This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-860

for the current year.

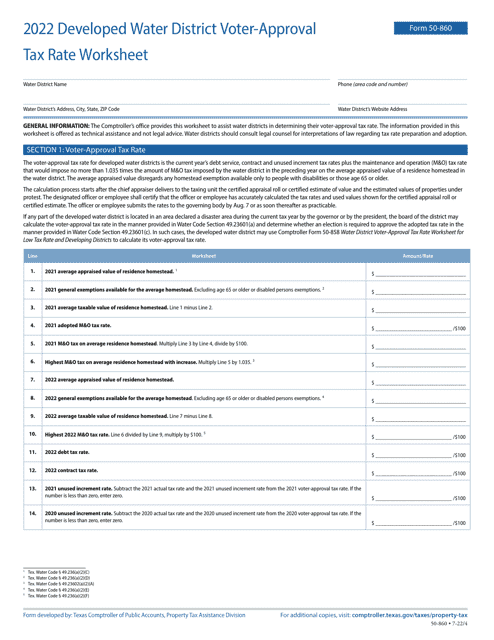

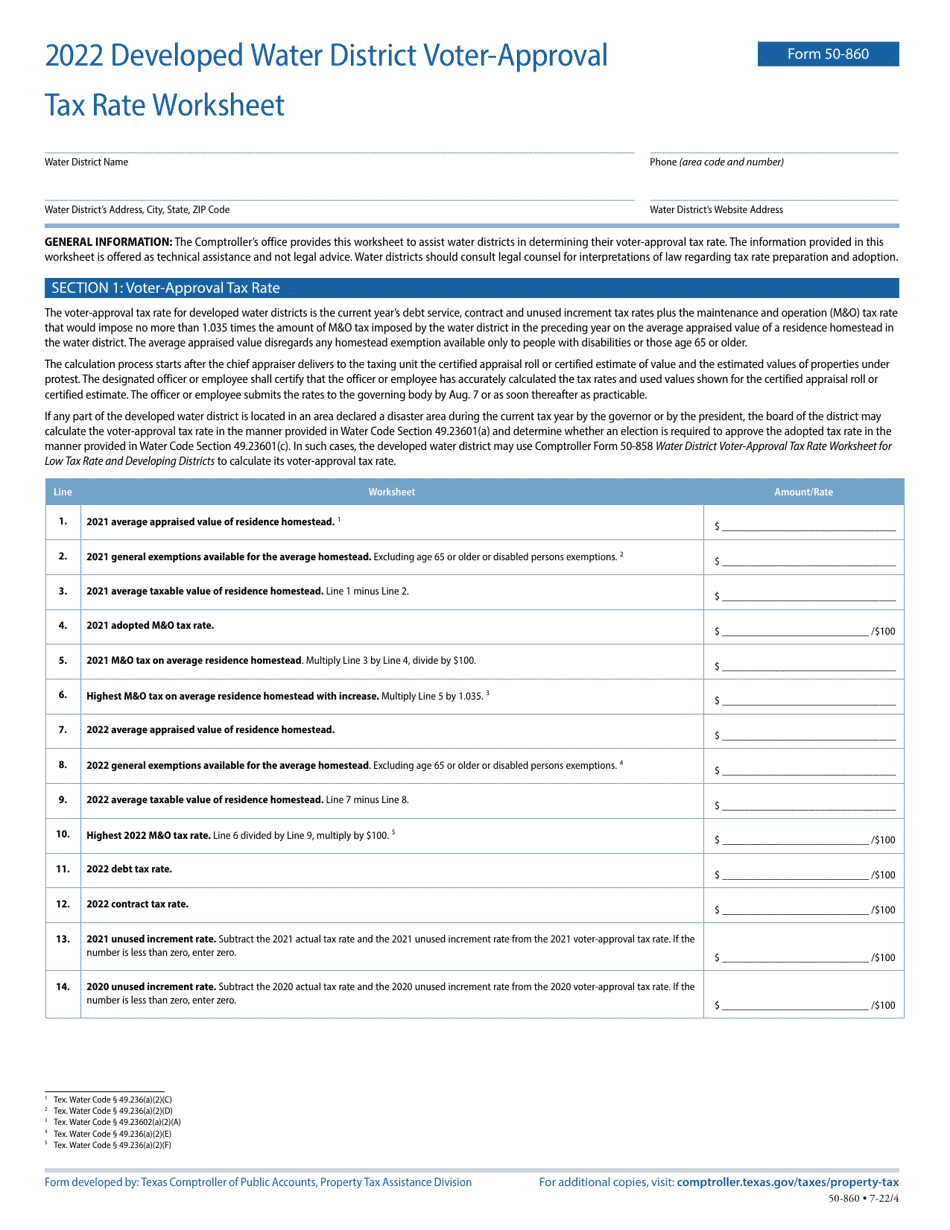

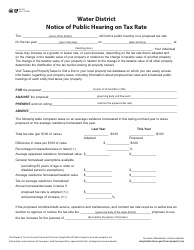

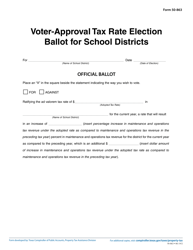

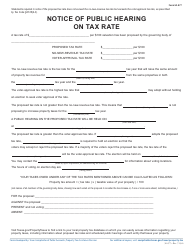

Form 50-860 Developed Water District Voter-Approval Tax Rate Worksheet - Texas

What Is Form 50-860?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-860?

A: Form 50-860 is the Developed Water District Voter-Approval Tax Rate Worksheet.

Q: What is the purpose of Form 50-860?

A: The purpose of Form 50-860 is to calculate the voter-approved tax rate for a developed water district in Texas.

Q: Who needs to fill out Form 50-860?

A: Developed water districts in Texas need to fill out Form 50-860.

Q: What information is required on Form 50-860?

A: Form 50-860 requires information such as the appraised value of property, the effective tax rate, and the rollback tax rate.

Q: Are there any filing fees for Form 50-860?

A: No, there are no filing fees for Form 50-860.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-860 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.