and water districts have their own tax rate calculation worksheets.

Q: What should I do if I have questions about Form 50-856?

A: If you have questions about Form 50-856, you can contact the Texas Comptroller of Public Accounts for assistance.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-856 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.